AI Agents: The Biggest Upgrade to Your Crypto Workflow

Do you trade crypto, farm yields in DeFi with your stablecoins, or bet on prediction markets?

Congrats, you’re part of the 99% of people in crypto and one of the biggest beneficiaries of the Agents revolution.

Let me say it clearly: AI Agents can improve your trading, farming, and prediction workflows, helping you earn more while touching more grass.

Sounds too good to be true? Let me explain…

By the way, I’m @ diego_defai, a Crypto × AI researcher with 3.5M+ impressions on X, and AI Agents are my obsession.

In this article, we will discover why you should implement AI Agents in your workflow and we will also analyze the top AI Agents available today.

Three Categories Where Agents Are Disrupting

There are three crypto-sectors where AI Agents are changing the rules of the game and improving users’ workflow:

- Trading (spot & perps)

- Farming (especially stablecoins)

- Prediction markets (Polymarket)

In these three areas, AI Agents bring countless advantages; from higher yields to better accuracy and execution.

How Agents Actually Help Humans

Let’s make it simple.

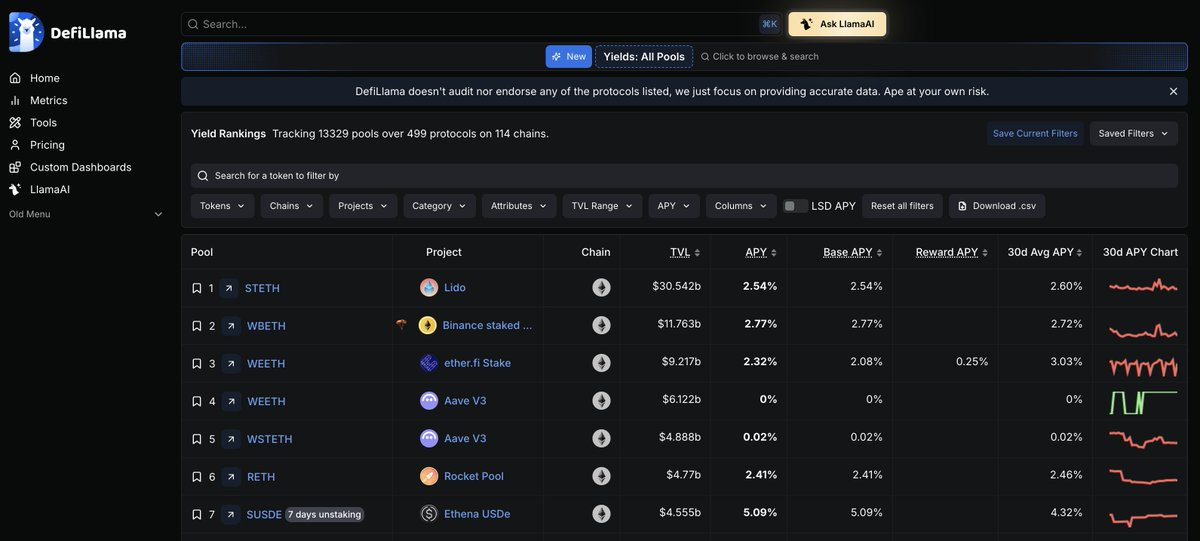

You have 10,000 USDC and want to deploy it into the most profitable farming opportunity in DeFi.

Before Agents, you had to research protocols manually and since APYs constantly change, you needed to monitor screens 24/7 to stay on top.

If you were a smart farmer, you probably used APY aggregators to check opportunities quickly. But even that was still a sub-optimal solution.

Now imagine a digital assistant, an AI Agent, that tracks on-chain APYs in real time and automatically moves your capital when better opportunities appear.

You no longer need to manually check APYs or move your 10,000 USDC every time a new opportunity arrives.

Today, AI Agents can:

- Earn higher APY compared to humans (they never sleep)

- Deploy assets autonomously when new opportunities arise

- Analyze far more data than any human ever could

A human might evaluate 10 protocols.

An AI Agent can scan 1,000 and instantly choose the best one.

This is why, with AI Agents, you can touch more grass while still having access to the best yield opportunities.

The “Boring” Part — They’re Also More Secure

Beyond those advantages, Agents also enhance security.

They interact directly with whitelisted smart contracts, avoiding scammy UIs, failed transactions, and phishing attempts.

The result? A generally higher level of security.

To summarize why you should use AI Agents in your workflow:

- They’re more secure

- They analyze massive data sets

- They never sleep

- They deploy capital autonomously

Top AI Agents by Use Case

Now that we understand why you should use them, it’s time to explore the top AI Agents for the three use cases we mentioned earlier: Yield Farming, Crypto Trading and Prediction Markets.

For Yield Farming

If you want the best-optimized and fully passive stablecoin yields:

- @ ZyfAI → A multichain stablecoin Agent that moves your USDC across Base and Arbitrum. The average APY is around 22%.

- @ Almanak → If you like farming airdrops, this is the solution for you. Deposit stablecoins and earn a native 7% APY + points for the future airdrop.

- @ gizatechxyz (Arma Agent) → If you prefer predictable yields, Giza offers a fixed 15% APY on your stablecoins.

There are also Agents offering passive yields on BTC and ETH:

- @ mamo → Uses $cbBTC and provides an average 1–2% APY.

- @ gizatechxyz (Pulse Agent) → Using the @ pendle_fi stack, it offers a fixed 12% APY on your ETH.

Bonus: we’re running a public challenge to track real APYs from these AI Agents. Check the latest episode here 👇

AI Agents for Traders

You can find two main types of Agents in this field:

- Trading Companions → They help you analyze markets and improve your decision-making process.

- Autonomous Trading Agents → They handle the entire process: research, execution, and position management.

Trading Companions

- @ Velvet_Capital → If you like trading shitcoins, you should start using their AI Agents on the Velvet Trading Terminal.

- @ Cod3xOrg → Create your own trading Agent and ask it trading suggestions.

- @ HeyAnonai → Their HUD is a graphic layer that can be applied to different trading front ends and provides real-time, AI-powered insights.

Autonomous Trading Agents

- @ modenetwork → They offer two Agents: the Breakout Agent and the Trend Agent. Simply deposit USDC into their agentic wallet and you’re done.

If you want to explore this topic further, I wrote a dedicated article about it.

AI Agents For Prediction Markets

If you like betting on Prediction Markets, you can use:

- Companion Agents → to help with research and decision-making

- Autonomous Agents → that place predictions for you

Prediction Companions:

- @ polytraderAI -> An AI companion that analyzes news, sentiment, and inefficiencies to spot arbitrage opportunities before humans do.

- @ polybroapp -> A research terminal that gives you deep AI analysis on different prediction markets

- @ polytaleai -> Focused on politics and sports. Tracks whales, X sentiment, and news cycles to predict outcomes before others notice.

Autonomous Prediction Agents:

- @ quantrix_agent-> Quantrix conducts research, predicts outcomes, and manages users’ portfolios autonomously.

- @ SemanticLayer -> The first-ever Polymarket Agent, leveraging the x402 standard to trade autonomously and generate passive income

Also for this topic I have wrote a dedicated article:

Track all the Agents on My DeFAI Sheets

If you’ve been following my content lately, you know I maintain a Google Sheet tracking all AI Agents; from stablecoin agents to trading agents and prediction agents.

This sheet was also used by @ scattering_io for their DeFAI mapping.

If you want access to it (tracking all AI Agents in DeFAI), just RT this article and comment “I want the sheet.” I’ll share it in your DMs.

Disclaimer:

- This article is reprinted from [diego_defai]. All copyrights belong to the original author [diego_defai]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

What is AIXBT by Virtuals? All You Need to Know About AIXBT

Dimo: Decentralized Revolution of Vehicle Data