2025 RAM Price Prediction: Navigating the Future of Memory Market Dynamics

Introduction: RAM's Market Position and Investment Value

Ramifi Protocol (RAM), as a decentralized algorithmic stablecoin, has been making waves in the cryptocurrency market since its inception in 2021. As of 2025, RAM's market capitalization stands at $4,922.838, with a circulating supply of approximately 362,000 tokens, and a price hovering around $0.013599. This asset, often referred to as the "dynamic purchasing power tracker," is playing an increasingly crucial role in providing a unique approach to stable value in the volatile crypto market.

This article will comprehensively analyze RAM's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. RAM Price History Review and Current Market Status

RAM Historical Price Evolution Trajectory

- 2021: Reached all-time high of $3.85 on April 21, marking a significant milestone

- 2024: Hit all-time low of $0.00534443 on August 9, indicating a major market downturn

- 2025: Showed signs of recovery, with price increasing by 55.94% over the past year

RAM Current Market Situation

As of November 4, 2025, RAM is trading at $0.013599. The token has experienced a decline in the short term, with a 24-hour price drop of 9.69%. This downward trend extends to the 30-day timeframe, showing a 9.12% decrease. However, RAM has demonstrated strong performance over the past year, with a substantial 55.94% increase in value.

The current market capitalization of RAM stands at $4,922.838, ranking it at 7747 in the overall cryptocurrency market. With a circulating supply of 362,000 tokens out of a total supply of 7,213,000, RAM has a relatively low circulation ratio of 5.02%. The 24-hour trading volume is $8,497.69, indicating moderate market activity.

Despite recent short-term losses, RAM's long-term growth and its unique approach as a decentralized algorithmic stablecoin continue to attract investor interest.

Click to view the current RAM market price

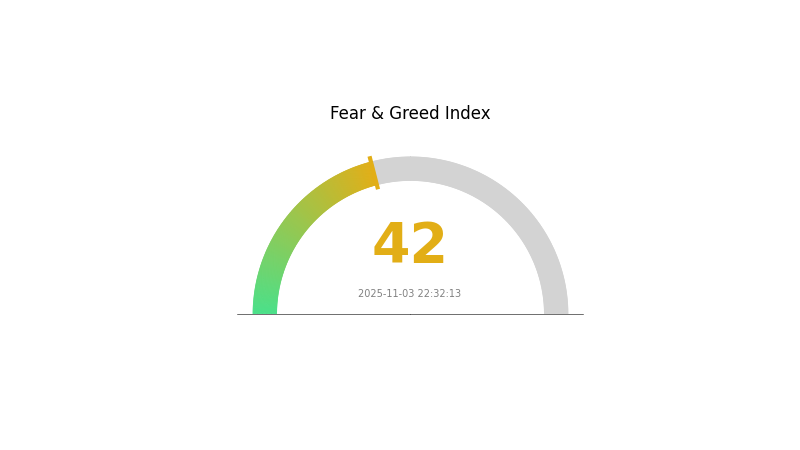

RAM Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 42, indicating a state of fear. This suggests that investors are still wary of potential market risks. However, for contrarian investors, periods of fear often present buying opportunities. It's crucial to remember that market sentiment can shift rapidly, and thorough research is essential before making any investment decisions. Keep an eye on key technical indicators and fundamental developments to navigate these uncertain times effectively.

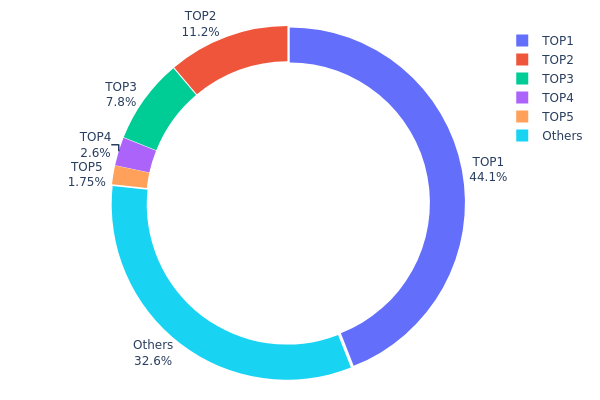

RAM Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of RAM tokens among various wallet addresses. Analysis of this data reveals a significant concentration of RAM holdings, with the top address controlling 44.05% of the total supply, equivalent to 3,177,490 RAM tokens. The top five addresses collectively hold 67.36% of all RAM tokens, indicating a high degree of centralization.

This concentration level raises concerns about potential market manipulation and price volatility. With a single address holding over 44% of the supply, there is a risk of large-scale selling pressure or market movements triggered by this dominant holder. The second and third largest holders, with 11.17% and 7.80% respectively, also wield considerable influence over the token's market dynamics.

The current distribution pattern suggests a relatively low level of decentralization for RAM, which may impact its on-chain stability and overall market structure. While 32.64% of tokens are distributed among other addresses, the significant concentration in the top five wallets could pose challenges for achieving a more balanced and widely distributed token ecosystem.

Click to view the current RAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 3177.49K | 44.05% |

| 2 | 0x92d8...273374 | 805.94K | 11.17% |

| 3 | 0xea42...0dde78 | 562.92K | 7.80% |

| 4 | 0x49ac...31123d | 187.86K | 2.60% |

| 5 | 0xda3a...551a50 | 126.04K | 1.74% |

| - | Others | 2352.44K | 32.64% |

II. Key Factors Affecting Future RAM Prices

Supply Mechanism

- Supply-side structural adjustment: The memory chip sector has shown strong performance due to supply-side structural adjustments and new demand momentum.

- Historical pattern: Production cuts combined with demand growth have historically driven price increases.

- Current impact: The tight supply of DRAM is pushing up DDR5 prices, potentially affecting consumers the most.

Institutional and Major Player Dynamics

- Enterprise adoption: The latest CPU platforms from Intel and AMD have fully embraced DDR5, making it the only choice for new platforms.

Macroeconomic Environment

- Inflation hedging properties: As AI demand increases, it may stimulate memory chip stocks to reach new highs.

Technological Development and Ecosystem Building

- DDR5 Maturity: DDR5 technology is finding its "sweet spot," which could lead to potential price drops as the technology matures.

- AI-driven demand: The development of AI markets and competition is expected to drive server demand, potentially influencing RAM prices.

- New platform adoption: The comprehensive adoption of DDR5 by new platforms is a decisive factor, as it's becoming the future trend for the latest CPU platforms.

III. RAM Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.01047 - $0.0136

- Neutral estimate: $0.0136 - $0.01469

- Optimistic estimate: $0.01469 - $0.01577 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.01043 - $0.01527

- 2027: $0.01393 - $0.02172

- 2028: $0.01762 - $0.02331

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.02083 - $0.02416 (assuming steady market growth)

- Optimistic scenario: $0.02416 - $0.02749 (assuming strong market performance)

- Transformative scenario: $0.02749 - $0.03000 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: RAM $0.02682 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01577 | 0.0136 | 0.01047 | 0 |

| 2026 | 0.01527 | 0.01469 | 0.01043 | 8 |

| 2027 | 0.02172 | 0.01498 | 0.01393 | 10 |

| 2028 | 0.02331 | 0.01835 | 0.01762 | 34 |

| 2029 | 0.02749 | 0.02083 | 0.01854 | 53 |

| 2030 | 0.02682 | 0.02416 | 0.01256 | 77 |

IV. RAM Professional Investment Strategies and Risk Management

RAM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate RAM tokens during market dips

- Set price alerts for significant market movements

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to algorithmic stablecoins

- Set stop-loss orders to limit potential losses

RAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Ramifi Protocol wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for RAM

RAM Market Risks

- High volatility: RAM's price may experience significant fluctuations

- Limited adoption: Algorithmic stablecoins face challenges in gaining widespread acceptance

- Competition: Other algorithmic stablecoins may impact RAM's market share

RAM Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of algorithmic stablecoins

- Cross-border restrictions: Varying regulations across jurisdictions may limit RAM's global use

- Compliance requirements: Future regulations may impose additional obligations on RAM holders

RAM Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Oracle manipulation: Risk of inaccurate price feeds affecting RAM's stability mechanism

- Network congestion: High transaction volumes on the BSC network could impact RAM's functionality

VI. Conclusion and Action Recommendations

RAM Investment Value Assessment

RAM offers a unique approach to algorithmic stablecoins with potential long-term value, but faces significant short-term risks due to market volatility and regulatory uncertainties.

RAM Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio and focus on learning about algorithmic stablecoins ✅ Experienced investors: Consider RAM as part of a diversified crypto portfolio, closely monitor market trends ✅ Institutional investors: Conduct thorough due diligence and consider RAM for speculative positions

RAM Trading Participation Methods

- Spot trading: Purchase RAM tokens on Gate.com

- DeFi platforms: Participate in liquidity pools or yield farming (if available)

- OTC trading: For large volume transactions, consider over-the-counter options

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Why is RAM so expensive now?

RAM prices are high due to increased demand, limited supply, and rising production costs. Market dynamics and technological advancements also contribute to the current expensive pricing.

What is good RAM in 2025?

In 2025, 16GB RAM is ideal for most users, while 32GB is best for gamers and content creators. High-end systems may use 64GB or more for demanding tasks.

What is the memory price trend in 2025?

In 2025, memory prices show a significant upward trend. DDR4 prices have increased by 38-43% in Q3, indicating a sharp rise in the overall memory market.

Will RAM prices increase with tariffs?

Yes, RAM prices are likely to increase with tariffs. The potential rise could be significant, affecting the pricing of RAM trucks. This is a direct result of new trade policies.

Share

Content