Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures

TL;DR

- In the October FOMC meeting, a 25 bps cut came in line with market expectations, but dissenting votes revealed growing divisions within the Fed.

- This week’s upcoming data include ISM manufacturing and services PMI, September trade balance, ADP payrolls, October employment figures, and the University of Michigan consumer sentiment index, among others.

- The crypto market remained under pressure last week. BTC fell 3.51%, and ETH dropped 5.99%. BTC ETFs saw outflows of $607.35 million, while ETH ETFs attracted inflows of $114.18 million. The Fear & Greed Index slipped back to 42 (fear), while the ETH/BTC ratio declined another 2.64% to 0.0346.

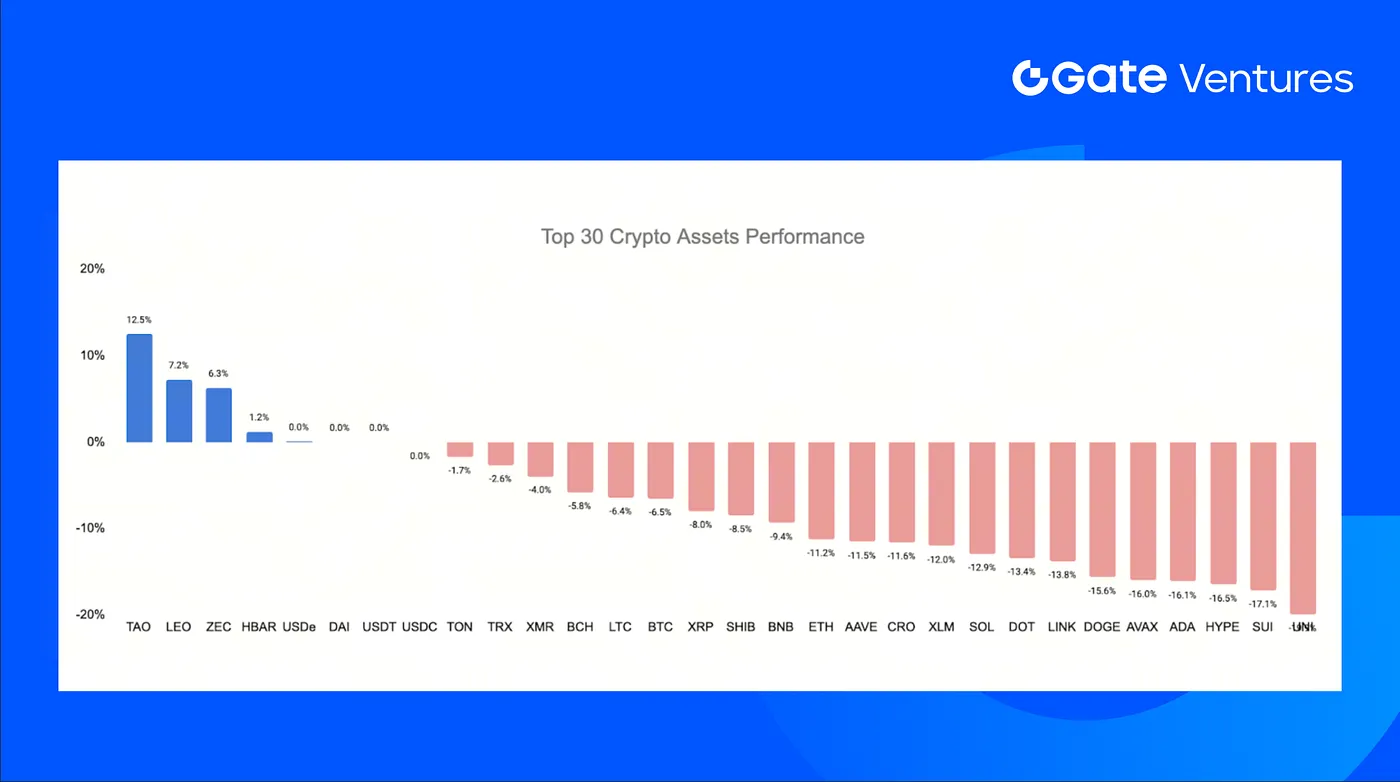

- The total crypto market cap fell by 3.92%, with altcoins underperforming, especially those outside the top 10, which declined by 4.37%. The privacy narrative was the only outperformer, led by ZEC, ZK, DASH, and MINA.

- Among the top 30 tokens, the market saw an average decline of 11.56%. Only TAO (+12.5%), LEO, ZEC (+7.2%), and HBAR (+1.2%) recorded gains.

- New listings include Canton Network (CC) — an institution-grade blockchain backed by major financial firms, trading between $0.13–$0.16 post-TGE — and Kite AI, a decentralized AI compute network backed by General Catalyst and PayPal Ventures, which peaked at $0.20 and stabilized around $0.13.

- Circle’s Arc public testnet has gone live, drawing participation from global financial giants.

- Fusaka hard fork is set to go live on December 3, bringing scalability and data upgrades to Ethereum.

- Securitize has announced a $1.25 billion SPAC deal, marking a milestone for onchain finance.

Macro Overview

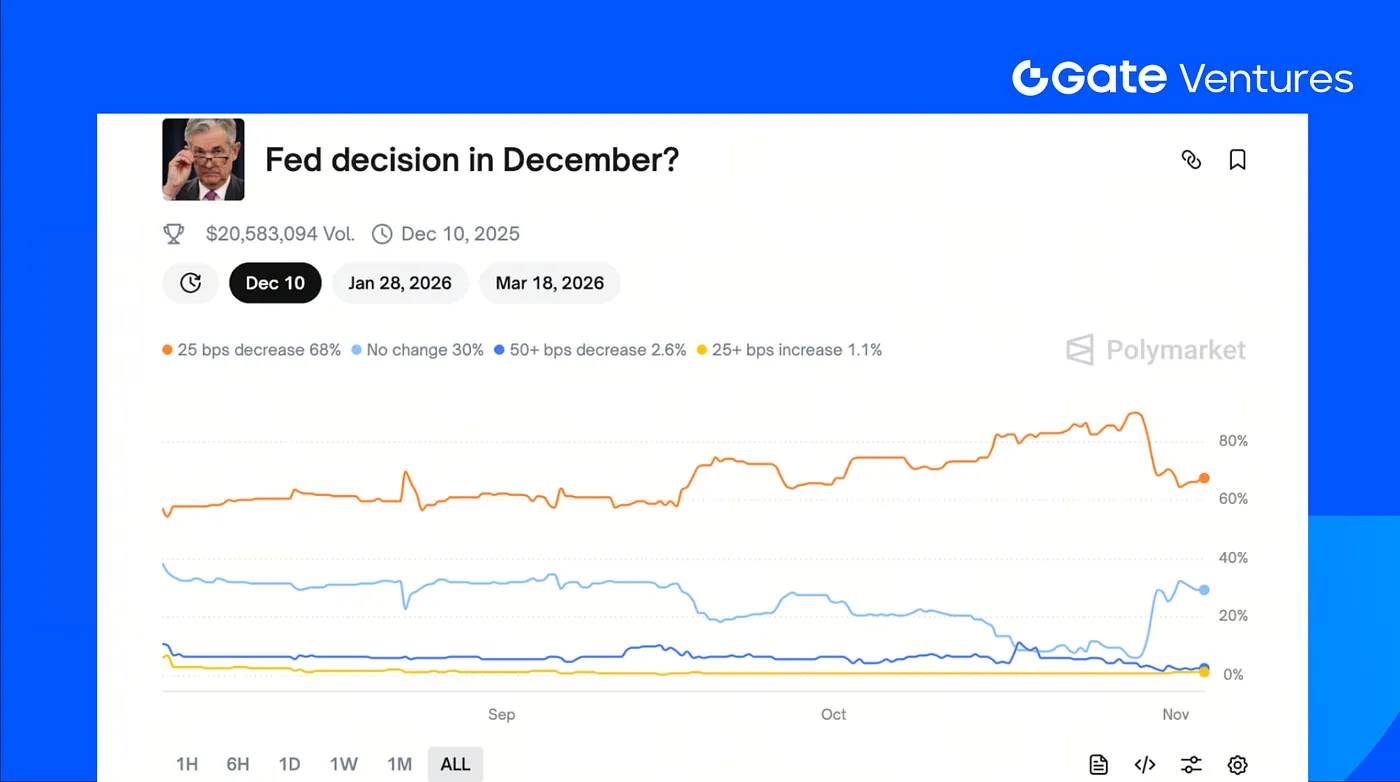

In the Oct FOMC meeting 25 bps cut came in line with market expectations, but dissents showed growing divisions within the Fed.

The Federal Reserve cut rates by 25 basis points at its October meeting, in line with market expectations. Two officials dissented: Governor Stephen Miran favored a 50-basis-point cut, aligning with Trump’s call; Kansas City Fed President Thomas Schmid preferred to keep rates unchanged. The policy statement changed little from September: job growth has slowed this year, the unemployment rate has risen but remains low; inflation has increased since the start of the year and remains elevated. What truly rattled markets was Powell’s “hawkish” stance on a possible December cut. At the press conference he said, “A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it.” He added that the Fed cut in September because of labor-market weakness, but “logic going forward is a different thing.” He also noted there was clear disagreement among Fed officials in this meeting.

On the balance sheet side, the Fed announced it will end quantitative tightening (QT) on December 1. At that time, the $5 billion per month reduction in US Treasuries will stop, and maturing principal will be reinvested. The $35 billion monthly cap on mortgage‑backed securities (MBS) runoff will remain in place, but maturing principal will be reinvested into Treasury bills (T‑bills).

This week’s macroeconomic data will include ISM manufacturing and service PMI, Sept balance of trade, ADP payroll, Oct employment data, UoM consumer sentiment, etc. As the US government shutdown continues, more focus will be cast on the release of private sector economic data, including PMI from ISM, ADP’s payroll numbers and consumer confidence data from the University of Michigan. The dual impacts of strong US economic growth and concerns over the government policies will further be assessed from the data release like PMI, as well as the performance of other major economies. (1, 2)

Polymarket: Fed Decision in Decemeber

DXY

The dollar index closed on October with a strong upward trend, rising to around $99.8, which is its highest level since early August, supported by a hawkish tone from the Fed.(3)

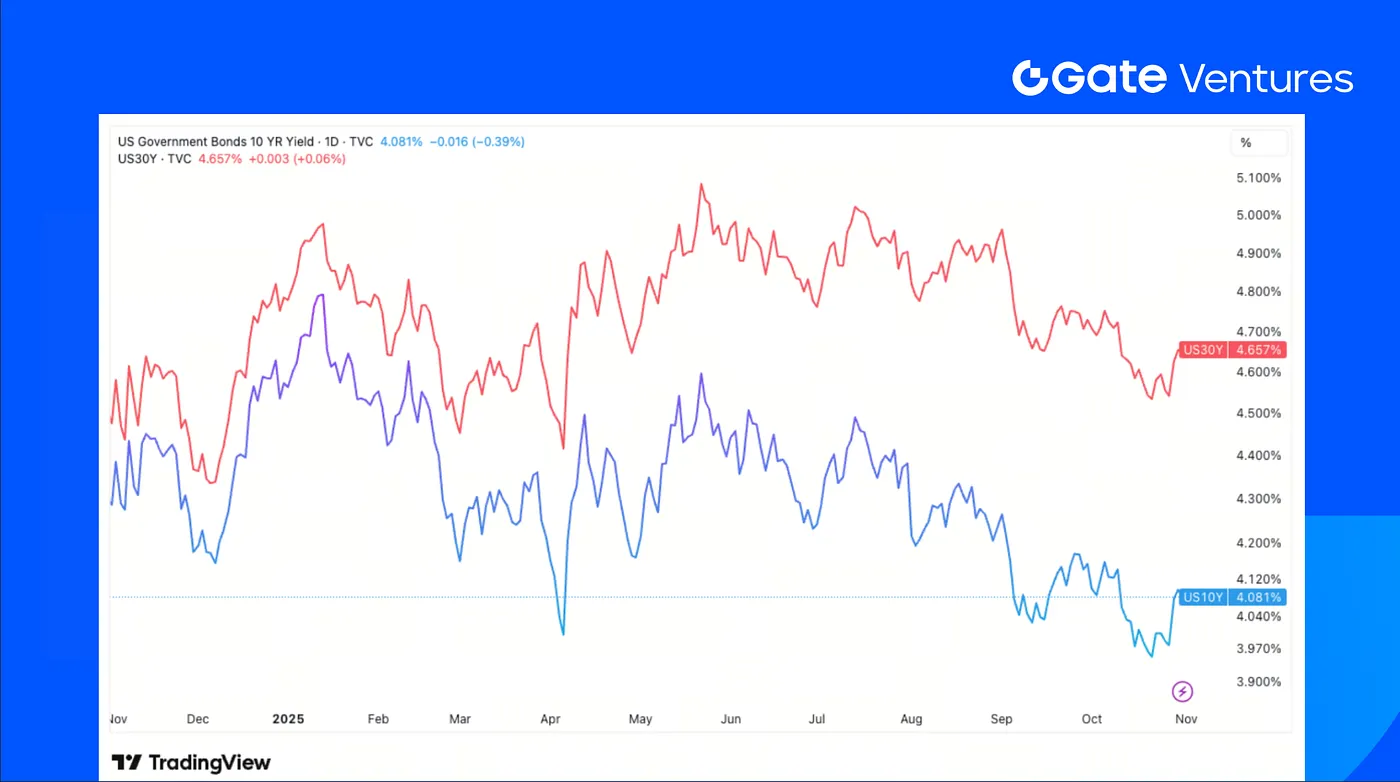

US 10-Year and 30-Year Bond Yields

The US 10-year bond yield touched 4.10% last Friday, recording a big rebound last week thanks to the Fed’s cautious move and hawkish tone on future policy.(4)

Gold

Gold prices fell for 1% on Friday due to the rate cut uncertainty this year, and landed at around $3,995 dollar/oz. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC fell 3.51% over the past week, while ETH declined 5.99%. Bitcoin ETFs saw net outflows of $607.35M, whereas Ethereum ETFs recorded inflows of $114.18M. (6)

The BTC Fear & Greed Index retreated to 42, returning to the “fear” zone. Meanwhile, the ETH/BTC ratio has continued its steady downtrend since August, slipping another 2.64% last week to 0.0346.

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap dropped 3.92% last week, while the market excluding BTC and ETH slipped 3.77%. Altcoins underperformed further, with the market excluding the top 10 tokens down 4.37%.

The only sector showing resilience was the privacy narrative. Tokens such as ZEC (Zcash), ZK (zkSync), DASH (Dashpay), and MINA (Mina Protocol) all posted notable gains amid the broader market pullback.

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Nov 3rd 2025

The overall market remained weak, with most of the top 30 tokens posting losses and an average decline of 11.56%. Only TAO (Bittensor), LEO (UNUS SED LEO), ZEC (Zcash), and HBAR (Hedera) managed to record price increases.

TAO led the gains with a 12.5% surge following the launch of Europe’s first staked TAO ETP by Deutsche Digital Assets, which fueled strong institutional interest.

ZEC rose 7.2% after Electric Coin Co. (ECC), which is the team behind Zcash and the Zashi wallet, unveiled its Q4 2025 roadmap, boosting market confidence in the project’s development trajectory. (9)

4. New Token Launched

Canton Network is an institution-grade blockchain built to enable privacy-preserving interoperability across financial markets. In collaboration with leading partners including Goldman Sachs, Capgemini, and Microsoft, it provides decentralized infrastructure for regulated asset tokenization and settlement.

Following its TGE, the token (CC) was listed on OKX, Bybit, Binance Pre-Market, and Hyperliquid Futures, trading in the $0.13–$0.16 range.

Kite AI is a decentralized AI compute and coordination network that enables verifiable, on-chain model training and inference. It introduces a token-based ecosystem aligning data providers, model developers, and compute node operators through transparent smart-contract incentives.

Backed by leading investors such as General Catalyst and PayPal Ventures, the project has garnered strong market attention. Following its listing on major exchanges’ futures markets, including Gate, OKX, and Bybit, Kite debuted around $0.13, briefly surged to $0.20, and has since stabilized near the $0.13 level.

The Key Crypto Highlights

1. Circle’s Arc public testnet goes live, drawing participation from global financial giants

Circle has launched the public testnet for Arc, its enterprise-focused Layer 1 blockchain designed to bridge global financial infrastructure onchain. Over 100 institutions, including BlackRock, Visa, Apollo, BNY Mellon, and Deutsche Bank, are participating across payments, capital markets, and technology. Featuring sub-second finality, predictable dollar fees, and native USDC gas, Arc aims to unify onchain settlement for stablecoin payments, FX, and lending. The launch follows Circle’s $1.2B IPO, underscoring its bid to anchor institutional finance on blockchain rails. (10)

2. Fusaka hard fork to go live 3-Dec, bringing scalability and data upgrades to Ethereum

Ethereum Foundation developers confirmed 3-Dec as the mainnet launch date for the Fusaka upgrade, following successful testnet deployments on Hoodi, Holesky, and Sepolia. The backward-compatible hard fork introduces around a dozen EIPs, including PeerDAS for improved data sampling, a 5× gas limit increase to 150 million, and expanded blob capacity. Fusaka focuses on scaling and validator efficiency, marking Ethereum’s most significant update since Pectra, with a $2M security audit bounty preceding the rollout.(11)

3. Securitize announces $1.25B SPAC deal, marking milestone for onchain finance

Securitize, a leader in tokenized securities, will go public through a $1.25B SPAC deal sponsored by Cantor Fitzgerald, listing on Nasdaq under ticker SECZ. The firm will also tokenize its own equity, reinforcing its mission to digitize capital markets. Backed by BlackRock, ARK Invest, and Morgan Stanley, Securitize issues BlackRock’s BUIDL fund, the first $1B tokenized Treasury. The listing includes a $469M PIPE led by Arche, ParaFi, Hanwha, and Borderless, aimed at scaling its regulated onchain financial infrastructure.(12)

Key Ventures Deals

1. Standard Economics secures $9M to to power low-cost global transfers, targeting unbanked users through stablecoin-based remittances

Standard Economics, a stablecoin remittance startup founded by former SpaceX and X employees, raised $9M in a seed round led by Paradigm with participation from Lightspeed and strategic angels. Its Uno app enables free cross-border payments in Mexico and plans expansion to Argentina and the Philippines. Targeting the unbanked, the firm seeks to make stablecoin transfers as ubiquitous as internet access. The raise highlights accelerating mainstream adoption of compliant, low-cost digital dollar payment infrastructure. (13)

2. ZAR raises $12.9M from a16z, Dragonfly, and VanEck to distribute stablecoins via corner stores and kiosks

ZAR, a Pakistan-based fintech startup, raised $12.9M in a round led by Andreessen Horowitz (a16z) with participation from Dragonfly Capital, VanEck Ventures, Coinbase Ventures, and Endeavor Catalyst. Founded by Sebastian Scholl and Brandon Timinsky, ZAR converts cash into stablecoins through local stores and phone kiosks, targeting over 100M unbanked Pakistanis. The funding supports expansion across emerging markets as Pakistan formalizes crypto regulation through its new Virtual Assets Regulatory Authority (PVARA). (14)

3. Accountable raises $7.5M to expand undercollateralized crypto credit platform and institutional-grade solvency verification in DeFi space

Accountable, an undercollateralized crypto credit protocol, raised $7.5M in a round led by Pantera Capital with participation from OKX Ventures, Onigiri Capital, and KPK. The funding will expand the team and support mainnet launch in mid-November. Positioned as a transparency layer for institutional lending, Accountable verifies over $1B in assets, offering real-time solvency proof. Pantera said it fills the “missing layer” in crypto credit, addressing failures seen in 2022’s lending cycle. (15)

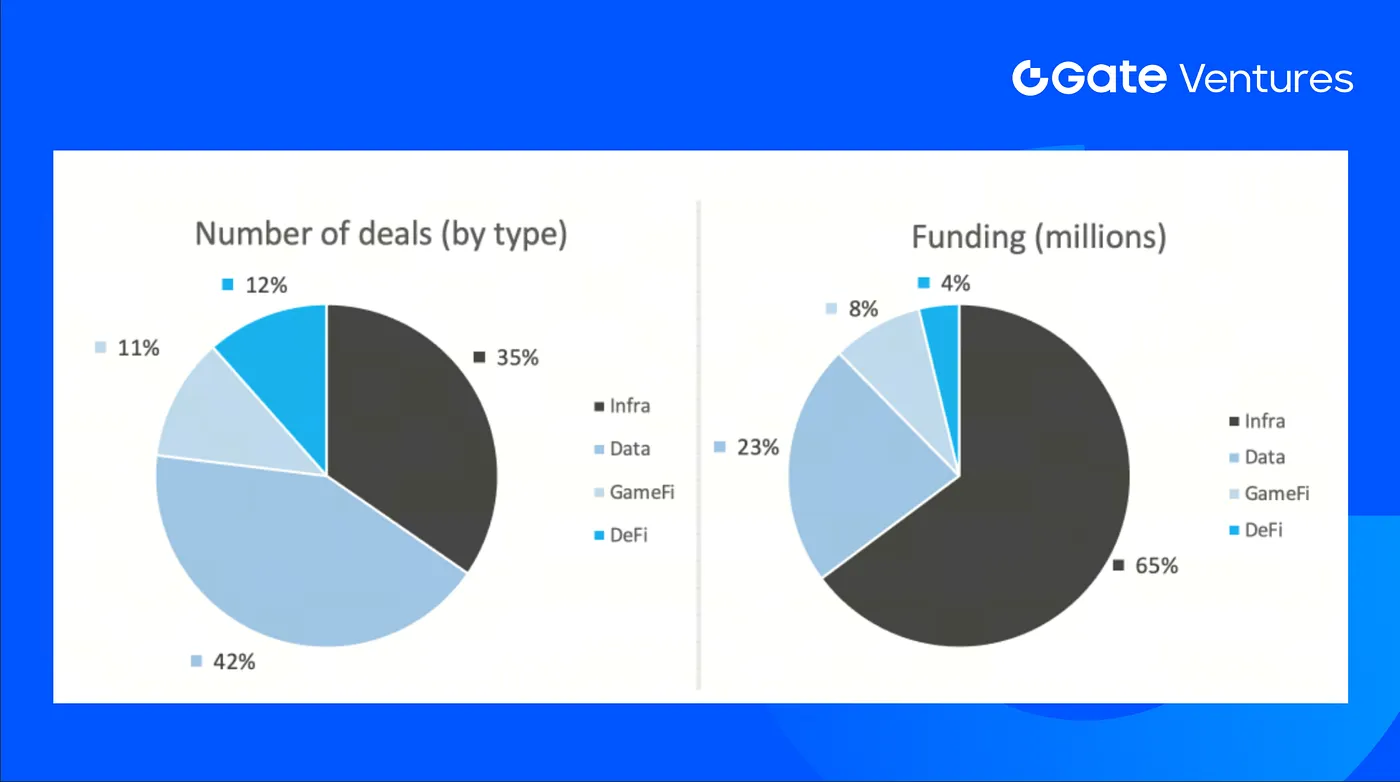

Ventures Market Metrics

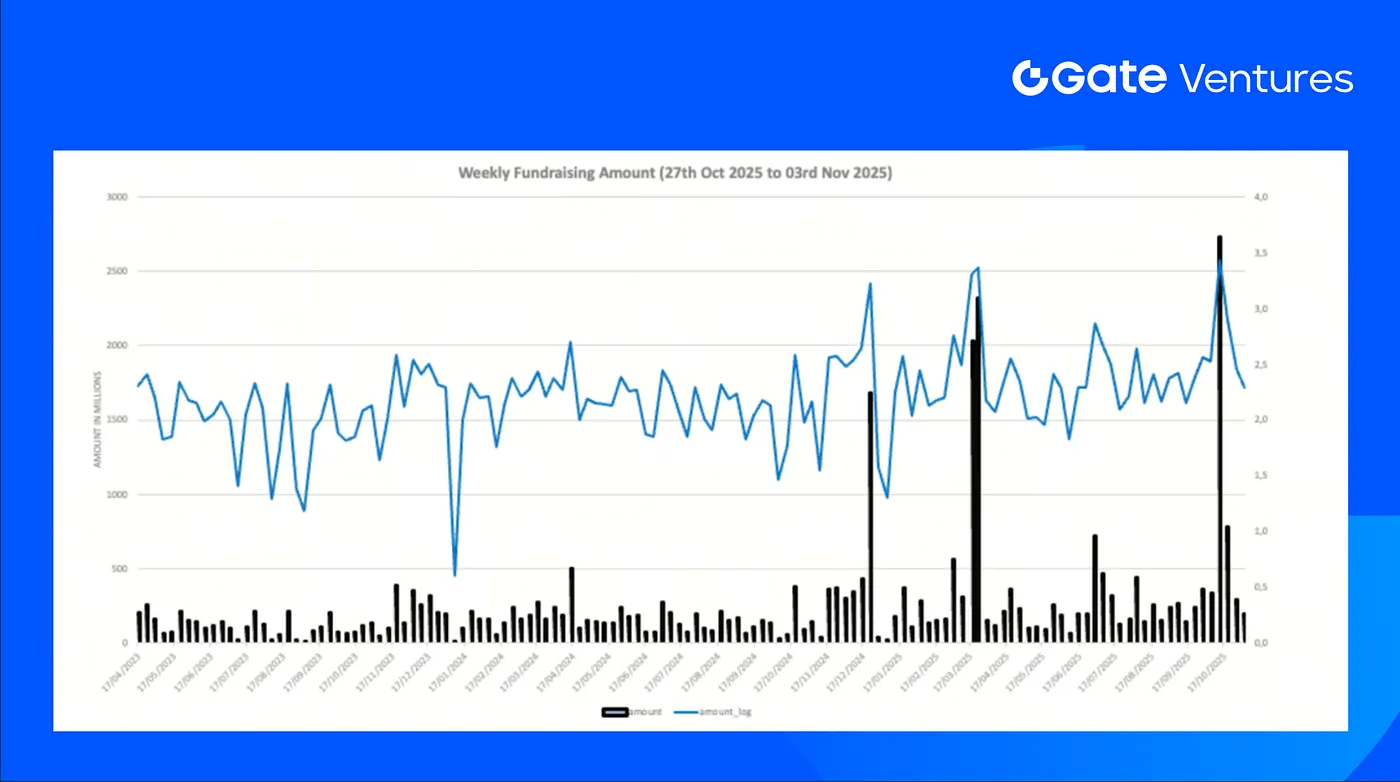

The number of deals closed in the previous week was 26, with Data having 11 deals, representing 42% for each sector of the total number of deals. Meanwhile, Infra had 9 (35%), Gamefi had 3 (12%) and DeFi had 3 (12%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 03rd Nov 2025

The total amount of disclosed funding raised in the previous week was $211M, 8% deals (7/26) in previous week didn’t public the raised amount. The top funding came from Infra sector with $137M. Most funded deals: Bron $15M, ZAR $12.9M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 03rd Nov 2025

Total weekly fundraising fell to $211M for the 5th week of Oct-2025, a decrease of -31% compared to the week prior. Weekly fundraising in the previous week was up +36% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-3-november-2025.html

- Fed Decision in December, Polymarket, https://polymarket.com/event/fed-decision-in-december?tid=1762146604410

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Launch of TAO staked ETP in Europe, https://coinmarketcap.com/community/articles/6905e9560ba95b2b1712833b/

- ZCash Developer ECC’s roadmap announcement, https://coinmarketcap.com/community/articles/6906f4861ab7be27d0157855/

- Circle’s Arc public testnet goes live, drawing participation from global financial giants,

https://www.theblock.co/post/376497/circle-launches-arc-public-testnet-blackrock-visa-anthropic-among-institutional-participants - Fusaka hard fork to go live Dec. 3, bringing scalability and data upgrades to Ethereum,

https://www.theblock.co/post/377065/ethereum-devs-officially-target-dec-3-for-fusaka-upgrade - Securitize announces $1.25B SPAC deal, marking milestone for onchain finance,

https://www.theblock.co/post/376583/tokenization-giant-securitize-to-go-public-via-1-25-billion-spac-deal - Standard Economics secures $9M to to power low-cost global transfers, targeting unbanked users through stablecoin-based remittances,

https://www.ainvest.com/news/standard-economics-aims-starlink-money-9m-seed-2510/ - ZAR raises $12.9M from a16z, Dragonfly, and VanEck to distribute stablecoins via corner stores and kiosks,

https://cointelegraph.com/news/a16z-backs-zar-stablecoins-pakistan

https://x.com/zardotapp/status/1983140063832625398 - Accountable raises $7.5M to expand undercollateralized crypto credit platform and institutional-grade solvency verification in DeFi space,

https://blockworks.co/news/pantera-funding-round-accountable

Thanks for your attention.

Share

Content