13:00

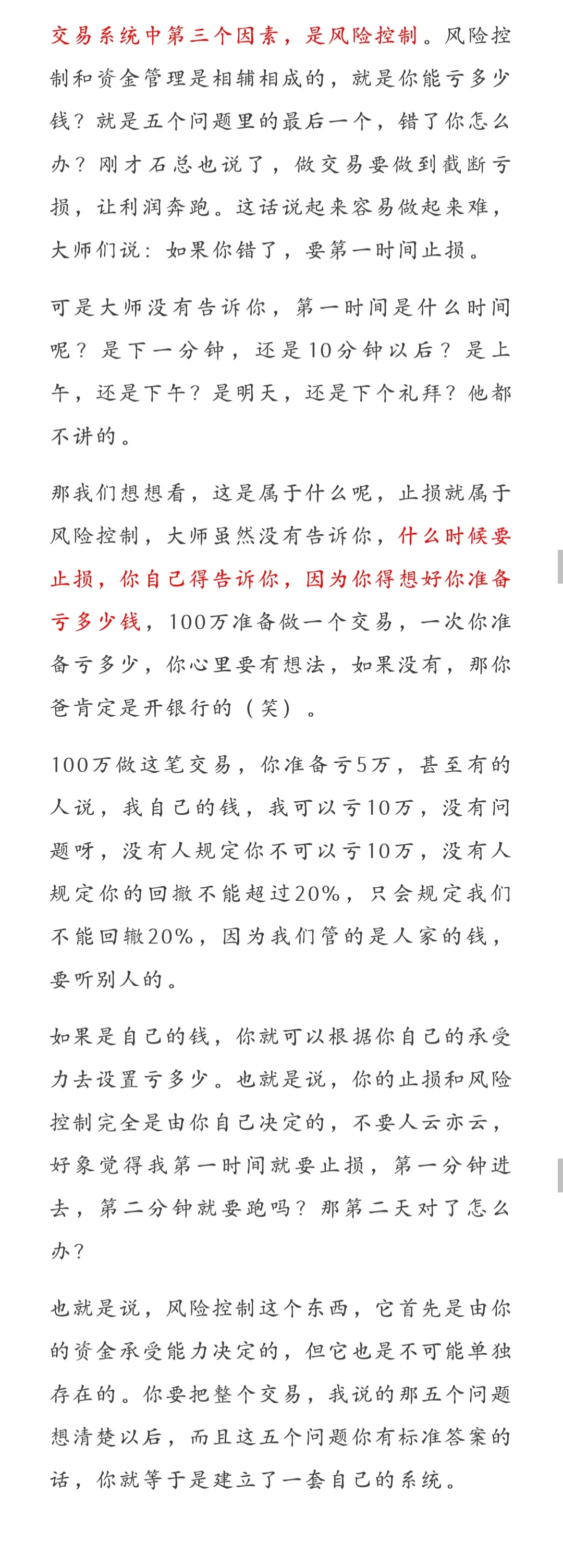

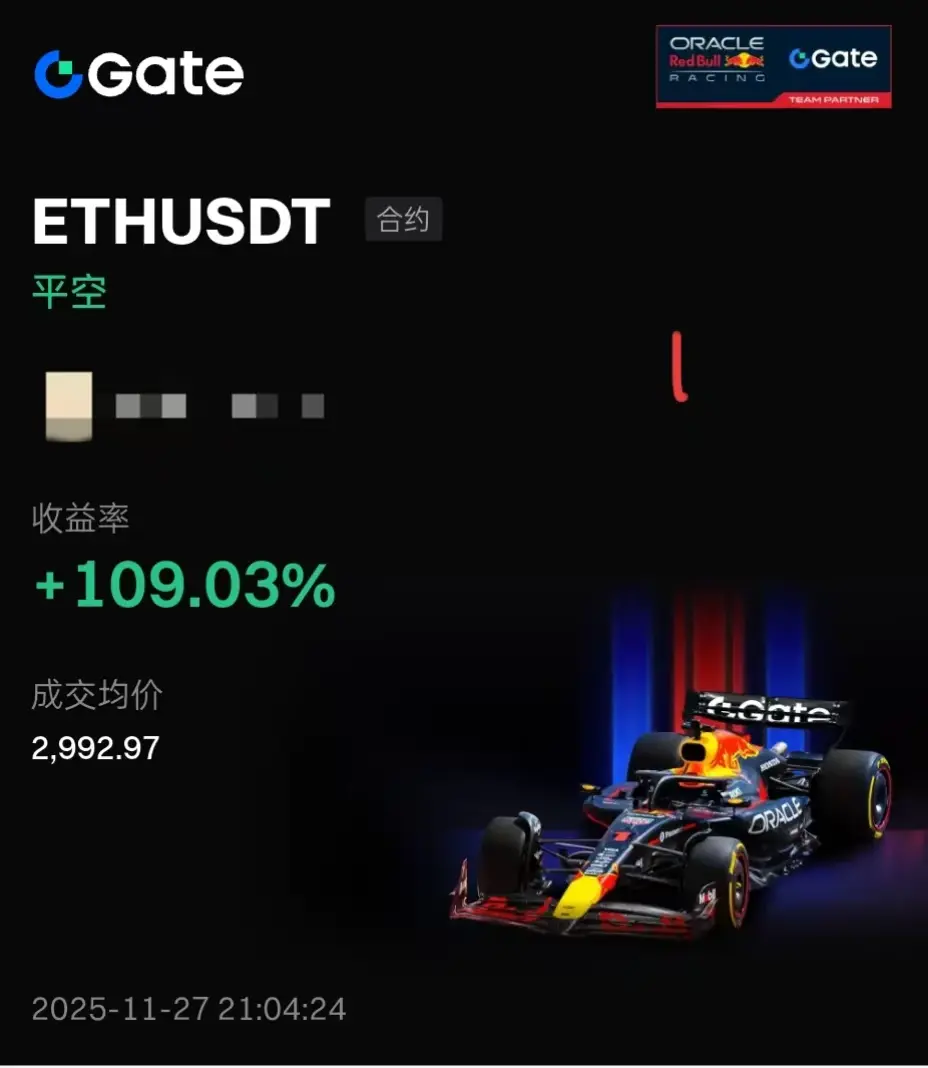

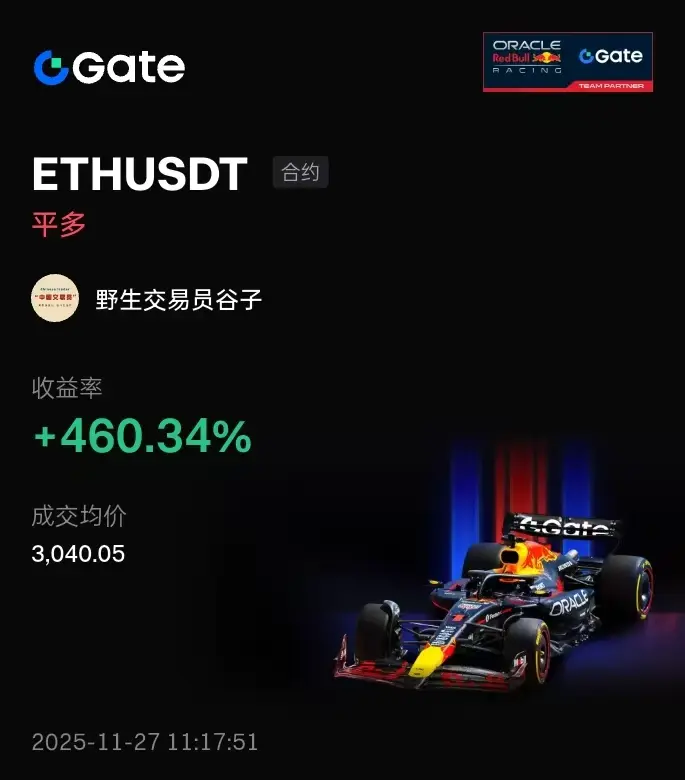

The current market has validated the long position strategy shared with everyone over the weekend, yesterday, and the day before. There is a need for a rebound from the four-hour to daily charts. Bitcoin is just 200 points shy of the target level of around 92000 given to everyone, while Ethereum has exceeded expectations at 3040 and is currently fluctuating around this position.

The current market position is quite awkward for short positions. The lower long positions can still be held after reducing positions. Personally, I have already exited my positions, but I have not taken a short position. Currently, there is no short formation or structure. The four-hour chart has only temporarily rebounded to a level, and is now undergoing a corrective consolidation, but the daily chart has not yet done so.

The market is as follows: the pressure that can currently be inferred is between 3150-55, which is also the target for the next long position, corresponding to the 50% Fibonacci sequence, which is reasonable. The strongest pressure is at 3250-70. One must take it one step at a time; at least for now, there is no short position pattern, except for very short-term trades.

The support below is at 2980-85, which is also the support of the trend line. If it breaks down, there won't be space for short positions, so I personally tend to think that after a consolidation in the four-hour timeframe, it will continue to rise, following the daily rebound. Whether it moves like this needs to be observed to see if 2980 can effectively break. The reasonable defense for long positions is also below 2980, which requires waiting. If given the opportunity, I will attempt to enter long positions after a pullback around 2900-2980, with the stop loss set at the low of the activation point at that time. The target for long positions will be around 3040-70-3150, depending on the situation at that time.

The historical review of Bitcoin indicates that the pullbacks are generally weak compared to the trends, so they do not necessarily have to be deep. Currently, a reasonable stop-loss for long positions is below 89200, and entering long positions around 90600 is an option, but it's uncertain whether there will be an opportunity. Likewise, if a significant pullback occurs, breaking below 89200, one should be cautious about entering long positions. The target for Bitcoin long positions is around 91800-93640.

In the case where the daily line does not rebound to the right level, I will not short, nor will I trade in ultra-short lines. In the end, today the US market is closed, and there may not be significant movements. It's better to watch more and act less. If there is an opportunity, then take action; if not, just observe.

Personal opinion, for reference only.

Last night in the live stream, if you followed the ideas to make money, press 1. If no one did, then that would be sad 💔.

The current market has validated the long position strategy shared with everyone over the weekend, yesterday, and the day before. There is a need for a rebound from the four-hour to daily charts. Bitcoin is just 200 points shy of the target level of around 92000 given to everyone, while Ethereum has exceeded expectations at 3040 and is currently fluctuating around this position.

The current market position is quite awkward for short positions. The lower long positions can still be held after reducing positions. Personally, I have already exited my positions, but I have not taken a short position. Currently, there is no short formation or structure. The four-hour chart has only temporarily rebounded to a level, and is now undergoing a corrective consolidation, but the daily chart has not yet done so.

The market is as follows: the pressure that can currently be inferred is between 3150-55, which is also the target for the next long position, corresponding to the 50% Fibonacci sequence, which is reasonable. The strongest pressure is at 3250-70. One must take it one step at a time; at least for now, there is no short position pattern, except for very short-term trades.

The support below is at 2980-85, which is also the support of the trend line. If it breaks down, there won't be space for short positions, so I personally tend to think that after a consolidation in the four-hour timeframe, it will continue to rise, following the daily rebound. Whether it moves like this needs to be observed to see if 2980 can effectively break. The reasonable defense for long positions is also below 2980, which requires waiting. If given the opportunity, I will attempt to enter long positions after a pullback around 2900-2980, with the stop loss set at the low of the activation point at that time. The target for long positions will be around 3040-70-3150, depending on the situation at that time.

The historical review of Bitcoin indicates that the pullbacks are generally weak compared to the trends, so they do not necessarily have to be deep. Currently, a reasonable stop-loss for long positions is below 89200, and entering long positions around 90600 is an option, but it's uncertain whether there will be an opportunity. Likewise, if a significant pullback occurs, breaking below 89200, one should be cautious about entering long positions. The target for Bitcoin long positions is around 91800-93640.

In the case where the daily line does not rebound to the right level, I will not short, nor will I trade in ultra-short lines. In the end, today the US market is closed, and there may not be significant movements. It's better to watch more and act less. If there is an opportunity, then take action; if not, just observe.

Personal opinion, for reference only.

Last night in the live stream, if you followed the ideas to make money, press 1. If no one did, then that would be sad 💔.