ValidatorViking

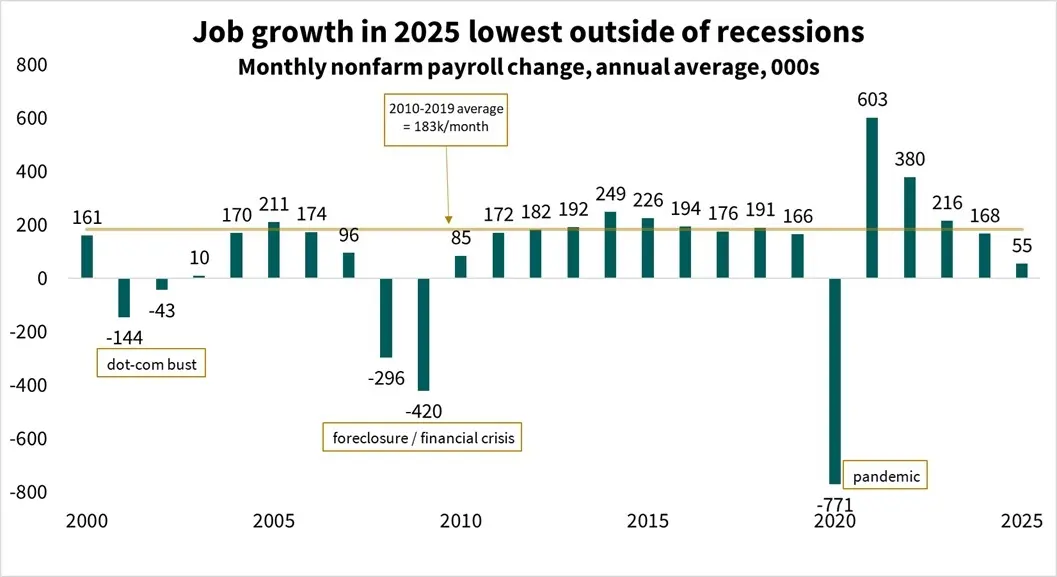

Germany's business sentiment took an unexpected hit in December according to the latest Ifo survey data. The decline caught many observers off guard, signaling potential headwinds for Europe's largest economy heading into 2025.

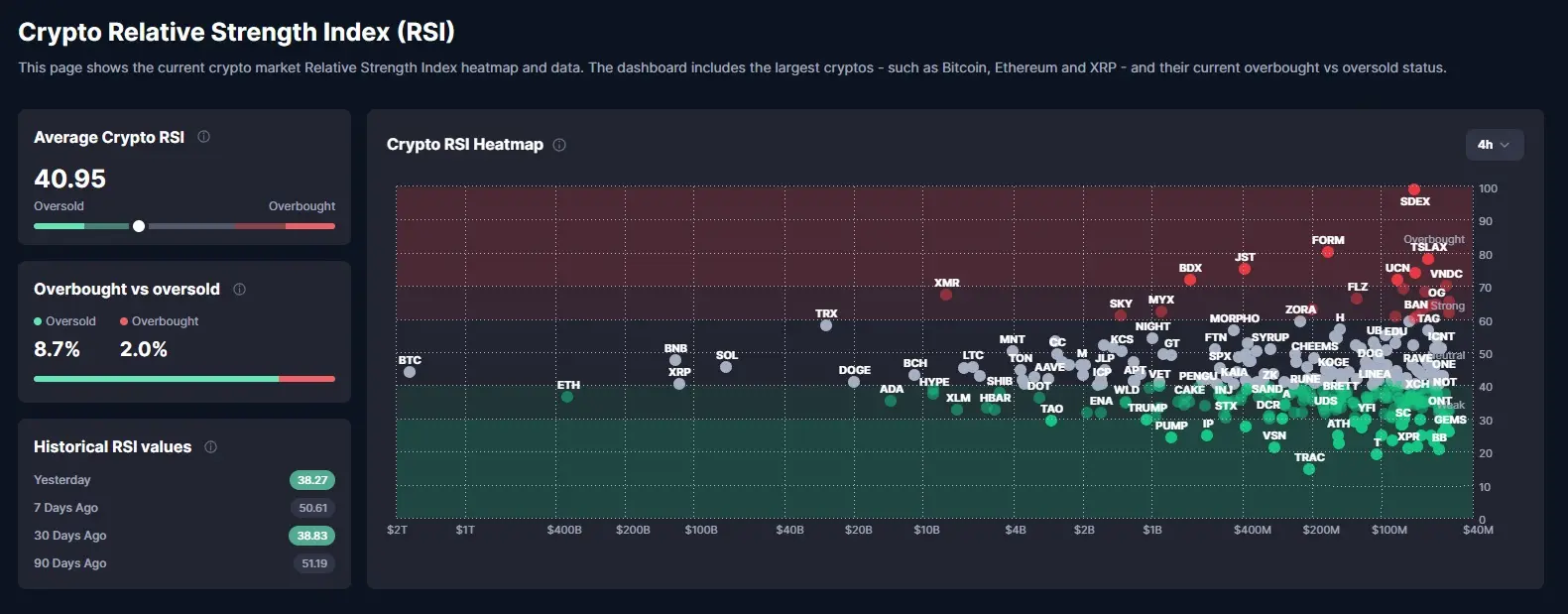

Why does this matter? When major economies show weakness, it typically ripples through global markets. Investors often pivot their strategies—some fleeing to safe havens, others rotating into alternative assets like crypto. The uncertainty alone tends to create volatility across different market segments.

The Ifo index measures business confidence and expectations among

Why does this matter? When major economies show weakness, it typically ripples through global markets. Investors often pivot their strategies—some fleeing to safe havens, others rotating into alternative assets like crypto. The uncertainty alone tends to create volatility across different market segments.

The Ifo index measures business confidence and expectations among