SKY Latest Developments and Price Analysis — Why You Should Pay Attention to Sky.money

What Is SKY?

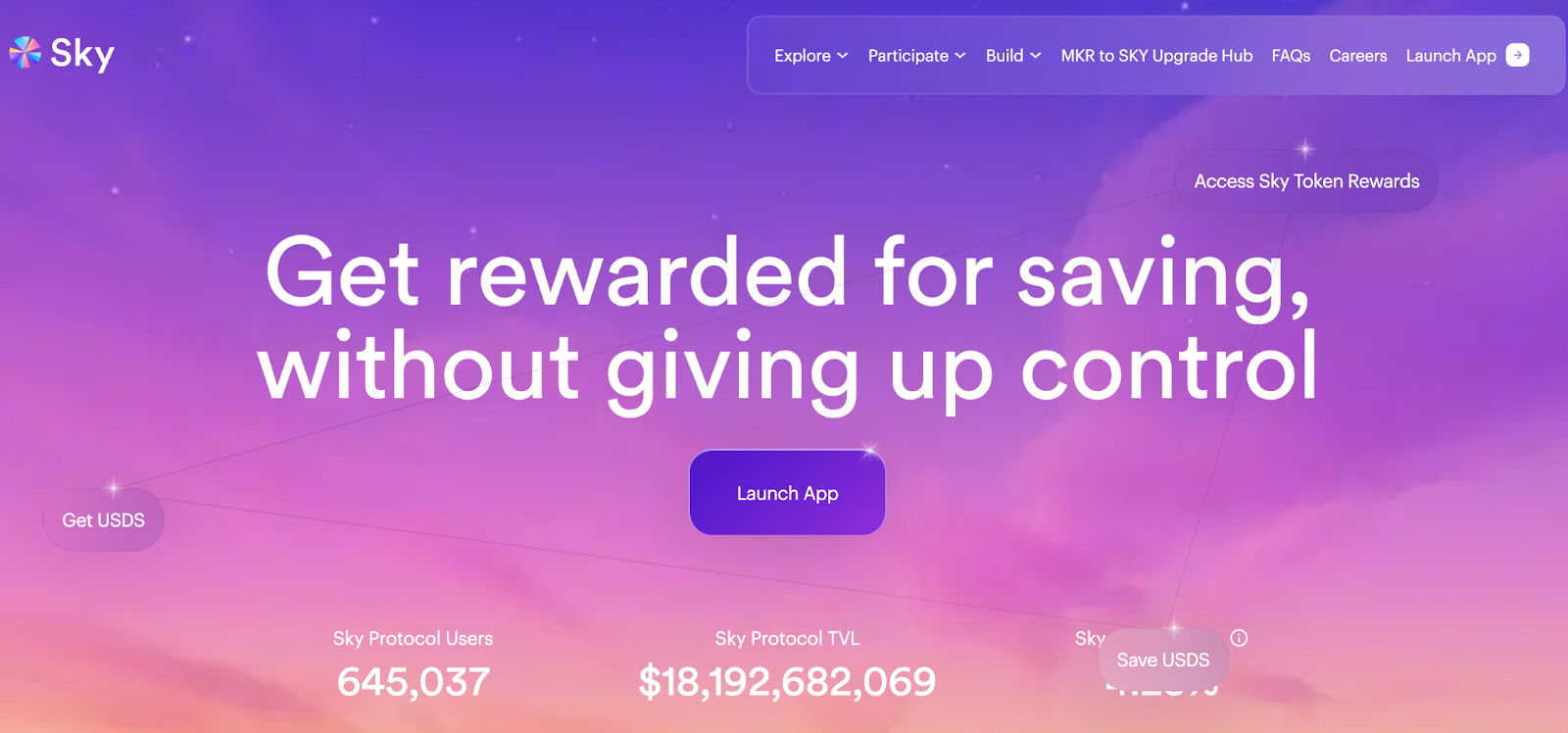

Image: https://sky.money/

SKY is the core governance token of Sky Protocol. Sky Protocol builds on the foundational concepts of early MakerDAO, featuring enhanced mechanisms and upgraded governance. The SKY token powers protocol governance, drives ecosystem incentives, and enables participation in a variety of financial products.

Sky Protocol’s mission is to deliver the USDS stablecoin and a suite of yield-generating tools, so users can securely store, lend, and trade assets in a decentralized environment, while actively participating in ecosystem governance. SKY holders vote on key parameters such as protocol interest rates, collateral asset types, and incentive allocation. This structure enables holders to act as both investors and contributors to the ecosystem’s growth.

Current Price and Market Performance

Image: https://www.gate.com/trade/SKY_USDT

As of December 3, 2025, SKY trades at approximately $0.0559. Over the past year, it reached a high of $0.1005 before undergoing a market correction and now sits at a relatively low level. There are roughly 2.29 billion tokens in circulation.

This market correction presents long-term investors with a low-cost entry point. For those focused on protocol governance and the long-term value of the ecosystem, this is a strategic opportunity to allocate to SKY. Market data indicates that buyback initiatives and ecosystem feature rollouts often trigger short-term rallies in SKY’s price, reflecting investor confidence in the protocol’s development.

Buyback Program and Market Confidence

Sky Protocol recently launched a large-scale buyback program, purchasing up to 40.5 million SKY in a single week. This buyback strategy reduces circulating supply and signals the team’s strong commitment to the protocol’s long-term growth. Over the past several months, this proactive approach has driven periodic price increases, strengthened community trust, and boosted governance participation.

The team typically pairs buyback programs with additional ecosystem incentives, including higher staking rewards and improved liquidity mining returns, allowing holders to earn more by remaining invested. For investors, this provides a relatively strong value support mechanism.

Key Features and Earning Opportunities on Sky.money

Sky.money serves as the primary gateway to Sky Protocol, allowing users to participate in the ecosystem without the need to custody assets. Its main features include:

- USDS Savings (Sky Savings Rate): Deposit USDS to earn stable returns, with an annual yield of approximately 4.25%. This is similar to a bank deposit, but decentralized and with instant withdrawals.

- Sky Token Rewards: Contribute USDS to support ecosystem projects and earn SKY or other token rewards, with an annual yield of about 4.94%.

- Staking SKY: Hold and stake SKY to earn governance rewards and lending yields, with annual returns of up to 16.34%.

- Advanced Module stUSDS: Tailored for experienced users. This module offers liquidity provision and lending opportunities, with yields of up to 28.58% per year.

Sky.money continues to roll out new features, such as cross-chain asset management and liquidity pool optimization. This provides users with more ways to earn and participate.

Investment and Utility Value of SKY

For everyday users, Sky.money delivers a secure and transparent DeFi platform. Users can earn stable yields through USDS and participate in governance and high-yield staking with SKY.

For long-term investors, SKY’s current low price, combined with active buyback programs and ongoing feature expansion, offers significant potential for value appreciation. By engaging with Sky.money, users not only earn returns. They also help shape the protocol’s future through voting in governance.

Risk Disclosure

While SKY offers multiple earning opportunities, certain risks still exist:

- Market volatility can cause significant price swings;

- Uncertainty around protocol governance or ecosystem upgrades;

- High-yield modules may involve smart contract risks.

Investors should only allocate capital that aligns with their risk tolerance and stay informed on protocol updates and community governance developments.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution