What is Aria Protocol (ARIAIP)?

What Is Aria Protocol?

(Source: Aria_Protocol)

Aria Protocol is an on-chain solution specializing in IP-based Real-World Assets (RWA). Aria converts real-world IP rights (starting with the music industry) into fungible tokens, allowing these previously illiquid rights to be held, traded, and monetized just like cryptocurrencies. In essence, Aria enables music royalty revenue to become tokens you can own, representing a true fusion of culture and finance on the blockchain.

Three Pillars of Protocol Architecture

The Aria ecosystem is built upon three core components, each with distinct responsibilities, working together to advance the IP financialization framework:

- Aria Protocol — The protocol itself, managing on-chain infrastructure and tokenization processes.

- Aria Foundation — The foundation overseeing protocol governance, resource allocation, and ecosystem development.

- Aria Protocol Labs Inc. — The primary development company, responsible for building applications and expanding partnerships.

This layered structure enables Aria to bring real-world IP rights on-chain. It transforms them into liquid, investable assets. Aria also ensures transparent rights distribution among creators, holders, and investors.

How It Works

The IP tokenization process in Aria Protocol consists of three stages:

- Fundraising:

Aria’s management company acquires music IP rights with royalty streams and issues IP RWA tokens based on these assets. - Staking:

Investors can hold and stake these tokens to participate in royalty distribution. - Royalty Collection:

When royalties are generated from music, the protocol proportionally distributes income to token stakers and rights holders.

The process is transparent and traceable, driven by smart contracts for automated, fair, and accurate income distribution.

Dual Engines: Governance and Growth

Within the Aria ecosystem, Aria Foundation and Aria Protocol Labs Inc. serve as the dual engines of governance and development. The Foundation operates as an independent steward of governance, resource allocation, and community management; Labs is the primary driver of technical development and application innovation.

Aria Foundation focuses on “public governance” and long-term strategic planning. It maintains protocol transparency, coordinates developers and partners, advances decentralized governance, and ensures secure, compliant tokenization of IP rights. Its core mission is to promote the IP RWA market, making copyright investment, previously reserved for institutions, accessible to everyone.

Aria Protocol Labs Inc. functions as the protocol’s innovation engine, turning concepts into real-world technical solutions. It develops user applications, creator onboarding tools, and partner integration systems, clarifying the relationship between creators and investors and making it easier for creators to tokenize works and for investors to access IP investment. As the ecosystem grows, Labs attracts more developers. This fosters a diverse, collaborative network and drives Aria toward full decentralization.

Together, the Foundation sustains governance and transparency, while Labs powers technology and adoption. This collaboration ensures Aria Protocol strikes a balance between decentralization and real-world utility, supporting robust and ongoing ecosystem growth.

IP RWA: Transforming Intangible Assets into Financial Products

IP RWA (Intellectual Property Real-World Asset) is Aria’s foundational concept—a new approach to tokenizing real-world assets for on-chain finance.

Traditionally, assets like songs, film copyrights, and brand designs were accessible only to institutional investors or industry insiders. Aria’s framework tokenizes these rights as IP RWA tokens on-chain, enabling anyone to purchase, trade, and hold them as crypto assets. This model not only establishes a new way to invest in music but also marks the beginning of a new era for capitalizing cultural IP.

Tokenomics

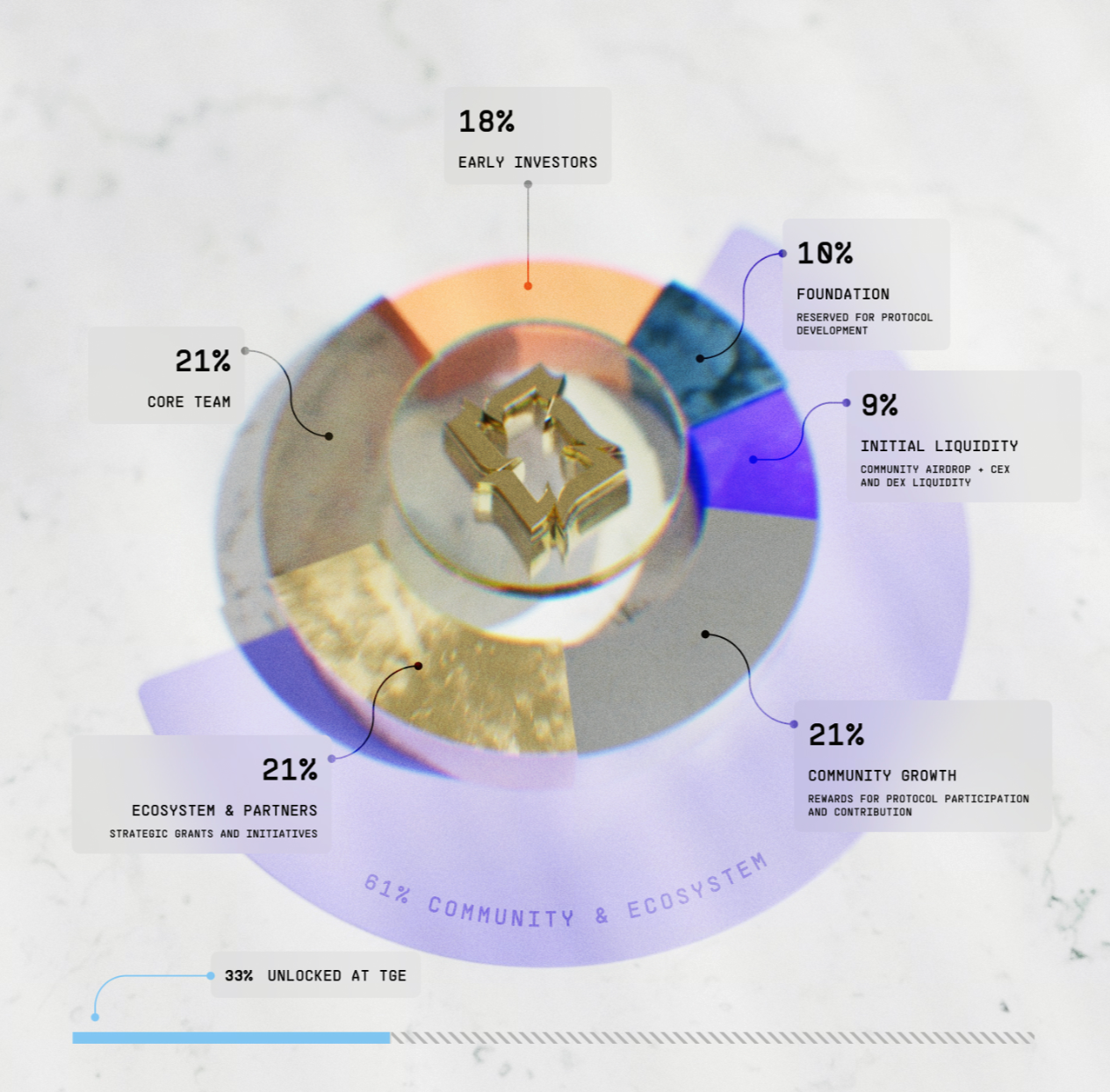

$ARIAIP has a total supply of 1 billion (1,000,000,000) tokens, with a fixed cap and no further issuance. The token distribution emphasizes long-term incentives and community alignment, balancing development and governance. Distribution is as follows:

- Foundation (10%): Fully unlocked at Token Generation Event (TGE), supporting governance and ecosystem initiatives.

- Initial Liquidity (9%): Fully released at TGE to provide market liquidity.

- Community Growth (21%): 33% unlocked at TGE for airdrops and community rewards.

- Ecosystem & Partners (21%): 33% unlocked at TGE to drive collaboration and application deployment.

- Core Team (21%): Subject to vesting, ensuring long-term commitment and development.

- Early Investors (18%): Initially locked, released in stages to stabilize market dynamics.

(Source: Aria_Protocol)

Notably, 61% of the total supply is allocated directly to community and ecosystem growth (community, partners, liquidity, and foundation), underscoring Aria’s commitment to decentralized governance and participatory development. At TGE, the protocol also launches a community airdrop and a Community Offering on the Vibe platform. Five percent of total supply is distributed via airdrop, fully released at launch as a reward for early contributors and Story community members.

$ARIAIP: The Heart of Protocol Economics and Governance

Throughout the Aria ecosystem, $ARIAIP serves as the central utility token—representing governance, powering liquidity, and driving community engagement. Key functions include:

- Liquidity Provision: Facilitates trading liquidity and collateral for the IP RWA market.

- Protocol Governance: Token holders participate in major proposals and ecosystem votes, shaping protocol evolution.

- Community & Exclusive Access: $ARIAIP also serves as access to exclusive community benefits and events, encouraging active participation in governance and creative initiatives.

To learn more about Web3, register here: https://www.gate.com/

Conclusion

Aria Protocol’s innovation lies in both its technology and philosophy. It breaks down traditional financial barriers surrounding intangible assets, making music and creative works into financial products with real returns. With Aria, songs and creations can be split, tokenized, and shared for collective ownership by a global community. This transformation goes beyond the music industry; it redefines cultural assets in the Web3 era. Aria Protocol builds an economy where creativity becomes an asset, allowing IP to thrive and generate value on-chain.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks