2025 POND Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: POND's Market Position and Investment Value

Marlin (POND) is an open protocol providing high-performance programmable network infrastructure for DeFi and Web 3.0. Since its inception in 2020, POND has established itself as a native functional token with multi-faceted utility within the Marlin ecosystem. As of December 2025, POND boasts a market capitalization of approximately $32.19 million, with a circulating supply of 8.2 billion tokens trading at around $0.003924. This infrastructure asset is playing an increasingly pivotal role in supporting decentralized finance operations and Web 3.0 applications through its governance, incentive, and staking mechanisms.

This article will provide a comprehensive analysis of POND's price trajectory from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for crypto asset investors.

Marlin (POND) Market Analysis Report

I. POND Price History Review and Current Market Status

POND Historical Price Evolution

- December 2020: Project launch with initial price of $0.008, reaching an all-time high of $0.323362 on December 22, 2020.

- 2021-2024: Sustained decline from peak levels, reflecting market corrections and competitive pressures in the DeFi infrastructure sector.

- 2025: Continued downward trajectory, with the token reaching a new all-time low of $0.00376604 on December 19, 2025, representing an 80.83% decline over a one-year period.

POND Current Market Dynamics

Price Performance:

- Current price: $0.003924 (as of December 19, 2025)

- 24-hour change: +1.36% ($0.000052650355169692)

- 7-day change: -11.57%

- 30-day change: -22.86%

- 1-year change: -80.83%

Market Capitalization:

- Market cap (circulating): $32,186,194.69

- Fully diluted valuation: $39,240,000.00

- Market dominance: 0.0012%

Supply Metrics:

- Circulating supply: 8,202,394,162 POND (82.02% of total supply)

- Total supply: 10,000,000,000 POND

- Maximum supply: 10,000,000,000 POND

Trading Activity:

- 24-hour trading volume: $17,940.76

- 24-hour high: $0.003994

- 24-hour low: $0.00376

- Exchange listings: 20 exchanges

- Active holders: 11,247

Market Sentiment:

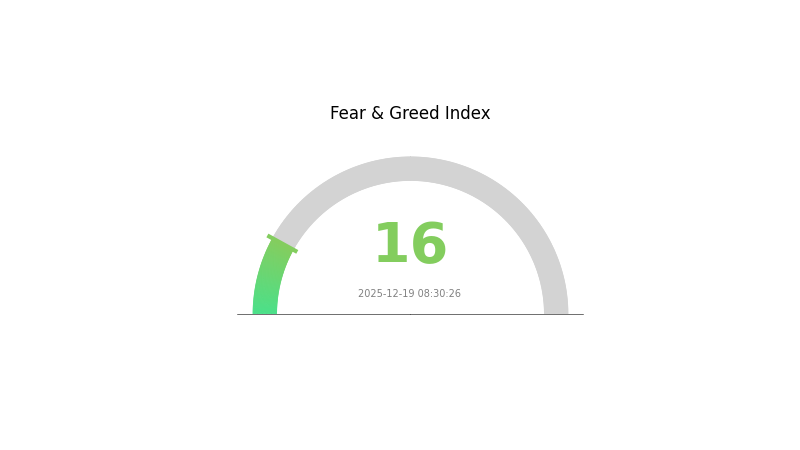

- Current market emotion indicator: Extreme Fear (VIX: 16)

- Price recovery from near all-time lows observed in 24-hour trading session

Visit POND Market Price on Gate.com for real-time updates.

POND Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This represents a significant risk-averse sentiment among investors, suggesting widespread market pessimism and potential capitulation. During such extreme fear periods, opportunities often emerge for contrarian investors. However, caution is advised as volatility may persist. Monitor key support levels and maintain a disciplined risk management strategy. Consider dollar-cost averaging for long-term positions on Gate.com to mitigate timing risks in this fearful market environment.

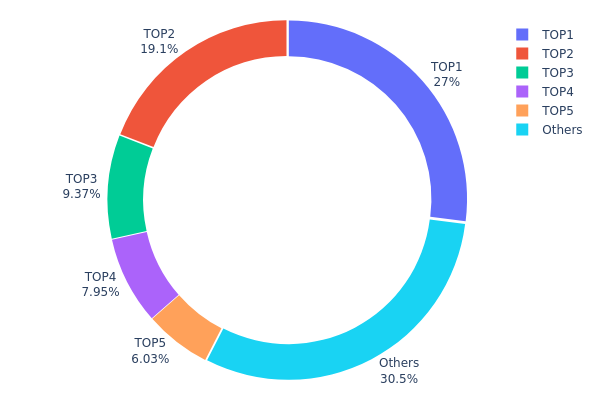

POND Holdings Distribution

The address holdings distribution chart illustrates the concentration of POND tokens across blockchain addresses, revealing the degree of token ownership centralization within the ecosystem. By analyzing the top holders and their respective proportions, this metric provides critical insight into the token's decentralization characteristics, potential market manipulation risks, and overall chain structure stability.

POND currently exhibits moderate concentration characteristics, with the top five addresses collectively controlling 69.46% of the total token supply. The largest holder commands 27.01% of tokens, while the second-largest holds 19.12%, indicating a significant concentration among the top two addresses alone, which account for 46.13% of all POND in circulation. However, the remaining 30.54% distributed among other addresses demonstrates that substantial token reserves remain dispersed throughout the ecosystem, providing some degree of decentralization offset. The concentration gradient between top holders remains relatively steep, with holdings decreasing progressively from the first to the fifth address.

The current distribution pattern presents both structural considerations and market implications. While the top five addresses maintaining nearly 70% of supply suggests potential liquidity concentration and governance influence risks, the substantial "Others" category indicates that POND's decentralization foundation has not been entirely compromised. This configuration suggests a token structure typical of projects in development or institutional distribution phases, where early investors and core stakeholders maintain significant positions. The concentration level warrants monitoring regarding potential coordinated market movements or liquidity constraints, though the presence of distributed holdings among remaining addresses provides a stabilizing factor against extreme centralization scenarios.

View current POND Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcee2...97180d | 2701097.09K | 27.01% |

| 2 | 0xe5fe...9ebecc | 1912624.02K | 19.12% |

| 3 | 0xaba3...8f2f4e | 937035.84K | 9.37% |

| 4 | 0xf977...41acec | 794587.46K | 7.94% |

| 5 | 0x7f75...14edf9 | 602774.07K | 6.02% |

| - | Others | 3051881.52K | 30.54% |

Core Factors Influencing POND's Future Price

Supply Mechanism

- Limited Token Supply: POND has a relatively constrained supply of approximately 1 billion tokens in circulation, creating a foundation for potential price appreciation as demand increases.

- Historical Patterns: As user recognition and adoption of POND increase, demand tends to rise. If market supply remains constant while demand grows, prices naturally trend upward. Conversely, if supply increases without corresponding demand growth, prices may face downward pressure.

- Current Impact: The limited supply dynamics suggest that as the Pond liquidity network expands its user base and application scenarios, supply constraints could support price appreciation if demand accelerates.

Macroeconomic Environment

- Monetary Policy Impact: Global economic conditions, policy adjustments, and financial market changes directly affect investor confidence. During economic recovery periods, investors' risk appetite increases, potentially driving greater investment in digital currencies and supporting POND price growth. Conversely, economic downturns may push investors toward risk-averse assets, creating price pressure on POND.

- Market Sentiment: Investor confidence and market emotion significantly influence price volatility. When overall market conditions are favorable, investors typically exhibit optimism, potentially pushing POND prices upward. Negative news or panic selling can conversely depress prices.

Technology Development and Ecosystem Building

- Platform Innovation: The Pond liquidity network aims to construct an efficient and secure liquidity solution. Continuous technological iteration and platform upgrades are critical factors influencing POND's price. The platform's core technology and user base provide essential support for POND's future growth potential.

- Expanded Use Cases: As blockchain technology advances, POND's application scenarios continue to broaden. For example, certain platforms have begun accepting POND as a payment method, allowing users to enjoy transaction discounts. This enhances POND's practical utility value and lays the foundation for price appreciation. As more enterprises and platforms adopt POND, its application scope will expand further, providing additional upside potential.

- Ecosystem Applications: POND functions as the native token for the Pond platform, designed to provide users with liquidity access, reward mechanisms, and ecosystem participation opportunities. As platform users increase and application scenarios expand, POND's demand is projected to rise, potentially driving price appreciation.

Community and Strategic Partnerships

- Community Development: An active and engaged community brings greater attention and support to POND, potentially driving price increases. Continuous introduction of new features and user experience improvements by the development team attract more participants and foster a positive cycle of ecosystem growth.

- Strategic Collaborations: Partnerships with recognized projects and platforms help enhance POND's market credibility and liquidity, contributing to broader adoption and price appreciation potential.

Three、2025-2030 POND Price Forecast

2025 Outlook

- Conservative Forecast: $0.00204 - $0.00392

- Neutral Forecast: $0.00392

- Optimistic Forecast: $0.00561 (requires sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectations: Gradual accumulation phase with incremental adoption growth and increasing institutional interest in the POND ecosystem.

- Price Range Predictions:

- 2026: $0.00357 - $0.00605

- 2027: $0.00373 - $0.00757

- 2028: $0.00617 - $0.00870

- Key Catalysts: Enhanced protocol functionality, expanded partnership networks, growing decentralized application ecosystem, and improved market liquidity through platforms like Gate.com.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00729 - $0.00896 (assumes steady market maturation and moderate adoption acceleration)

- Optimistic Scenario: $0.00828 - $0.01225 (assumes breakthrough in mainstream adoption and significant technological advancements)

- Transformative Scenario: $0.01225+ (assumes revolutionary use case realization and widespread institutional adoption)

- 2030-12-31: POND trades at $0.01225 (achieves 110% cumulative growth from 2025 baseline, reflecting strong long-term value proposition)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00561 | 0.00392 | 0.00204 | 0 |

| 2026 | 0.00605 | 0.00477 | 0.00357 | 21 |

| 2027 | 0.00757 | 0.00541 | 0.00373 | 37 |

| 2028 | 0.0087 | 0.00649 | 0.00617 | 65 |

| 2029 | 0.00896 | 0.00759 | 0.00729 | 93 |

| 2030 | 0.01225 | 0.00828 | 0.00588 | 110 |

Marlin (POND) Professional Investment Strategy and Risk Management Report

IV. POND Professional Investment Strategy and Risk Management

POND Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi enthusiasts, Web 3.0 infrastructure believers, and governance-focused participants who believe in Marlin's network scalability potential.

- Operational Recommendations:

- Accumulate POND tokens during market downturns, leveraging the current 80.83% year-over-year decline as a potential entry opportunity for long-term believers.

- Participate in network staking to earn protocol incentives while holding POND, creating a compounding effect on returns.

- Actively engage in governance voting to influence network resource allocation and fund pool management decisions, maximizing token utility beyond price appreciation.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at $0.00376 (historical low and current ATL as of December 19, 2025) and $0.323362 (historical high from December 22, 2020) to establish trading ranges and breakout targets.

- Volume Analysis: Monitor the 24-hour trading volume of approximately $17,940.76 to assess liquidity conditions and price momentum sustainability during position entries and exits.

- Wave Trading Key Points:

- Capture upward momentum during positive market sentiment shifts, targeting the 7-day and 30-day downtrend reversals showing -11.57% and -22.86% declines respectively.

- Execute disciplined take-profit orders at 15-25% gains from entry points to lock in profits before potential reversals given the token's high volatility.

POND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation, focusing on small-position staking and governance participation with minimal leverage exposure.

- Active Investors: 3-5% of total crypto portfolio allocation, allowing for both staking rewards and selective wave trading during identified support-level bounces.

- Professional Investors: 5-8% of total crypto portfolio allocation, with structured positions combining staking, governance hedging strategies, and tactical trading around key technical levels.

(2) Risk Hedging Solutions

- Position Sizing: Implement a maximum 5% loss per trade rule, ensuring that no single POND position exceeds the investor's pre-defined risk tolerance given the token's extreme 80.83% annual decline.

- Diversification Across Chains: Although POND currently trades primarily on Ethereum (ETH), monitor potential cross-chain deployments to reduce single-chain dependency risk and enhance liquidity access.

(3) Secure Storage Solutions

- Self-Custody Recommendation: Transfer POND tokens to Gate.com Web3 wallet for decentralized control, enabling direct participation in staking and governance while maintaining custody security.

- Exchange Custody Option: Maintain a portion of POND holdings on Gate.com for active trading execution, liquidity management, and reduced operational friction during time-sensitive market opportunities.

- Security Best Practices: Enable multi-signature authentication for wallet operations, maintain offline backup of seed phrases, regularly audit smart contract interactions for protocol updates, and never share private keys or seed phrases with third parties.

V. POND Potential Risks and Challenges

POND Market Risks

- Severe Price Depreciation: The token has experienced an 80.83% decline over the past year, falling to the all-time low of $0.00376604 on December 19, 2025, indicating sustained downward pressure and weak market confidence in Marlin's utility proposition.

- Extreme Volatility: With historical highs of $0.323362 and lows approaching current prices, POND demonstrates extreme price swings that create unpredictable investment outcomes and heightened liquidation risks for leveraged positions.

- Low Trading Liquidity: The 24-hour volume of only $17,940.76 relative to a market cap of approximately $32.2 million reflects poor liquidity conditions, making large position entries and exits potentially difficult without significant price slippage.

POND Regulatory Risks

- Classification Uncertainty: The regulatory treatment of Marlin's programmable network infrastructure and POND as a governance/staking token remains unclear across different jurisdictions, potentially exposing holders to sudden regulatory restrictions.

- DeFi Regulatory Crackdown: As regulatory bodies worldwide intensify scrutiny of decentralized finance platforms, protocols like Marlin providing DeFi infrastructure may face compliance challenges that negatively impact token value.

- Governance Token Restrictions: Future regulations may classify POND as a security rather than a utility token, fundamentally altering its trading ability and custody requirements for institutional investors.

POND Technology Risks

- Network Adoption Uncertainty: Despite Marlin's positioning as high-performance infrastructure for DeFi and Web 3.0, the project's limited market presence (ranked 663 with only 11,247 token holders) raises questions about real-world adoption and sustainable usage growth.

- Smart Contract Vulnerabilities: The underlying protocol's security depends on flawless implementation of complex programmable network infrastructure, where any code vulnerabilities could result in catastrophic value loss or network compromise.

- Competitive Infrastructure Pressure: Marlin faces competition from established and emerging blockchain infrastructure providers with greater resources, network effects, and developer adoption, potentially limiting POND's long-term viability.

VI. Conclusion and Action Recommendations

POND Investment Value Assessment

Marlin (POND) represents a speculative infrastructure investment with significant technological potential but substantial current market challenges. The token's 80.83% year-over-year decline reflects weak market confidence in the protocol's value proposition despite its positioning in the critical DeFi and Web 3.0 infrastructure sector. With only 11,247 token holders and minimal 24-hour trading volumes, POND exhibits illiquidity characteristics typical of early-stage protocols with unproven market adoption. The token's primary value drivers—governance rights, protocol incentives through network participation, and staking rewards—depend entirely on Marlin achieving meaningful network adoption and developer engagement. For long-term believers in programmable network infrastructure, the current depressed valuations may present asymmetric entry opportunities, though the significant downside risks and limited liquidity warrant extreme caution and careful position sizing.

POND Investment Recommendations

✅ Beginners: Avoid direct POND purchases until demonstrating understanding of staking mechanics and governance participation. If interested, start with micro-positions (0.5-1% of crypto portfolio) only through Gate.com's intuitive trading interface, combining small purchases with educational engagement via Marlin's official channels and community forums to understand the protocol's real-world adoption trajectory.

✅ Experienced Investors: Construct a structured position combining staking participation (60%) for protocol incentive accumulation with selective wave trading (40%) around identified support levels at $0.00376 and technical resistance zones. Implement disciplined profit-taking at 20-30% gains and strict stop-losses at 15% below entry points, prioritizing capital preservation over aggressive accumulation given extreme volatility.

✅ Institutional Investors: Conduct comprehensive technical due diligence on Marlin's network architecture, competitive differentiation, and developer ecosystem before committing capital. Establish governance participation strategies to influence protocol direction, negotiate liquidity provision arrangements with Gate.com market makers to ensure efficient position entry and exit, and structure POND as a minority allocation within broader Web 3.0 infrastructure exposure rather than a concentrated bet.

POND Trading Participation Methods

- Gate.com Spot Trading: Execute direct POND purchases using Gate.com's spot trading pairs, offering competitive pricing, reliable order execution, and seamless integration with the platform's Web3 wallet for immediate staking or governance participation following purchases.

- Staking and Yield Generation: Lock POND tokens in Marlin's native staking mechanisms accessible through Gate.com to earn protocol incentives while maintaining governance participation rights, creating passive income aligned with long-term infrastructure belief.

- Liquidity Pool Participation: Provide liquidity for POND trading pairs on Gate.com to earn trading fees and protocol rewards, generating returns independent of price appreciation while supporting ecosystem liquidity infrastructure.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely. POND's extreme volatility, limited liquidity, and unproven network adoption create substantial downside risks suitable only for highly sophisticated investors with significant risk capital.

FAQ

Can pond reach $1?

POND reaching $1 is highly unlikely given current market conditions. It would require massive market cap expansion and extraordinary liquidity inflows far beyond historical trends.

What does pond crypto do?

Pond is a large AI model for crypto that recommends tokens with similar on-chain behaviors to those you are familiar with, helping users discover relevant tokens in the crypto space.

What is POND token and what is its use case?

POND is Marlin's native utility token enabling governance participation. Token holders vote on key ecosystem decisions, providing decentralized control over protocol development and strategic directions.

Is POND a good investment for 2025?

POND shows promising potential for 2025 with strong market fundamentals and positive price projections. Growing adoption and project developments suggest it could deliver solid returns for investors seeking exposure to the crypto market.

What factors could influence POND price in the future?

POND price will be influenced by regulatory changes, technological advancements, market adoption, trading volume, investor sentiment, and ecosystem developments. These factors combined will drive future price movements and market dynamics.

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

LMWR vs AAVE: Understanding the Linguistic Debate Between Language Minority Ways of Reading and African American Vernacular English

Is Vaulta (A) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 DCB Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Decubate (DCB) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Debox (BOX) a Good Investment?: Analyzing Growth Potential and Risks in the Web3 Storage Market

Solana and Ethereum 2.0: A Comprehensive Comparison

Seamlessly Integrate Your Wallet with Web3 Platforms

Understanding the Total Number of Bitcoins in Circulation

Unlock Your Free Layer Zero Tokens: A Step-by-Step Guide

SHM Token Comprehensive Guide: Price, Forecasts, and Purchasing Instructions