2025 L1 Price Prediction: Ethereum's Dominance Challenged by Emerging Layer-1 Protocols

Introduction: L1's Market Position and Investment Value

Lamina1 (L1), as a creator-owned platform designed for IP incubation, distribution, and monetization, has been making waves since its inception. As of 2025, Lamina1's market capitalization has reached $14,862, with a circulating supply of approximately 2,400,584 tokens, and a price hovering around $0.006191. This asset, hailed as a "future-oriented IP ecosystem," is playing an increasingly crucial role in the realm of intellectual property and digital content creation.

This article will comprehensively analyze Lamina1's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. L1 Price History Review and Current Market Status

L1 Historical Price Evolution

- 2024: Initial launch, price peaked at $0.9 on November 14

- 2025: Significant market downturn, price dropped to an all-time low of $0.004306 on November 3

L1 Current Market Situation

As of November 3, 2025, L1 is trading at $0.006191, representing a substantial 99.01% decrease from its all-time high. The token has experienced significant volatility in recent periods, with a 24-hour decline of 18.17% and a 7-day drop of 21.91%. The market capitalization stands at $14,862.02, ranking 7012th in the cryptocurrency market. Trading volume in the past 24 hours reached $19,987.83, indicating moderate market activity. The current price is hovering close to its all-time low, suggesting a challenging market environment for L1.

Click to view the current L1 market price

L1 Market Sentiment Indicator

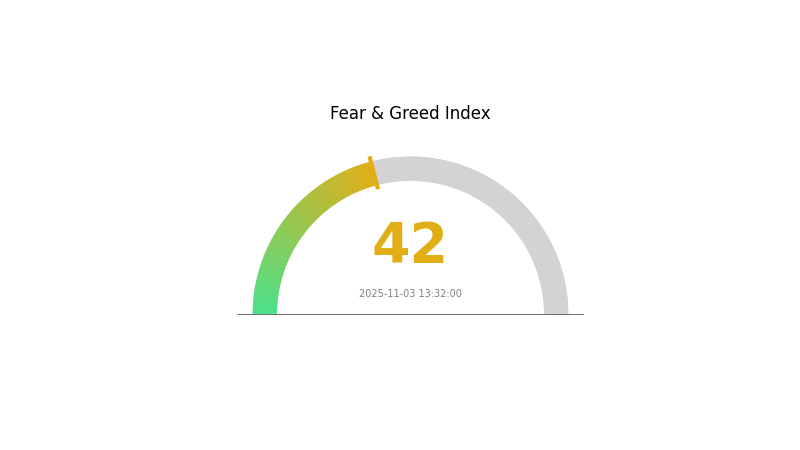

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 42, indicating a state of fear. This suggests investors are showing hesitancy and uncertainty. During such periods, some view it as an opportunity to accumulate, following the contrarian investing principle of "be greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and stay informed with reliable sources like Gate.com for comprehensive crypto insights.

L1 Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of L1 tokens among different addresses. Based on the provided data, we observe that the table is currently empty, indicating a lack of specific information about top addresses and their holdings.

This absence of data could suggest several possibilities. It might indicate a highly decentralized distribution where no single address holds a significant percentage of tokens, aligning with the principles of decentralization. Alternatively, it could point to limited publicly available information or ongoing data collection processes.

Without concrete data, it's challenging to assess the market structure, potential price volatility, or manipulation risks accurately. However, this situation underscores the importance of transparency in blockchain ecosystems and the need for comprehensive data collection and analysis to better understand the token distribution landscape.

Click to view the current L1 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting L1's Future Price

Supply Mechanism

- Inflation and Halving: L1 tokens often have predetermined emission schedules, with periodic reductions in new supply.

- Historical Patterns: Supply changes have historically impacted prices, with reduced inflation often correlating with price increases.

- Current Impact: The next supply reduction is expected to potentially drive up prices due to decreased selling pressure.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions are increasingly adding L1 tokens to their portfolios.

- Corporate Adoption: Companies like MicroStrategy have adopted L1 tokens as treasury assets.

- Government Policies: Some countries are exploring L1 adoption for various use cases, potentially affecting demand.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rates, influence capital flow into crypto assets.

- Inflation Hedge Properties: L1 tokens are increasingly viewed as potential hedges against inflation.

- Geopolitical Factors: Global tensions and economic uncertainties can drive demand for decentralized assets.

Technical Development and Ecosystem Growth

- Scalability Upgrades: Implementations like sharding and layer-2 solutions are enhancing network capacity.

- Interoperability Advancements: Cross-chain bridges and protocols are expanding the L1 ecosystem.

- Ecosystem Applications: DeFi, NFTs, and Web3 applications are driving adoption and utility of L1 platforms.

III. L1 Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00446 - $0.00619

- Neutral prediction: $0.00619 - $0.00730

- Optimistic prediction: $0.00730 - $0.00842 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00672 - $0.011

- 2028: $0.00562 - $0.01421

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.00775 - $0.01384 (assuming steady market growth)

- Optimistic scenario: $0.01384 - $0.01841 (assuming strong market performance)

- Transformative scenario: Above $0.01841 (extreme favorable conditions)

- 2030-12-31: L1 $0.01841 (potential peak for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00842 | 0.00619 | 0.00446 | 0 |

| 2026 | 0.01015 | 0.00731 | 0.00701 | 18 |

| 2027 | 0.011 | 0.00873 | 0.00672 | 41 |

| 2028 | 0.01421 | 0.00986 | 0.00562 | 59 |

| 2029 | 0.01565 | 0.01204 | 0.00879 | 94 |

| 2030 | 0.01841 | 0.01384 | 0.00775 | 123 |

IV. Professional Investment Strategies and Risk Management for L1

L1 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with high risk tolerance

- Operational suggestions:

- Accumulate L1 tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend directions and potential reversals

- RSI (Relative Strength Index): Spot overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Use stop-loss orders to limit downside risk

L1 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, and regularly update software

V. Potential Risks and Challenges for L1

L1 Market Risks

- High volatility: Significant price fluctuations are common

- Limited liquidity: May face challenges in executing large trades

- Competition: Other layer-1 platforms may outperform L1

L1 Regulatory Risks

- Uncertain regulations: Potential for unfavorable regulatory changes

- Cross-border compliance: Varying legal status across jurisdictions

- Tax implications: Evolving tax laws may impact profitability

L1 Technical Risks

- Network security: Potential vulnerabilities in blockchain infrastructure

- Scalability issues: May face challenges in handling increased transaction volume

- Smart contract bugs: Possibility of exploits in platform's smart contracts

VI. Conclusion and Action Recommendations

L1 Investment Value Assessment

L1 presents a high-risk, high-potential opportunity in the creator economy blockchain space. While it offers innovative features for IP monetization, its current market position and price volatility warrant caution.

L1 Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging with strict risk management

✅ Institutional investors: Conduct comprehensive due diligence and consider as part of a diversified crypto portfolio

L1 Trading Participation Methods

- Spot trading: Direct purchase and sale of L1 tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance opportunities involving L1 tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will 1inch reach $10?

1inch is unlikely to reach $10 soon. It would require a 6,000%+ gain, which is improbable given current market trends and historical performance.

Does 1inch crypto have a future?

Yes, 1inch crypto has a promising future. Its cross-chain integration, especially with Solana, and expanding market share in DeFi are key drivers. The Fusion+ API enhancements and focus on bridgeless, MEV-protected swaps position it well for growth in the evolving crypto landscape.

How much will 1 Litecoin be worth in 2025?

Based on current projections, 1 Litecoin is expected to be worth approximately $509.18 in 2025, assuming continued market growth and adoption.

What is the price target for Li Auto in 2025?

The price target for Li Auto in 2025 is $41.03, with a range from $29.58 to $52.47, based on analyst forecasts.

Share

Content