2025 XPOWER Price Prediction: Will This Crypto Asset Soar or Plummet in the Coming Years?

Introduction: XPOWER's Market Position and Investment Value

XPOWER (XPOWER), as a DeFi infrastructure based on Fractal Bitcoin, has been playing an increasingly important role in the Web3 ecosystem since its inception. As of 2025, XPOWER's market capitalization has reached $35,070, with a circulating supply of approximately 26,250,000 tokens, and a price hovering around $0.001336. This asset, known as the "community token of NebX," is playing a crucial role in the largest Web3 traffic task platform on X.

This article will comprehensively analyze XPOWER's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. XPOWER Price History Review and Current Market Status

XPOWER Historical Price Evolution

- 2024: Initial launch, price reached an all-time high of $0.65173 on September 27

- 2024: Market correction, price dropped to an all-time low of $0.00009 on October 2

- 2025: Gradual recovery, price currently at $0.001336

XPOWER Current Market Situation

XPOWER is currently trading at $0.001336, with a 24-hour trading volume of $28,628.18. The token has shown positive short-term momentum, with a 7.57% increase in the last 24 hours and a 2% gain in the past hour. However, the longer-term trend remains bearish, with significant declines of 25.90% over the past week, 41.33% over the last month, and 66.45% over the past year.

The current market capitalization stands at $35,070, ranking XPOWER at 6,218th in the overall cryptocurrency market. With a circulating supply of 26,250,000 XPOWER tokens and a total supply of 210,000,000, the circulation ratio is 12.5%. The fully diluted market cap is $280,560.

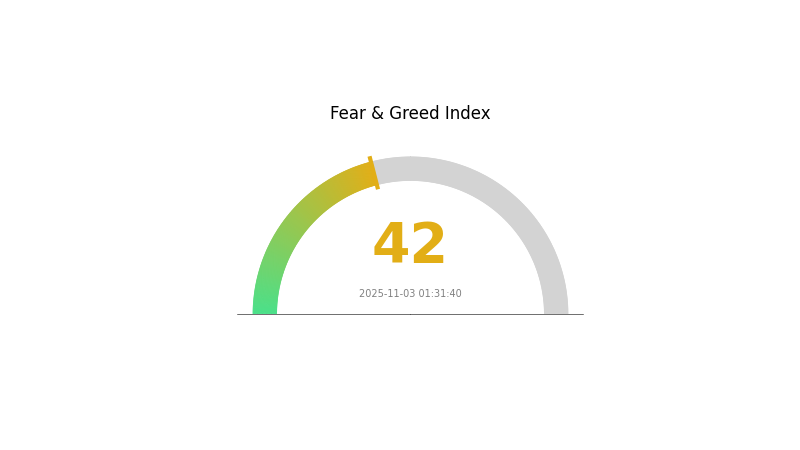

Despite recent gains, XPOWER is still trading significantly below its all-time high of $0.65173, recorded on September 27, 2024. The current price represents a 99.79% decrease from that peak. The market sentiment for XPOWER appears cautious, as reflected in the broader cryptocurrency market's fear index (VIX) of 42, indicating a state of fear among investors.

Click to view the current XPOWER market price

XPOWER Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of uncertainty, as reflected in the Fear and Greed Index reading of 42. This indicates a prevailing sentiment of fear among investors. During such times, it's crucial to remain cautious and conduct thorough research before making investment decisions. While some may see this as an opportunity to "buy the dip," others might prefer to wait for more stable market conditions. Remember, market sentiment can shift quickly, so stay informed and consider diversifying your portfolio to manage risk effectively.

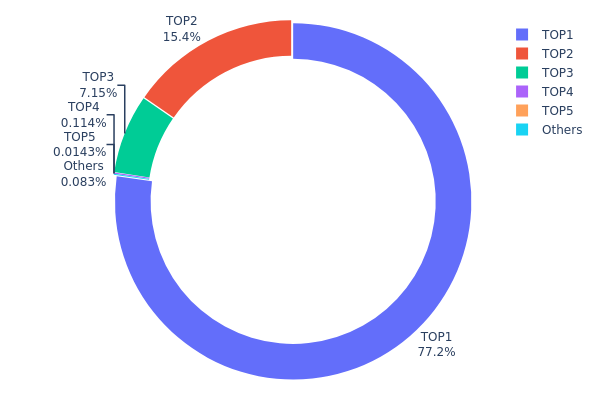

XPOWER Holdings Distribution

The address holdings distribution data for XPOWER reveals a highly concentrated ownership structure. The top address holds an overwhelming 77.23% of the total supply, while the second and third largest holders account for 15.40% and 7.14% respectively. This means that the top three addresses collectively control 99.77% of all XPOWER tokens.

Such extreme concentration raises significant concerns about the token's market dynamics and potential for price manipulation. With nearly all tokens held by just three addresses, the liquidity and trading volume could be severely limited, potentially leading to high volatility and susceptibility to large price swings based on the actions of these major holders.

This distribution pattern suggests a low level of decentralization and a fragile on-chain structure for XPOWER. The concentration of tokens in so few hands could impact the project's governance, if applicable, and may deter broader adoption due to concerns about equal participation and fair market conditions.

Click to view the current XPOWER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | bc1pw7...2a86rp | 162203.48K | 77.23% |

| 2 | 16G1xY...Vp9Wxh | 32342.28K | 15.40% |

| 3 | 1J6Zg3...pXfvdg | 15010.00K | 7.14% |

| 4 | 1AxYGu...YEpQx7 | 240.00K | 0.11% |

| 5 | bc1pnc...uq0dk3 | 30.00K | 0.01% |

| - | Others | 174.24K | 0.10999999999999% |

II. Key Factors Affecting XPOWER's Future Price

Supply Mechanism

- Price volatility: XPOWER has shown extreme price volatility, with recent gains of 78.38% and a price of $0.0044.

- Historical pattern: Low-priced tokens like XPOWER tend to attract speculative capital but carry high risks.

- Current impact: The high volatility suggests potential for rapid price swings in both directions.

Institutional and Whale Dynamics

- Corporate adoption: Xpeng Motors' platform technology and product innovation are key driving factors for XPOWER.

Macroeconomic Environment

- Geopolitical factors: International situations may impact the market price of XPOWER.

Technological Development and Ecosystem Building

-

SEPA 2.0 Feiyan Architecture Platform: Xpeng's core technology base redefines AI intelligent vehicle standards, covering three major technologies:

- X-EEA electronic and electrical architecture

- Three-electric system technology

- Hardware integration technology

-

Ecosystem applications: Xpeng's I-F-H three major sub-platforms support a full range of "sedan-SUV-MPV" products with "one car dual energy" capabilities.

III. XPOWER Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00071 - $0.00100

- Neutral prediction: $0.00100 - $0.00134

- Optimistic prediction: $0.00134 - $0.00168 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00143 - $0.00222

- 2028: $0.00102 - $0.00246

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00223 - $0.00246 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00246 - $0.00260 (assuming strong market performance and increased utility)

- Transformative scenario: $0.00260 - $0.00268 (assuming breakthrough use cases and mainstream adoption)

- 2030-12-31: XPOWER $0.00246 (potential stabilization after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00168 | 0.00134 | 0.00071 | 0 |

| 2026 | 0.00207 | 0.00151 | 0.00091 | 12 |

| 2027 | 0.00222 | 0.00179 | 0.00143 | 33 |

| 2028 | 0.00246 | 0.002 | 0.00102 | 49 |

| 2029 | 0.00268 | 0.00223 | 0.00172 | 67 |

| 2030 | 0.0026 | 0.00246 | 0.00167 | 83 |

IV. Professional Investment Strategies and Risk Management for XPOWER

XPOWER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate XPOWER during market dips

- Set a target holding period of at least 1-2 years

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Set strict stop-loss orders to manage downside risk

XPOWER Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for XPOWER

XPOWER Market Risks

- High volatility: Price fluctuations can be extreme

- Limited liquidity: May impact ability to execute large trades

- Market sentiment: Susceptible to rapid shifts in investor perception

XPOWER Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations

- Cross-border restrictions: Varying legal status across jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

XPOWER Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network scalability: Possible congestion during high demand

- Technological obsolescence: Risk of being outpaced by newer projects

VI. Conclusion and Action Recommendations

XPOWER Investment Value Assessment

XPOWER presents a high-risk, high-potential opportunity within the DeFi space. While it offers innovative features and community-driven governance, investors should be aware of its significant volatility and regulatory uncertainties.

XPOWER Investment Recommendations

✅ Beginners: Consider small, exploratory positions with strict risk management ✅ Experienced investors: Implement dollar-cost averaging strategy with set profit targets ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

XPOWER Trading Participation Methods

- Spot trading: Available on Gate.com exchange

- Staking: Participate in yield-generating protocols if available

- DeFi interactions: Explore XPOWER's ecosystem for additional opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

As of 2025, Ethereum has the highest price prediction among major cryptocurrencies, based on technological advancements and market trends.

How much is the Xpower coin?

As of 2025, the Xpower coin is priced at $0.001358. The market cap stands at $35.64K, showing a slight decrease in the last 24 hours.

What is the price prediction for Link 2025?

Based on current predictions, Chainlink (LINK) is expected to reach around $215 by 2025. The token is projected to maintain a strong position in the crypto market.

What is Pepe's price prediction for 2025?

Pepe's price could reach $0.000045 by 2025, depending on overall crypto market trends and Bitcoin's performance.

Share

Content