Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

273.37K Popularity

73.99K Popularity

11.28K Popularity

11.96K Popularity

12.7K Popularity

- Hot Gate FunView More

- MC:$3.58KHolders:10.82%

- MC:$3.5KHolders:10.00%

- MC:$3.75KHolders:20.85%

- MC:$3.6KHolders:10.81%

- MC:$3.52KHolders:10.00%

- Pin

Bitcoin rebounds 6% in a day, recovering to $91,000

Source: DecenterKorea Original Title: Bitcoin rebounds 6% in a day, recovering to $91,000 [Decenter Market Update] Original Link: https://www.decenter.kr/NewsView/2H1L4U8051/GZ03

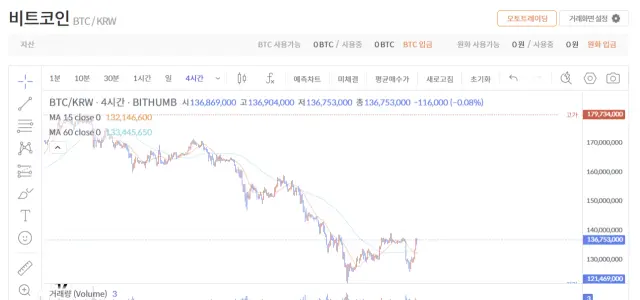

As of 8 AM on the 3rd, Bitcoin(BTC) recorded a price of 136,877,000 won, which is a 5.36% increase compared to the previous day at domestic cryptocurrency exchanges.

Bitcoin ( BTC ) has rebounded, recovering the $91,000 mark within a day. Amid the series of friendly moves towards cryptocurrency by major American financial firms, investor sentiment has been stimulated, and expectations for global liquidity expansion have coincided, leading to a collective rise in major cryptocurrencies.

As of 8 AM on the 3rd, based on the global cryptocurrency market, Bitcoin(BTC) is trading at $91,992.34, up 6.22% from 24 hours ago. Ethereum(ETH) has also risen 7.82% to $3,017.71. XRP( has increased by 6.49% to $2.169, and Binance Coin)BNB( is up 6.17% to $880.34. Solana)SOL( is trading at $139.91, having surged by 10.07%.

The domestic market showed the same trend. In domestic cryptocurrency exchanges, BTC recorded 136,877,000 won, up 5.36% from the previous day. ETH rose 6.93% to 4,489,000 won, while XRP is trading at 3,226 won, up 5.74%.

This rebound is analyzed to have been influenced by a series of positive signals from large financial institutions. Bank of America recommended on the 2nd ) local time ( that clients in advisory portfolios should allocate up to 4% of BTC starting in January next year. Large asset management firms, which had previously blocked access to cryptocurrency ETFs, have also reversed their conservative stance by allowing ETF trading.

Bitwise stated in a report that “the recent price movements of BTC show the clearest macroeconomic dislocation in recent years,” adding that “while global liquidity is surging, BTC is unable to keep pace with the increase in money supply and the record-breaking flow of gold. This gap will create opportunities for a rise next year.”

The investment sentiment in cryptocurrency has shifted back to a state of 'extreme fear.' The fear and greed index from a cryptocurrency data analysis company has dropped by 1 point to 23 points compared to the previous day. This index indicates that the closer the value is to 0, the more the investment sentiment is repressed, while the closer it is to 100, the more it indicates market overheating.

![])https://img-cdn.gateio.im/webp-social/moments-2680403b63-26dfdb25e3-153d09-6d5686.webp(