MVRK vs XLM: Battle of the Blockchain Titans Shaping the Future of Cross-Border Payments

Introduction: MVRK vs XLM Investment Comparison

In the cryptocurrency market, the comparison between Mavryk Network and Stellar has been an unavoidable topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positions.

Mavryk Network (MVRK): Launched in 2025, it has gained market recognition for its focus on tokenizing real-world assets (RWA).

Stellar (XLM): Since its inception in 2014, it has been hailed as a decentralized gateway for transferring digital and fiat currencies, becoming one of the cryptocurrencies with high global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between MVRK and XLM, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

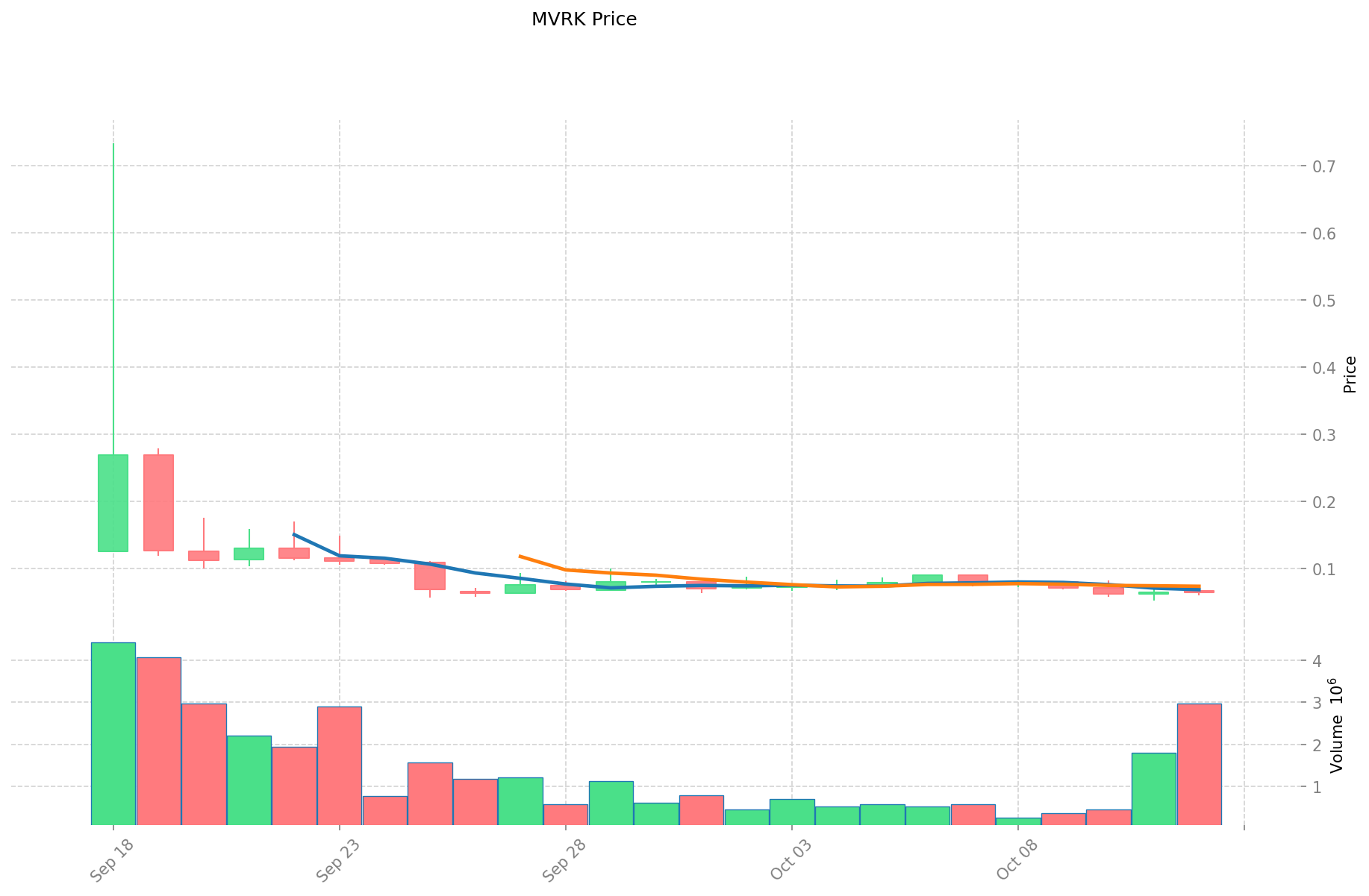

I. Price History Comparison and Current Market Status

MVRK and XLM Historical Price Trends

- 2025: MVRK secured a $10B+ RWA tokenization deal with MultiBank Group and MAG, potentially impacting its price.

- 2018: XLM reached its all-time high of $0.875563, likely influenced by the overall crypto market bull run.

- Comparative analysis: MVRK's price history is limited due to its recent launch, while XLM has shown significant volatility since 2014, with its price ranging from $0.00047612 to $0.875563.

Current Market Situation (2025-10-13)

- MVRK current price: $0.06453

- XLM current price: $0.33981

- 24-hour trading volume: MVRK $196,191.15 vs XLM $9,458,481.86

- Market Sentiment Index (Fear & Greed Index): 24 (Extreme Fear)

Click to view real-time prices:

- Check MVRK current price Market Price

- Check XLM current price Market Price

II. Core Factors Affecting MVRK vs XLM Investment Value

Supply Mechanisms (Tokenomics)

- MVRK: Technology innovation-driven value proposition with development activity as a key metric

- XLM: Strong focus on adoption rates and real-world implementation in cross-border transactions

- 📌 Historical pattern: Both cryptocurrencies' value fluctuates based on community trust levels and technological advancement cycles

Institutional Adoption and Market Applications

- Institutional holdings: Both require strong partnerships to achieve mainstream credibility

- Enterprise adoption: MVRK/XLM competitive positioning depends on their ability to solve real financial problems

- Regulatory stance: Compliance with evolving regulatory frameworks critical for both assets' long-term viability

Technical Development and Ecosystem Building

- MVRK technical foundation: Relies on continuous innovation and developer community engagement

- XLM technical development: Market demand satisfaction through practical financial solutions

- Ecosystem comparison: Both need robust developer activity and community trust to maintain investment value

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: Value tied to perceived utility in solving real-world problems

- Macroeconomic monetary policy: Both subject to broader cryptocurrency market sentiment

- Geopolitical factors: Cross-border transaction capabilities may provide competitive advantage in certain scenarios

III. 2025-2030 Price Prediction: MVRK vs XLM

Short-term Prediction (2025)

- MVRK: Conservative $0.0554958 - $0.06453 | Optimistic $0.06453 - $0.0671112

- XLM: Conservative $0.303045 - $0.3405 | Optimistic $0.3405 - $0.384765

Mid-term Prediction (2027)

- MVRK may enter a growth phase, with estimated price range $0.04346134218 - $0.0841187268

- XLM may enter a bullish market, with estimated price range $0.316922673375 - $0.547411890375

- Key drivers: Institutional fund inflow, ETF, ecosystem development

Long-term Prediction (2030)

- MVRK: Base scenario $0.11712060629181 - $0.170996085186042 | Optimistic scenario $0.170996085186042+

- XLM: Base scenario $0.582832115003531 - $0.74602510720452 | Optimistic scenario $0.74602510720452+

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

MVRK:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0671112 | 0.06453 | 0.0554958 | 0 |

| 2026 | 0.074377278 | 0.0658206 | 0.038834154 | 2 |

| 2027 | 0.0841187268 | 0.070098939 | 0.04346134218 | 8 |

| 2028 | 0.114892161021 | 0.0771088329 | 0.039325504779 | 19 |

| 2029 | 0.13824071562312 | 0.0960004969605 | 0.09024046714287 | 48 |

| 2030 | 0.170996085186042 | 0.11712060629181 | 0.091354072907611 | 81 |

XLM:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.384765 | 0.3405 | 0.303045 | 0 |

| 2026 | 0.460543275 | 0.3626325 | 0.3336219 | 6 |

| 2027 | 0.547411890375 | 0.4115878875 | 0.316922673375 | 21 |

| 2028 | 0.580194865614375 | 0.4794998889375 | 0.421959902265 | 41 |

| 2029 | 0.635816852731125 | 0.529847377275937 | 0.270222162410728 | 55 |

| 2030 | 0.74602510720452 | 0.582832115003531 | 0.501235618903036 | 71 |

IV. Investment Strategy Comparison: MVRK vs XLM

Long-term vs Short-term Investment Strategy

- MVRK: Suitable for investors focused on real-world asset tokenization and ecosystem potential

- XLM: Suitable for investors interested in cross-border payment solutions and established networks

Risk Management and Asset Allocation

- Conservative investors: MVRK: 30% vs XLM: 70%

- Aggressive investors: MVRK: 60% vs XLM: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- MVRK: High volatility due to newer market entry and dependency on RWA tokenization success

- XLM: Susceptible to broader cryptocurrency market fluctuations and competition in the payment sector

Technical Risk

- MVRK: Scalability, network stability

- XLM: Network congestion during high-volume periods, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both differently, with MVRK potentially facing more scrutiny due to its focus on real-world asset tokenization

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- MVRK advantages: Innovative RWA tokenization, potential for high growth in a developing market

- XLM advantages: Established network, proven track record in cross-border transactions, wider adoption

✅ Investment Advice:

- New investors: Consider a balanced approach, leaning towards XLM for its established market presence

- Experienced investors: Explore a strategic mix of both, with a higher allocation to MVRK for potential growth

- Institutional investors: Evaluate MVRK for its RWA potential, while maintaining XLM for its established network utility

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between MVRK and XLM? A: MVRK focuses on tokenizing real-world assets (RWA) and was launched in 2025, while XLM has been operating since 2014 as a decentralized gateway for transferring digital and fiat currencies.

Q2: Which cryptocurrency has a higher current price? A: As of 2025-10-13, XLM has a higher price at $0.33981, compared to MVRK at $0.06453.

Q3: How do the supply mechanisms differ between MVRK and XLM? A: MVRK's value is driven by technological innovation and development activity, while XLM focuses on adoption rates and real-world implementation in cross-border transactions.

Q4: What are the long-term price predictions for MVRK and XLM by 2030? A: The base scenario for MVRK is $0.11712060629181 - $0.170996085186042, while for XLM it's $0.582832115003531 - $0.74602510720452.

Q5: How should conservative investors allocate their portfolio between MVRK and XLM? A: Conservative investors are advised to allocate 30% to MVRK and 70% to XLM.

Q6: What are the main risks associated with investing in MVRK and XLM? A: MVRK faces high volatility due to its newer market entry and dependency on RWA tokenization success, while XLM is susceptible to broader cryptocurrency market fluctuations and competition in the payment sector.

Q7: Which cryptocurrency might be more suitable for new investors? A: New investors might consider leaning towards XLM due to its established market presence and proven track record in cross-border transactions.

Is Camino Network (CAM) a good investment? A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

What are AliExpress Coin

Best Crypto Wallet For Australians Beginners

RWA on Avalanche (AVAX): How Real-World Assets Come On-Chain

Is Ondo Finance (ONDO) a good investment?: Analyzing the potential and risks of this innovative DeFi protocol

2025 AMP Price Prediction: Strategic Analysis and Market Outlook for Cryptocurrency Investors

Is Rarible (RARI) a good investment?: A Comprehensive Analysis of the NFT Platform's Tokenomics, Market Position, and Future Potential in the Digital Art Ecosystem

Is READY! (READY) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

Is Hifi Finance (HIFI) a good investment?: A Comprehensive Analysis of Risks, Rewards, and Market Potential for 2024

Is Agoric (BLD) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Is Chrono.tech (TIMECHRONO) a good investment?: A Comprehensive Analysis of Features, Performance, and Future Potential