2025 CRVPrice Prediction: Analyzing Market Trends and Future Potential of the Curve DAO Token

Introduction: CRV's Market Position and Investment Value

Curve (CRV), as a decentralized exchange protocol for efficient stablecoin trading, has achieved significant milestones since its inception in 2020. As of 2025, Curve's market capitalization has reached $1.14 billion, with a circulating supply of approximately 1.4 billion tokens, and a price hovering around $0.8154. This asset, often hailed as the "stablecoin trading pioneer," is playing an increasingly crucial role in the decentralized finance (DeFi) ecosystem.

This article will comprehensively analyze Curve's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

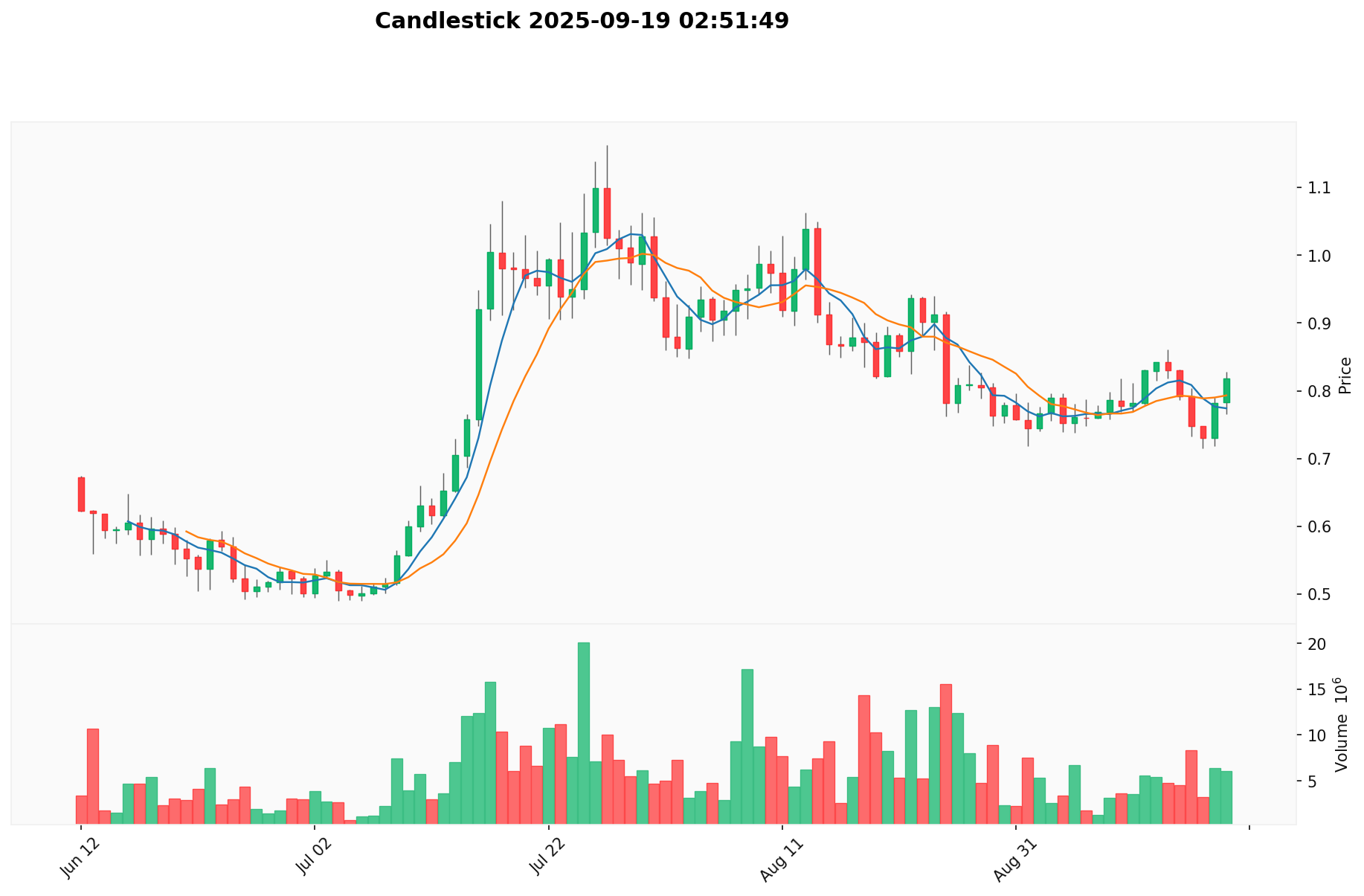

I. CRV Price History Review and Current Market Status

CRV Historical Price Evolution

- 2020: Initial launch in January, price reached ATH of $15.37 on August 14

- 2022: Crypto winter, price declined significantly

- 2024: Market recovery, CRV hit ATL of $0.180354 on August 5

CRV Current Market Situation

As of September 19, 2025, CRV is trading at $0.8154, with a 24-hour change of 4.9%. The current price represents a significant recovery from its all-time low but remains well below its all-time high. CRV's market cap stands at $1.14 billion, ranking it 106th among cryptocurrencies. The 24-hour trading volume is $4,462,230, indicating moderate market activity. With a circulating supply of 1,403,205,690 CRV out of a total supply of 2,305,663,982, the token has a circulation ratio of 46.31%. The fully diluted market cap is $2.47 billion, suggesting potential for growth if the entire supply enters circulation.

Click to view the current CRV market price

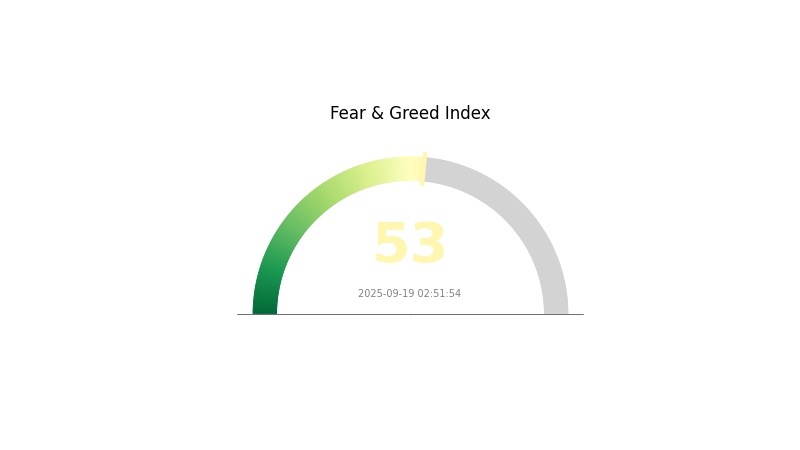

CRV Market Sentiment Indicator

2025-09-19 Fear and Greed Index: 53 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral today, with the Fear and Greed Index holding steady at 53. This balanced sentiment suggests that investors are cautiously optimistic, neither overly fearful nor excessively greedy. Traders on Gate.com are maintaining a level-headed approach, carefully weighing potential risks and opportunities in the CRV market. As always, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in this dynamic market environment.

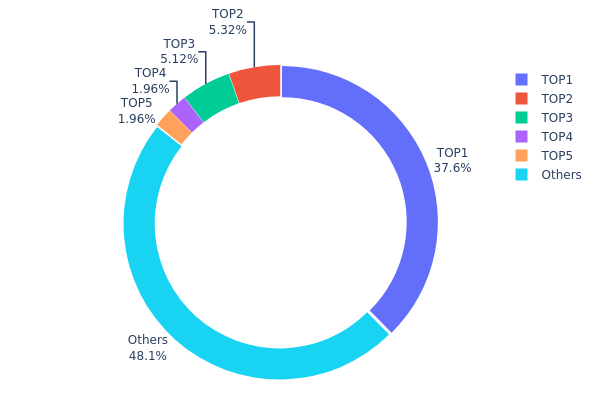

CRV Holdings Distribution

The address holdings distribution data reveals a significant concentration of CRV tokens among a few top addresses. The largest holder possesses 37.58% of the total supply, while the top 5 addresses collectively control 51.91% of CRV tokens. This high concentration raises concerns about potential market manipulation and centralization risks.

Such a distribution structure could lead to increased volatility in CRV's price, as large holders have the capacity to significantly impact the market with their trading activities. The dominant position of the top address, holding over one-third of the supply, particularly warrants attention as it could potentially exert undue influence on governance decisions and market dynamics.

While 48.09% of tokens are distributed among other addresses, the current holding pattern suggests a relatively low level of decentralization for CRV. This concentration may impact the token's resilience to market shocks and could pose challenges to the project's long-term stability and governance structure.

Click to view the current CRV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5f3b...94e2a2 | 866566.92K | 37.58% |

| 2 | 0xf977...41acec | 122609.42K | 5.31% |

| 3 | 0x5a52...70efcb | 118000.00K | 5.11% |

| 4 | 0xc06f...0b3370 | 45272.51K | 1.96% |

| 5 | 0x8fa1...984d4a | 45186.63K | 1.95% |

| - | Others | 1108003.33K | 48.09% |

II. Key Factors Affecting CRV's Future Price

Supply Mechanism

- Maximum Supply: The maximum supply of CRV is capped at 3,030,303,030.299 tokens.

- Current Impact: With a circulating supply of 1,391,042,725.90429617 tokens, the controlled release of remaining tokens may influence price dynamics.

Institutional and Major Holder Dynamics

- Enterprise Adoption: Curve Finance has gained traction as a major DeFi protocol, attracting institutional interest in CRV tokens.

- National Policies: Regulatory developments in various countries regarding DeFi and stablecoins could impact CRV's adoption and value.

Macroeconomic Environment

- Inflation Hedging Properties: As a DeFi token, CRV may be viewed as a potential hedge against inflation, particularly in unstable economic conditions.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions could drive interest in decentralized finance solutions, potentially benefiting CRV.

Technical Development and Ecosystem Building

- Curve V2 Upgrade: The implementation of Curve V2 has enhanced the platform's ability to handle non-pegged asset pairs, potentially expanding CRV's use cases and value.

- Ecosystem Applications: Curve Finance serves as a major liquidity provider in the DeFi space, with its ecosystem including various stablecoin pools and yield-generating opportunities.

III. CRV Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.67736 - $0.80000

- Neutral prediction: $0.80000 - $0.84058

- Optimistic prediction: $0.84058 - $0.90000 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.65605 - $1.24831

- 2028: $0.79901 - $1.17692

- Key catalysts: DeFi sector expansion, broader crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $1.10000 - $1.35000 (assuming steady market growth)

- Optimistic scenario: $1.35000 - $1.53453 (with strong DeFi adoption)

- Transformative scenario: $1.53453 - $1.80000 (with groundbreaking protocol upgrades)

- 2030-12-31: CRV $1.33143 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.84058 | 0.8161 | 0.67736 | 0 |

| 2026 | 0.99401 | 0.82834 | 0.64611 | 1 |

| 2027 | 1.24831 | 0.91118 | 0.65605 | 11 |

| 2028 | 1.17692 | 1.07974 | 0.79901 | 32 |

| 2029 | 1.53453 | 1.12833 | 1.07192 | 38 |

| 2030 | 1.38469 | 1.33143 | 1.10509 | 63 |

IV. CRV Professional Investment Strategies and Risk Management

CRV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate CRV during market dips

- Stake CRV for additional rewards

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Curve protocol usage metrics

- Track overall DeFi market sentiment

CRV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance CRV with other DeFi and non-DeFi assets

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for CRV

CRV Market Risks

- High volatility: CRV price can experience significant short-term fluctuations

- Competition: Emerging DeFi protocols may challenge Curve's market position

- Liquidity risks: Potential for reduced liquidity during market stress

CRV Regulatory Risks

- Uncertain regulatory environment: Potential for increased DeFi regulation

- Cross-border compliance: Varying regulatory approaches in different jurisdictions

- Tax implications: Evolving tax treatment of DeFi tokens and activities

CRV Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability challenges: Ethereum network congestion may impact user experience

- Governance risks: Potential for contentious decisions in the DAO structure

VI. Conclusion and Action Recommendations

CRV Investment Value Assessment

CRV presents a unique value proposition in the DeFi space with its focus on efficient stablecoin trading. While it offers potential for long-term growth, investors should be aware of short-term volatility and regulatory uncertainties.

CRV Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and Curve's ecosystem ✅ Experienced investors: Consider a balanced approach, combining holding and active trading strategies ✅ Institutional investors: Evaluate CRV as part of a diversified DeFi portfolio, conduct thorough due diligence

CRV Participation Methods

- Spot trading: Buy and hold CRV on reputable exchanges

- Staking: Participate in Curve's liquidity pools for additional rewards

- Governance: Engage in Curve DAO voting to shape the protocol's future

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is CRV a good token?

CRV has strong potential due to its key role in DeFi. Its long-term outlook appears positive, though market conditions may impact its value.

Will CRV recover?

CRV shows potential for recovery based on recent trends and on-chain data. While the future remains uncertain, positive indicators suggest a possible rebound in the coming months.

Is CRV worth investing in?

CRV's investment potential is uncertain. Current market trends don't show immediate upside, but long-term prospects may vary. Always research thoroughly before investing.

Is CRV a stable coin?

No, CRV is not a stablecoin. It's the governance token for Curve Finance, a platform focused on stablecoin trading.

GUSD on Gate in 2025: Advantages and Opportunities of Gemini Dollar

2025 CRVPrice Prediction: Analyzing Market Trends, Adoption Metrics, and Key Factors Driving Curve DAO Token Valuation

What is WNXM: Understanding the Wrapped Nexus Mutual Token and Its Role in DeFi Insurance

2025 USUALPrice Prediction: Market Dynamics and Investment Opportunities in the Post-Pandemic Economy

How to Buy GUSD: A Complete Guide to Gemini Dollar

How Does Competitive Analysis Drive Crypto Market Share Growth?

What is TEXITcoin (TXC) fundamentals: whitepaper logic, use cases, and technical innovation analysis?

DIMO vs GMX: A Comprehensive Comparison of Decentralized Data and Derivatives Trading Platforms

What is Lumia (LUMIA) price today with $14.94M market cap and 146.59M circulating supply?

VXT vs DYDX: A Comprehensive Comparison of Two Leading Decentralized Exchange Tokens

SHPING vs VET: Comparing Two Leading Supply Chain and Logistics Blockchain Solutions