Bitcoin White Paper

What Is Bitcoin?

Bitcoin is a decentralized digital currency operating on a public blockchain, independent of banks or single institutions. Anyone can generate a wallet to create a private key (for ownership) and an address (for receiving funds), enabling peer-to-peer transfers. Transactions are secured by cryptography and recorded on the blockchain.

Bitcoin uses a Proof of Work (PoW) consensus mechanism: miners compete using computational power to package transactions and create blocks, earning block rewards and transaction fees. The total supply of Bitcoin is capped at 21 million, making it scarce; it is commonly used for storing value and cross-border payments.

What Are the Current Price, Market Cap, and Circulating Supply of Bitcoin (BTC)?

As of December 25, 2025 (data sourced from platform market feeds), Bitcoin’s price is approximately $87,500.10. The circulating supply is about 19,966,834 BTC, matching the total supply, with a maximum supply of 21,000,000 BTC.

The current circulating market capitalization stands at around $1,747,099,971,683.40, and the fully diluted valuation (FDV) is also about $1,747,099,971,683.40. Because issuance is close to the cap, FDV and market cap are nearly identical. Bitcoin's market dominance is approximately 55.073%, reflecting its share in the overall crypto market.

Click to view Top Crypto Market Cap Share

The 24-hour trading volume is about $751,446,250.97.

Click to view BTC USDT Price

Recent price changes: 1 hour -0.30%, 24 hours +0.68%, 7 days +0.76%, 30 days +0.12%.

Click to view Latest BTC Price Chart

These fluctuations reflect routine market volatility; investors should assess their own time horizons and risk tolerance when making decisions.

Who Created Bitcoin (BTC), and When?

Bitcoin was proposed in a whitepaper published in 2008 by the pseudonymous Satoshi Nakamoto. It was launched as open-source software and spread globally through independent network nodes. The genesis block was mined in 2009, marking the official start of the network (referencing public sources: Bitcoin Whitepaper, 2008; Genesis Block, 2009-01-03).

This background explains Bitcoin’s design goals: to build a peer-to-peer electronic cash system independent of banks, while using transparent ledgers and algorithmic rules for issuance and validation.

How Does Bitcoin (BTC) Work?

Bitcoin runs on blockchain technology—a chronological sequence of “blocks,” each recording a batch of transactions and linked by hash pointers for tamper-resistance.

Proof of Work (PoW): Miners compete to find a hash meeting network difficulty targets; the winner earns block proposal rights along with block rewards and transaction fees. Network difficulty automatically adjusts to keep block times around 10 minutes.

Private keys, public keys, and addresses: Private keys authorize transactions via digital signatures; public keys are derived from private keys; addresses are simplified representations for receiving payments. If a private key is lost or compromised, assets become unrecoverable or may be stolen.

Halving mechanism: Block rewards are halved roughly every four years to control issuance rate, contributing to scarcity and supply expectations. Transaction fees (miner fees) are set by users; during network congestion, higher fees may be needed for faster confirmations.

What Can You Do With Bitcoin (BTC)?

Store of Value: With its capped supply and strong network effects, Bitcoin is often seen as “digital gold,” favored for long-term holding and portfolio diversification.

Cross-border Payments and Remittance: Transfers can be made globally without traditional banking channels; costs and speeds depend on network congestion and chosen methods.

Micro-Payments & Scaling: Integrations like Lightning Network enable fast, low-fee micro-transactions; on-chain transfers are suited for larger amounts or higher security confirmation needs.

Collateral & Settlement: In certain compliant contexts, Bitcoin may be used as collateral or a hedging asset; actual usage depends on local regulations and platform policies.

What Are the Main Risks and Regulatory Considerations for Bitcoin (BTC)?

Price Volatility: Crypto asset prices fluctuate due to market supply/demand and macro factors; short-term swings can be significant—manage position sizing and diversify accordingly.

Click to view Latest BTC Price Chart

Private Key & Account Security: Loss of private keys is irreversible—always back up mnemonic phrases offline and store securely. For exchange accounts, enable two-factor authentication (2FA), withdrawal whitelists, and anti-phishing codes to guard against social engineering and phishing attacks.

Platform & Counterparty Risks: Centralized custody involves counterparty and compliance risks—regularly audit account security and consider self-custody solutions.

Regulation & Taxation: Compliance requirements, reporting, and tax treatment vary by jurisdiction—follow local laws and retain transaction records.

Network & Fees: Peak periods may cause congestion and fee increases—double-check addresses and run small test transactions to avoid irreversible losses from errors.

What Is the Long-Term Value Proposition of Bitcoin (BTC)?

Scarcity & Rule-Based Supply: Capped at 21 million BTC with a transparent issuance curve governed by halving events—minimizing human intervention risk.

Security & Decentralization: PoW consensus backed by global mining power secures the network; distributed nodes ensure independent record-keeping beyond any single authority.

Network Effects & Liquidity: High market cap and deep liquidity support tradeability and usability, helping Bitcoin serve as a store of value in macro asset allocation.

Macro Narratives & Institutional Adoption: Bitcoin is increasingly included in diversified portfolios amid inflationary pressures and loose monetary policy environments.

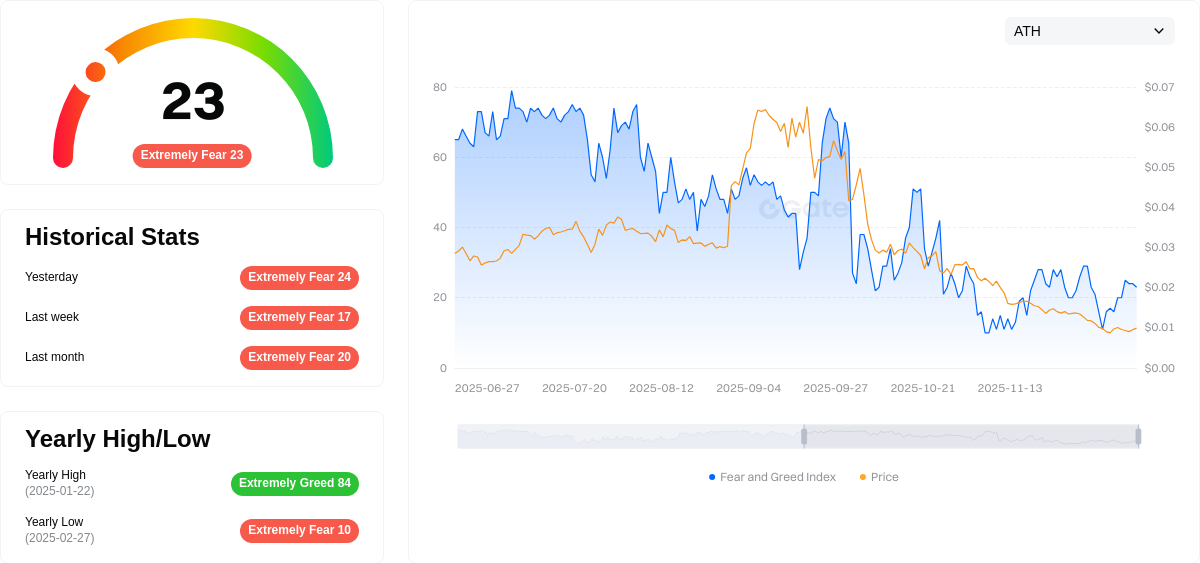

Click to view Crypto Market Fear & Greed Index

Long-term value depends on regulatory developments, infrastructure maturity, and ongoing user education.

How Can I Buy and Securely Store Bitcoin (BTC) on Gate?

Step 1: Register for a Gate account and complete identity verification. Set a strong password, enable two-factor authentication (2FA), and anti-phishing codes to enhance login and transaction security.

Step 2: Fund your Gate account. You can use fiat quick buy or deposit USDT before exchanging it for BTC within the platform. Pay attention to deposit channel fees and processing times.

Step 3: Go to the spot market and search for “BTC/USDT.” Choose between market orders (executed at current prices) or limit orders (executed at your set price), confirm quantity and fees before placing your order.

Step 4: Withdraw to a self-custody wallet for better security. Create a wallet and back up your mnemonic phrase offline (write it down or use encrypted media), test withdrawals with small amounts first, then move larger sums once confirmed.

Step 5: Enable withdrawal whitelists and regularly verify addresses. Whitelists restrict withdrawals to preset addresses—reducing risks of mistakes or theft; always check the network type and address prefixes before each withdrawal.

Step 6: Stay compliant & keep records. Retain transaction receipts and withdrawal records for local reporting or tax purposes—helpful for future reconciliation or audits.

How Does Bitcoin (BTC) Differ From Ethereum?

Purpose & Goals: Bitcoin focuses on robust record-keeping for value storage and payments; Ethereum aims to be a universal smart contract platform supporting complex decentralized applications.

Consensus Mechanism: Bitcoin uses Proof of Work (PoW) secured by mining; Ethereum uses Proof of Stake (PoS), leveraging staking and validator systems for lower energy consumption.

Supply & Economic Model: Bitcoin is capped at 21 million with halving events; Ethereum has no fixed cap—EIP-1559 introduced fee burning so net supply depends on burn rates versus staking amounts.

Feature Complexity: Bitcoin’s scripting language is deliberately limited for security; its mainnet prioritizes simplicity. Ethereum natively supports smart contracts powering ecosystems such as DeFi, NFTs, and diverse protocols.

Fees & Scalability: Bitcoin’s on-chain fees are based on transaction data size—Lightning Network supports fast micro-payments; Ethereum uses a Gas fee model with various Layer 2 solutions boosting throughput.

Summary of Bitcoin (BTC)

Bitcoin is a decentralized digital currency governed by transparent rules and PoW consensus, defined by its capped supply and scarcity. Current price levels, market cap, and dominance illustrate its pivotal role in the crypto sector. Understanding its history, technical workings, and use cases helps clarify its long-term value proposition and risk boundaries. Practically, you can buy on Gate then transfer to self-custody using strategies like backing up private keys, enabling two-factor authentication, withdrawal whitelists, and small test withdrawals to enhance security. Portfolio allocation should align with personal goals and regulatory context—diversify holdings, document compliance actions, periodically review risk exposure—to participate more securely in this open financial network.

FAQ

Who Wrote the Bitcoin Whitepaper?

The Bitcoin whitepaper was authored by an individual or group under the pseudonym Satoshi Nakamoto in 2008. This nine-page technical document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” details Bitcoin’s foundational principles and operating mechanisms. Satoshi’s real identity remains unconfirmed—a major mystery in crypto history.

When Was the Bitcoin Whitepaper Published?

The whitepaper was published on October 31, 2008. It was first shared publicly via a cryptography mailing list—marking the official birth of the Bitcoin concept. On January 3rd, 2009, the network launched with the mining of its first block (Genesis Block).

What Are the Main Topics Covered in the Bitcoin Whitepaper?

The whitepaper focuses on three core areas: First, it solves the “double-spending problem” in digital money—ensuring transaction uniqueness via Proof of Work; second, it introduces a decentralized network architecture enabling transactions without banks or intermediaries; third, it explains incentives—miners earn newly minted bitcoins plus transaction fees as rewards. These innovations form the basis for modern cryptocurrencies.

Why Is the Bitcoin Whitepaper So Important?

The whitepaper is the foundational document of the cryptocurrency movement—it achieved true decentralization in digital currency for the first time. It proved that cryptography and game theory could secure monetary systems without central authorities. The paper inspired thousands of crypto assets and shifted the trajectory of financial technology—it remains essential reading for understanding blockchain technology.

How Should I Read the Bitcoin Whitepaper?

While only nine pages long, the whitepaper includes dense cryptographic and distributed systems terminology. Beginners should start with translated versions for foundational understanding. Suggested approach: First grasp core concepts (double-spending, Proof of Work, blockchain); next study technical details (hash functions, Merkle trees, timestamp servers); finally review code implementations for hands-on validation. Many educational platforms—including Gate Academy—offer detailed breakdowns as supplementary resources.

Key Terms Related to Bitcoin (BTC)

- Proof of Work: A consensus mechanism where participants solve complex mathematical problems to verify transactions and create new blocks.

- Mining: The process where miners use computational power to package transactions, validate blocks, and earn rewards.

- Blockchain: A distributed ledger comprised of cryptographically-linked blocks ensuring immutability of transactions.

- Hash: A unique identifier generated by cryptographic functions used to validate data integrity within blocks.

- Difficulty Adjustment: Automatic tuning of mining difficulty based on total network hash rate—to maintain average block times near 10 minutes.

- UTXO Model: The Unspent Transaction Output accounting method used by Bitcoin—each transaction consumes UTXOs as inputs.

References & Further Reading on Bitcoin (BTC)

-

Official Site / Whitepaper:

-

Developer Docs:

-

Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem