2025 BACON Price Prediction: Will This Meme Coin Sizzle or Fizzle in the Crypto Market?

Introduction: BACON's Market Position and Investment Value

BaconDAO (BACON), as a DAO organization for collaborative learning and investment in cryptocurrency, has been making strides since its inception. As of 2025, BACON's market capitalization has reached $3,775.77, with a circulating supply of approximately 16,633,333 tokens, and a price hovering around $0.000227. This asset, known as a "community-driven knowledge hub," is playing an increasingly crucial role in the field of crypto education and investment.

This article will comprehensively analyze BACON's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. BACON Price History Review and Current Market Status

BACON Historical Price Evolution Trajectory

- 2021: Initial launch, price peaked at $0.489454 on August 31

- 2023: Market downturn, price hit an all-time low of $0.00013103 on October 30

- 2025: Gradual recovery, price fluctuating around $0.000227

BACON Current Market Situation

As of November 4, 2025, BACON is trading at $0.000227, with a 24-hour trading volume of $9,902.16. The token has experienced a significant decline of 11.94% in the past 24 hours. BACON's market capitalization currently stands at $3,775.77, ranking it at 7833 in the global cryptocurrency market. The circulating supply is 16,633,333 BACON tokens, representing 8.32% of the total supply of 200,000,000 tokens. Despite the recent price drop, BACON has shown a positive 1-hour change of 2.27%, indicating some short-term buying interest. However, the token is down 11.81% over the past week, suggesting an overall bearish trend in the short to medium term.

Click to view the current BACON market price

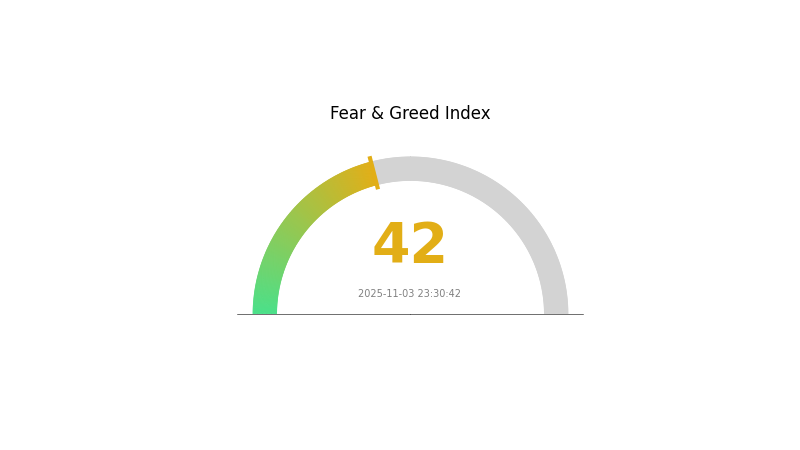

BACON Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 42, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can signal a good time to invest, it's crucial to conduct thorough research and manage risks. Keep an eye on market trends and fundamental factors that could influence crypto prices. As always, diversification and a long-term perspective are key strategies in navigating volatile markets.

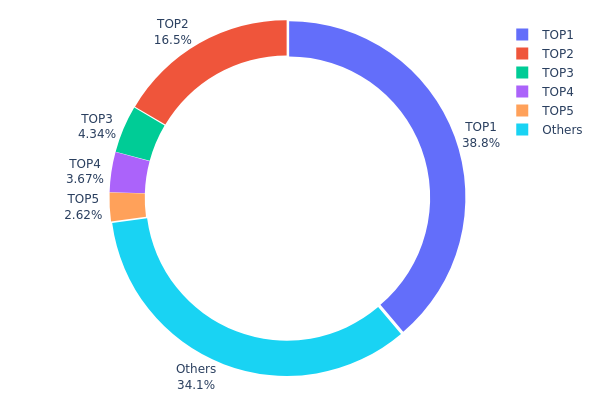

BACON Holdings Distribution

The address holdings distribution data for BACON reveals a highly concentrated ownership structure. The top address holds a significant 38.79% of the total supply, while the top 5 addresses collectively control 65.87% of BACON tokens. This level of concentration indicates a potentially centralized distribution of power within the BACON ecosystem.

Such a concentrated distribution raises concerns about market stability and vulnerability to price manipulation. With a single address controlling over one-third of the supply, there is a risk of significant market impact should this holder decide to sell or move their tokens. Additionally, the top 5 addresses having the ability to influence nearly two-thirds of the supply could lead to coordinated actions affecting price dynamics and overall market sentiment.

This concentration also suggests that BACON's on-chain structure may be less decentralized than ideal for a robust cryptocurrency ecosystem. While the remaining 34.13% is distributed among other holders, the dominance of a few large addresses could potentially undermine the project's resilience and decision-making processes, especially if BACON employs any form of on-chain governance.

Click to view the current BACON Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x533e...ff9648 | 77581.57K | 38.79% |

| 2 | 0x0d07...b492fe | 32975.10K | 16.48% |

| 3 | 0x1330...7a577b | 8677.26K | 4.33% |

| 4 | 0xa701...bd50db | 7339.49K | 3.66% |

| 5 | 0x039a...d9eb8d | 5238.70K | 2.61% |

| - | Others | 68187.88K | 34.13% |

II. Key Factors Affecting BACON's Future Price

Market Conditions and Investor Sentiment

- Market volatility: The value of BACON may fluctuate significantly due to various factors, including market conditions and investor sentiment.

- Current impact: Investors and traders closely monitor the value of cryptocurrency tokens to make informed decisions when buying, selling, or holding tokens.

Regulatory Developments

- Regulatory impact: Changes in regulations and policy developments can significantly influence the price of BACON and other cryptocurrencies.

- Current impact: Investors should stay informed about regulatory changes that may affect the cryptocurrency market.

Technological Advancements

- Technological progress: Technological advancements in the cryptocurrency space can impact BACON's value and adoption.

- Current impact: Ongoing technological improvements may influence investor confidence and the token's utility.

III. BACON Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00013 - $0.00020

- Neutral prediction: $0.00020 - $0.00025

- Optimistic prediction: $0.00025 - $0.00027 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00020 - $0.00033

- 2028: $0.00027 - $0.00044

- Key catalysts: Increased adoption, technological improvements, market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.00030 - $0.00040 (assuming steady market growth)

- Optimistic scenario: $0.00040 - $0.00050 (assuming strong market performance)

- Transformative scenario: $0.00050 - $0.00052 (assuming breakthrough innovations)

- 2030-12-31: BACON $0.00039 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00027 | 0.00023 | 0.00013 | 0 |

| 2026 | 0.00034 | 0.00025 | 0.00022 | 8 |

| 2027 | 0.00033 | 0.0003 | 0.0002 | 30 |

| 2028 | 0.00044 | 0.00031 | 0.00027 | 37 |

| 2029 | 0.00041 | 0.00038 | 0.0003 | 66 |

| 2030 | 0.00052 | 0.00039 | 0.00028 | 73 |

IV. BACON Professional Investment Strategies and Risk Management

BACON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking exposure to DAO and community-driven projects

- Operation suggestions:

- Accumulate BACON tokens during market dips

- Participate actively in the BaconDAO community to maximize value

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor BaconDAO community activities and product launches

- Set stop-loss orders to manage downside risk

BACON Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Use of stablecoins: Maintain a portion of portfolio in stablecoins for stability

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BACON

BACON Market Risks

- Volatility: High price fluctuations common in small-cap tokens

- Liquidity: Limited trading volume may lead to slippage

- Competition: Other DAO projects may impact BACON's market share

BACON Regulatory Risks

- DAO classification: Uncertain regulatory status of DAOs in various jurisdictions

- Token classification: Potential for BACON to be classified as a security

- Compliance requirements: Evolving regulations may impose new obligations

BACON Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits

- Scalability: Limitations of Ethereum network may impact growth

- Governance attacks: Risk of malicious actors manipulating DAO voting

VI. Conclusion and Action Recommendations

BACON Investment Value Assessment

BACON offers exposure to a community-driven DAO focused on crypto education and investment. While it presents potential for growth, it carries significant risks due to its small market cap and early-stage nature.

BACON Investment Recommendations

✅ Beginners: Limit exposure, focus on learning about DAOs and community governance ✅ Experienced investors: Consider small allocation as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence before considering investment

BACON Participation Methods

- Token purchase: Acquire BACON tokens on Gate.com

- Community engagement: Participate in BaconDAO governance and educational activities

- Staking: Explore any staking options offered by BaconDAO for potential rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is bacon going up in price?

Yes, bacon prices are trending upward. Increased production costs and supply chain issues are driving the price rise. Expect this trend to continue in the near future.

How much was a pound of bacon in 2025?

In September 2025, a pound of bacon cost $7.29, up 1.1% from $7.208 in August.

How much will $1 bitcoin be worth in 2025?

Based on expert predictions, $1 of Bitcoin in 2025 is expected to be worth approximately $145,167. This forecast suggests significant growth potential for Bitcoin in the coming years.

Why is bacon so expensive now?

Bacon prices are high due to increased production costs, rising wages, supply chain issues, and fluctuating demand in the pork industry.

Share

Content