2025 SMX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: SMX's Market Position and Investment Value

Snapmuse.io (SMX) has established itself as a pioneering network financing platform for the entertainment industry since its inception. As of 2025, SMX's market capitalization has reached $13,122.35, with a circulating supply of approximately 9,500,000 tokens, and a price hovering around $0.0013813. This asset, dubbed the "Creator's Crowdfunding Token," is playing an increasingly crucial role in the realm of social media, influencer marketing, gaming, and AI projects.

This article will provide a comprehensive analysis of SMX's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SMX Price History Review and Current Market Status

SMX Historical Price Evolution Trajectory

- 2024: SMX reached its all-time high of $0.08918 on April 19, 2024

- 2025: SMX hit its all-time low of $0.00066 on April 13, 2025, marking a significant price drop

SMX Current Market Situation

As of November 3, 2025, SMX is trading at $0.0013813, with a 24-hour trading volume of $53,856.94. The token has experienced a slight decline of 0.46% in the past 24 hours. SMX's market capitalization stands at $13,122.35, ranking it at 7124 in the overall cryptocurrency market.

The circulating supply of SMX is 9,500,000 tokens, which represents only 1.9% of the total supply of 500,000,000 SMX. The fully diluted market capitalization is $690,650.00.

In terms of recent price trends, SMX has shown mixed performance across different timeframes:

- 1 hour: -0.21%

- 24 hours: -0.46%

- 7 days: +33.73%

- 30 days: -11.04%

- 1 year: -70.17%

The significant 33.73% increase over the past week indicates a short-term bullish momentum, despite the overall bearish trend observed in the longer timeframes.

Click to view the current SMX market price

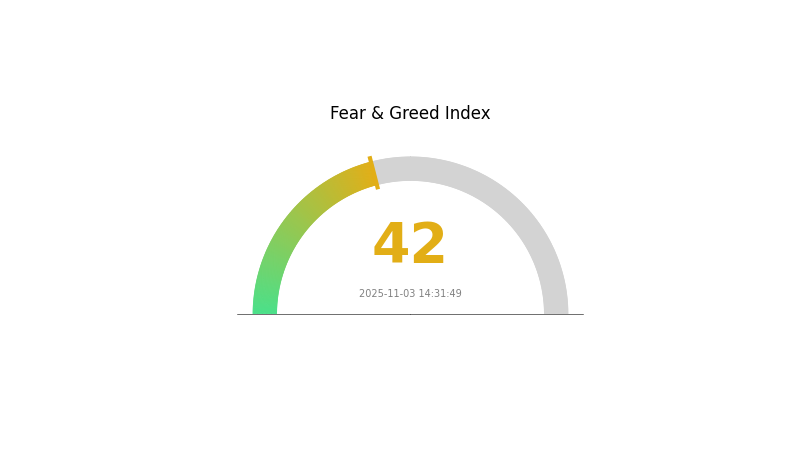

SMX Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 42, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. While fear may present potential entry points for long-term investors, it's essential to conduct thorough research and manage risks carefully. As always, diversification and a well-thought-out investment strategy are key in navigating volatile crypto markets.

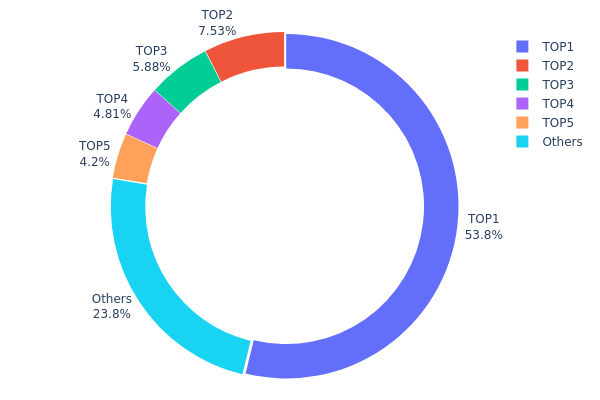

SMX Holdings Distribution

The address holdings distribution data for SMX reveals a highly concentrated ownership structure. The top address holds a significant 53.78% of the total supply, accounting for 268,942.37K tokens. This level of concentration is notable and could potentially impact market dynamics. The subsequent four largest holders possess 7.52%, 5.88%, 4.81%, and 4.20% respectively, collectively controlling an additional 22.41% of the supply.

Such a concentrated distribution raises concerns about market manipulation risks and potential price volatility. With over 76% of tokens held by just five addresses, the SMX market structure appears vulnerable to large-scale movements initiated by these major holders. This concentration could lead to increased price fluctuations if any of these addresses were to liquidate substantial portions of their holdings.

From a broader perspective, this distribution pattern suggests a relatively low level of decentralization for SMX. The dominance of a few large holders may impact the token's overall stability and could be seen as a potential risk factor for smaller investors. However, it's worth noting that 23.81% of the supply is distributed among other addresses, which may provide some balance to the ecosystem.

Click to view the current SMX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xabee...c09df2 | 268942.37K | 53.78% |

| 2 | 0x4982...6e89cb | 37631.75K | 7.52% |

| 3 | 0x5cb5...c86770 | 29400.00K | 5.88% |

| 4 | 0x0d07...b492fe | 24051.01K | 4.81% |

| 5 | 0xb9cb...9167bb | 21000.00K | 4.20% |

| - | Others | 118974.86K | 23.81% |

II. Key Factors Affecting SMX's Future Price

Institutional and Large Holder Dynamics

- Institutional Holdings: Short-term uncertainties exist in liquidity and customer structure, potentially impacting institutional interest in SMX.

- Corporate Adoption: SMX's innovative molecular marking technology is transforming compliance from a cost center to a value-creating asset, which may attract corporate interest.

- National Policies: Policy drivers are expected to support SMX's long-term prospects, potentially making it an important member of mid to long-term technology investment portfolios.

Macroeconomic Environment

- Monetary Policy Impact: Financial events and regulatory changes can significantly influence SMX's price volatility.

- Geopolitical Factors: International situations, such as trade war uncertainties, can affect SMX's market performance.

Technological Development and Ecosystem Building

- Molecular Marking Technology: SMX's patented system embeds traceable markers into materials like plastics, metals, and textiles, creating potential for value in various industries.

- Global Collaboration: SMX's future price is likely to be influenced by its global partnerships and collaborations.

- Patent Portfolio: The company's strong patent reserve is a key factor that may drive its long-term value and price performance.

III. SMX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00134 - $0.00138

- Neutral prediction: $0.00138 - $0.00148

- Optimistic prediction: $0.00148 - $0.00158 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00143 - $0.00201

- 2027: $0.00157 - $0.00180

- Key catalysts: Increased adoption and market expansion

2028-2030 Long-term Outlook

- Base scenario: $0.00177 - $0.00193 (assuming steady market growth)

- Optimistic scenario: $0.00203 - $0.00278 (assuming strong market performance)

- Transformative scenario: $0.00278+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: SMX $0.00278 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00158 | 0.00138 | 0.00134 | 0 |

| 2026 | 0.00201 | 0.00148 | 0.00143 | 7 |

| 2027 | 0.0018 | 0.00174 | 0.00157 | 26 |

| 2028 | 0.00191 | 0.00177 | 0.00108 | 28 |

| 2029 | 0.00203 | 0.00184 | 0.00177 | 33 |

| 2030 | 0.00278 | 0.00193 | 0.00178 | 39 |

IV. SMX Professional Investment Strategies and Risk Management

SMX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate SMX during market dips

- Set a target exit price and stick to it

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set stop-loss orders to limit potential losses

SMX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SMX

SMX Market Risks

- High volatility: SMX price may experience significant fluctuations

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

SMX Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting SMX

- Cross-border restrictions: Possible limitations on international trading

- Tax implications: Evolving tax laws may impact SMX investments

SMX Technical Risks

- Smart contract vulnerabilities: Potential for code exploits

- Network congestion: Possible delays in transaction processing

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

SMX Investment Value Assessment

SMX presents a unique opportunity in the entertainment and social media space, but carries significant short-term risks due to market volatility and regulatory uncertainties. Long-term potential depends on the platform's adoption and growth.

SMX Investment Recommendations

✅ Beginners: Consider small, experimental positions with strict risk management ✅ Experienced investors: Implement a dollar-cost averaging strategy with set profit targets ✅ Institutional investors: Conduct thorough due diligence and consider SMX as part of a diversified crypto portfolio

SMX Trading Participation Methods

- Spot trading: Buy and sell SMX on Gate.com

- Staking: Participate in staking programs if available

- NFT purchases: Engage with the Snapmuse.io platform by acquiring creator NFTs

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the SMX forecast for 2025?

Based on current market analysis, the SMX price is projected to reach between $2.86 and $3.07 by 2025.

What is going on with SMX stock?

SMX stock underwent a reverse split on October 23, 2025, reducing shares from 15.5 million to 1 million. This affects stock price and trading volume.

How volatile is SMX stock?

SMX stock shows significant volatility, with a current weekly volatility of about 32%. While this has decreased from 40% a year ago, it's still higher than most US stocks.

What will SMCI be worth in 2025?

SMCI is projected to reach $100 by 2025, with some forecasts suggesting it could even surpass this value.

Share

Content