# BItcoin

6.63M

MissCrypto

#FedRateDecisionApproaches 🚨

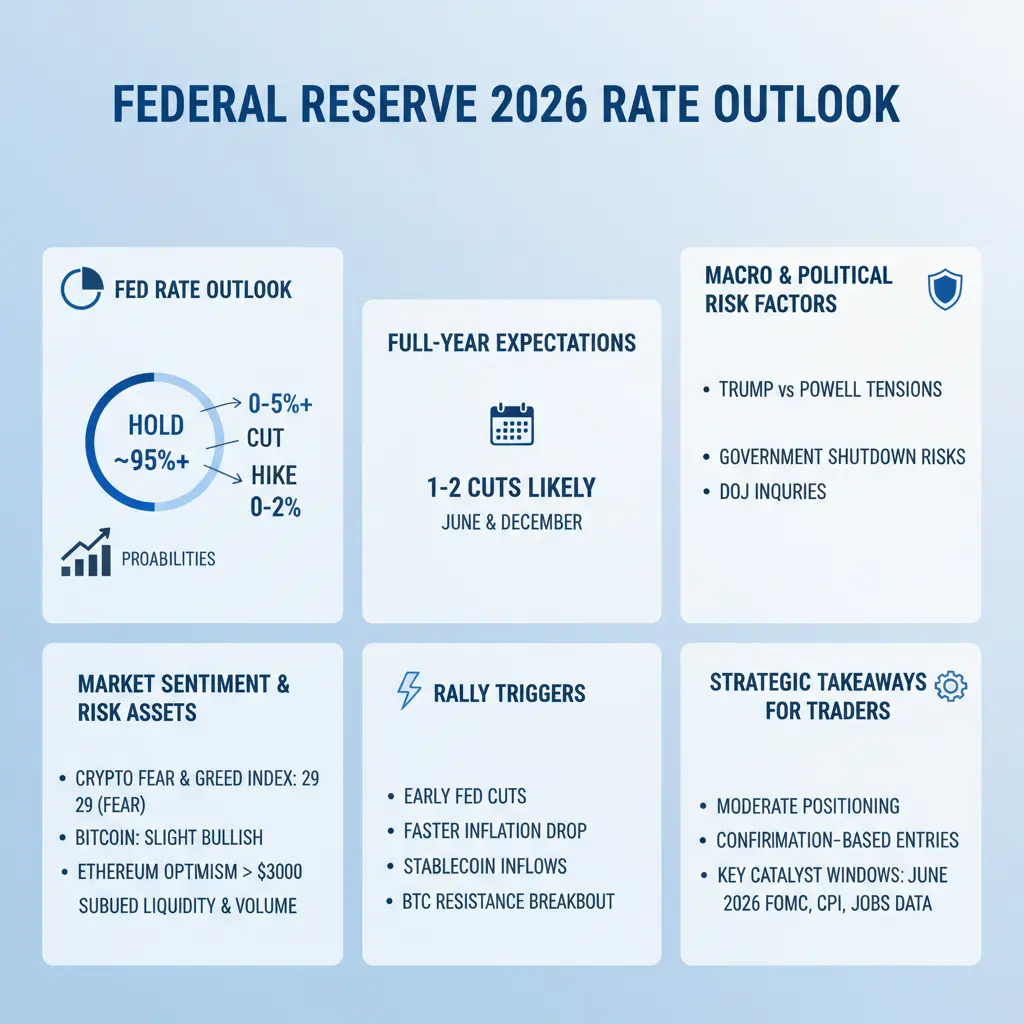

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 4

- 8

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

#CryptoMarketWatch #CryptoMarketWatch 📊🚀

Price action is heating up, but direction isn’t obvious yet. Bitcoin is hovering around important support zones while capital continues to rotate selectively across altcoins.

What’s driving today’s uncertainty isn’t charts alone — it’s macro pressure: • Upcoming Fed policy decisions are keeping traders cautious

• Rising geopolitical stress in the Middle East is adding risk premium

• Regulatory developments are influencing sentiment across crypto markets

In environments like this, liquidity decides the winners. Short-term moves can be sharp and mislead

Price action is heating up, but direction isn’t obvious yet. Bitcoin is hovering around important support zones while capital continues to rotate selectively across altcoins.

What’s driving today’s uncertainty isn’t charts alone — it’s macro pressure: • Upcoming Fed policy decisions are keeping traders cautious

• Rising geopolitical stress in the Middle East is adding risk premium

• Regulatory developments are influencing sentiment across crypto markets

In environments like this, liquidity decides the winners. Short-term moves can be sharp and mislead

- Reward

- 8

- 11

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

🚨 #CryptoRegulationNewProgress 🚨

Crypto regulation ab uncertainty se nikal kar clarity & enforcement ke phase mein enter kar chuki hai.

Governments worldwide licensing, AML, taxation aur stablecoin oversight ko formal bana rahi hain — jo market ko stronger, safer aur more institutional bana raha hai.

🌍 Global Shift • Europe: Strict KYC/AML, anonymous accounts ka end

• USA: Institutional adoption + Bitcoin strategic focus

• Asia: Licensing, taxation aur regulated trading

• Pakistan: PVARA, PCC, stablecoin partnerships & Digital Rupee (CBDC) pilot

📈 Market Impact Regulation ka matlab suppres

Crypto regulation ab uncertainty se nikal kar clarity & enforcement ke phase mein enter kar chuki hai.

Governments worldwide licensing, AML, taxation aur stablecoin oversight ko formal bana rahi hain — jo market ko stronger, safer aur more institutional bana raha hai.

🌍 Global Shift • Europe: Strict KYC/AML, anonymous accounts ka end

• USA: Institutional adoption + Bitcoin strategic focus

• Asia: Licensing, taxation aur regulated trading

• Pakistan: PVARA, PCC, stablecoin partnerships & Digital Rupee (CBDC) pilot

📈 Market Impact Regulation ka matlab suppres

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

💰Capital flow from Silver to $BTC ?

Analysts note that historically, the BTC/Silver exchange rate reached its minimum 13 months after the peak, showing a drop of 75-85% 📉

At the moment, it's the twelfth month, and the collapse is already at 78%.

According to this dynamic, a capital flow from Silver to BTC could start in the first half of 2026.

#BTC #Bitcoin #Silver $BTC

Analysts note that historically, the BTC/Silver exchange rate reached its minimum 13 months after the peak, showing a drop of 75-85% 📉

At the moment, it's the twelfth month, and the collapse is already at 78%.

According to this dynamic, a capital flow from Silver to BTC could start in the first half of 2026.

#BTC #Bitcoin #Silver $BTC

BTC1,63%

- Reward

- 5

- 4

- Repost

- Share

Gate_Square :

:

Buy silver!View More

#CryptoMarketWatch 📊🚀

Markets are moving fast, and the crypto ecosystem is showing mixed signals today. BTC is testing key support zones while altcoins rotate with emerging trends.

Macro factors are influencing every move:

• Fed rate decisions approaching (#FedRateDecisionApproaches)

• Middle East tensions (#MiddleEastTensionsEscalate)

• Regulatory news shaping sentiment (#CryptoRegulationNewProgress)

Liquidity is key — short-term spikes can be unpredictable, but disciplined positioning wins in the long term.

Smart traders focus on:

• Support & resistance levels

• Volume trends

• High-impact

Markets are moving fast, and the crypto ecosystem is showing mixed signals today. BTC is testing key support zones while altcoins rotate with emerging trends.

Macro factors are influencing every move:

• Fed rate decisions approaching (#FedRateDecisionApproaches)

• Middle East tensions (#MiddleEastTensionsEscalate)

• Regulatory news shaping sentiment (#CryptoRegulationNewProgress)

Liquidity is key — short-term spikes can be unpredictable, but disciplined positioning wins in the long term.

Smart traders focus on:

• Support & resistance levels

• Volume trends

• High-impact

- Reward

- 11

- 12

- Repost

- Share

AYATTAC :

:

thanks for information sent every dayView More

JUST IN: Stablecoin Market Cap Hits All-Time High as $2 Billion Floods Exchanges.

The sidelines are officially emptying. In the last 6 hours, on-chain data recorded a massive $2 billion inflow of USDT and USDC into centralized exchange wallets. This liquidity injection arrives precisely as Bitcoin stabilizes above $91,500, signaling that large capital allocators are finished de-risking from the recent geopolitical scare and are positioning for deployment.

This matters because it represents "potential energy."

Unlike open interest, which indicates leverage, stablecoin inflows represent raw spot

The sidelines are officially emptying. In the last 6 hours, on-chain data recorded a massive $2 billion inflow of USDT and USDC into centralized exchange wallets. This liquidity injection arrives precisely as Bitcoin stabilizes above $91,500, signaling that large capital allocators are finished de-risking from the recent geopolitical scare and are positioning for deployment.

This matters because it represents "potential energy."

Unlike open interest, which indicates leverage, stablecoin inflows represent raw spot

BTC1,63%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

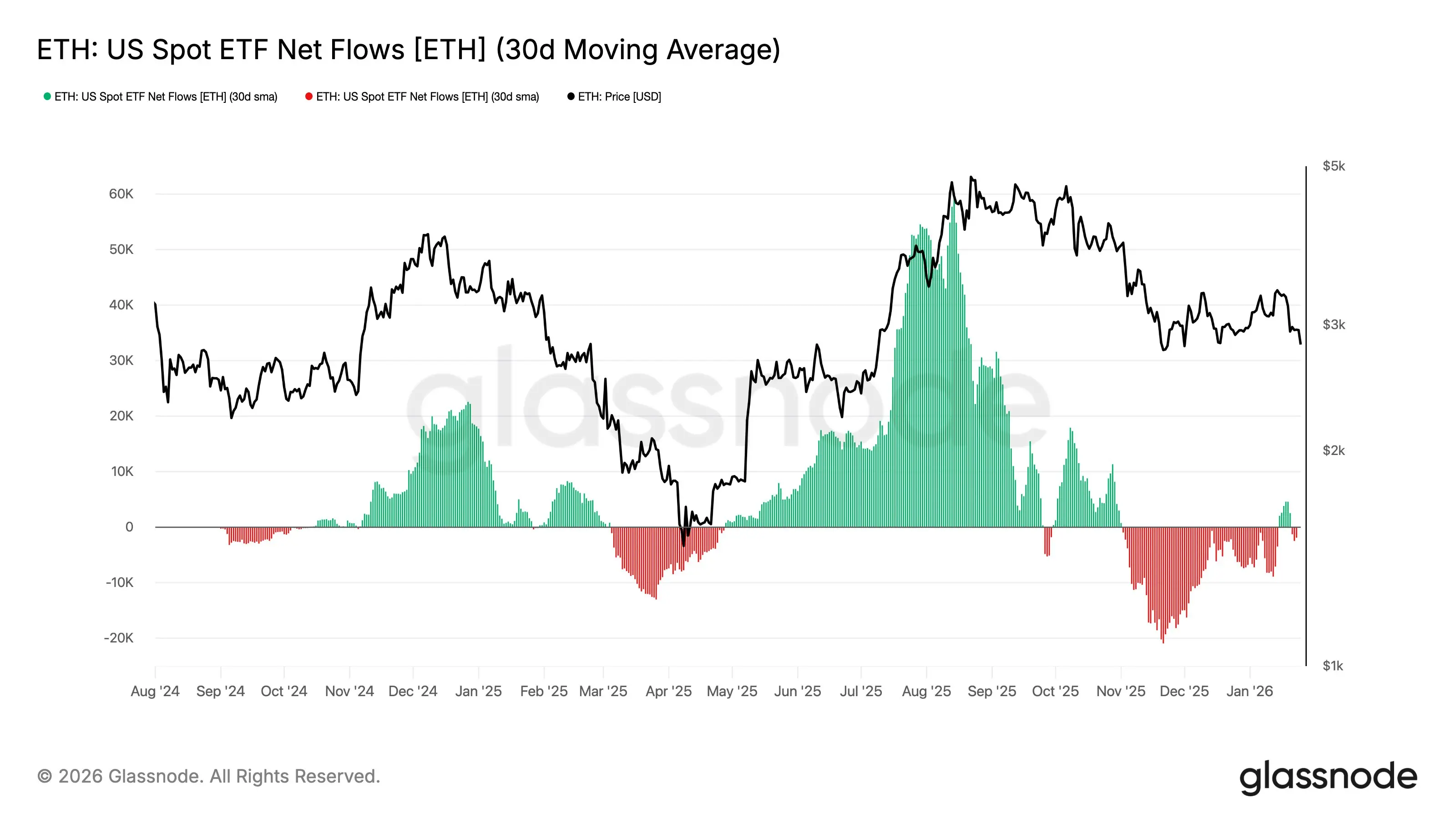

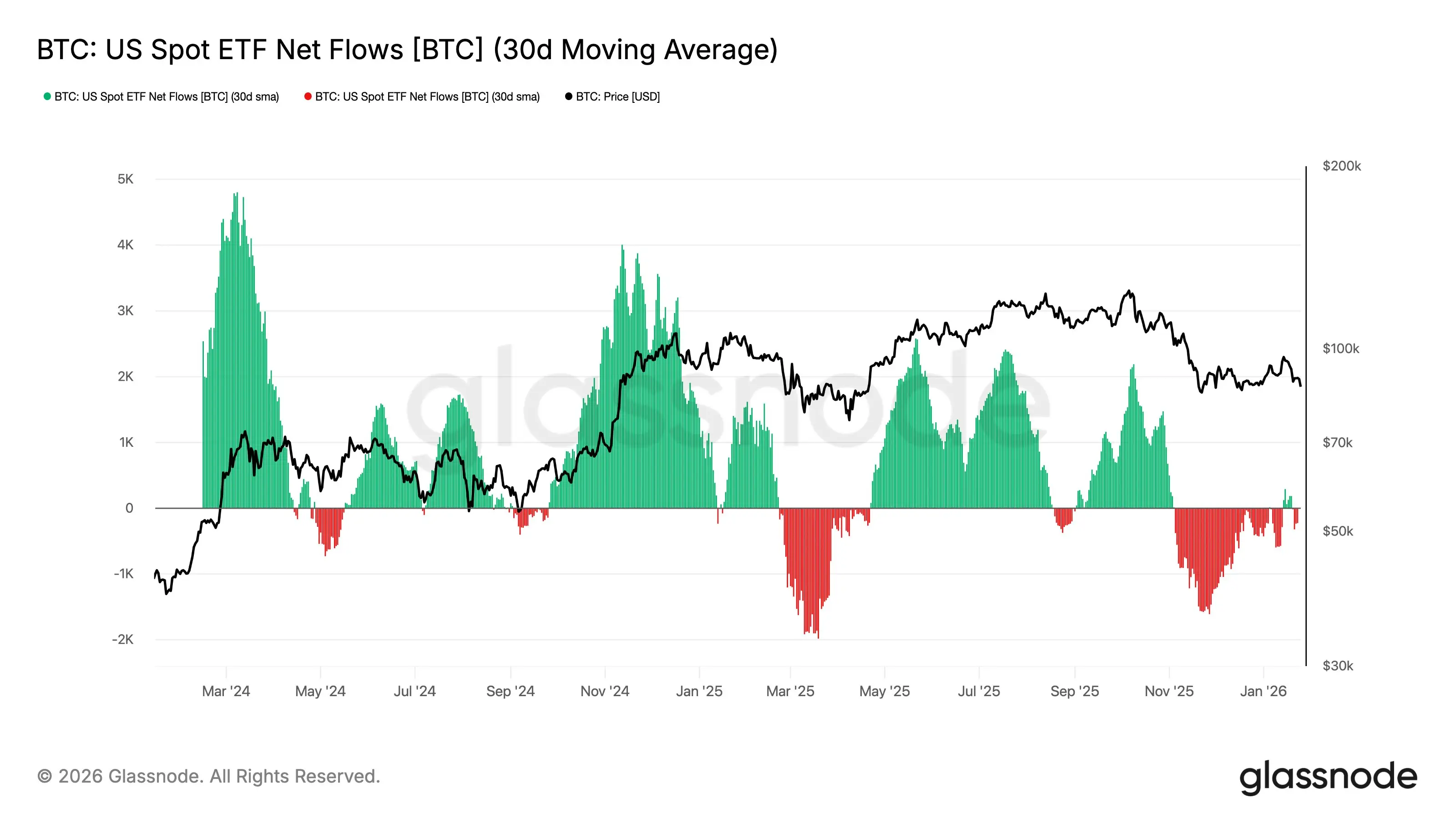

2026 GOGOGO 👊ETF Flow Divergence Highlights Structural Differences Between #Bitcoin and #Ethereum Demand

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

The 30-day moving average of US spot ETF net flows reveals a clear divergence between Bitcoin and Ethereum, offering insight into how institutional demand is evolving across the two assets. While both benefited from ETF-driven inflows during the mid-2025 risk-on phase, the persistence and price impact of those flows differ materially.

Bitcoin ETF flows show a more cyclical but resilient pattern. Periods of strong inflows tend to coincide with sustained price appreciation, and even during outflow phases,

- Reward

- 1

- 2

- Repost

- Share

CryptoZeno :

:

Good luck everyone View More

Gate.io is more than just a cryptocurrency exchange — it’s a platform where anyone can learn and grow in the world of digital assets. On Gate.io, you can trade Bitcoin, Ethereum, and thousands of altcoins while discovering new crypto projects early. The platform offers advanced security, low trading fees, and user-friendly tools, making it easy for beginners to understand trading and for experienced traders to optimize their strategies. By exploring Gate.io, you not only trade crypto but also gain knowledge about the market, trends, and opportunities that can help you make smarter financial de

- Reward

- like

- Comment

- Repost

- Share

#BitcoinFallsBehindGold 📉🟡

Bitcoin is losing ground against gold. The BTC/Gold ratio is down ~55% from its peak

and has now fallen below the 200-week

moving average — a level many long-term investors watch closely.

Historically, moments like this have sparked

debate:

·

🟢 Value zone? Long-term buyers see weakness vs gold as an

accumulation signal.

·

🔴 More downside? Others warn the trend still favors safe

havens in the near term.

With macro uncertainty high and gold leading,

the question is whether Bitcoin is setting up for a rebound — or needs more

time to base.

#Bitcoin

Bitcoin is losing ground against gold. The BTC/Gold ratio is down ~55% from its peak

and has now fallen below the 200-week

moving average — a level many long-term investors watch closely.

Historically, moments like this have sparked

debate:

·

🟢 Value zone? Long-term buyers see weakness vs gold as an

accumulation signal.

·

🔴 More downside? Others warn the trend still favors safe

havens in the near term.

With macro uncertainty high and gold leading,

the question is whether Bitcoin is setting up for a rebound — or needs more

time to base.

#Bitcoin

BTC1,63%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

7.26K Popularity

69.62K Popularity

26.64K Popularity

9.38K Popularity

8.96K Popularity

8.24K Popularity

7.65K Popularity

6.77K Popularity

73.84K Popularity

20.27K Popularity

81.59K Popularity

23.21K Popularity

49.43K Popularity

43.54K Popularity

196.39K Popularity

News

View MoreForbes Interview with Gate Founder Dr. Han: Building Long-term Competitive Advantage for Crypto Platforms through Transparency and Compliance

12 m

Overview of Mainstream Perp DEXs: Hyperliquid trading volume slightly declines, with position funds still dominating

13 m

JustLend DAO TVL surpasses $6.71 billion threshold

20 m

Gate ETF will launch RIVER3L and RIVER3S, participate in the new coin challenge and share 30,000 USDT

21 m

Mirae Asset Global Investments 增持 8.7 万股 MSTR,价值 1410 万美元

25 m

Pin