2025 STZ Price Prediction: Will the Crypto Token Surge or Plummet in the Coming Years?

Introduction: STZ's Market Position and Investment Value

99Starz (STZ), as a blockchain game ecosystem token, has been bringing play-to-earn gaming to millions of players through NFT leasing and guild formation since its inception. As of 2025, 99Starz has a market capitalization of $9,488.60913, with a circulating supply of approximately 1,364,286 tokens, and a price hovering around $0.006955. This asset, known as the "P2E enabler," is playing an increasingly crucial role in the blockchain gaming and metaverse sectors.

This article will comprehensively analyze the price trends of 99Starz from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. STZ Price History Review and Current Market Status

STZ Historical Price Evolution

- 2021: All-time high reached, price peaked at $0.977213 on December 19

- 2025: Market downturn, price dropped to all-time low of $0.00399686 on April 14

- 2025: Gradual recovery, current price at $0.006955 as of November 4

STZ Current Market Situation

As of November 4, 2025, STZ is trading at $0.006955, with a 24-hour trading volume of $9,552.42. The token has experienced a 2.05% decrease in the last 24 hours. STZ's market cap stands at $9,488.61, ranking it at 7369th position in the cryptocurrency market. The current circulating supply is 1,364,286 STZ, with a total supply of 99,000,000 tokens. STZ is showing mixed performance across different timeframes, with a 1.56% increase over the past week but a 2.12% decrease over the last 30 days. The token has seen a significant decline of 62.99% over the past year, indicating a bearish long-term trend.

Click to view the current STZ market price

STZ Market Sentiment Indicator

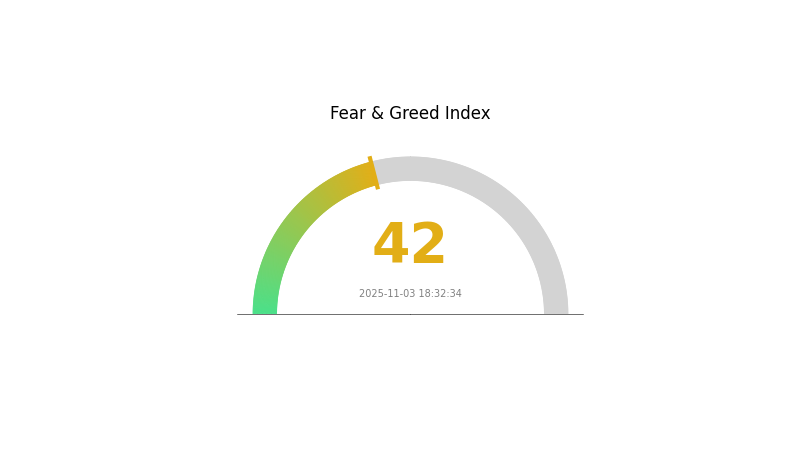

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 42. This indicates a cautious mood among investors, potentially signaling undervalued market conditions. Such periods of fear often present opportunities for long-term investors to accumulate assets at lower prices. However, it's crucial to conduct thorough research and exercise caution before making investment decisions. Keep an eye on market trends and stay informed about the latest developments in the crypto space.

STZ Holdings Distribution

The address holdings distribution data for STZ reveals a highly concentrated ownership structure. The top address holds a substantial 56.60% of the total supply, amounting to 56,035.18K tokens. This is followed by two addresses holding approximately 11.5% and 11.35% respectively, collectively accounting for nearly 80% of the total supply.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With the top three addresses controlling over 79% of tokens, there's a risk of significant market impact should these large holders decide to sell or move their assets. This concentration also suggests a low level of decentralization, which may be at odds with the principles of many blockchain projects.

The remaining holdings are distributed among smaller addresses, with the 4th and 5th largest holders owning 3.89% and 2.23% respectively. While this long-tail distribution provides some balance, it's not sufficient to offset the dominance of the top holders. This structure implies that STZ's market dynamics and governance (if applicable) could be heavily influenced by a small number of entities, potentially affecting its overall stability and future development.

Click to view the current STZ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc2e6...36f774 | 56035.18K | 56.60% |

| 2 | 0xe87d...07f2d2 | 11385.86K | 11.50% |

| 3 | 0x8851...f83dfe | 11246.33K | 11.35% |

| 4 | 0x3814...01a694 | 3856.18K | 3.89% |

| 5 | 0x9f5c...0762ea | 2212.66K | 2.23% |

| - | Others | 14263.79K | 14.43% |

II. Key Factors Influencing STZ's Future Price

Supply Mechanism

- Earnings reports: Quarterly financial results significantly impact stock price movements.

- Historical pattern: Positive earnings surprises tend to boost investor confidence and stock price.

- Current impact: Recent Q2 FY2026 earnings exceeded expectations, with EPS of $3.63 vs $3.48 forecast, potentially driving positive price momentum.

Institutional and Major Holder Dynamics

- Institutional holdings: Congress members have traded STZ stock 4 times in the past 6 months, indicating ongoing interest from policymakers.

- Corporate adoption: Constellation Brands (STZ) remains a major player in the alcoholic beverage industry with popular brands like Corona and Modelo.

Macroeconomic Environment

- Monetary policy impact: Federal Reserve decisions on interest rates can affect consumer spending on discretionary items like alcoholic beverages.

- Inflation hedging properties: As a consumer staples company, STZ may offer some inflation protection, potentially supporting stock value during inflationary periods.

Technological Development and Ecosystem Building

- Cost-saving initiatives: STZ has achieved $105 million in cost savings year-to-date, enhancing operational efficiency.

- Profit margin stability: The company maintains a strong operating profit margin of 39-40%, demonstrating resilience in challenging economic conditions.

III. STZ Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00417 - $0.00600

- Neutral forecast: $0.00600 - $0.00800

- Optimistic forecast: $0.00800 - $0.00946 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation

- Price range prediction:

- 2027: $0.00606 - $0.00935

- 2028: $0.00837 - $0.01261

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.01000 - $0.01300 (assuming steady market growth)

- Optimistic scenario: $0.01300 - $0.01631 (assuming strong market performance)

- Transformative scenario: $0.01631 - $0.02000 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: STZ $0.01199 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00946 | 0.00696 | 0.00417 | 0 |

| 2026 | 0.00911 | 0.00821 | 0.00624 | 18 |

| 2027 | 0.00935 | 0.00866 | 0.00606 | 24 |

| 2028 | 0.01261 | 0.009 | 0.00837 | 29 |

| 2029 | 0.01318 | 0.01081 | 0.00756 | 55 |

| 2030 | 0.01631 | 0.01199 | 0.01043 | 72 |

IV. Professional Investment Strategies and Risk Management for STZ

STZ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors interested in blockchain gaming

- Operation suggestions:

- Accumulate STZ during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit downside risk

- Take profits at predetermined price targets

STZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage option: Paper wallet for long-term holding

- Security precautions: Enable 2FA, use strong passwords, avoid sharing private keys

V. Potential Risks and Challenges for STZ

STZ Market Risks

- High volatility: Gaming tokens can experience sharp price swings

- Competition: Emerging projects may challenge 99Starz's market position

- Market sentiment: Broader crypto market trends can impact STZ price

STZ Regulatory Risks

- Uncertain regulations: Evolving laws may affect P2E gaming models

- Cross-border compliance: Varying international rules could limit expansion

- Token classification: Potential security designation could impact trading

STZ Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Network congestion could affect gameplay

- Interoperability challenges: Difficulties in cross-chain asset transfers

VI. Conclusion and Action Recommendations

STZ Investment Value Assessment

STZ offers exposure to the growing blockchain gaming sector but carries significant risks due to market volatility and regulatory uncertainties. Long-term potential exists if 99Starz can maintain its competitive edge in the P2E space.

STZ Investment Recommendations

✅ Beginners: Start with small positions, focus on education ✅ Experienced investors: Consider as part of a diversified gaming token portfolio ✅ Institutional investors: Evaluate for thematic blockchain gaming exposure

STZ Trading Participation Methods

- Spot trading: Buy and sell STZ on Gate.com

- Staking: Participate in STZ staking programs if available

- NFT leasing: Engage with 99Starz ecosystem for potential returns

Cryptocurrency investments are extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is STZ a buy hold or sell?

Based on current ratings, STZ is primarily a BUY. Most analysts recommend buying, with fewer suggesting hold or sell. The overall sentiment favors purchasing STZ stock.

Will Spirit Aerosystems stock go up?

Based on current market analysis, Spirit Aerosystems stock may see modest growth. However, its performance depends on aerospace industry trends and company-specific factors.

What is STZ's long-term outlook?

STZ's long-term outlook is positive. Analysts predict the price could reach $170 in the next 12 months, based on market trends and evaluations.

What is the price target for Zeta Global in 2025?

The price target for Zeta Global in 2025 is $17.86, with a high prediction of $22.19 and a low estimate of $13.54.

Share

Content