2025 AM Price Prediction: Navigating the Future of Automotive Markets in a Post-Pandemic World

Introduction: AM's Market Position and Investment Value

Aston Martin Cognizant Fan Token (AM) has established itself as a unique utility token in the sports fan engagement sector since its inception. As of 2025, AM's market capitalization stands at $386,458.0398, with a circulating supply of approximately 2,774,286 tokens and a price hovering around $0.1393. This asset, often referred to as a "fan engagement token," is playing an increasingly crucial role in connecting sports teams with their supporters.

This article will comprehensively analyze AM's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. AM Price History Review and Current Market Status

AM Historical Price Evolution Trajectory

- 2021: Initial launch, price reached all-time high of $12.06 on July 6

- 2022-2024: Gradual decline amid broader crypto market downturn

- 2025: Continued bearish trend, price hit all-time low of $0.00017613 on April 14

AM Current Market Situation

As of October 31, 2025, AM is trading at $0.1393, down 4.19% in the past 24 hours. The token has experienced significant losses over various time frames, with a 7-day decline of 7.93%, a 30-day drop of 26.44%, and a staggering 67.83% decrease over the past year.

AM's current market cap stands at $386,458, ranking it 3,667th among all cryptocurrencies. The token's circulating supply is 2,774,286 AM, representing 27.74% of its total supply of 10,000,000 tokens. The fully diluted market cap is $1,393,000.

Trading volume in the last 24 hours reached $17,047, indicating modest market activity. The token is currently trading 98.85% below its all-time high and 79,088% above its all-time low, suggesting a potential for recovery but also highlighting the extreme volatility in its price history.

Click to view current AM market price

AM Market Sentiment Indicator

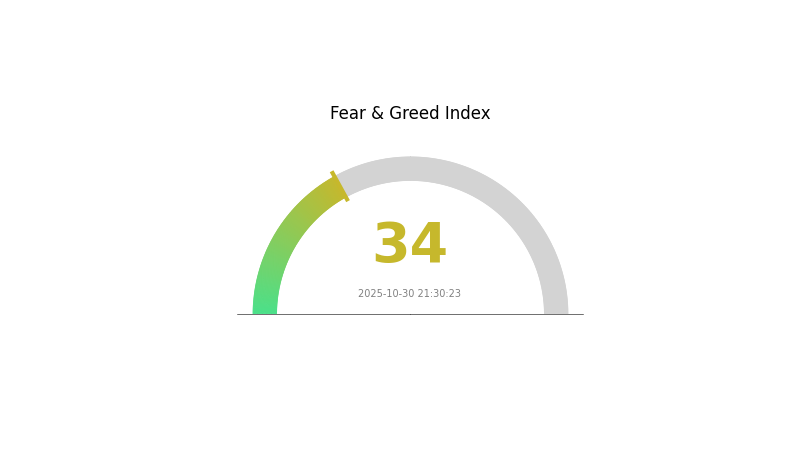

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 34, indicating a state of fear. This suggests investors are currently risk-averse and hesitant to make bold moves. Such periods of fear can present potential buying opportunities for contrarian investors, as assets may be undervalued. However, it's crucial to conduct thorough research and risk assessment before making any investment decisions in this volatile market environment.

AM Holdings Distribution

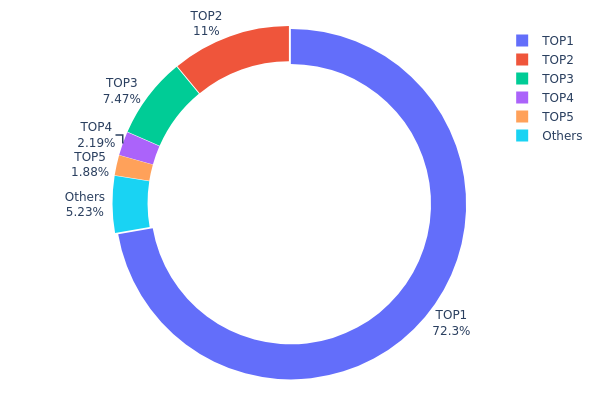

The address holdings distribution data provides crucial insights into the concentration of AM tokens among various wallet addresses. Analysis of this data reveals a highly centralized distribution pattern, with the top address holding a significant 72.26% of the total supply. This extreme concentration is further emphasized by the fact that the top 5 addresses collectively control 94.78% of AM tokens.

Such a concentrated distribution raises concerns about market manipulation and price volatility. The dominant holder, with over 70% of the supply, has the potential to significantly influence market dynamics. This level of centralization may lead to increased price volatility and susceptibility to large sell-offs or accumulation events, potentially impacting smaller investors disproportionately.

From a market structure perspective, this distribution pattern suggests a low degree of decentralization for AM. The high concentration in a few addresses indicates limited token dispersion among a broader user base, which may affect the token's resilience and overall ecosystem stability. This concentration could also impact governance decisions if AM utilizes a token-based voting system.

Click to view the current AM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 7225.71K | 72.26% |

| 2 | 0xc80A...e92416 | 1097.59K | 10.98% |

| 3 | 0xc368...816880 | 746.79K | 7.47% |

| 4 | 0x0D07...b492Fe | 218.82K | 2.19% |

| 5 | 0xE51a...E99F77 | 188.26K | 1.88% |

| - | Others | 522.82K | 5.22% |

II. Key Factors Influencing AM's Future Price

Supply Mechanism

- Token Distribution: The total supply of AM is 1 trillion tokens

- Market Impact: Gate.com's public sale of 150 billion AM tokens directly affects market supply

- Platform Adoption: Continuous expansion of the user base and application scenarios on the AM platform

- Ecosystem Growth: Ongoing expansion of Meme tokens and related applications within the AM ecosystem

Macroeconomic Environment

- Monetary Policy Impact: Major central banks' policy expectations

- Inflation Hedging Properties: Performance in inflationary environments

- Geopolitical Factors: Impact of international situations

Technological Development and Ecosystem Building

- AI Integration: Potential integration of artificial intelligence technologies

- Ecosystem Applications: Key DApps and ecosystem projects

III. AM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.13243 - $0.14

- Neutral prediction: $0.14 - $0.16

- Optimistic prediction: $0.16 - $0.19377 (requires strong market recovery and increased adoption)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.11661 - $0.24821

- 2027: $0.13066 - $0.30902

- Key catalysts: Expanding use cases, technological advancements, and broader market trends

2030 Long-term Outlook

- Base scenario: $0.32018 - $0.39702 (assuming steady growth and adoption)

- Optimistic scenario: $0.39702 - $0.45657 (with accelerated market penetration)

- Transformative scenario: Above $0.47386 (with groundbreaking developments and mass adoption)

- 2030-12-31: AM $0.39702 (potential average price based on projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.19377 | 0.1394 | 0.13243 | 0 |

| 2026 | 0.24821 | 0.16658 | 0.11661 | 19 |

| 2027 | 0.30902 | 0.2074 | 0.13066 | 48 |

| 2028 | 0.38215 | 0.25821 | 0.23239 | 85 |

| 2029 | 0.47386 | 0.32018 | 0.25614 | 129 |

| 2030 | 0.45657 | 0.39702 | 0.22233 | 185 |

IV. AM Professional Investment Strategies and Risk Management

AM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Aston Martin fans and long-term sports token investors

- Operation suggestions:

- Accumulate AM tokens during market dips

- Hold through market volatility, focusing on long-term fan engagement value

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Aston Martin F1 team performance and announcements

- Watch for significant fan token utility updates or partnerships

AM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of sports token allocation

(2) Risk Hedging Solutions

- Diversification: Balance AM with other fan tokens and broader crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. AM Potential Risks and Challenges

AM Market Risks

- High volatility: Fan token prices can fluctuate dramatically

- Limited liquidity: Potential challenges in executing large trades

- Dependency on team performance: Token value tied to Aston Martin's F1 results

AM Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter fan token regulations

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of fan tokens

AM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Blockchain network congestion: Transaction delays during high-activity periods

- Wallet security: Risk of hacks or user errors leading to token loss

VI. Conclusion and Action Recommendations

AM Investment Value Assessment

AM offers unique exposure to the Aston Martin F1 fan ecosystem but carries significant volatility and speculative risks. Long-term value depends on continued fan engagement and team performance.

AM Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about fan token utility

✅ Experienced investors: Consider AM as part of a diversified sports token portfolio

✅ Institutional investors: Evaluate AM for thematic sports/entertainment allocations

AM Trading Participation Methods

- Spot trading: Direct purchase and sale of AM tokens on Gate.com

- Staking: Participate in potential staking programs if offered by Socios.com

- Fan engagement: Utilize AM tokens for voting and exclusive experiences

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is AMP crypto prediction for 2025?

AMP crypto is predicted to reach $0.0025 to $0.0033 in 2025, showing potential growth after a period of market consolidation.

What is the target price for AM?

The target price for AM is $18.36, with a maximum estimate of $20.00 and a minimum of $16.00 as of 2025-10-30.

Will AMC ever go back up in 2025?

Yes, AMC could potentially go back up in 2025. If the company successfully services its debt and market conditions improve, a significant price increase is possible.

Will AMD reach $1000?

Based on current projections and continued growth trends, AMD could potentially reach $1000 per share by 2030. Long-term prospects look promising if the company maintains its trajectory.

Share

Content