2025 ATA Price Prediction: Expert Analysis and Market Forecast for Automata Network's Token Performance

Introduction: Market Position and Investment Value of ATA

Automata Network (ATA), as a decentralized service protocol providing privacy middleware for dApps across multiple blockchains, has established itself as a significant player in the privacy and governance solutions sector since its inception in 2021. As of December 2025, ATA has achieved a market capitalization of approximately $9.29 million with a circulating supply of approximately 587.79 million tokens, currently trading at $0.01581 per token. This asset, recognized for its innovative privacy-preserving and MEV minimization capabilities through solutions like Witness and Conveyor, is playing an increasingly critical role in enhancing blockchain interoperability and user privacy across multiple blockchain ecosystems.

This article will provide a comprehensive analysis of ATA's price trends and market dynamics, incorporating historical performance data, market supply-demand fundamentals, ecosystem development initiatives, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to Automata Network's growth potential through 2030.

Automata (ATA) Market Analysis Report

I. ATA Price History Review and Current Market Status

ATA Historical Price Evolution

-

June 2021: Project launch with an initial price of $10.00, reaching an all-time high (ATH) of $2.36 on June 7, 2021, marking the peak of early market enthusiasm.

-

2021-2025: Extended bearish period, with the token experiencing significant depreciation over the multi-year cycle, declining approximately 83.12% over the past year alone.

-

December 2025: Token reached its all-time low (ATL) of $0.01508035 on December 19, 2025, reflecting sustained downward pressure in the market.

ATA Current Market Status

As of December 22, 2025, ATA is trading at $0.01581, with a 24-hour trading volume of $29,056.24. The token's market capitalization stands at approximately $9.29 million, with a fully diluted valuation of $15.81 million, representing 58.78% of market cap to fully diluted valuation ratio.

The circulating supply totals 587,792,028.26 ATA tokens out of a maximum supply of 1 billion tokens. Over the past 24 hours, ATA has declined by 1.97%, while the 7-day and 30-day price changes show decreases of 9.96% and 24.86%, respectively. The token is currently ranked 1,211 by market capitalization and is listed on 12 exchanges. The market dominance of ATA stands at 0.00049%, with 1,838 unique token holders.

Click to view current ATA market price

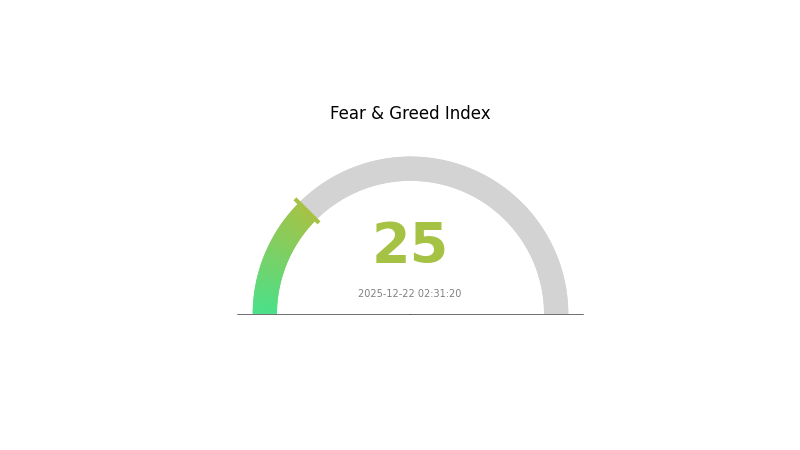

ATA Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The Fear and Greed Index has dropped to 25, indicating extreme fear in the cryptocurrency market. This sentiment typically signals significant market pessimism and widespread concern among investors. During periods of extreme fear, asset prices often reach attractive entry points for long-term investors. However, caution is advised as further downside movements may occur. Monitor market developments closely on Gate.com to identify potential opportunities while managing risk appropriately.

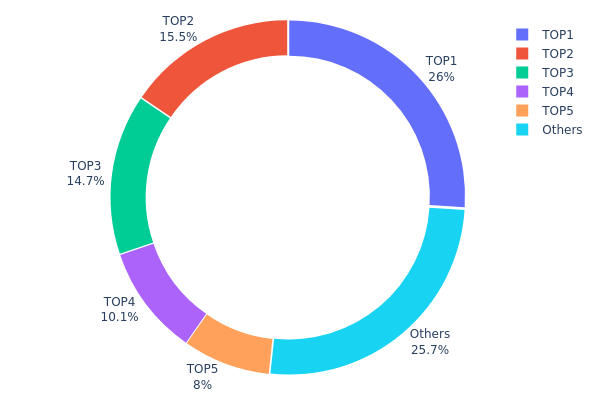

ATA Holdings Distribution

The address holdings distribution chart illustrates the concentration of ATA tokens across different wallet addresses on the blockchain. It provides a critical perspective on token ownership patterns, revealing how ATA supply is dispersed among major holders and the broader community. By examining the top holders and their respective percentages of total supply, this metric serves as a key indicator of decentralization, potential market manipulation risks, and the overall health of the token's ecosystem structure.

ATA currently exhibits moderate concentration characteristics in its holdings distribution. The top five addresses collectively control 74.29% of the total token supply, with the largest holder commanding 26.00% and the second-largest holding 15.51%. While this concentration level warrants attention, the presence of a substantial "Others" category representing 25.71% distributed among numerous smaller addresses demonstrates some degree of decentralization. The distribution does not indicate extreme centralization, though the top holder's significant stake suggests meaningful influence over potential governance or market movements.

The current address distribution presents a balanced risk profile for market dynamics. The concentration among the top five holders creates potential for coordinated price movements or market impact, particularly if large positions are liquidated or deployed strategically. However, the relatively diversified tail of smaller holders provides a stabilizing counterweight to concentrated ownership. This structure reflects a maturing token ecosystem where early supporters and institutional participants maintain substantial positions while retail and community participation has grown alongside broader adoption.

Click to view the current ATA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x927d...eedc83 | 260000.00K | 26.00% |

| 2 | 0x5a52...70efcb | 155139.14K | 15.51% |

| 3 | 0x6106...987354 | 147000.00K | 14.70% |

| 4 | 0xf977...41acec | 100869.17K | 10.08% |

| 5 | 0x1d8d...7d266c | 80000.00K | 8.00% |

| - | Others | 256991.69K | 25.71% |

II. Core Factors Impacting ATA's Future Price

Supply Mechanism

-

Automatic Token Distribution: ATA implements an automated distribution mechanism through smart contract technology, which automatically allocates tokens to platform users and token holders. This automation ensures fairness and transparency in token distribution.

-

Current Impact: The predictable and transparent nature of ATA's automated distribution mechanism provides market participants with clarity regarding token supply dynamics, potentially supporting price stability through reduced uncertainty about future token availability.

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve's hawkish stance and persistent inflation have created headwinds for crypto markets in the near term. The Federal Reserve's cautious approach to interest rate cuts will remain a core factor affecting market dynamics in the coming months, with potential rate cut timing representing a critical variable for cryptocurrency market sentiment.

-

Market Volatility: Cryptocurrency markets may continue to experience volatility in the short term given the current monetary policy environment and inflation concerns.

Technical Development and Ecosystem

-

Protocol Updates and Hard Forks: Automata's price trajectory is influenced by blockchain protocol updates, hard forks, and coordination improvements. These technical enhancements can affect network functionality and user adoption.

-

Real-World Events Impact: Regulatory changes, enterprise and government adoption developments, and security incidents affecting cryptocurrency trading platforms can materially influence ATA's price movements.

Three、2025-2030 ATA Price Forecast

2025-2026 Outlook

- Conservative Forecast: $0.01221 - $0.01288

- Neutral Forecast: $0.01586 - $0.01673

- Bullish Forecast: $0.0176 - $0.01757 (requires sustained market recovery and increased adoption)

2027-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery phase with increasing institutional interest and ecosystem expansion

- Price Range Forecast:

- 2027: $0.01372 - $0.02367

- 2028: $0.01816 - $0.02347

- Key Catalysts: Network upgrades, strategic partnerships, growing DeFi integration, and improved market sentiment

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01558 - $0.02545 (assuming moderate adoption and stable market conditions)

- Bullish Scenario: $0.02133 - $0.03294 (assuming accelerated ecosystem development and broader cryptocurrency market expansion)

- Transformative Scenario: $0.03294+ (extreme favorable conditions including mainstream institutional adoption and breakthrough technological innovations)

- 2030-12-22: ATA trading at $0.0237 average (demonstrating strong year-on-year appreciation of approximately 49% from 2029 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0176 | 0.01586 | 0.01221 | 0 |

| 2026 | 0.01757 | 0.01673 | 0.01288 | 5 |

| 2027 | 0.02367 | 0.01715 | 0.01372 | 8 |

| 2028 | 0.02347 | 0.02041 | 0.01816 | 29 |

| 2029 | 0.02545 | 0.02194 | 0.01558 | 38 |

| 2030 | 0.03294 | 0.0237 | 0.02133 | 49 |

Automata (ATA) Professional Investment Strategy and Risk Management Report

IV. ATA Professional Investment Strategy and Risk Management

ATA Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors focused on privacy and MEV solutions in blockchain infrastructure; supporters of decentralized governance; risk-averse participants seeking exposure to privacy middleware technology

- Operational Recommendations:

- Accumulate ATA during market downturns to build a core position, given the current 24-hour price decline of -1.97% and year-over-year decline of -83.12%

- Participate in governance activities by staking ATA tokens to earn potential rewards and influence network development

- Maintain holdings through complete market cycles to benefit from potential adoption of Witness privacy solutions and Conveyor MEV minimization protocol

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price volatility tracking: Monitor the 24-hour high of $0.01618 and low of $0.01532 to identify entry and exit points within established trading ranges

- Volume analysis: Track the 24-hour trading volume of 29,056.2388099 ATA to assess market interest and liquidity conditions

- Wave Trading Key Points:

- Consider resistance levels near historical highs ($2.36) as potential profit-taking zones for tactical exits

- Utilize support levels near current lows ($0.01508) as potential accumulation zones for tactical entries

- Monitor governance participation timelines as catalysts for potential price movements

ATA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-7% of total portfolio allocation

- Professional Investors: 7-15% of total portfolio allocation, with additional hedging strategies

(2) Risk Hedging Solutions

- Portfolio diversification: Balance ATA holdings with other blockchain infrastructure tokens to reduce concentration risk

- Position sizing: Implement stop-loss orders at 15-20% below entry points to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and governance participation, offering convenience for frequent transactions

- Cold Storage Approach: Use hardware wallets for long-term holdings exceeding 12 months to enhance security against cyber threats

- Security Considerations: Enable multi-factor authentication on all exchange accounts; never share private keys; regularly update wallet software; conduct transactions through verified channels only; maintain backup recovery phrases in secure offline locations

V. ATA Potential Risks and Challenges

ATA Market Risk

- High price volatility: ATA has experienced an 83.12% decline over the past year, indicating significant price instability and potential for substantial losses

- Low market capitalization: With a total market cap of $15.81 million, ATA remains highly susceptible to large capital flows and market manipulation

- Limited liquidity: The 24-hour trading volume of approximately $29,000 suggests relatively thin liquidity, which could result in slippage during large transactions

ATA Regulatory Risk

- Evolving privacy regulation: Privacy-focused features in Witness and governance solutions may face increasing regulatory scrutiny from global financial authorities

- Compliance uncertainty: As jurisdictions develop clearer staking and DeFi regulations, ATA's reward mechanisms and governance model may require modifications

- International regulatory divergence: Different regulatory frameworks across blockchains (Ethereum, BSC, substrate-based chains) where ATA operates could create compliance complexity

ATA Technology Risk

- Protocol adoption challenges: Conveyor MEV minimization solution requires widespread adoption across multiple blockchains to achieve effectiveness, which remains unproven

- Smart contract vulnerabilities: Privacy middleware solutions carry inherent risks of technical exploits or security flaws that could compromise user data

- Network scalability: Maintaining privacy and security while scaling across multiple blockchains presents ongoing technical challenges that could impact network performance

VI. Conclusion and Action Recommendations

ATA Investment Value Assessment

Automata Network presents an emerging infrastructure play focused on privacy middleware and MEV minimization across multiple blockchains. The protocol's native token ATA benefits from multiple utility cases including governance, mining rewards, protocol fees, and Geode auctions. However, the significant year-over-year price decline of 83.12%, coupled with low market liquidity and modest market capitalization, reflects market skepticism regarding near-term adoption prospects. The technology remains innovative but unproven at scale, making ATA suitable primarily for investors with high risk tolerance and extended investment horizons who believe in the long-term value of privacy solutions in blockchain infrastructure.

ATA Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through Gate.com, focusing exclusively on long-term holding strategies while learning about privacy protocols and MEV solutions ✅ Experienced Investors: Allocate 3-7% with balanced exposure to governance participation alongside tactical trading during significant volatility periods, implementing systematic rebalancing quarterly ✅ Institutional Investors: Conduct comprehensive due diligence on protocol adoption metrics; consider positions of 7-15% with sophisticated hedging strategies; engage with development team on roadmap clarity

ATA Trading Participation Methods

- Gate.com Spot Trading: Execute buy and sell orders directly on Gate.com's spot market for ATA/USDT pairs with full custody control

- Gate.com Staking Programs: Participate in potential ATA staking rewards programs to generate additional yield beyond price appreciation

- Smart Contract Interaction: Engage directly with Witness governance solutions and Geode auctions for users seeking maximum protocol participation and potential rewards

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions carefully according to their own risk tolerance and should consider consulting professional financial advisors. Never invest more capital than you can afford to lose.

FAQ

What is the price prediction for ATA in 2025?

ATA is expected to show positive momentum in 2025, with predictions suggesting potential gains based on technical analysis and market trends. The price may fluctuate between $0.0752 and $0.0971, with possibilities for growth as the network expands.

What is ATA crypto?

ATA is the native token of the Automata Network, a privacy middleware protocol for decentralized applications. As an ERC-20 token, ATA enables network governance, staking for rewards, and participation in consensus mechanisms across multiple blockchain networks.

How has ATA's historical price performance been, and what factors influence its price movements?

ATA has shown a 3.210% change over the past year, with a 52-week range from 0.713 to 2.579. Price movements are driven by market demand, blockchain adoption rates, ecosystem developments, and overall crypto market sentiment.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

Today's XRP Analysis: Buy, Sell, or Hold? 📈💥 | Market Insights and Predictions

2025 FST Price Prediction: Expert Analysis and Market Forecast for Fastcoin's Future Value

Comprehensive Insight into MANA Token Value in the Metaverse

2025 TCOM Price Prediction: Expert Analysis and Market Forecast for China Telecom Stock

2025 DORA Price Prediction: Expert Analysis and Market Forecast for the Coming Year