#BitcoinMarketAnalysis

Bitcoin continues to dominate the crypto landscape, but the recent market movements have traders and investors asking critical questions: Where is BTC headed next, and how should one position themselves?

Current Market Dynamics:

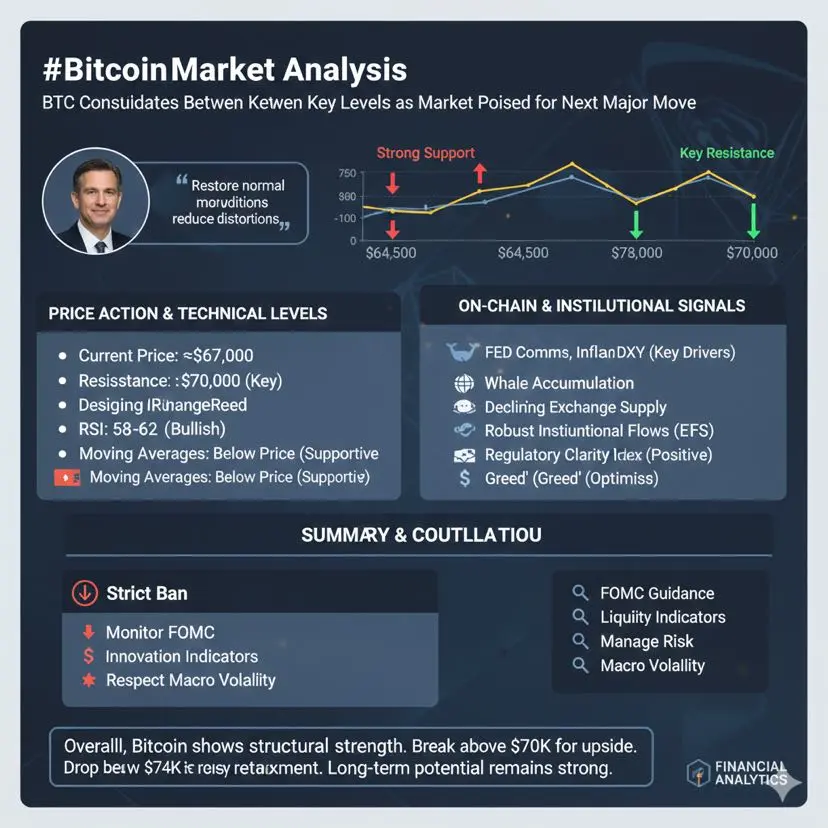

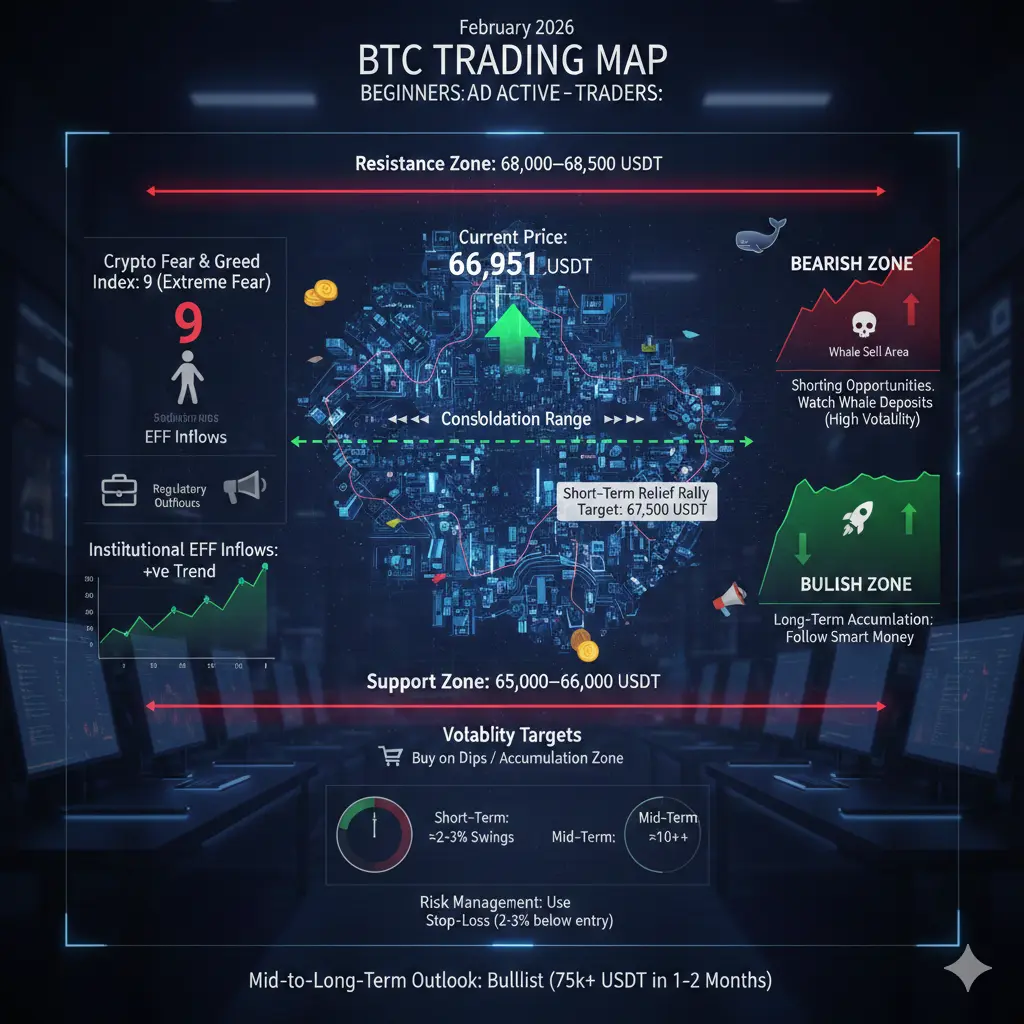

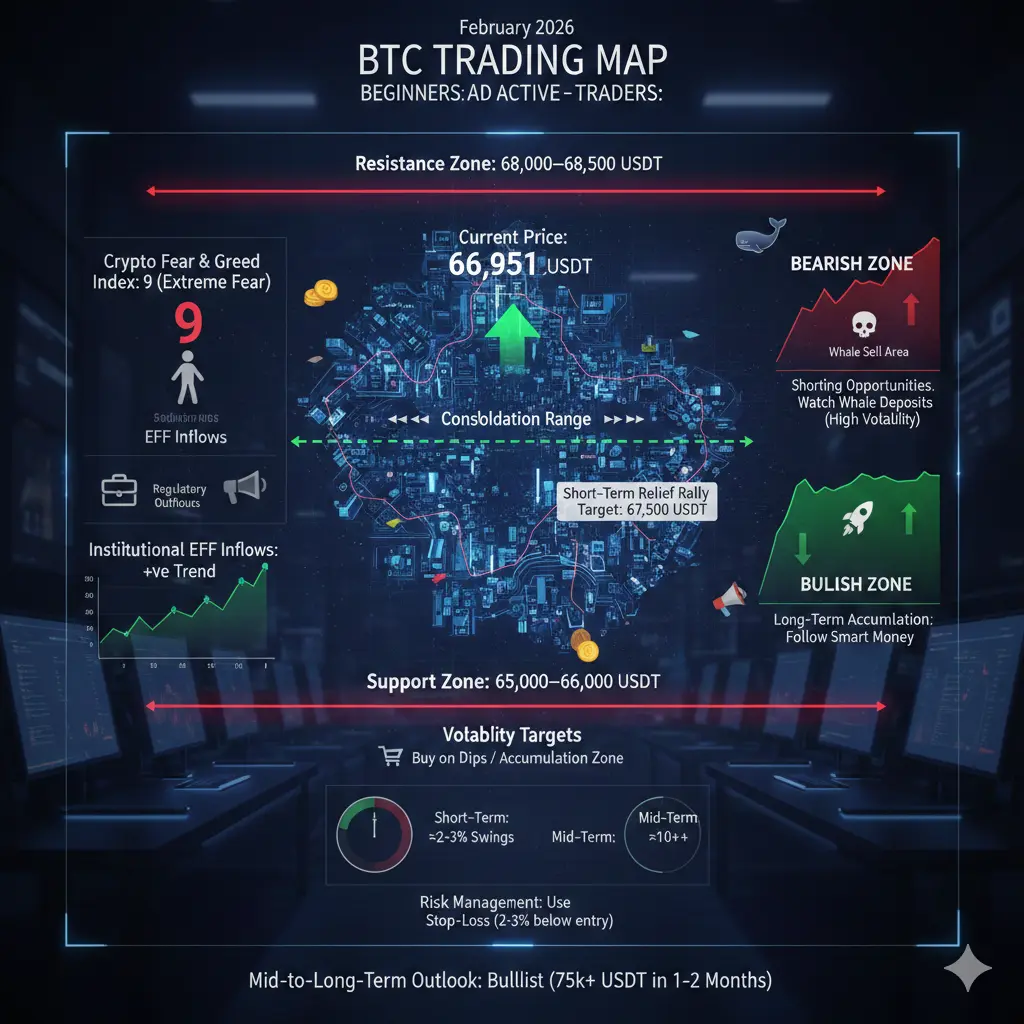

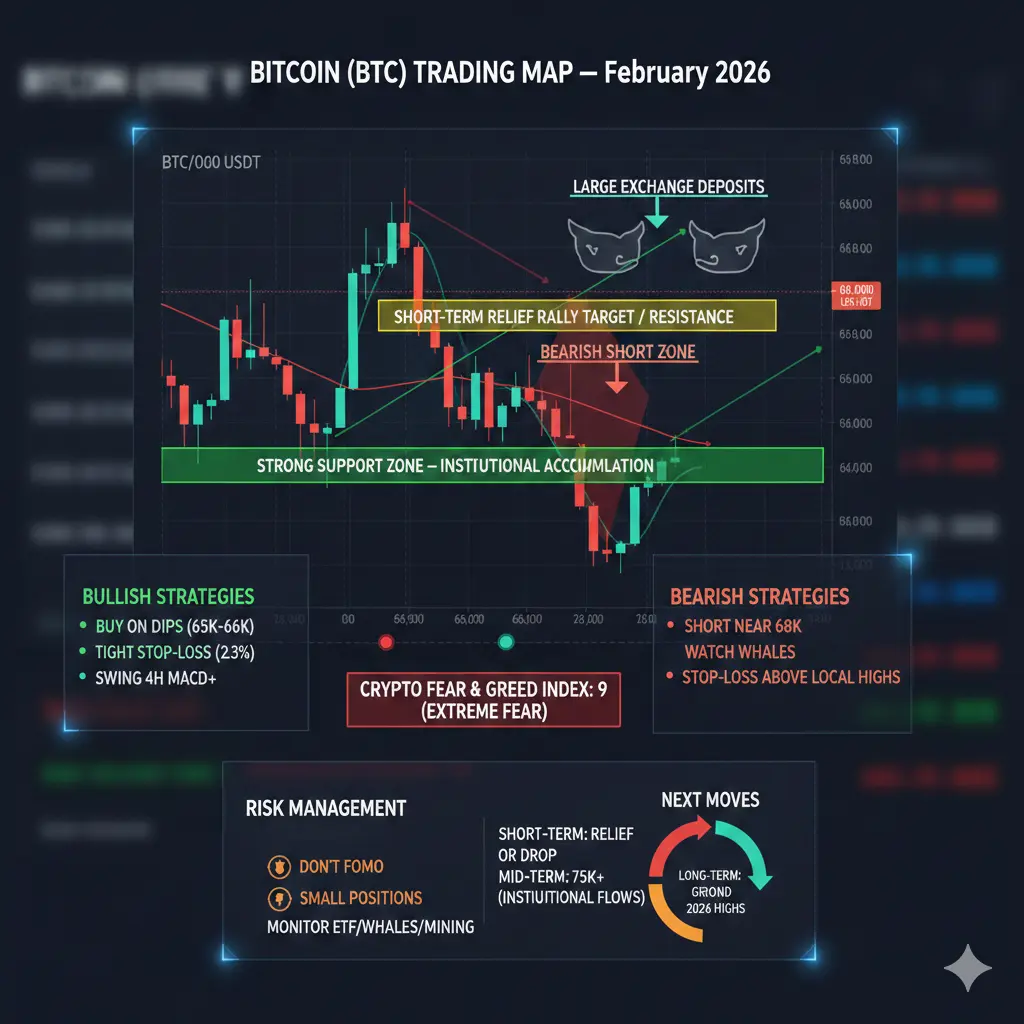

• Price Action: Bitcoin recently faced volatility around key support and resistance levels. Short-term corrections have tested trader sentiment, while macro trends continue to play a pivotal role.

• Liquidity and Volume: Trading volume remains concentrated around key price zones, signaling cautious participation from institutional players and retail alike.

• Funding Rates & Leverage: Funding rates on major exchanges show moderate long positioning, but spikes in leverage can trigger rapid liquidations if momentum shifts.

Macro Factors Influencing Bitcoin:

• Interest Rates & Fed Policy: Strong employment data or delayed rate cuts can impact BTC as risk appetite shifts toward the U.S. dollar.

• Global Liquidity Flows: ETF outflows, institutional profit-taking, and cross-asset correlations (with stocks and gold) play a role in short-term price swings.

• Geopolitical Events: Ongoing geopolitical tensions, trade news, or regulatory announcements continue to influence investor sentiment.

Technical Outlook:

• Key support levels are being monitored closely; a break below these could signal deeper short-term corrections.

• Resistance zones indicate where selling pressure may appear and consolidation might occur.

• Momentum indicators suggest caution — BTC is in a phase where trend confirmation is critical before aggressive entries.

Investor Takeaways:

Long-term Holders: Current fluctuations can represent accumulation opportunities if confidence in BTC’s fundamentals remains.

Short-term Traders: Risk management is essential — trading on momentum, using stop-losses, and monitoring leverage exposure can mitigate sudden moves.

Macro-Aware Investors: Watch interest rates, dollar strength, and institutional flows for broader trend signals.

Conclusion:

Bitcoin remains the bellwether of the crypto market. While short-term volatility is inevitable, careful analysis of support/resistance, macro conditions, and investor sentiment can provide strategic opportunities. The key is discipline, patience, and staying informed — not reacting impulsively to every spike or dip.

BTC’s journey continues to be shaped by both technical and macro factors, making it essential for investors to maintain a clear strategy and adaptive mindset.

Bitcoin continues to dominate the crypto landscape, but the recent market movements have traders and investors asking critical questions: Where is BTC headed next, and how should one position themselves?

Current Market Dynamics:

• Price Action: Bitcoin recently faced volatility around key support and resistance levels. Short-term corrections have tested trader sentiment, while macro trends continue to play a pivotal role.

• Liquidity and Volume: Trading volume remains concentrated around key price zones, signaling cautious participation from institutional players and retail alike.

• Funding Rates & Leverage: Funding rates on major exchanges show moderate long positioning, but spikes in leverage can trigger rapid liquidations if momentum shifts.

Macro Factors Influencing Bitcoin:

• Interest Rates & Fed Policy: Strong employment data or delayed rate cuts can impact BTC as risk appetite shifts toward the U.S. dollar.

• Global Liquidity Flows: ETF outflows, institutional profit-taking, and cross-asset correlations (with stocks and gold) play a role in short-term price swings.

• Geopolitical Events: Ongoing geopolitical tensions, trade news, or regulatory announcements continue to influence investor sentiment.

Technical Outlook:

• Key support levels are being monitored closely; a break below these could signal deeper short-term corrections.

• Resistance zones indicate where selling pressure may appear and consolidation might occur.

• Momentum indicators suggest caution — BTC is in a phase where trend confirmation is critical before aggressive entries.

Investor Takeaways:

Long-term Holders: Current fluctuations can represent accumulation opportunities if confidence in BTC’s fundamentals remains.

Short-term Traders: Risk management is essential — trading on momentum, using stop-losses, and monitoring leverage exposure can mitigate sudden moves.

Macro-Aware Investors: Watch interest rates, dollar strength, and institutional flows for broader trend signals.

Conclusion:

Bitcoin remains the bellwether of the crypto market. While short-term volatility is inevitable, careful analysis of support/resistance, macro conditions, and investor sentiment can provide strategic opportunities. The key is discipline, patience, and staying informed — not reacting impulsively to every spike or dip.

BTC’s journey continues to be shaped by both technical and macro factors, making it essential for investors to maintain a clear strategy and adaptive mindset.