Post content & earn content mining yield

placeholder

The NYSE just surrendered to the ledger.

For years, traditional finance mocked 24/7 markets and instant settlement. Today, they adopted both.

The New York Stock Exchange is launching tokenized trading with on chain settlement, enabling round the clock equities and ETF markets funded by stablecoins.

This is the bullish pivot where legacy finance admits the public ledger is the superior rail.

The clock never stops.

For years, traditional finance mocked 24/7 markets and instant settlement. Today, they adopted both.

The New York Stock Exchange is launching tokenized trading with on chain settlement, enabling round the clock equities and ETF markets funded by stablecoins.

This is the bullish pivot where legacy finance admits the public ledger is the superior rail.

The clock never stops.

- Reward

- like

- Comment

- Repost

- Share

"Stablecoins quietly handled $33 trillion in transactions in 2025."

"In 2025, stablecoins moved a staggering $33 trillion behind the scenes."

"Stablecoins facilitated $33 trillion in transfers quietly in 2025."

"A silent $33 trillion flowed through stablecoins in 2025."

"In 2025, stablecoins moved a staggering $33 trillion behind the scenes."

"Stablecoins facilitated $33 trillion in transfers quietly in 2025."

"A silent $33 trillion flowed through stablecoins in 2025."

- Reward

- like

- Comment

- Repost

- Share

p小将

p小将

Created By@DreamJourney

Listing Progress

100.00%

MC:

$2.43K

Create My Token

#GoldmanEyesPredictionMarkets Goldman Sachs Steps Into Prediction Markets: A Strategic Shift Toward Crowd-Sourced Intelligence

In mid-January 2026, Goldman Sachs CEO David Solomon made headlines during the firm's Q4 2025 earnings call by revealing active exploration into **prediction markets**. Describing them as "super interesting," Solomon disclosed personal meetings with leaders from two major platforms in the sector—widely understood to be Kalshi and Polymarket—and confirmed that dedicated internal teams are dedicating significant time to studying integration opportunities. This move marks

In mid-January 2026, Goldman Sachs CEO David Solomon made headlines during the firm's Q4 2025 earnings call by revealing active exploration into **prediction markets**. Describing them as "super interesting," Solomon disclosed personal meetings with leaders from two major platforms in the sector—widely understood to be Kalshi and Polymarket—and confirmed that dedicated internal teams are dedicating significant time to studying integration opportunities. This move marks

- Reward

- 3

- 8

- Repost

- Share

Discovery :

:

1000x VIbes 🤑View More

$WHITEWHALE

This is what happens when you blindly trust an influencer coin with your money

In the end, someone has got to win and others have got to lose. This is part of the mechanics of the shitcoin market.

Money that comes fast can also disappear just as fast.

This is what happens when you blindly trust an influencer coin with your money

In the end, someone has got to win and others have got to lose. This is part of the mechanics of the shitcoin market.

Money that comes fast can also disappear just as fast.

- Reward

- like

- Comment

- Repost

- Share

#TariffTensionsHitCryptoMarket

🌍 How Geopolitical Risks Are Reshaping the Crypto Market

Geopolitical tensions don’t just dominate headlines — they quietly redirect capital flows, alter market rankings, and reshape investor behavior. In periods of uncertainty, crypto markets reward resilience over speed.

📊 The Core Reality

Rising tensions in the Middle East and the ongoing Ukraine–Russia conflict have intensified volatility and ranking shifts across the crypto market. The separation between structurally strong assets and fragile projects has become increasingly visible.

📈 Market Behavior

Bi

🌍 How Geopolitical Risks Are Reshaping the Crypto Market

Geopolitical tensions don’t just dominate headlines — they quietly redirect capital flows, alter market rankings, and reshape investor behavior. In periods of uncertainty, crypto markets reward resilience over speed.

📊 The Core Reality

Rising tensions in the Middle East and the ongoing Ukraine–Russia conflict have intensified volatility and ranking shifts across the crypto market. The separation between structurally strong assets and fragile projects has become increasingly visible.

📈 Market Behavior

Bi

- Reward

- 1

- 3

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

JUST IN: 🇫🇷 France supports suspending the EU's trade deal with the US.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 4

- Repost

- Share

GateUser-c7e1ce6b :

:

The dog whale ate your chips and then sold them to retail investors at a high price. Now all your chips are in the hands of retail investors, so the price has come back.View More

Ethereum 3040 is empty, set a warning and prepare to stop loss

View Original

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQVDVVPYUW&ref_type=126&shareUid=U1ZCUVxaBgcO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VQVDVVPYUW&ref_type=126&shareUid=U1ZCUVxaBgcO0O0O

- Reward

- like

- Comment

- Repost

- Share

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$62.62KHolders:24

100.00%

- Reward

- like

- Comment

- Repost

- Share

The past two days of this cliff-like decline have left many of our long brothers battered and their accounts in chaos. Some still stubbornly hold on, but the more they resist, the more anxious and deeper they go, leaving only regret and frustration.

But brothers, the market has already played out, and it's too late to regret. What's the use? Once the trend reverses, resisting isn't faith—it's gambling your funds on luck. What's past is past; what we need to do is cut losses, shift direction, and regain the rhythm. Getting out of a losing position isn't waiting for the market to give you a brea

View OriginalBut brothers, the market has already played out, and it's too late to regret. What's the use? Once the trend reverses, resisting isn't faith—it's gambling your funds on luck. What's past is past; what we need to do is cut losses, shift direction, and regain the rhythm. Getting out of a losing position isn't waiting for the market to give you a brea

- Reward

- like

- 1

- Repost

- Share

AZhouWanying :

:

Experienced driver, guide me 📈JUST IN: Strategy’s Bitcoin hoard has surpassed over 700,000 coins worth nearly $64 billion.

BTC-3,73%

- Reward

- like

- Comment

- Repost

- Share

豆包ai

豆包ai

Created By@floki1u

Listing Progress

0.00%

MC:

$3.39K

Create My Token

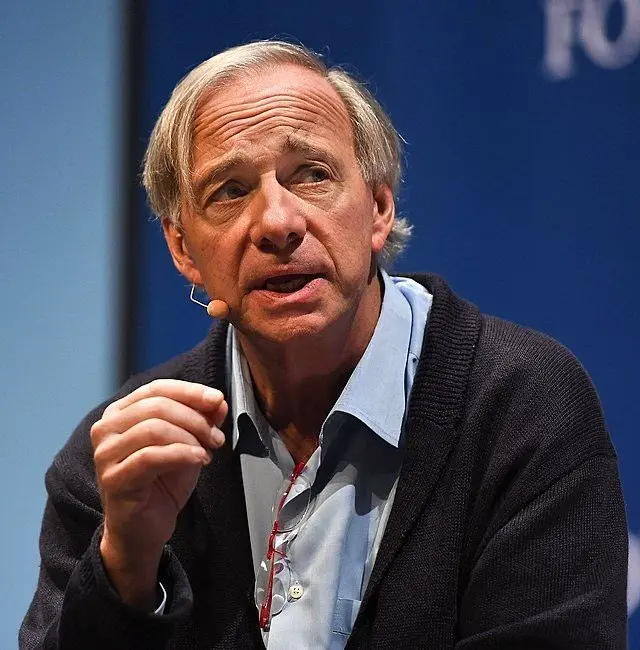

🚨 ARENAR INTEL:

Billionaire investor Ray Dalio warns that President Trump’s aggressive political direction could trigger a new phase of global financial conflict, as foreign governments and investors reconsider their exposure to U.S. assets amid rising economic tensions.

#WorldNews #Markets

Billionaire investor Ray Dalio warns that President Trump’s aggressive political direction could trigger a new phase of global financial conflict, as foreign governments and investors reconsider their exposure to U.S. assets amid rising economic tensions.

#WorldNews #Markets

- Reward

- like

- Comment

- Repost

- Share

January 17, 2026

U23 Men's Asian Cup China vs. Uzbekistan quarter-finals,

The match ended in a draw after 120 minutes,

The picture shows Chinese goalkeeper Li Hao walking towards the goal before the penalty shootout begins.

In the following minutes, Li Hao saved 2 penalties,

Leading China to advance to the semi-finals.

You can't only start to be confident after winning,

That's not confidence, that's a replay of the result.

View OriginalU23 Men's Asian Cup China vs. Uzbekistan quarter-finals,

The match ended in a draw after 120 minutes,

The picture shows Chinese goalkeeper Li Hao walking towards the goal before the penalty shootout begins.

In the following minutes, Li Hao saved 2 penalties,

Leading China to advance to the semi-finals.

You can't only start to be confident after winning,

That's not confidence, that's a replay of the result.

- Reward

- like

- Comment

- Repost

- Share

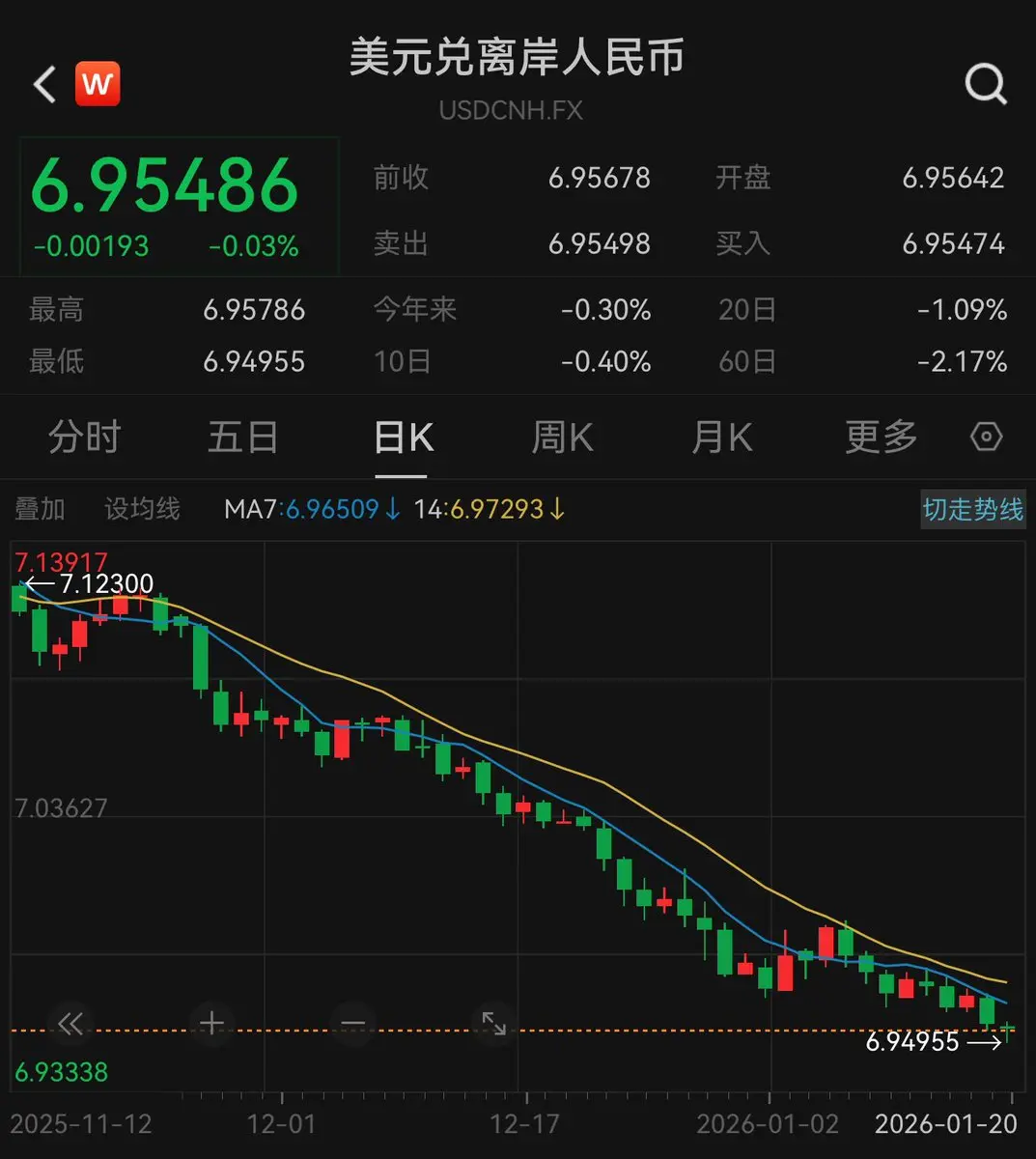

The US dollar is falling like the A-shares of two years ago😃

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$175.17KHolders:77661

100.00%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More9.09K Popularity

37.41K Popularity

50.76K Popularity

12.94K Popularity

9.18K Popularity

Hot Gate Fun

View More- MC:$3.35KHolders:10.00%

- MC:$3.35KHolders:00.00%

- MC:$3.34KHolders:10.00%

- MC:$3.38KHolders:10.00%

- MC:$3.39KHolders:10.00%

News

View MoreCryCry马(CC) and 1(1) perpetual contracts are now live on Gate, supporting 1-10x leverage. Gate Perp DEX is also launching simultaneously.

21 m

Seeker(SKR) will be officially launched on Gate Global on January 21, supporting SKR/USDT spot trading

32 m

Mastercard is weighing strategic investment in Zerohash rather than an acquisition.

57 m

Mastercard is considering investing in Zerohash

57 m

Mastercard is considering investing in Zerohash

58 m

Pin