2025 LIQ Fiyat Tahmini: Likidite Protokol Tokenlerinin Geleceğini Belirleyen Yükseliş Trendleri ve Temel Etkenler

Giriş: LIQ'un Piyasadaki Konumu ve Yatırım Değeri

LIQ Protocol (LIQ), merkeziyetsiz zincir üstü bir tasfiye motoru olarak, kuruluşundan beri Solana ağında Serum piyasası ve borç verme platformlarına güç sağlamaktadır. 2025 itibarıyla LIQ’un piyasa değeri 17.775 ABD Dolarına ulaşmış, yaklaşık 30.000.000 token dolaşımdadır ve fiyatı 0,0005925 ABD Doları civarında seyretmektedir. “Solana'nın tasfiye protokolü” olarak bilinen bu varlık, Solana blokzincirinde merkeziyetsiz finans (DeFi) alanında giderek daha belirleyici bir rol üstlenmektedir.

Bu makalede, LIQ’un 2025-2030 yılları arasındaki fiyat eğilimleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. LIQ Fiyat Geçmişi ve Güncel Piyasa Durumu

LIQ Tarihsel Fiyat Gelişimi

- 2021: LIQ, 9 Eylül’de 4,38 ABD Doları ile tüm zamanların en yüksek seviyesine ulaşarak önemli bir eşik atladı.

- 2025: Token, 30 Temmuz’da 0,00052968 ABD Doları ile tarihinin en düşük seviyesini görerek ciddi bir piyasa gerilemesi yaşadı.

LIQ Güncel Piyasa Durumu

3 Kasım 2025 itibarıyla LIQ, 0,0005925 ABD Doları seviyesinden işlem görüyor ve son 24 saatte %2,31’lik bir değer kaybı yaşadı. Token’ın piyasa değeri 17.775 ABD Doları; toplam arzı 100.000.000, dolaşımdaki miktarı ise 30.000.000 LIQ’dur. LIQ, 7 günde %8,57, 30 günde %25,3 ve yıllık bazda %50,32 oranında ciddi değer kaybı yaşadı. Güncel fiyat, zirve değerinden %99,98 düşük olup, token’ın mevcut piyasa koşullarında zorlandığını gösteriyor. Son 24 saatteki işlem hacmi ise 10.121,67 ABD Doları ile orta seviye bir piyasa hareketliliğine işaret ediyor.

Güncel LIQ piyasa fiyatını görmek için tıklayın

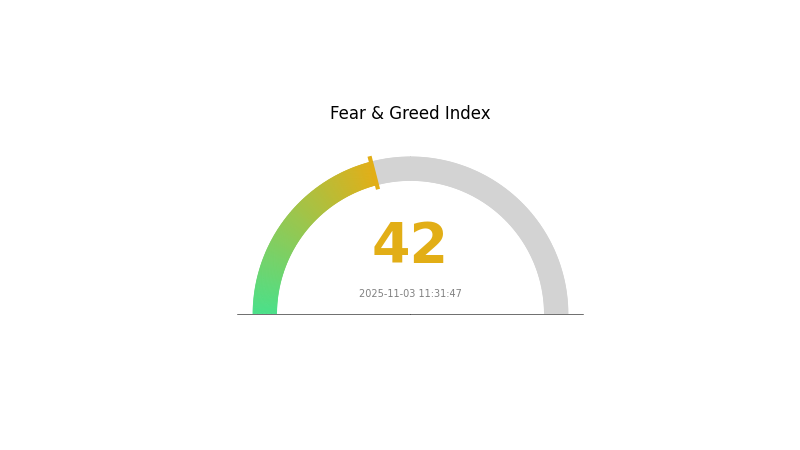

LIQ Piyasa Duyarlılığı Göstergesi

2025-11-03 Korku ve Açgözlülük Endeksi: 42 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu anda korku hakim ve Korku & Açgözlülük Endeksi 42 seviyesinde. Bu, yatırımcıların son dönemdeki dalgalanmalar veya olumsuz haberler nedeniyle temkinli davrandığını gösteriyor. Ancak, karşıt bakış açısındaki yatırımcılar için bu tür korku dönemleri potansiyel alım fırsatları yaratabilir. Her yatırım kararında detaylı araştırma yapmalı ve risk toleransınızı gözetmelisiniz. Piyasa duyarlılığı hızla değişebileceğinden, güncel kalın ve stratejinizi buna göre ayarlayın.

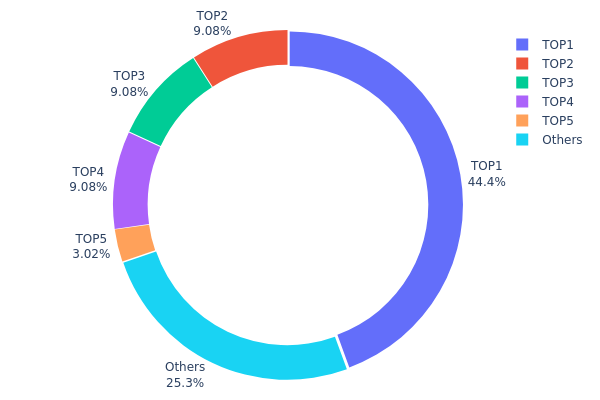

LIQ Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, LIQ tokenlerinde belirgin bir yoğunlaşma olduğunu gösteriyor. En büyük adres toplam arzın %44,41’ini elinde bulundururken, bu durum yüksek seviyede merkezileşmeye işaret ediyor. Sonraki üç adresin her biri %9,07’lik paya sahip ve birlikte arzın %27,21’ini oluşturuyor. Bu yoğunlaşma, token’ın merkeziyetsizliği ve piyasa istikrarı açısından endişe doğurmaktadır.

Böyle bir dağılım, fiyat oynaklığının artmasına ve piyasa manipülasyonuna karşı hassasiyeti artırabilir. En büyük sahibi, token arzı üzerinde ciddi bir etkiye sahip olduğu için piyasa dinamiklerini önemli ölçüde etkileyebilir. Bu tablo, LIQ’un zincir üstü yapısının merkeziyetsiz bir ekosistem için idealden uzak olduğunu gösteriyor.

Kısacası, mevcut LIQ varlık dağılımı oldukça merkezileşmiş bir piyasa yapısına işaret etmekte ve fiyat istikrarı ile merkeziyetsizleşme çabalarına yönelik riskler barındırmaktadır. Bu yoğunlaşma, adil piyasa uygulamalarına önem veren yatırımcıları caydırabilir ve projenin uzun vadeli gelişimi ile benimsenmesi önünde engeller oluşturabilir.

Güncel LIQ Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 44.396,73K | 44,41% |

| 2 | 5Q544f...pge4j1 | 9.073,87K | 9,07% |

| 3 | 5Q544f...pge4j1 | 9.073,87K | 9,07% |

| 4 | 5Q544f...pge4j1 | 9.073,87K | 9,07% |

| 5 | E7ywD9...bKWeoD | 3.015,88K | 3,01% |

| - | Others | 25.335,04K | 25,37% |

II. LIQ’un Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Likitide: İşlem hacmi ve stok devir oranı, LIQ fiyatında büyük dalgalanmalara yol açabilir.

- Tarihsel Desen: Geçmiş arz değişimleriyle fiyat dalgalanmaları arasında güçlü bir ilişki gözlenmiştir.

- Mevcut Etki: Şu anki arz dinamiklerinin fiyat hareketleri üzerinde etkili olması bekleniyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Büyük hissedarların sahiplik oranları, LIQ fiyat istikrarında belirleyici olabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Başlıca merkez bankalarının politika değişiklikleri, LIQ’un değerini etkileyebilir.

- Enflasyondan Korunma Özelliği: Enflasyonist dönemlerde LIQ’un performansı fiyat üzerinde belirleyici olabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Kurumsal Yönetim: Yönetim kurulunun yapısı ve liderlik, LIQ’un uzun vadeli değerini etkiler.

III. 2025-2030 Dönemi LIQ Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,00044 - 0,00059 ABD Doları

- Tarafsız tahmin: 0,00059 - 0,00068 ABD Doları

- İyimser tahmin: 0,00068 - 0,00076 ABD Doları (olumlu piyasa ortamı ve proje gelişmeleriyle)

2027-2028 Görünümü

- Piyasa beklentisi: Artan benimsenmeyle birlikte potansiyel bir büyüme evresi

- Fiyat tahmin aralığı:

- 2027: 0,00059 - 0,00098 ABD Doları

- 2028: 0,00074 - 0,00119 ABD Doları

- Ana katalizörler: Proje kilometre taşları, piyasa döngüleri ve genel kripto adaptasyonu

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00104 - 0,00122 ABD Doları (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,00122 - 0,00140 ABD Doları (güçlü proje ve piyasa koşullarında)

- Dönüştürücü senaryo: 0,00140 - 0,00166 ABD Doları (büyük atılımlar ve yaygın benimsemeyle)

- 2030-12-31: LIQ 0,00166 ABD Doları (iyimser projeksiyona göre olası zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00076 | 0,00059 | 0,00044 | 0 |

| 2026 | 0,00091 | 0,00068 | 0,00052 | 14 |

| 2027 | 0,00098 | 0,00079 | 0,00059 | 33 |

| 2028 | 0,00119 | 0,00089 | 0,00074 | 49 |

| 2029 | 0,0014 | 0,00104 | 0,00062 | 74 |

| 2030 | 0,00166 | 0,00122 | 0,0008 | 105 |

IV. LIQ için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

LIQ Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- Operasyonel öneriler:

- Piyasa düşüşlerinde LIQ biriktirin

- Kısmi kâr alımı için fiyat hedefleri belirleyin

- LIQ’ları güvenli, saklayıcı olmayan bir cüzdanda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve dönüş sinyallerini yakalamak için kullanılır

- RSI: Aşırı alım/aşırı satım koşullarını tespit etmek için kullanılır

- Dalgalı al-sat için önemli noktalar:

- Solana ekosistem gelişmelerini yakından izleyin

- Aşağı yönlü riski sınırlamak için sıkı stop-loss emirleri kullanın

LIQ Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10’u

- Profesyonel yatırımcılar: Maksimum %15’i

(2) Riskten Korunma Stratejileri

- Diversifikasyon: Yatırımı Solana ekosistemindeki farklı projelere dağıtın

- Opsiyon stratejileri: Düşüşlere karşı koruyucu putlardan yararlanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik tedbirleri: İki faktörlü doğrulama ve güçlü şifreler kullanın

V. LIQ için Potansiyel Riskler ve Zorluklar

LIQ Piyasa Riskleri

- Yüksek oynaklık: LIQ fiyatında ciddi dalgalanmalar olabilir

- Düşük likidite: Sınırlı işlem hacmi kaymalara yol açabilir

- Korelasyon riski: Solana'nın performansına yüksek bağımlılık

LIQ Düzenleyici Riskleri

- Belli olmayan düzenleyici ortam: DeFi projelerine yönelik artan inceleme ihtimali

- Uyum zorlukları: Gelişen düzenlemeler LIQ’un operasyonlarını etkileyebilir

- Sınır ötesi kısıtlamalar: Uluslararası farklı regülasyonlar benimsemeyi sınırlayabilir

LIQ Teknik Riskleri

- Akıllı sözleşme açıkları: Protokolde istismar veya hata riski

- Ölçeklenebilirlik sorunları: Solana ağına bağımlılık

- Birlikte çalışabilirlik zorlukları: Kısıtlı zincirler arası işlevsellik

VI. Sonuç ve Eylem Önerileri

LIQ Yatırım Değeri Değerlendirmesi

LIQ, Solana DeFi ekosisteminde yüksek riskli, yüksek potansiyelli bir fırsat sunar. Yenilikçi tasfiye çözümleriyle öne çıksa da, piyasada, regülasyonlarda ve teknolojide önemli zorluklarla karşı karşıya.

LIQ Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kapsamlı araştırma sonrası küçük, keşif amaçlı pozisyonlar açabilirsiniz ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı durum tespiti yapın, çeşitlendirilmiş bir DeFi portföyünde değerlendirin

LIQ Alım Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden işlem yapılabilir

- DeFi likidite sağlama: LIQ Protocol’ün likidite havuzlarına katılım

- Yield farming: Solana ekosisteminde stake fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan görüş almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

XRP 100 ABD Dolarına ulaşabilir mi?

XRP, finansal yeniden yapılandırma, ETF onayları ve kurumsal talep sayesinde 2025 sonuna doğru 100 ABD Dolarına ulaşabilir. Ancak bu tahmin, gerektirdiği büyük piyasa değeri artışı nedeniyle oldukça spekülatiftir.

Liquity coin için tahmin nedir?

Liquity coin’in 2026 yılı için tahmini 1,25 ABD Doları olup, %5’lik potansiyel fiyat artışı öngörülmektedir. Bu tahmin mevcut piyasa eğilimlerine ve analizlere dayanmaktadır.

2025’te bir XRP’nin değeri ne olacak?

Mevcut piyasa tahminlerine göre, Kasım 2025’te bir XRP’nin 2,90 ila 3,20 ABD Doları arasında olması beklenmektedir.

PancakeSwap (CAKE) ne kadar yükselebilir?

PancakeSwap (CAKE), piyasa analizlerine göre 2025 sonuna kadar en fazla 4,1 ABD Dolarına ulaşabilir.

2025 yılında SOL’un rakiplerinden hangi ana özelliklerle ayrıştığı nedir?

ML vs SOL: Veri Analizinde Makine Öğrenimi ile İstatistiksel Öğrenmenin Karşılaştırılması

Meteora (MET) teknik dokümanı, protokolün temel işleyiş mantığı ve kullanım alanlarıyla ilgili hangi bilgileri sunuyor?

2030 yılına kadar Jupiter (JUP) kripto piyasasında nasıl bir evrim geçirecek?

2025 FRAG Fiyat Tahmini: Kripto para birimi için piyasa trendleri ve olası büyüme faktörlerinin kapsamlı analizi

PLSPAD ve SOL: Merkeziyetsiz Finans alanında Blockchain platformlarının rekabeti

Soğuk cüzdan işlemlerinde işlem ücreti ödenmesi gerekiyor mu? Ayrıntılı inceleme

Sadece 1 $ ile Mikro İşlemeye Başlamak: Yeni Başlayanlar İçin Kılavuz

BNB Smart Chain’in özellikleri ve avantajlarını incelemek

ADP nedir: Otomatik Veri İşleme Sistemleri için Kapsamlı Bir Rehber

READY Hakkında: Mükemmellik ve Gelişim için Çerçeveyi Anlamaya Yönelik Kapsamlı Bir Rehber