Что такое ARB: разъяснение токена управления Arbitrum и его роли в экосистеме решений для масштабирования Ethereum

Позиция и значение Arbitrum

В 2023 году Offchain Labs представила Arbitrum (ARB), созданный для решения проблем масштабируемости и высоких транзакционных издержек в сети Ethereum.

Как Layer 2-решение для масштабирования Ethereum, Arbitrum играет важную роль в экосистемах DeFi и смарт-контрактов.

На 2025 год Arbitrum закрепил за собой статус одного из ведущих Layer 2-решений для Ethereum, демонстрируя значительный транзакционный оборот и динамичное сообщество разработчиков. В статье анализируются его техническая архитектура, рыночные результаты и перспективы развития.

История создания и развития

Предпосылки

Arbitrum был разработан компанией Offchain Labs в 2023 году для решения масштабируемости Ethereum и снижения высоких комиссий за газ.

Проект появился на фоне роста интереса к приложениям на Ethereum и был нацелен на максимальное ускорение и удешевление транзакций при сохранении безопасности Ethereum.

Запуск Arbitrum стал новым этапом для DeFi-протоколов и dApp-разработчиков, стремящихся к большей производительности.

Ключевые вехи

- 2023: Запуск основной сети с высокой пропускной способностью и низкими издержками.

- 2023: Важное обновление, позволившее усилить совместимость с инструментами и кошельками Ethereum.

- 2024: Массовое внедрение крупными DeFi-протоколами, что привело к обновлению исторических максимумов цены ARB.

- 2025: Взрывной рост экосистемы, более 1 000 dApps на платформе.

Благодаря поддержке Arbitrum Foundation проект продолжает совершенствовать технологию, безопасность и практические сценарии применения.

Как работает Arbitrum?

Децентрализованное управление

Arbitrum базируется на децентрализованной сети нодов по всему миру и не зависит от контроля банков или государственных структур.

Узлы сети совместно подтверждают транзакции — это обеспечивает прозрачность, устойчивость к атакам и гарантирует пользователям автономию, а сети — высокую надежность.

Ядро блокчейна

Блокчейн Arbitrum — это открытый, неизменяемый цифровой реестр, где фиксируются все транзакции.

Транзакции группируются в блоки и связываются криптографическими хэшами, формируя защищённую цепочку.

Любой желающий может проверить запись в реестре, что устраняет необходимость в посредниках и способствует доверию.

Arbitrum использует технологию Optimistic Rollups, что позволяет значительно повысить производительность и снизить издержки.

Механизмы честности

Arbitrum применяет механизм Optimistic Rollup для проверки транзакций и предотвращения мошенничества, в том числе двойного расходования.

Валидаторы обеспечивают безопасность сети, обрабатывая транзакции вне основной цепи и отправляя батчи данных в Ethereum, а в качестве вознаграждения получают ARB.

Главное преимущество — ускоренное выполнение и существенное снижение стоимости транзакций по сравнению с основной сетью Ethereum.

Безопасность транзакций

В Arbitrum реализовано шифрование на основе пары публичного и приватного ключей:

- Приватные ключи (аналог секретных паролей) подписывают транзакции

- Публичные ключи (эквивалент номера счета) подтверждают право на владение

Такая система обеспечивает безопасность средств и псевдоанонимность транзакций.

Arbitrum наследует модель безопасности Ethereum, внедряя дополнительные механизмы защиты от мошенничества.

Рынок Arbitrum

Объем обращения

На 12 сентября 2025 г. в обращении находится 5 295 780 056 ARB при общем объеме эмиссии 10 000 000 000 токенов.

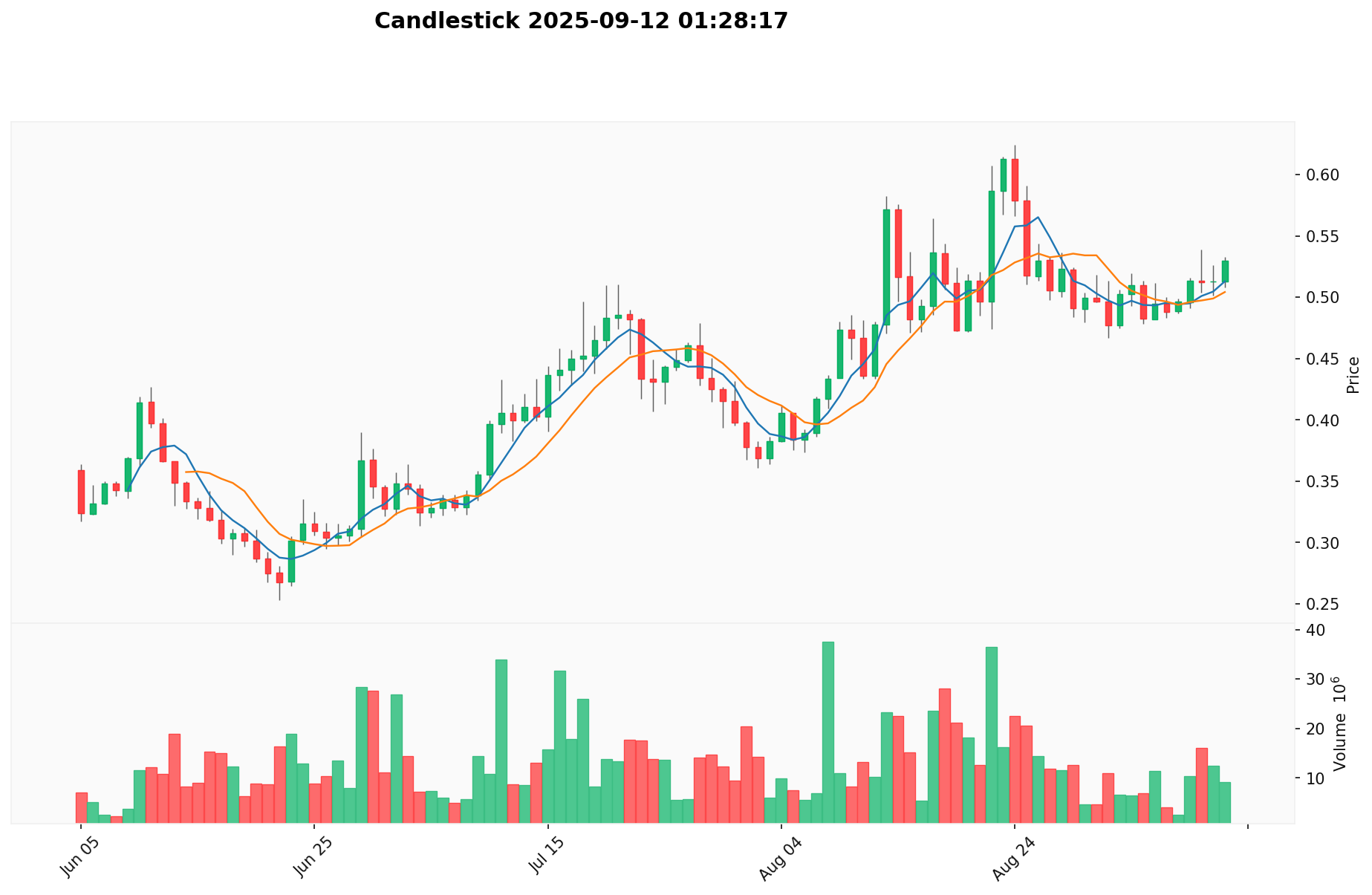

Движение цены

Arbitrum достиг исторического максимума — $4,00 — 23 марта 2023 г., чему способствовали высокий спрос и возрастающая популярность Layer 2-решений.

Минимальное значение составило $0,2422, зафиксированное 7 апреля 2025 г., вероятно на фоне рыночных коррекций или отдельных трудностей экосистемы Layer 2.

Ценовые колебания отражают рыночные ожидания, степень внедрения и внешние факторы, влияющие на сектор криптовалют.

Посмотреть актуальную цену ARB

Ончейн-метрики

- Дневной объем транзакций: $5 004 613 (характеризует сетевую активность)

- Активные адреса: 55 562 (демонстрирует вовлеченность пользователей)

Экосистема Arbitrum: приложения и партнерства

Ключевые сценарии использования

Экосистема Arbitrum включает различные приложения:

- DeFi: Uniswap, предоставляющий децентрализованную торговлю.

- NFT: Множество проектов, развивающих цифровые коллекционные объекты и блокчейн-игры.

Стратегические партнерства

Arbitrum сотрудничает с Chainlink, что усиливает его технологические возможности и укрепляет влияние на рынке. Такие партнерства закладывают основу для дальнейшего развития экосистемы.

Вызовы и обсуждение

Перед Arbitrum стоят следующие задачи:

- Технические ограничения: проблемы масштабируемости

- Регуляторные риски: вероятность дополнительного контроля со стороны регуляторов

- Конкуренция: рост числа альтернативных решений Layer 2

Эти темы активно обсуждаются в профессиональном сообществе и способствуют постоянному развитию Arbitrum.

Сообщество Arbitrum и атмосфера в социальных сетях

Энтузиазм участников

Сообщество Arbitrum отличается высокой активностью, дневные объемы транзакций достигают миллионов.

В X регулярно появляются трендовые посты и хэштеги (#Arbitrum), их месячное число достигает сотен тысяч.

Рост цены и новые функции вызывают всплески интереса.

Настроения в соцсетях

Мнения в X разделились:

- Сторонники отмечают безопасность и масштабируемость Arbitrum, считая платформу будущим масштабирования Ethereum.

- Критики опасаются центризации и усиления конкуренции со стороны других L2-решений.

В недавнее время преобладает оптимизм на фоне восходящего рынка.

Горячие обсуждения

Пользователи X активно обсуждают регуляторные перспективы, энергоэффективность и значение Arbitrum для будущего масштабирования Ethereum, демонстрируя его инновационный потенциал и сложности для массового внедрения.

Где узнать больше об Arbitrum

- Официальный сайт: Перейдите на официальный сайт Arbitrum для получения информации о функционале, сценариях использования и последних обновлениях.

- Whitepaper: Whitepaper проекта раскрывает техническую архитектуру, цели и видение развития.

- Новости в X: В социальной сети X аккаунт @arbitrum публикует обновления о технических усовершенствованиях, событиях сообщества и партнёрствах, собирая тысячи лайков и ретвитов.

Планы развития Arbitrum

- 2026: Запуск дополнительных оптимизаций для дальнейшего снижения издержек транзакций

- Экосистемные цели: Поддержка тысяч dApps и привлечение миллионов пользователей

- Долгосрочная стратегия: Стать ведущим Layer 2-решением масштабирования для Ethereum

Как присоединиться к Arbitrum?

- Покупка: Приобретайте ARB на Gate.com

- Хранение: Используйте Web3-кошелёк для безопасного хранения

- Участие в управлении: Голосуйте через систему Arbitrum DAO

- Разработка экосистемы: Изучите документацию для разработчиков Arbitrum, чтобы создавать dApps или вносить вклад в развитие кода

Итоги

Arbitrum меняет представление о масштабируемости блокчейна с помощью Layer 2-технологий, обеспечивая прозрачность, безопасность и эффективные транзакции. Благодаря активному сообществу, расширенной инфраструктуре и уверенным рыночным позициям Arbitrum занимает ведущие позиции в криптоиндустрии. Несмотря на регуляторные и технические вызовы, инновационный подход и чёткая дорожная карта обеспечивают проекту прочную перспективу в будущем децентрализованных технологий. Arbitrum заслуживает внимания — как у новичков, так и у опытных участников рынка.

FAQ

Что такое ARB?

ARB — это токен Arbitrum, Layer 2-решения для масштабирования Ethereum, направленного на повышение скорости и снижение стоимости транзакций.

Что представляет собой MODE: полный гид по методам статистического анализа

Что представляет собой VELODROME: инновационный круговой трек, меняющий стандарты велоспорта

Каким образом ключевые особенности Boba Network обеспечивают реализацию её мультицепочной стратегии Layer 2?

Как экономическая модель токена распределяет права управления и обеспечивает утилитарную ценность?

Откройте новые возможности: сделки на децентрализованной бирже Mantle

Как модель токеномики позволяет повысить эффективность управления проектом и оптимизировать распределение стоимости?

Биткойн упал на 26%: скрытые сигналы и инвестиционные идеи за его превосходством над большинством криптоактивов

Возвращается ли волатильность BTC? Структура цен на Биткойн и возобновленная дискуссия вокруг $50,000

Прогноз цены Биткойна: является ли падение ниже $80,000 риском или возможностью?

Технический анализ ETH: Исследование уровня поддержки $2,500 под паттерном коррекции ABCD