# GlobalMarkets

7423

MoonGirl

🌍⚠️ #USIranTensionsImpactMarkets ⚠️🌍

全球市场再次紧张不安,随着美伊之间的紧张局势升级,金融市场充满不确定性。📉🔥

每当地缘政治风险增加,市场反应迅速——有时甚至情绪化。我们看到的不仅是股票和石油等传统市场的波动,还包括加密货币。

🛢 由于供应担忧,中东局势紧张通常会导致油价飙升。

📊 投资者减少风险敞口,股市往往变得谨慎。

🪙 黄金可能吸引避险需求。

₿ 比特币的角色成为焦点——它是像风险资产一样运作,还是作为对冲工具?

这是一个新闻头条在几分钟内就能影响市场的环境。突如其来的价格波动、假突破、流动性抢夺和高波动性变得司空见惯。

聪明的交易者明白:

✔️ 首先保护资本

✔️ 减少过度杠杆

✔️ 避免情绪化决策

✔️ 跟随确认的趋势,而非恐慌

高波动性意味着两件事:

⚡ 更高的风险

⚡ 更高的机会

现在的问题是——这种紧张局势会进一步升级,导致市场持续不稳定吗?还是外交努力会平息投资者情绪,恢复信心?

你在这种情况下的策略是什么?

是保持现金、对冲、逢低买入,还是等待确认?👇

让我们在下方讨论。

#GlobalMarkets #CryptoNews #Bitcoin #TradingStrategy #MoonGirlLive

全球市场再次紧张不安,随着美伊之间的紧张局势升级,金融市场充满不确定性。📉🔥

每当地缘政治风险增加,市场反应迅速——有时甚至情绪化。我们看到的不仅是股票和石油等传统市场的波动,还包括加密货币。

🛢 由于供应担忧,中东局势紧张通常会导致油价飙升。

📊 投资者减少风险敞口,股市往往变得谨慎。

🪙 黄金可能吸引避险需求。

₿ 比特币的角色成为焦点——它是像风险资产一样运作,还是作为对冲工具?

这是一个新闻头条在几分钟内就能影响市场的环境。突如其来的价格波动、假突破、流动性抢夺和高波动性变得司空见惯。

聪明的交易者明白:

✔️ 首先保护资本

✔️ 减少过度杠杆

✔️ 避免情绪化决策

✔️ 跟随确认的趋势,而非恐慌

高波动性意味着两件事:

⚡ 更高的风险

⚡ 更高的机会

现在的问题是——这种紧张局势会进一步升级,导致市场持续不稳定吗?还是外交努力会平息投资者情绪,恢复信心?

你在这种情况下的策略是什么?

是保持现金、对冲、逢低买入,还是等待确认?👇

让我们在下方讨论。

#GlobalMarkets #CryptoNews #Bitcoin #TradingStrategy #MoonGirlLive

BTC5.57%

- 赞赏

- 5

- 14

- 转发

- 分享

ShainingMoon :

:

2026年GOGOGO 👊查看更多

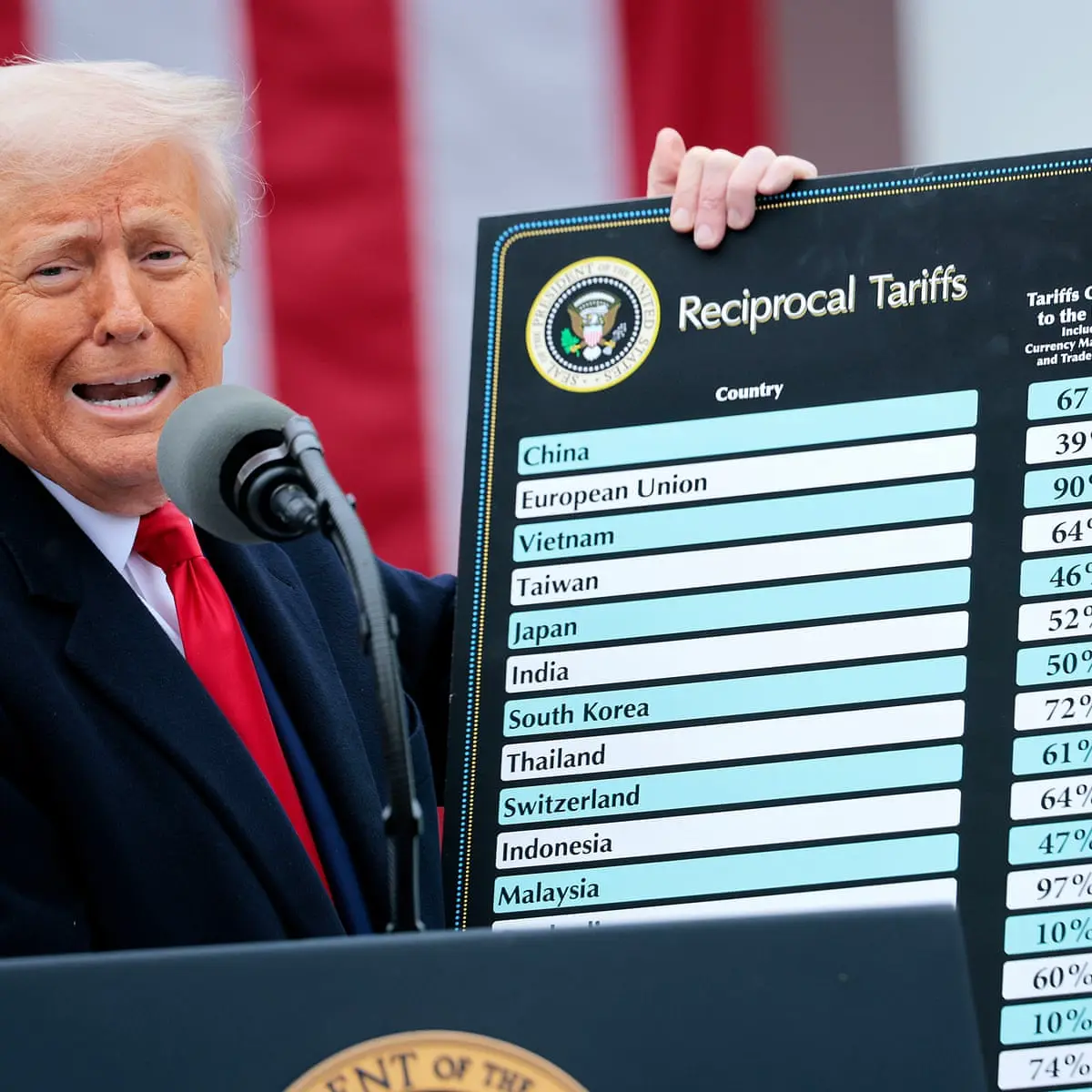

2026年2月下旬——贸易政策冲击再次成为焦点。

特朗普总统在获得美国最高法院批准后,宣布对进口商品实施15%的统一关税。支持者将此措施称为“解放日”,旨在缩小贸易逆差并加强国内制造业。

市场没有等待——股市、加密货币和商品市场的波动性扩大。

📉 市场即时反应

₿ 比特币:约$67.8K #TrumpordersfederalbanonAnthropicAI −1.9%#TrumpAnnouncesNewTariffs

风险偏好降温,出现温和回调。

Ξ 以太坊:约$1,925

在科技行业疲软的背景下测试$1,900的需求区。

📊 美股:

纳斯达克综合指数和标普500指数均下跌约2%,高β科技股和全球制造商领跌。

🥇 避险资产:

黄金和美元吸引了防御性资金流入,交易者进行仓位调整。

🔍 推动行情的因素?

1️⃣ 扩大的15%关税

从之前的10%水平提升,表明采取更激进的保护主义立场,直接影响全球供应链。

2️⃣ 法律支持

最高法院的裁决加强了在第232条款和第301条款下的行政权力,减少了短期政策不确定性——但也增加了全球贸易紧张的风险。

3️⃣ 报复担忧

市场预期可能出现反制关税、通胀压力和跨国企业利润压缩。

4️⃣ 加密货币的地位

数字资产目前表现得像流动性敏感的风险资产——但机构交易部门似乎在逢低逐步增持。

🧠 关注的战术水平

• 比特币:(区域,作为短期结构性支撑

查看原文特朗普总统在获得美国最高法院批准后,宣布对进口商品实施15%的统一关税。支持者将此措施称为“解放日”,旨在缩小贸易逆差并加强国内制造业。

市场没有等待——股市、加密货币和商品市场的波动性扩大。

📉 市场即时反应

₿ 比特币:约$67.8K #TrumpordersfederalbanonAnthropicAI −1.9%#TrumpAnnouncesNewTariffs

风险偏好降温,出现温和回调。

Ξ 以太坊:约$1,925

在科技行业疲软的背景下测试$1,900的需求区。

📊 美股:

纳斯达克综合指数和标普500指数均下跌约2%,高β科技股和全球制造商领跌。

🥇 避险资产:

黄金和美元吸引了防御性资金流入,交易者进行仓位调整。

🔍 推动行情的因素?

1️⃣ 扩大的15%关税

从之前的10%水平提升,表明采取更激进的保护主义立场,直接影响全球供应链。

2️⃣ 法律支持

最高法院的裁决加强了在第232条款和第301条款下的行政权力,减少了短期政策不确定性——但也增加了全球贸易紧张的风险。

3️⃣ 报复担忧

市场预期可能出现反制关税、通胀压力和跨国企业利润压缩。

4️⃣ 加密货币的地位

数字资产目前表现得像流动性敏感的风险资产——但机构交易部门似乎在逢低逐步增持。

🧠 关注的战术水平

• 比特币:(区域,作为短期结构性支撑

- 赞赏

- 5

- 8

- 转发

- 分享

AYATTAC :

:

如此富有创意且令人印象深刻的帖子。 你总是带来一些独特的内容。

为你一直支持感到自豪。⚡⚡如此富有创意且令人印象深刻的帖子。

你总是带来一些独特的内容。

为你一直支持感到自豪。⚡⚡如此富有创意且令人印象深刻的帖子。

你总是带来一些独特的内容。

为你一直支持感到自豪。⚡⚡

查看更多

#IranTensionsEscalate 🚨 | 全球市场紧张不安

地缘政治风险不再只是头条新闻——它是一股影响市场的力量。

涉及伊朗的紧张局势升级正在重塑全球情绪,引发商品、加密货币和风险资产的防御性布局。

⚠️ 什么在驱动恐惧?

• 中东地区军事和政治压力升高

• 关键能源走廊附近的战略威胁

• 逐渐升级的言辞增加不确定性溢价

🌍 为什么这对市场很重要

中东不仅仅是一个地区——它是全球能源供应的心跳。霍尔木兹海峡附近的任何不稳定都将对油价、通胀预期和投资者心理产生冲击。

📊 立即市场反应

🛢️ 随着供应风险溢价扩大,油价上涨

💰 黄金走强,资本寻求避险保护

₿ 加密货币表现出波动性——短期恐惧,长期对冲叙事复苏

📉 随着机构减少敞口,风险资产犹豫不决

🧠 智能资金策略

现在不是情绪化交易的时候。

✔️ 波动性有利于纪律严明的交易者

✔️ 风险管理胜过预测

✔️ 资本在头条新闻达到顶峰前轮动

🔍 大局观

地缘政治升级历来带来伪装成混乱的机遇。市场不会因为紧张而崩溃——它们会重新定价风险。懂得布局、时机和流动性的人在不确定性增加时获胜。

📌 最后思考

当全球紧张局势升级时,信息成为杠杆。

保持警惕。保持战略。交易现实——而非噪音。

#GateSquare #Geopolitics #GlobalMarkets #MarketVolatility #Breakin

地缘政治风险不再只是头条新闻——它是一股影响市场的力量。

涉及伊朗的紧张局势升级正在重塑全球情绪,引发商品、加密货币和风险资产的防御性布局。

⚠️ 什么在驱动恐惧?

• 中东地区军事和政治压力升高

• 关键能源走廊附近的战略威胁

• 逐渐升级的言辞增加不确定性溢价

🌍 为什么这对市场很重要

中东不仅仅是一个地区——它是全球能源供应的心跳。霍尔木兹海峡附近的任何不稳定都将对油价、通胀预期和投资者心理产生冲击。

📊 立即市场反应

🛢️ 随着供应风险溢价扩大,油价上涨

💰 黄金走强,资本寻求避险保护

₿ 加密货币表现出波动性——短期恐惧,长期对冲叙事复苏

📉 随着机构减少敞口,风险资产犹豫不决

🧠 智能资金策略

现在不是情绪化交易的时候。

✔️ 波动性有利于纪律严明的交易者

✔️ 风险管理胜过预测

✔️ 资本在头条新闻达到顶峰前轮动

🔍 大局观

地缘政治升级历来带来伪装成混乱的机遇。市场不会因为紧张而崩溃——它们会重新定价风险。懂得布局、时机和流动性的人在不确定性增加时获胜。

📌 最后思考

当全球紧张局势升级时,信息成为杠杆。

保持警惕。保持战略。交易现实——而非噪音。

#GateSquare #Geopolitics #GlobalMarkets #MarketVolatility #Breakin

查看原文

- 赞赏

- 4

- 1

- 转发

- 分享

Yunna :

:

2026年盛宴这里是为Gate.io应用程序👇🚨🌍 #USIsraelStrikesIranBTCPlunges ——地缘政治紧张局势震动加密市场的专业且以市场为导向的帖子

在涉及美国和以色列对伊朗的空袭报道后,地缘政治紧张局势升级,引发全球金融市场的剧烈反应——比特币承受明显的下行压力。📉🪙🔍 市场反应概述

• 📉 比特币和主要山寨币波动性增加

• 💵 投资者转向传统避险资产

• 📊 股指期货和原油市场反应剧烈

• ⚠️ 全球市场风险情绪减弱

地缘政治冲突常常带来短期不确定性,导致流动性和投资者仓位的快速变化。📊 投资者应关注的事项

✔️ 比特币关键支撑区域

✔️ 交易量激增与清算水平

✔️ 避险资金流向 (美元、黄金、原油

)✔️ 宏观经济头条

虽然加密市场对地缘政治冲击反应激烈,但历史模式显示,波动阶段常常带来风险与战略机遇。在Gate.io,保持实时图表和风险管理工具的更新,以应对快速变化的市场环境。🚀⚠️ 以新闻为导向的市场变化迅速——理性交易,明智管理风险敞口。

你认为地缘政治不稳定会增强还是削弱比特币作为去中心化资产的长期叙事?欢迎在下方分享你的观点。👇#CryptoNews #Bitcoin #GlobalMarkets #Gateio

在涉及美国和以色列对伊朗的空袭报道后,地缘政治紧张局势升级,引发全球金融市场的剧烈反应——比特币承受明显的下行压力。📉🪙🔍 市场反应概述

• 📉 比特币和主要山寨币波动性增加

• 💵 投资者转向传统避险资产

• 📊 股指期货和原油市场反应剧烈

• ⚠️ 全球市场风险情绪减弱

地缘政治冲突常常带来短期不确定性,导致流动性和投资者仓位的快速变化。📊 投资者应关注的事项

✔️ 比特币关键支撑区域

✔️ 交易量激增与清算水平

✔️ 避险资金流向 (美元、黄金、原油

)✔️ 宏观经济头条

虽然加密市场对地缘政治冲击反应激烈,但历史模式显示,波动阶段常常带来风险与战略机遇。在Gate.io,保持实时图表和风险管理工具的更新,以应对快速变化的市场环境。🚀⚠️ 以新闻为导向的市场变化迅速——理性交易,明智管理风险敞口。

你认为地缘政治不稳定会增强还是削弱比特币作为去中心化资产的长期叙事?欢迎在下方分享你的观点。👇#CryptoNews #Bitcoin #GlobalMarkets #Gateio

BTC5.57%

- 赞赏

- 1

- 评论

- 转发

- 分享

这里是为Gate.io应用程序👇🚨🌍 #USIsraelStrikesIranBTCPlunges ——地缘政治紧张局势震动加密市场的专业且以市场为导向的帖子

在涉及美国和以色列对伊朗的空袭报道后,地缘政治紧张局势升级,引发全球金融市场的剧烈反应——比特币承受明显的下行压力。📉🪙🔍 市场反应概述

• 📉 比特币和主要山寨币波动性增加

• 💵 投资者转向传统避险资产

• 📊 股指期货和原油市场反应剧烈

• ⚠️ 全球市场风险情绪减弱

地缘政治冲突常常带来短期不确定性,导致流动性和投资者仓位的快速变化。📊 投资者应关注的事项

✔️ 比特币关键支撑区域

✔️ 交易量激增与清算水平

✔️ 避险资金流向 (美元、黄金、原油

)✔️ 宏观经济头条

虽然加密市场对地缘政治冲击反应激烈,但历史模式显示,波动阶段常常带来风险与战略机遇。在Gate.io,保持实时图表和风险管理工具的更新,以应对快速变化的市场环境。🚀⚠️ 以新闻为导向的市场变化迅速——理性交易,明智管理风险敞口。

你认为地缘政治不稳定会增强还是削弱比特币作为去中心化资产的长期叙事?欢迎在下方分享你的观点。👇#CryptoNews #Bitcoin #GlobalMarkets #Gateio

在涉及美国和以色列对伊朗的空袭报道后,地缘政治紧张局势升级,引发全球金融市场的剧烈反应——比特币承受明显的下行压力。📉🪙🔍 市场反应概述

• 📉 比特币和主要山寨币波动性增加

• 💵 投资者转向传统避险资产

• 📊 股指期货和原油市场反应剧烈

• ⚠️ 全球市场风险情绪减弱

地缘政治冲突常常带来短期不确定性,导致流动性和投资者仓位的快速变化。📊 投资者应关注的事项

✔️ 比特币关键支撑区域

✔️ 交易量激增与清算水平

✔️ 避险资金流向 (美元、黄金、原油

)✔️ 宏观经济头条

虽然加密市场对地缘政治冲击反应激烈,但历史模式显示,波动阶段常常带来风险与战略机遇。在Gate.io,保持实时图表和风险管理工具的更新,以应对快速变化的市场环境。🚀⚠️ 以新闻为导向的市场变化迅速——理性交易,明智管理风险敞口。

你认为地缘政治不稳定会增强还是削弱比特币作为去中心化资产的长期叙事?欢迎在下方分享你的观点。👇#CryptoNews #Bitcoin #GlobalMarkets #Gateio

BTC5.57%

- 赞赏

- 3

- 1

- 转发

- 分享

Crypto_Buzz_with_Alex :

:

祝你在马年财源广进 🐴📊 市场洞察

比特币在$68K 之上稳定,随着地缘政治头条影响全球情绪。

人工智能、军事技术和社交媒体活动推动市场话题热度。

波动性带来机遇——但风险管理至关重要。

#Bitcoin #CryptoMarkets #AI #GlobalMarkets #Trading

比特币在$68K 之上稳定,随着地缘政治头条影响全球情绪。

人工智能、军事技术和社交媒体活动推动市场话题热度。

波动性带来机遇——但风险管理至关重要。

#Bitcoin #CryptoMarkets #AI #GlobalMarkets #Trading

BTC5.57%

- 赞赏

- 3

- 评论

- 转发

- 分享

📢🌍 #TrumpAnnouncesNewTariffs – 全球市场反应

前美国总统唐纳德·特朗普宣布了新的关税措施,重新点燃了关于全球贸易政策及其潜在经济影响的讨论。🏛️📊

🔍 这对市场意味着:

🔹 贸易紧张局势升级可能引发通胀担忧

🔹 对全球供应链可能施加压力

🔹 股市、商品和加密货币的波动性加剧

🔹 投资者情绪向风险资产转变

📉📈 从历史上看,宏观不确定性可能引发短期的避险反应——但也可能促使投资者对比特币等替代资产产生兴趣,因为他们重新评估投资组合配置。

💡 交易员洞察:

密切关注:

✔️ 美元走强

✔️ 股市表现

✔️ 比特币的关键支撑和阻力位

✔️ 主要山寨币的成交量激增

在Gate.io,使用高级图表工具和实时市场数据,自信应对波动。🚀

⚠️ 宏观驱动的头条新闻可能迅速影响市场——保持信息灵通,谨慎管理风险。

你认为新关税会给加密货币市场带来压力还是会增加对去中心化资产的需求?在下方分享你的看法!👇

#CryptoNews #GlobalMarkets #Bitcoin #MacroTrends #TradePolicy

前美国总统唐纳德·特朗普宣布了新的关税措施,重新点燃了关于全球贸易政策及其潜在经济影响的讨论。🏛️📊

🔍 这对市场意味着:

🔹 贸易紧张局势升级可能引发通胀担忧

🔹 对全球供应链可能施加压力

🔹 股市、商品和加密货币的波动性加剧

🔹 投资者情绪向风险资产转变

📉📈 从历史上看,宏观不确定性可能引发短期的避险反应——但也可能促使投资者对比特币等替代资产产生兴趣,因为他们重新评估投资组合配置。

💡 交易员洞察:

密切关注:

✔️ 美元走强

✔️ 股市表现

✔️ 比特币的关键支撑和阻力位

✔️ 主要山寨币的成交量激增

在Gate.io,使用高级图表工具和实时市场数据,自信应对波动。🚀

⚠️ 宏观驱动的头条新闻可能迅速影响市场——保持信息灵通,谨慎管理风险。

你认为新关税会给加密货币市场带来压力还是会增加对去中心化资产的需求?在下方分享你的看法!👇

#CryptoNews #GlobalMarkets #Bitcoin #MacroTrends #TradePolicy

BTC5.57%

- 赞赏

- 3

- 评论

- 转发

- 分享

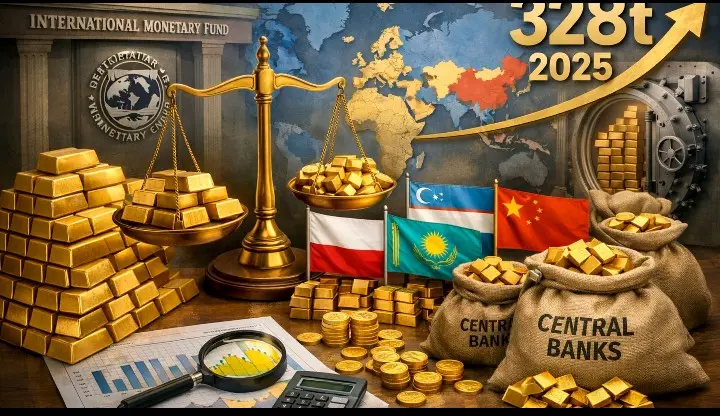

📈 中国黄金储备达到15个月高点

中国在全球市场不确定性中持续加强其金融稳定性。最新数据显示,该国黄金储备已达到15个月高点,表明其战略性积累以多元化外汇储备和对冲货币波动。

黄金仍然是长期财富保值的基石,中国的持续积累凸显其在保障经济韧性和应对潜在全球市场变动方面的关注。

全球投资者密切关注这些动态,因为它们可能影响全球黄金市场和投资者情绪。

#ChinaGoldReserves #GlobalMarkets #FinancialStability #GoldInvestment #经济策略

查看原文中国在全球市场不确定性中持续加强其金融稳定性。最新数据显示,该国黄金储备已达到15个月高点,表明其战略性积累以多元化外汇储备和对冲货币波动。

黄金仍然是长期财富保值的基石,中国的持续积累凸显其在保障经济韧性和应对潜在全球市场变动方面的关注。

全球投资者密切关注这些动态,因为它们可能影响全球黄金市场和投资者情绪。

#ChinaGoldReserves #GlobalMarkets #FinancialStability #GoldInvestment #经济策略

- 赞赏

- 8

- 9

- 转发

- 分享

CryptoEye :

:

LFG 🔥查看更多

加载更多

加入 4000万 人汇聚的头部社区

⚡️ 与 4000万 人一起参与加密货币热潮讨论

💬 与喜爱的头部博主互动

👍 查看感兴趣的内容

热门话题

30.9万 热度

11.94万 热度

17.86万 热度

1.43万 热度

41.48万 热度

5514 热度

25.15万 热度

791 热度

6771 热度

15.45万 热度

345.57万 热度

16.18万 热度

608.2万 热度

6.26万 热度

39.69万 热度