Ethereum Price Prediction: ETH Could Rebound to 3592 or Fall to 2749

BlackRock Enters the Ethereum Staking ETF Market

On November 19, BlackRock, a global asset management leader, registered the iShares Staked Ethereum Trust ETF in Delaware. This move signals BlackRock’s intent to target institutional investors seeking yield opportunities. The ETF registration comes as regulatory dynamics shift and more competing products enter the market, underscoring BlackRock’s proactive positioning in the crypto asset ETF space. The fund must still submit further documentation before it can secure final regulatory approval.

Market Landscape for Ethereum Staking ETFs

BlackRock’s registration is a standard preliminary step for ETF launches, with a formal application to regulatory authorities still required. Bloomberg ETF analyst Eric Balchunas notes that BlackRock’s staked ETH ETF was registered under the Securities Act of 1933.

Earlier this year, BlackRock sought to add staking to its iShares Ethereum Trust (ETHA), and in July 2025, Nasdaq submitted a 19b-4 amendment to the SEC. The SEC had previously taken a cautious approach to staking-related ETFs, but recent improvements in the crypto ETF regulatory environment have made a difference. In September, the SEC approved general exchange listings and streamlined the review process for individual ETFs, accelerating the launch of compliant products.

Competitive Landscape and BlackRock’s Strategy

Several staking Ethereum ETFs with first-mover advantages—such as REX-Osprey’s ESK and Grayscale’s ETFs incorporating ETH and SOL staking—are already in the market, putting BlackRock in direct competition with these asset managers.

Unlike its competitors, BlackRock has confined its crypto ETF offerings to Bitcoin and Ethereum, focusing on market size, liquidity, and institutional demand. This targeted strategy has delivered strong results: ETHA has seen $13 billion in cumulative net inflows and $11.4 billion in net assets, surpassing $1 billion in assets within just two months of launch. The Bitcoin ETF IBIT has performed even more impressively, with $63.12 billion in cumulative net inflows and total assets reaching $72.76 billion, making it the leading Bitcoin ETF globally.

Ethereum Price Technical Outlook

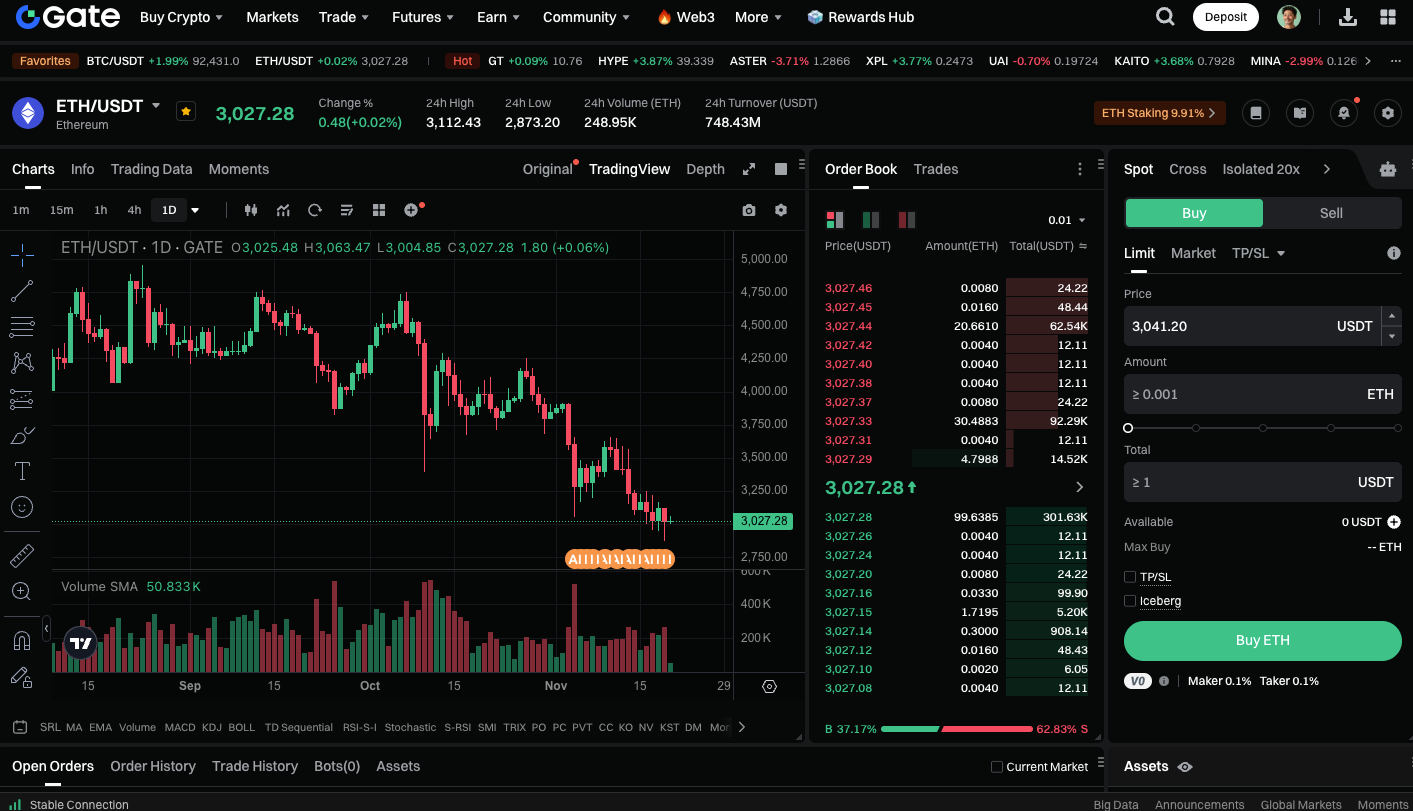

Ethereum is currently trading near $3,017. If ETH holds above this level, it could continue its short-term recovery toward the key resistance at $3,592. However, a close below $3,017 may lead to further downside, with the next support level at $2,749. Investors should pay close attention to these support and resistance levels to evaluate market trends.

Start trading ETH spot now: https://www.gate.com/trade/ETH_USDT

Summary

BlackRock’s entry into the Ethereum staking ETF market—set against a backdrop of regulatory improvements and rising competition—offers institutional investors new yield-generating tools. Meanwhile, ETH prices are testing a critical support area and could soon see either a rebound or further decline. For investors, tracking ETF developments and key price technicals is essential for capitalizing on opportunities and managing risk.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution