What is FYDE: A Comprehensive Guide to Financial Yield Data Extraction

Fyde's Positioning and Significance

In 2024, Fyde (FYDE) was introduced to bridge AI and DeFi by bringing the Liquid Vault archetype to Ethereum. As a pioneering platform integrating artificial intelligence with decentralized finance, Fyde plays a crucial role in the DeFi sector, helping users consistently lock in gains, earn yield, and maintain liquidity.

As of 2025, Fyde has established itself as an innovative player in the AI-powered DeFi space, offering users the ability to grow their crypto holdings faster with reduced volatility. This report will delve into its technological architecture, market performance, and future potential.

Origins and Development History

Birth Background

Fyde was created in 2024 to address the challenges of volatile crypto markets and the need for more intelligent, automated investment strategies in DeFi. It emerged during a period of growing interest in AI applications within the blockchain space, aiming to revolutionize how users manage their crypto assets.

Fyde's launch brought new possibilities for both experienced crypto investors and newcomers seeking to optimize their DeFi strategies.

Important Milestones

- 2024: Mainnet launch, introducing the Liquid Vault concept to Ethereum.

- 2024: Integration of AI models to protect against rugpulls and severe downside events.

- 2025: Ecosystem expansion, with the number of supported tokens and investment narratives growing significantly.

With support from its development team and community, Fyde continues to enhance its technology, security, and real-world applications in the DeFi space.

How Does Fyde Work?

Decentralized Control

Fyde operates on Ethereum's decentralized network, free from control by traditional financial institutions or governments. This decentralized nature ensures transparency and resilience, giving users greater autonomy over their investments.

Blockchain Core

Fyde utilizes Ethereum's blockchain, a public and immutable digital ledger that records all transactions. Smart contracts on Ethereum enable the automated and secure operation of Fyde's Liquid Vaults. Anyone can verify records, establishing trust without intermediaries.

Ensuring Fairness

As an ERC20 token on Ethereum, Fyde benefits from Ethereum's consensus mechanism to validate transactions and prevent fraud. Ethereum validators maintain network security and are rewarded for their efforts.

Secure Transactions

Fyde employs Ethereum's public-private key cryptography to secure transactions:

- Private keys are used to sign transactions

- Public keys are used to verify ownership

This mechanism ensures fund security while transactions remain pseudonymous on the Ethereum blockchain.

FYDE's Market Performance

Circulation Overview

As of November 04, 2025, FYDE has a circulating supply of 2,115,511 tokens, with a total supply of 100,000,000.

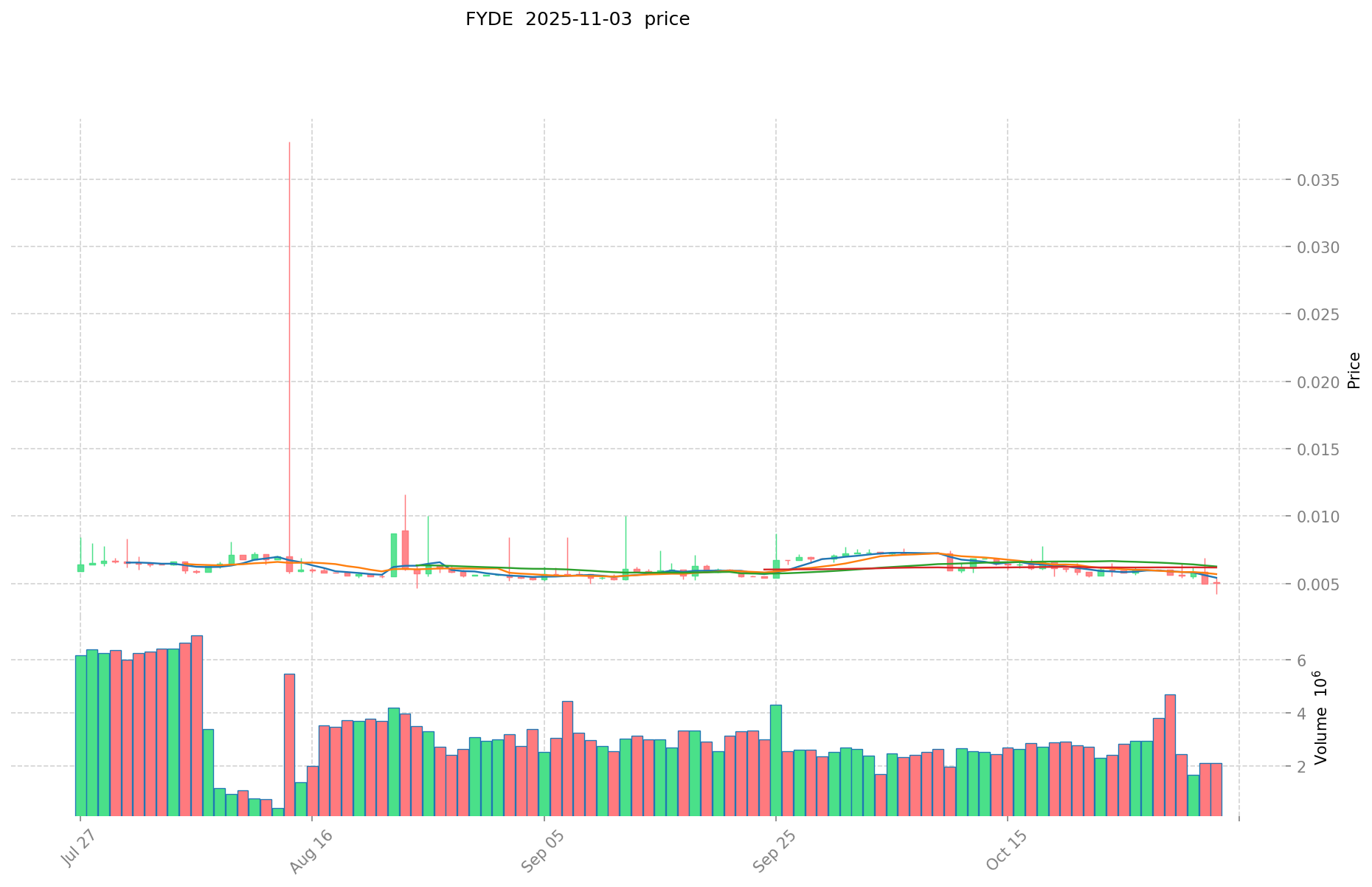

Price Fluctuations

FYDE reached its all-time high of $0.34 on October 14, 2024. Its lowest price was $0.004198, recorded on November 02, 2025. These fluctuations reflect market sentiment, adoption trends, and external factors.

Click to view the current market price of FYDE

On-Chain Metrics

- Daily Transaction Volume: $10,514.13

- Active Addresses: 782

FYDE Ecosystem Applications and Partnerships

Core Use Cases

FYDE's ecosystem supports various applications:

- DeFi: Liquid Vaults, providing automated yield optimization and risk management.

- AI: AI models for token analysis and risk assessment, driving intelligent investment strategies.

Strategic Collaborations

FYDE has integrated with Ethereum to enhance its technological capabilities and market influence. These partnerships provide a solid foundation for FYDE's ecosystem expansion.

Controversies and Challenges

FYDE faces the following challenges:

- Technical Hurdles: Scalability and performance optimization on Ethereum

- Regulatory Risks: Potential scrutiny of AI-driven investment products

- Competitive Pressure: Emerging DeFi protocols with similar offerings

These issues have sparked discussions within the community and market, driving FYDE's continuous innovation.

FYDE Community and Social Media Atmosphere

Fan Enthusiasm

FYDE's community is vibrant, with 782 holders as of the latest data.

On X platform, related posts and tags like #FYDE often trend, reflecting community engagement.

Price fluctuations and new feature releases ignite community enthusiasm.

Social Media Sentiment

Sentiment on X presents a mixed picture:

- Supporters praise FYDE's AI-driven approach and yield optimization, viewing it as a "next-generation DeFi solution".

- Critics focus on price volatility and potential risks associated with automated investing.

Recent trends show cautious optimism amidst market volatility.

Hot Topics

X users actively discuss FYDE's AI models, yield strategies, and market performance, showcasing both its transformative potential and the challenges in DeFi adoption.

More Information Sources for FYDE

- Official Website: Visit FYDE's official website for features, use cases, and latest updates.

- Whitepaper: FYDE's whitepaper details its technical architecture, goals, and vision.

- X Updates: On X platform, FYDE uses @FydeLabs, covering technological updates, community events, and partnership news.

FYDE Future Roadmap

- Ecosystem Goals: Expand Liquid Vault offerings and improve AI models

- Long-term Vision: Become a leading AI-driven DeFi platform for yield optimization and risk management

How to Participate in FYDE?

- Purchase Channels: Buy FYDE on Gate.com

- Storage Solutions: Use Web3 wallets compatible with Ethereum for secure storage

- Participate in Governance: Follow FYDE's official channels for potential governance opportunities

- Build the Ecosystem: Visit FYDE's documentation to learn about integrating with Liquid Vaults

Summary

FYDE redefines DeFi through AI integration, offering automated yield optimization and risk management. Its innovative approach, active community, and clear roadmap position it uniquely in the cryptocurrency space. Despite facing challenges in a competitive DeFi landscape, FYDE's commitment to AI-driven solutions gives it a distinctive edge in decentralized finance's future. Whether you're a newcomer or an experienced player, FYDE is worth watching and engaging with in the evolving DeFi sector.

FAQ

Is FydeOS safe to use?

Yes, FydeOS is safe to use. It's not spyware and functions like Chrome OS, with Google Play Store access. Users report positive experiences.

Is FydeOS owned by Google?

No, FydeOS is not owned by Google. It's owned by Fyde Technology, a Chinese company. FydeOS is based on Chromium OS, but operates independently from Google.

What is the purpose of FydeOS?

FydeOS aims to provide a de-googled ChromeOS experience, offering offline capabilities and eliminating the need for a Google account login.

How does FydeOS compare to ChromeOS?

FydeOS offers enterprise-focused features and integrates with third-party services, unlike ChromeOS which relies on Google's ecosystem. It provides more flexibility for managing sensitive data and works in regions where Google services are restricted.

Share

Content