# JapanBondMarketSellOff

621

BeautifulDay

#JapanBondMarketSellOff 📉

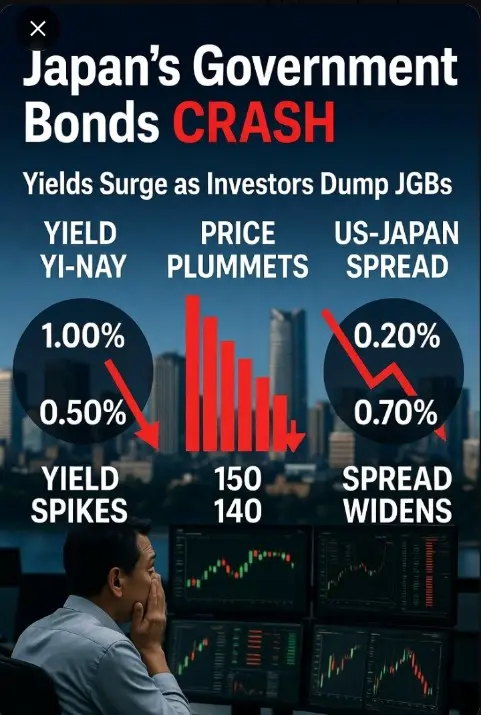

Japan’s bond market is under pressure as investors sell long-term government bonds, pushing yields to multi-decade highs. This comes amid fiscal uncertainty and political spending promises, raising concerns about Japan’s debt sustainability.

Key Points:

Long-term JGB yields spike as demand weakens.

Bank of Japan is scaling back yield control, leaving markets to price risk freely.

Global ripple: Rising Japanese yields are affecting US and European bond markets.

💡 Investor Tip: Watch for BOJ interventions and upcoming bond auctions — these could stabilize or further s

Japan’s bond market is under pressure as investors sell long-term government bonds, pushing yields to multi-decade highs. This comes amid fiscal uncertainty and political spending promises, raising concerns about Japan’s debt sustainability.

Key Points:

Long-term JGB yields spike as demand weakens.

Bank of Japan is scaling back yield control, leaving markets to price risk freely.

Global ripple: Rising Japanese yields are affecting US and European bond markets.

💡 Investor Tip: Watch for BOJ interventions and upcoming bond auctions — these could stabilize or further s

- Reward

- 5

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#JapanBondMarketSellOff: A Wake-Up Call for Global Financial Markets

The recent Japan bond market sell-off has captured the attention of investors worldwide, signaling a potential turning point in one of the most stable and carefully managed financial systems. For decades, Japan’s bond market—especially Japanese Government Bonds (JGBs)—has been considered a global safe haven, supported by ultra-loose monetary policy and strong institutional backing. However, the latest sell-off suggests that even the most predictable markets are no longer immune to global economic pressures.

At the heart of th

The recent Japan bond market sell-off has captured the attention of investors worldwide, signaling a potential turning point in one of the most stable and carefully managed financial systems. For decades, Japan’s bond market—especially Japanese Government Bonds (JGBs)—has been considered a global safe haven, supported by ultra-loose monetary policy and strong institutional backing. However, the latest sell-off suggests that even the most predictable markets are no longer immune to global economic pressures.

At the heart of th

- Reward

- 5

- 7

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#JapanBondMarketSellOff

If you think the Japan bond market sell-off is merely a local issue, you're oversimplifying. This is macro pressure cracking one of the last artificial pillars holding global liquidity. Japan’s bond market has long been manipulated through Yield Curve Control with cheap money, suppressed yields, and enforced stability. That era is visibly ending.

Let's clarify: a bond sell-off indicates a loss of confidence, not merely a rate adjustment. Currently, Japanese Government Bonds (JGBs) are being sold off, leading to falling prices and rising yields. This shift means investor

If you think the Japan bond market sell-off is merely a local issue, you're oversimplifying. This is macro pressure cracking one of the last artificial pillars holding global liquidity. Japan’s bond market has long been manipulated through Yield Curve Control with cheap money, suppressed yields, and enforced stability. That era is visibly ending.

Let's clarify: a bond sell-off indicates a loss of confidence, not merely a rate adjustment. Currently, Japanese Government Bonds (JGBs) are being sold off, leading to falling prices and rising yields. This shift means investor

BTC1,63%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🇯🇵📉 #JapanBondMarketSellOff | Market Alert 💹

Japan’s bond market is experiencing a significant sell-off, drawing attention from global investors and impacting broader financial markets. Rising yields and shifts in monetary policy expectations are fueling market volatility. ⚡

🔍 Key Points to Watch:

💵 Rising yields affecting bond prices and investor sentiment

🌐 Potential spillover into global equities and crypto markets

🏦 Market reaction influenced by Bank of Japan policy signals

💡 Traders and investors should stay informed and monitor developments using Gate.io’s real-time data and ana

Japan’s bond market is experiencing a significant sell-off, drawing attention from global investors and impacting broader financial markets. Rising yields and shifts in monetary policy expectations are fueling market volatility. ⚡

🔍 Key Points to Watch:

💵 Rising yields affecting bond prices and investor sentiment

🌐 Potential spillover into global equities and crypto markets

🏦 Market reaction influenced by Bank of Japan policy signals

💡 Traders and investors should stay informed and monitor developments using Gate.io’s real-time data and ana

- Reward

- 2

- Comment

- Repost

- Share

#JapanBondMarketSellOff

If you think the Japan bond market sell-off is merely a local issue, you're oversimplifying. This is macro pressure cracking one of the last artificial pillars holding global liquidity. Japan’s bond market has long been manipulated through Yield Curve Control with cheap money, suppressed yields, and enforced stability. That era is visibly ending.

Let's clarify: a bond sell-off indicates a loss of confidence, not merely a rate adjustment. Currently, Japanese Government Bonds (JGBs) are being sold off, leading to falling prices and rising yields. This shift means investor

If you think the Japan bond market sell-off is merely a local issue, you're oversimplifying. This is macro pressure cracking one of the last artificial pillars holding global liquidity. Japan’s bond market has long been manipulated through Yield Curve Control with cheap money, suppressed yields, and enforced stability. That era is visibly ending.

Let's clarify: a bond sell-off indicates a loss of confidence, not merely a rate adjustment. Currently, Japanese Government Bonds (JGBs) are being sold off, leading to falling prices and rising yields. This shift means investor

BTC1,63%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

39.14K Popularity

21.57K Popularity

9.07K Popularity

58.55K Popularity

343.75K Popularity

6.85K Popularity

7.04K Popularity

15.23K Popularity

108.96K Popularity

21.05K Popularity

198.82K Popularity

18.04K Popularity

6.83K Popularity

14.2K Popularity

152.99K Popularity

News

View MoreThe Senate Banking Committee shifts focus to housing issues; crypto market structure bill review postponed for several weeks

9 m

ETH falls below 3000 USDT

9 m

The Federal Reserve has a 95% probability of maintaining interest rates in January, with only a 5% chance of a rate cut.

1 h

Data: 1,705 BTC transferred from anonymous addresses, worth approximately $136 million

1 h

US stocks close with the three major indices up over 1%, Trump’s post boosts the market

2 h

Pin