Bên trong Web3 Unicorn Phantom: Rủi ro tiềm tàng và những quan ngại ngày càng lớn

Thị trường ví crypto năm 2025 đang bước vào cuộc đua khốc liệt giành thị phần.

Khi làn sóng meme coin dần suy yếu, các nhà giao dịch tần suất cao chuyển dịch mạnh sang các ví do sàn giao dịch hậu thuẫn, nơi có phí thấp và ưu đãi hấp dẫn hơn. Các nhà cung cấp ví độc lập ngày càng bị thu hẹp không gian bởi hệ sinh thái đóng của các sàn lớn.

Trong bối cảnh đó, Phantom trở thành tâm điểm. Đầu năm, Phantom gọi vốn thành công 150 triệu USD, nâng định giá lên 3 tỷ USD. Từ quý IV, dự án liên tục ra mắt stablecoin riêng CASH, nền tảng dự đoán thị trường và thẻ ghi nợ crypto, nhằm tìm kiếm động lực tăng trưởng mới ngoài dịch vụ giao dịch.

Định giá 3 tỷ USD: Từ gốc Solana đến mở rộng đa chuỗi

Phantom khởi đầu năm 2021, khi hệ sinh thái Solana mới hình thành và hạ tầng on-chain còn non trẻ. Các ví phổ biến như MetaMask chủ yếu hỗ trợ Ethereum, tương thích hạn chế với các chuỗi khác, khiến trải nghiệm người dùng chưa hoàn thiện.

Quá trình tạo ví thường yêu cầu người dùng tự ghi lại cụm từ khôi phục gồm 12 hoặc 24 từ. Nếu mất khóa, tài sản không thể phục hồi—quy trình vừa bất tiện vừa rủi ro, khiến nhiều người dùng tiềm năng e ngại.

Ba nhà sáng lập Phantom, từng làm việc nhiều năm tại 0x Labs (dự án hạ tầng DeFi trên Ethereum), nhận thấy cơ hội và ra mắt Phantom trên Solana, xây dựng ví với giao diện tối giản, trải nghiệm trực quan. Đột phá cốt lõi là tinh giản quy trình sao lưu: người dùng có thể đăng nhập bằng email, sinh trắc học hoặc sao lưu đám mây mã hóa, giảm phụ thuộc vào ghi nhớ cụm từ khôi phục thủ công và hạ thấp đáng kể rào cản cho người mới.

Phantom ra mắt tiện ích mở rộng trình duyệt vào tháng 4 năm 2021. Chỉ sau vài tháng, số người dùng vượt mốc 1 triệu, trở thành lựa chọn hàng đầu của cộng đồng Solana. Theo RootData, Phantom gọi vốn 9 triệu USD vòng Series A do a16z dẫn dắt vào tháng 7 năm 2021 khi vẫn đang thử nghiệm. Tháng 1 năm 2022, Paradigm dẫn đầu vòng Series B trị giá 109 triệu USD, đưa định giá lên 1,2 tỷ USD. Đầu năm 2025, Paradigm và Sequoia dẫn dắt vòng gọi vốn 150 triệu USD, nâng định giá Phantom lên 3 tỷ USD.

Phantom phát triển và mở rộng hỗ trợ đa chuỗi—gồm Ethereum, Polygon, Bitcoin, Base, Sui—vượt qua hình ảnh “chỉ Solana”. Tuy nhiên, Phantom vẫn chưa hỗ trợ BNB Chain nguyên bản. Một số người dùng thất vọng khi Phantom hỗ trợ ETH mà không hỗ trợ BNB Chain, khiến họ bỏ lỡ airdrop.

Thăng trầm của Phantom trong năm 2025

Với Phantom, năm 2025 vừa là năm thành công vừa là năm thử thách. Nền tảng tăng trưởng mạnh về người dùng và sản phẩm, nhưng các ví liên kết với sàn đã chiếm phần lớn khối lượng giao dịch.

Tăng trưởng người dùng nổi bật nhất. Số lượng người dùng hoạt động hàng tháng tăng từ 15 triệu đầu năm lên gần 20 triệu cuối năm, đưa Phantom trở thành ví độc lập tăng trưởng nhanh nhất—đặc biệt ở các thị trường mới nổi như Ấn Độ và Nigeria.

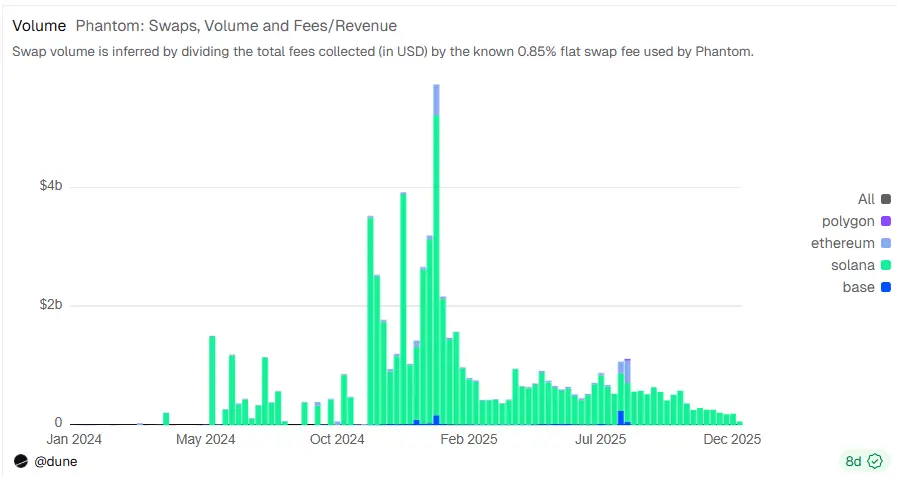

Tài sản lưu ký vượt 25 tỷ USD. Ở đỉnh cao, Phantom tạo ra 44 triệu USD doanh thu hàng tuần, thu nhập hàng năm từng vượt MetaMask. Đến nay, tổng doanh thu tích lũy của Phantom gần 570 triệu USD.

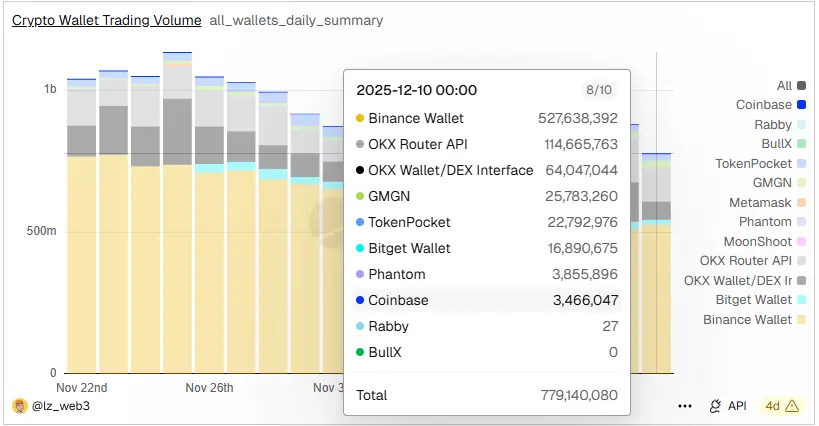

Tuy nhiên, khối lượng giao dịch vẫn là vấn đề đáng lo. Dữ liệu từ Dune Analytics cho thấy thị phần swap tích hợp toàn cầu của Phantom giảm từ gần 10% đầu năm xuống còn 2,3% vào tháng 5, và chỉ còn 0,5% cuối năm. Các ví do sàn hậu thuẫn, với phí thấp, niêm yết token nhanh và ưu đãi airdrop lớn, đã thu hút các nhà giao dịch tần suất cao. Binance Wallet kiểm soát gần 70% thị trường, OKX (ví cộng API định tuyến) chiếm hơn 20%.

Sự gắn kết sâu với Solana của Phantom là vấn đề lớn hơn. Dữ liệu cho thấy 97% giao dịch swap của Phantom diễn ra trên Solana. Tổng giá trị khóa (TVL) của Solana giảm hơn 34% từ đỉnh ngày 14 tháng 9 là 13,22 tỷ USD, hiện còn 8,67 tỷ USD—mức thấp nhất sáu tháng. Điều này ảnh hưởng trực tiếp đến chỉ số giao dịch cốt lõi của Phantom.

Đáp lại, Phantom đẩy mạnh phát triển sản phẩm mới để tạo làn sóng tăng trưởng thứ hai.

Về sản phẩm, Phantom đã ra mắt nhiều tính năng nổi bật:

- Tháng 7, Phantom tích hợp hợp đồng vĩnh viễn Hyperliquid, tạo ra khoảng 1,8 tỷ USD khối lượng giao dịch trong 16 ngày và thu về gần 930.000 USD qua mô hình hoàn phí builder code;

- Tháng 8, Phantom mua lại công cụ theo dõi meme coin Solsniper và nền tảng dữ liệu NFT SimpleHash, mở rộng đáp ứng nhu cầu giao dịch chuyên biệt.

- Cuối tháng 9, Phantom ra mắt stablecoin riêng CASH. Nguồn cung nhanh chóng vượt 100 triệu USD, tháng 11 ghi nhận đỉnh giao dịch hơn 160.000 lượt. Lợi thế cạnh tranh là chuyển khoản P2P miễn phí và phần thưởng lending tích hợp;

- Tháng 12, Phantom ra mắt thẻ ghi nợ Phantom Cash tại Mỹ, cho phép người dùng chi tiêu stablecoin on-chain trực tiếp, hỗ trợ Apple Pay, Google Pay và các hệ thống thanh toán di động hàng đầu;

- Ngày 12 tháng 12, Phantom công bố nền tảng dự đoán thị trường, tích hợp Kalshi vào ví và cung cấp cho người dùng đủ điều kiện;

- Phantom cũng phát hành SDK miễn phí “Phantom Connect”, cho phép người dùng truy cập nhiều ứng dụng web3 chỉ với một tài khoản, giảm rào cản cho cả nhà phát triển và người dùng.

Thẻ ghi nợ và stablecoin CASH là hai sản phẩm được chú ý nhất, khi Phantom hướng tới giải quyết bài toán “last mile” trong chi tiêu tài sản crypto.

CEO Phantom Brandon Millman tuyên bố công ty sẽ không phát hành token, không IPO, không xây dựng blockchain riêng trong ngắn hạn. Tất cả nỗ lực tập trung hoàn thiện sản phẩm, biến ví thành công cụ tài chính cho người dùng phổ thông. Millman tin rằng đích đến thực sự của ví là ai đưa crypto vào thanh toán đại chúng trước tiên, không phải ai kiểm soát khối lượng giao dịch lớn nhất.

Dù vậy, giải quyết bài toán “last mile” trong thanh toán crypto không dễ dàng. Phantom không phải ví độc lập, phi lưu ký đầu tiên ra mắt thẻ ghi nợ.

Quý II năm 2025, MetaMask hợp tác với Mastercard, Baanx, CompoSecure ra mắt MetaMask Card, cho phép chuyển đổi crypto sang fiat theo thời gian thực để chi tiêu, triển khai tại EU, Anh, Mỹ Latinh và nhiều khu vực khác. Thẻ của MetaMask ra mắt sớm hơn, phủ sóng rộng hơn, nhưng chỉ hỗ trợ Ethereum và Linea, dẫn đến phí cao và tốc độ chậm. Người dùng nhận xét “tiện lợi nhưng ít dùng”.

So với đó, thẻ ghi nợ của Phantom ra mắt muộn hơn, hiện chỉ có tại một số thị trường Mỹ. Việc chấp nhận vẫn còn bỏ ngỏ. Lý thuyết, phí thấp của Solana có thể giúp Phantom cạnh tranh ở các thị trường mới nổi nhạy cảm về phí, nhưng vẫn thua MetaMask Card về độ phủ toàn cầu và mức độ chấp nhận của thương nhân.

Với stablecoin, nếu CASH không đạt hiệu ứng mạng bền vững, có thể sẽ đi vào vết xe đổ của các stablecoin gốc ví khác: khởi đầu mạnh nhưng nhanh chóng suy yếu—như mUSD của MetaMask từng vượt 100 triệu USD nguồn cung sau khi ra mắt nhưng giảm xuống còn khoảng 25 triệu USD chỉ sau chưa đầy hai tháng.

Kết luận

Khi cơn sốt meme coin hạ nhiệt, khối lượng giao dịch không còn là “hào phòng thủ” vững chắc. Các ví độc lập cần tập trung lại vào dịch vụ tài chính cốt lõi.

Phantom tích hợp Hyperliquid Perpetuals và nền tảng dự đoán Kalshi để giữ chân người dùng nâng cao ở mảng giao dịch, đồng thời đặt cược vào stablecoin CASH và thẻ ghi nợ để đưa tài sản on-chain vào đời sống hàng ngày.

Chiến lược kép—kết hợp sản phẩm phái sinh giao dịch và thanh toán tiêu dùng—là câu trả lời của Phantom trước cuộc chơi “winner takes all” trên thị trường ví. Đây không chỉ là hành trình tìm kiếm làn sóng tăng trưởng thứ hai, mà còn tái định nghĩa khái niệm ví độc lập.

Miễn trừ trách nhiệm:

- Bài viết này được đăng lại từ [ChainCatcher], bản quyền thuộc về tác giả gốc [zhou, ChainCatcher]. Nếu có vấn đề về việc đăng lại, vui lòng liên hệ đội ngũ Gate Learn để được xử lý theo quy trình liên quan.

- Miễn trừ trách nhiệm: Quan điểm và nhận định trong bài viết này là của tác giả, không phải tư vấn đầu tư.

- Các phiên bản ngôn ngữ khác của bài viết này do đội ngũ Gate Learn chuyển ngữ. Trừ khi Gate được đề cập cụ thể, nghiêm cấm sao chép, phân phối hoặc đạo văn bài dịch.

Bài viết liên quan

Đề xuất Lạm phát của Solana có thể tăng giá SOL không?

Solana thúc đẩy dự án DePIN Roam: Một triệu nút và Hàn Quốc là trung tâm "Khai thác"

Hướng dẫn đầy đủ để mua đồng tiền Meme trên Blockchain Solana

Một cái nhìn toàn diện về các đồng tiền Meme Trump

Phân tích hệ sinh thái Sonic SVM