2025 KIM Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: KIM's Market Position and Investment Value

KIM (KIM) as a leader in experimental DeFi with customizable hooks, has been creating a breeding ground for innovation and creativity since its inception. As of 2025, KIM's market capitalization has reached $23,549.45, with a circulating supply of approximately 74,500,000 tokens, and a price maintaining around $0.0003161. This asset, hailed as the "innovative DeFi platform," is playing an increasingly crucial role in the Web3 space.

This article will comprehensively analyze KIM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. KIM Price History Review and Current Market Status

KIM Historical Price Evolution Trajectory

- 2024: KIM reached its all-time high of $0.04209 on May 23, marking a significant milestone for the project.

- 2025: The market experienced a sharp downturn, with KIM hitting its all-time low of $0.000289 on April 8.

- 2025: As of November 3, KIM is trading at $0.0003161, showing a slight recovery from its all-time low.

KIM Current Market Situation

KIM is currently trading at $0.0003161, with a 24-hour trading volume of $9,866.88. The token has experienced a 4.99% decrease in the last 24 hours. Its market capitalization stands at $23,549.45, ranking it at 6605 in the global cryptocurrency market. The circulating supply is 74,500,000 KIM tokens, which represents 7.45% of the total supply of 1,000,000,000 tokens. The fully diluted valuation of KIM is $316,100.00.

Over the past year, KIM has seen a significant decline of 95.47% in its value. In the shorter term, it has dropped 29.07% in the last 30 days and 17.94% in the past week. The token's all-time high of $0.04209 was recorded on May 23, 2024, while its all-time low of $0.000289 occurred on April 8, 2025.

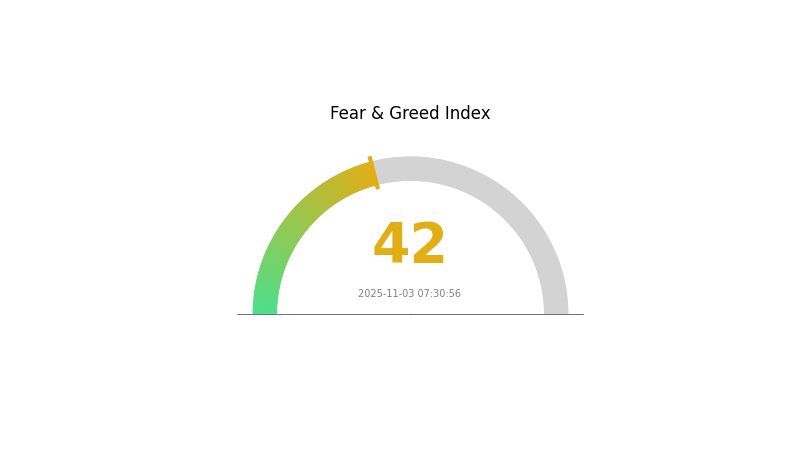

The current market sentiment for cryptocurrencies is characterized by fear, with the VIX index at 42. This indicates a high level of uncertainty and risk aversion among investors in the crypto market.

Click to view the current KIM market price

KIM Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers in the "Fear" zone at 42. This indicates investors' hesitancy and uncertainty about current market conditions. During such periods, seasoned traders often view it as a potential buying opportunity, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and risk assessment before making any investment decisions in this volatile market.

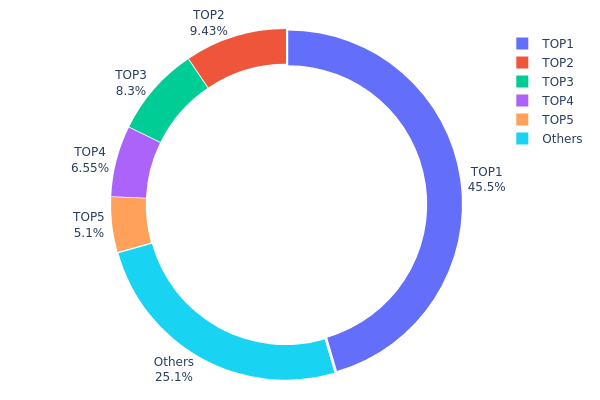

KIM Holdings Distribution

The address holdings distribution data for KIM reveals a highly concentrated ownership structure. The top address holds a substantial 45.47% of the total supply, indicating significant control by a single entity. The top 5 addresses collectively account for 74.84% of KIM tokens, with the remaining 25.16% distributed among other holders.

This concentration of holdings raises concerns about the token's decentralization and market stability. The dominant position of the top address could potentially influence market dynamics and price movements. Such a concentrated distribution may increase the risk of market manipulation and volatility, as large holders have the capacity to significantly impact supply and demand.

From a market structure perspective, this high concentration suggests a relatively low level of token dispersion among users. While this may provide some stability in the short term, it could pose challenges for long-term sustainability and adoption. Potential investors and users should be aware of this concentration when considering KIM's market dynamics and overall ecosystem health.

Click to view the current KIM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6800...591BdF | 327109.13K | 45.47% |

| 2 | 0x0D07...b492Fe | 67858.27K | 9.43% |

| 3 | 0x4D85...aE19BE | 59711.86K | 8.30% |

| 4 | 0x0000...00dEaD | 47130.26K | 6.55% |

| 5 | 0xFe71...A63A4c | 36666.67K | 5.09% |

| - | Others | 180909.99K | 25.16% |

II. Key Factors Affecting KIM's Future Price

Macroeconomic Environment

-

Impact of Monetary Policy: Major central banks' policy expectations will influence KIM's price. The Federal Reserve's interest rate decisions and forward guidance will be particularly important.

-

Inflation Hedging Properties: KIM's performance in an inflationary environment may affect its attractiveness as a potential hedge against inflation.

-

Geopolitical Factors: International tensions and global market trends could impact KIM's price as investors seek safe-haven assets during periods of uncertainty.

Technical Developments and Ecosystem Building

- Ecosystem Applications: The development and adoption of major DApps and ecosystem projects built on KIM's network could drive demand and affect its price.

III. KIM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00019 - $0.00025

- Neutral prediction: $0.00025 - $0.00032

- Optimistic prediction: $0.00032 - $0.00038 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00020 - $0.00041

- 2028: $0.00037 - $0.00057

- Key catalysts: Project milestones, market trends, and wider crypto adoption

2029-2030 Long-term Outlook

- Base scenario: $0.00049 - $0.00058 (assuming steady market growth)

- Optimistic scenario: $0.00058 - $0.00067 (with favorable market conditions)

- Transformative scenario: $0.00067 - $0.00070 (with exceptional project success and market boom)

- 2030-12-31: KIM $0.00070 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00038 | 0.00032 | 0.00019 | 0 |

| 2026 | 0.00042 | 0.00035 | 0.00019 | 10 |

| 2027 | 0.00041 | 0.00038 | 0.0002 | 20 |

| 2028 | 0.00057 | 0.0004 | 0.00037 | 25 |

| 2029 | 0.00067 | 0.00049 | 0.00033 | 53 |

| 2030 | 0.0007 | 0.00058 | 0.00054 | 82 |

IV. KIM Professional Investment Strategies and Risk Management

KIM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate KIM tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure cold storage

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend directions and potential reversal points

- RSI (Relative Strength Index): Determine overbought and oversold conditions

- Key points for swing trading:

- Monitor KIM's correlation with major cryptocurrencies

- Set strict stop-loss orders to manage downside risk

KIM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for KIM

KIM Market Risks

- High volatility: KIM's price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to slippage during large trades

- Market sentiment: Negative news in the DeFi sector could impact KIM's value

KIM Regulatory Risks

- Unclear regulations: Potential for stricter DeFi regulations in various jurisdictions

- Compliance challenges: KIM may face difficulties adapting to evolving regulatory requirements

- Legal uncertainties: Possible legal actions against DeFi projects could affect KIM

KIM Technical Risks

- Smart contract vulnerabilities: Potential for exploits in KIM's underlying code

- Network congestion: High gas fees on the MODE network could impact KIM transactions

- Scalability issues: KIM's growth may be limited by the underlying blockchain's capacity

VI. Conclusion and Action Recommendations

KIM Investment Value Assessment

KIM Exchange shows potential as an innovative DeFi platform with customizable hooks, but faces significant short-term risks due to market volatility and regulatory uncertainties. Long-term value depends on successful implementation and adoption of its unique features.

KIM Investment Recommendations

✅ Beginners: Allocate a small portion (1-2%) of crypto portfolio, focus on learning DeFi concepts ✅ Experienced investors: Consider a 5-10% allocation, actively monitor market trends and project developments ✅ Institutional investors: Conduct thorough due diligence, consider KIM as part of a diversified DeFi portfolio

KIM Trading Participation Methods

- Spot trading: Buy and sell KIM tokens on Gate.com

- Yield farming: Participate in liquidity provision on KIM Exchange (if available)

- Staking: Hold KIM tokens to earn rewards (if offered by the project)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Kim a good stock to buy?

Yes, Kim appears to be a good stock to buy. It has a 'Buy' analyst rating, a price target of $24.92, and offers a 4.67% dividend yield. With $2.09 billion in revenue, it shows strong fundamentals.

Is Kim a good investment?

Yes, Kim shows potential as a good investment in the Web3 space. Its innovative technology and growing adoption suggest promising future returns for investors.

What is the target price for Kimco?

The target price for Kimco is $30.00, with analysts projecting an average 12-month price target of $24.95. This suggests a potential upside of 16.59%.

How often does Kim pay dividends?

Kim pays dividends quarterly. The company maintains a consistent schedule, with the most recent dividend paid out in the last quarter.

Share

Content