IOTA’s Dom Schiener Reviews 2025 Progress on Rebased, ADAPT and On-Chain Use Cases

IOTA’s Dominik Schiener said that 2025 was a year of crypto exhaustion driven by excess leverage.

For 2026, they will work on making IOTA a digital public infrastructure for global trade, linking its token directly to network security, transaction validation, and real economic value.

In

IOTA0.72%

CryptoNewsFlash·13m ago

Don’t Sell Your Altcoins at This Stage of the Cycle, Warns Crypto Veteran

Crypto trader DonWedge warns against selling altcoins despite their current low performance. He believes a historical chart signals a potential upward breakout after a long downtrend, suggesting traders should practice patience rather than panic.

CaptainAltcoin·23m ago

Stellar (XLM) Testing Key Support — Could This Pattern Trigger an Rebound?

Date: Sun, Dec 21 2025 | 10:26 AM GMT

The broader cryptocurrency market has continued to struggle with uneven and choppy price action over the

CoinsProbe·23m ago

Small profit business? No, DeFi lending protocols are the underestimated "King of Value"

Original Title: Why the DeFi Lending Moat Is Bigger Than You Think

Original Author: Silvio, Cryptocurrency Researcher

Original Compilation: Dingdang, Odaily Planet Daily

As the market share of vaults and curators in the DeFi world continues to grow, the market begins to question: Are lending protocols gradually squeezing profit margins? Is lending no longer a good business?

But if we shift our perspective back to the entire on-chain credit value chain, the conclusion is quite the opposite. Lending protocols still hold the strongest moat in this value chain. We can quantify this with data.

In Aave and

PANews·26m ago

Matador Secures Regulatory Approval to Fund Major Bitcoin Expansion

Matador has taken a decisive step toward becoming a major corporate Bitcoin holder after receiving regulatory clearance in Canada. The Ontario Securities Commission approved the firm to raise up to $58 million through share sales. Matador plans to deploy this capital to expand its Bitcoin reserves a

BTC0.36%

Coinfomania·26m ago

Arbitrum (ARB) Flashes Potential Reversal Setup – Will It Rise Higher?

Date: Sat, Dec 20 2025 | 10:55 AM GMT

The broader cryptocurrency market has remained locked in choppy price action over the past several weeks, a

CoinsProbe·27m ago

Christmas market falls flat! Bitcoin spot ETF declines for the fifth consecutive day, with a net outflow of $175 million on Christmas Eve.

Bitcoin briefly returned above the 90,000 level at the beginning of the month but failed to continue its upward momentum. It is currently consolidating with slight fluctuations, showing a range-bound trend. The spot ETF market for Bitcoin is sending chills, experiencing net outflows for the fifth consecutive trading day, indicating that institutional investors are choosing to exit cautiously before the year-end holiday.

BlackRock IBIT had a single-day net outflow of 91.37 million USD.

According to data from SoSoValue, on December 24th (Eastern Time), the total net outflow from Bitcoin spot ETFs reached 175 million USD. This marks the fifth consecutive day of net outflows in this sector, with accumulated selling pressure casting a shadow over the year-end market sentiment.

Among issuers, BlackRock's IBIT had the highest single-day net outflow at 91.37 million USD, ranking first in outflows for the day; while Grayscale, which has been in a prolonged state of outflows

ChainNewsAbmedia·39m ago

The Danger of Random Crypto Drops: How Dusting Attacks Work and the Best Ways to Avoid Them

Nobody will be upset at receiving a random sum of crypto, but unfortunately, these sudden drops tend not to be goodwill gestures or surprise donations.

Instead, bits of ‘dust’ being transferred to a person’s wallet are often connected to one of crypto’s most common scams: the dusting attack

WORK-8.76%

DailyCoin·47m ago

NVIDIA's Largest Acquisition Ever: Invests 640 Billion to Acquire Groq Technology and the Father of Google TPU

NVIDIA acquires the core assets and technology licensing of AI inference chip startup Groq for approximately $20 billion, marking the largest deal in NVIDIA's history. Groq's founders and core team will join NVIDIA, but Groq will continue to operate independently. This transaction emphasizes technology licensing, aligns with antitrust regulatory trends, and will help NVIDIA compete in the AI inference field.

ChainNewsAbmedia·47m ago

Crypto Coach Says 2026 Will Be Epic for XRP, “Locked In”

Market commentator Coach JV has joined a growing list of analysts shifting their focus from XRP’s current struggles to 2026 as a potential turning point.

Indeed, XRP has failed to meet bullish expectations in 2025. However, several factors are now aligning to support the view that the next year

TheCryptoBasic·56m ago

Nga is ready to implement regulated cryptocurrency trading from 2026

Russia is getting closer to regulated cryptocurrency trading as the Moscow Exchange and the St. Petersburg Exchange confirm readiness to deploy crypto services after the legal framework is finalized by mid-2026. This move comes after the Bank of Russia announced its management roadmap in

TapChiBitcoin·57m ago

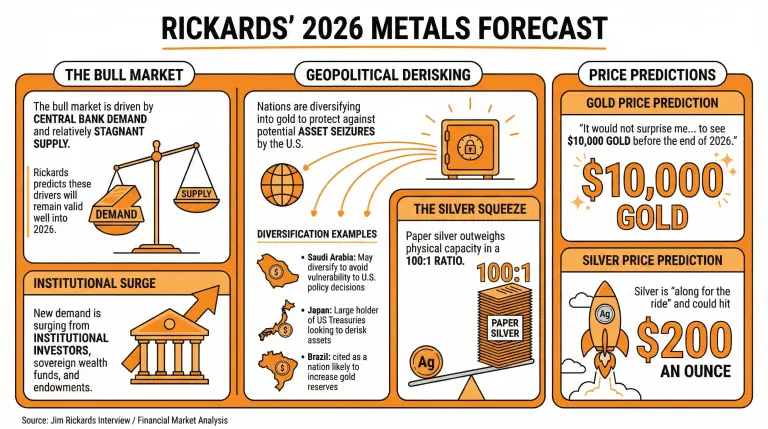

Jim Rickards' Explosive Predictions: Gold to $10,000, Silver to $200 in 2026

The legendary economist and best-selling author states that the elements driving up the whole metals market, with gold at its front, will continue next year. In a recent interview, Rickards explained that he would not be surprised if gold reaches prices of $10,000 and silver follows with $200 in 202

Coinpedia·57m ago

Is Pump.fun (PUMP) Poised for Further Downside? This Bearish Breakdown Suggests So!

Date: Tue, Dec 23, 2025 | 10:20 AM GMT

The broader cryptocurrency market continues to struggle with uneven and choppy price action, a phase that b

CoinsProbe·57m ago

Ho ho ho: Caroline Ellison set for Jan. 21, 2026 release after FTX cooperation deal

Caroline Ellison will exit federal custody on Jan. 21, 2026, after broad cooperation in the FTX case, a 10-year industry ban, and ongoing post-release supervision.

Summary

Bureau of Prisons data now lists Jan. 21, 2026 as Ellison's release date, about four weeks earlier than prior estimates and

Cryptonews·58m ago

Load More

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28