GUSD: The Evolution from Stablecoin to Yield-Bearing Dollar

Stablecoins: Beyond Just a Safe Haven

Historically, stablecoins have provided a secure refuge for capital in the crypto market. During periods of extreme volatility, investors typically convert assets to stablecoins to minimize risk. However, with the emergence of DeFi (Decentralized Finance) and RWA (Real-World Assets), stablecoins are evolving. No longer just passive stores of value. They are now becoming on-chain assets that generate ongoing returns.

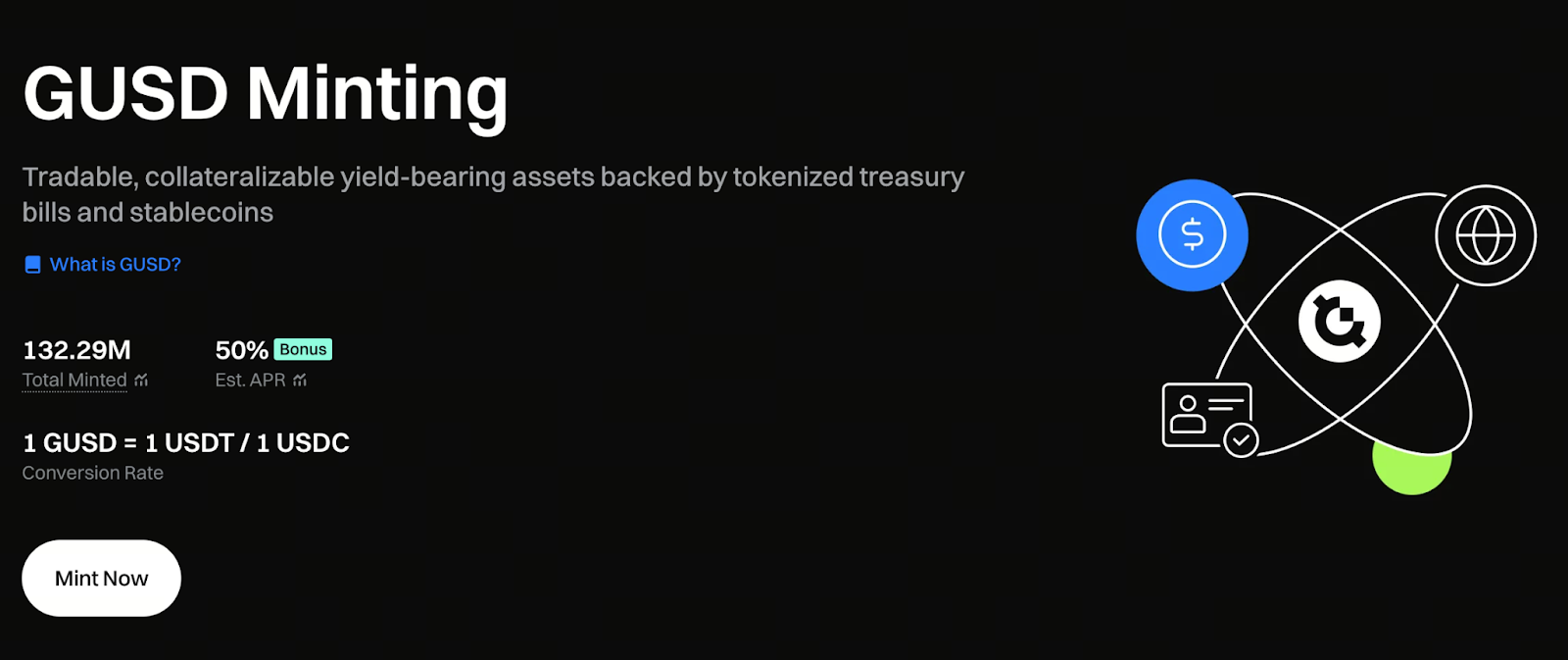

GUSD not only upholds a 1:1 peg with the US dollar, but also introduces interest-bearing features, allowing funds to grow while ensuring strong security.

Yield Generation Backed by Real-World Assets

GUSD’s yield isn’t driven by token inflation or algorithmic distributions. Low-risk, real-world financial instruments generate interest that provides returns. These assets consist of:

- U.S. Treasury Bills

- Investment-grade Corporate Notes

- Other traditional fixed-income securities

This structure delivers two essential benefits:

- Price Stability — Maintains parity with the US dollar, shielded from market volatility.

- Real Yield — Sustainable returns sourced from real-world interest income.

For those seeking steady performance, GUSD acts as a digital dollar that automatically accrues interest.

Multiple Ways to Participate

To accommodate different investment preferences, GUSD offers two flexible entry and exit options:

- Exchange Instantly: Seamlessly swap leading stablecoins such as USDT and USDC for GUSD to get started quickly.

- On-Chain Minting: Use smart contracts to mint GUSD at a 1:1 ratio and instantly participate in on-chain yield, with real-time, transparent data.

GUSD provides participation options for both centralized and decentralized platforms.

Mint GUSD to participate in daily annualized yield: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Automated Compounding Mechanism

GUSD features automatic interest accrual and periodic settlements, allowing assets to appreciate steadily over time.

For example, minting GUSD with 100 USDT at a 20% annualized yield would allow redemption of approximately 120 USDT at maturity.

This approach enables stable returns and automatic compounding.

GUSD’s Role in the Web3 Ecosystem

GUSD now serves as more than a value store; it forms a foundational layer of Web3 financial infrastructure and is widely integrated into:

- Staking and Long-Term Locking: Longer holding periods drive higher returns.

- Community Rewards and Airdrops: Distributed as ecosystem incentives to active participants.

- DeFi Protocol Integrations: Supports lending pools, savings pools, leveraged trading, Launchpool modules, and more.

These integrations position GUSD as a critical hub for on-chain liquidity and yield generation.

Three Key Advantages

- Longer Holding, Higher Returns

Yield is directly linked to duration of holdings, creating a stable, long-term incentive structure. - High Liquidity and Flexibility

Users can redeem funds either on-chain or through exchanges at any time, ensuring constant accessibility. - Deep Ecosystem Integration

As a core component of multiple DeFi protocols, GUSD boosts asset efficiency and market depth.

These strengths make GUSD a leading stablecoin that combines security with yield potential.

Compliance and Risk Disclosure

GUSD fully adheres to regulatory frameworks and employs prudent asset allocation. However, users should remain aware of potential risks such as market volatility and regulatory changes. Carefully review product terms and assess your risk tolerance before investing in any yield-bearing stablecoin.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

The advent of GUSD signals a new era for stablecoins. No longer just a digital proxy for the US dollar, GUSD is an interest-generating digital asset. By merging real-world assets with smart yield mechanisms, GUSD redefines stablecoins, enabling both stability and growth. As Web3 finance matures, GUSD will bridge the gap between traditional finance and the crypto economy. In this new landscape, each GUSD functions as a stablecoin with integrated yield mechanisms.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution