StateOfMind

The CoinMarketCap Altcoin Season Index is only 19, which means that in the past 90 days, only 19% of the top 100 cryptocurrencies outperformed BTC. On September 20th this year, the index even reached 78, and the average last week was just 25.

BTC dominance is still consolidating at a high level, and there are currently no systemic opportunities for altcoins. At this stage, only specific narratives (AI, Meme, RWA) have the potential for excess returns. #十二月行情展望

BTC dominance is still consolidating at a high level, and there are currently no systemic opportunities for altcoins. At this stage, only specific narratives (AI, Meme, RWA) have the potential for excess returns. #十二月行情展望

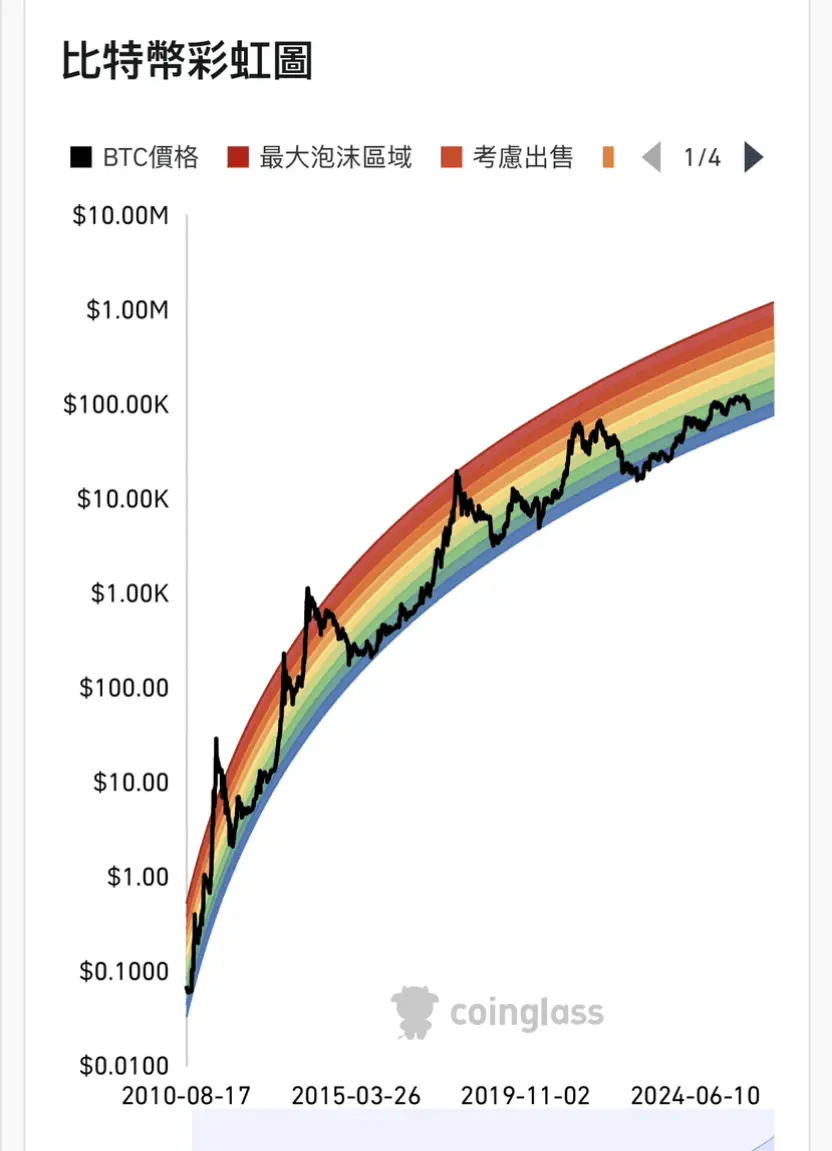

BTC0.52%