Post content & earn content mining yield

placeholder

十一

【$SKR Signal】Short | Volume Breakout Downtrend

$SKR is experiencing a volume surge and a crash, with a daily decline of over 26%. Combined with high open interest, this is a typical forced liquidation sell-off rather than a healthy correction.

🎯 Direction: Short (Short)

🎯 Entry: 0.0305 - 0.0315

🛑 Stop Loss: 0.0335 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0270

🚀 Target 2: 0.0240

Price action indicates market sentiment has shifted to panic. Massive sell-offs accompanied by high open interest suggest that long leverage is being systematicall

$SKR is experiencing a volume surge and a crash, with a daily decline of over 26%. Combined with high open interest, this is a typical forced liquidation sell-off rather than a healthy correction.

🎯 Direction: Short (Short)

🎯 Entry: 0.0305 - 0.0315

🛑 Stop Loss: 0.0335 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0270

🚀 Target 2: 0.0240

Price action indicates market sentiment has shifted to panic. Massive sell-offs accompanied by high open interest suggest that long leverage is being systematicall

SKR-19,93%

- Reward

- 1

- Comment

- Repost

- Share

In January 2021, I bought my first $BTC recently, with a cost of about 88,699. Below is a pyramid buy order. -> As macroeconomic conditions become more turbulent, holding fiat currency and US Treasuries is becoming less and less profitable. Other top assets (including US stocks, A-shares, gold, and silver) have already experienced a wild surge, and it should be about $BTC now. -> Global tax collection and compliance tightening are also major trends. The US policy on sovereign funds allocating to US Treasuries and US stocks has also started to fluctuate. Therefore, $BTC , as a non-sovereign a

BTC0,02%

- Reward

- like

- Comment

- Repost

- Share

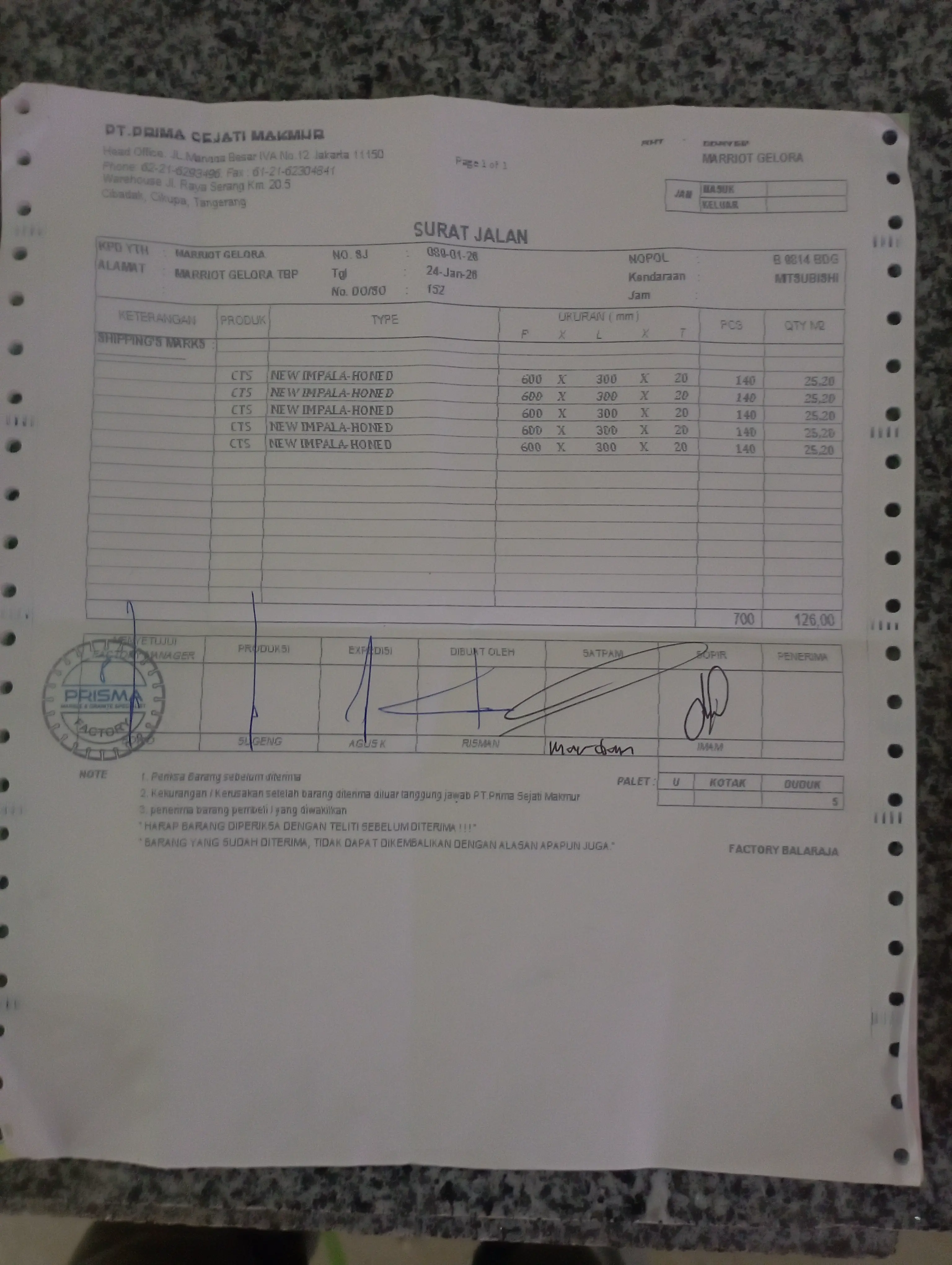

https://www.gate.com/id/competition/f1rb/s5?ref=VQJDB1BWUW&ref_type=165&utm_cmp=AXHKa1jSPromo 6-month discount, starting with the Ubud package..

*Package Price + VAT*:

*Benoa* : 185,000+11%=205,350

*Lovina* : 210,000+11%=233,100

*Ubud* : 223,000+11%=247,530

*Legian* : 225,000+11%=249,750

*Kintamani* : 310,000+11%=344,100

*Pandawa* : 472,000+11%=523,920

Richard : 082123579679

View Original*Package Price + VAT*:

*Benoa* : 185,000+11%=205,350

*Lovina* : 210,000+11%=233,100

*Ubud* : 223,000+11%=247,530

*Legian* : 225,000+11%=249,750

*Kintamani* : 310,000+11%=344,100

*Pandawa* : 472,000+11%=523,920

Richard : 082123579679

- Reward

- 1

- Comment

- Repost

- Share

lingc

凌川币

Created By@GateUser-37158bbb

Listing Progress

0.05%

MC:

$3.47K

Create My Token

#GateWeb3UpgradestoGateDEX My love in the Vietnamese market has received the attention of builders and developers in the industry.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 3

- 3

- Repost

- Share

GateUser-214abd8a :

:

It's still early.View More

On January 24, 2026, at 13:55 (UTC+8), ETH is quoted at approximately $2950 USD, with a 24-hour range of 2893-3020, a slight decline of about 0.5%. Trading volume is sluggish, daily candles show oscillation and convergence, and it is weakly correlated with BTC, showing a slight bearish trend with balanced bulls and bears. Below are actionable strategy plans.

1. Core Key Levels (Priority Order)

- Support: 2890 (intraday strong support), 2850 (mid-term key), 2780 (strong defense)

- Resistance: 2980-3020 (intraday), 3050 (shorts liquidation level), 3100 (previous high pressure)

- Range Anchoring:

1. Core Key Levels (Priority Order)

- Support: 2890 (intraday strong support), 2850 (mid-term key), 2780 (strong defense)

- Resistance: 2980-3020 (intraday), 3050 (shorts liquidation level), 3100 (previous high pressure)

- Range Anchoring:

ETH-0,44%

- Reward

- 1

- Comment

- Repost

- Share

On Friday, the three major US stock indices showed mixed performance, with the Dow Jones Industrial Average closing down nearly 0.6%. The Consumer Discretionary ETF rose about 0.8%, leading the US stock sector ETFs. Apple dipped slightly by 0.12%, marking a nearly 4% decline for the week and the eighth consecutive week of decline, the longest losing streak since May 2022.

Following a sharp decline in the US dollar, precious metal prices continued to soar. Gold prices briefly surpassed $4,990, hitting a new all-time high, up over 8% this week. Silver and platinum reached historic highs, with we

View OriginalFollowing a sharp decline in the US dollar, precious metal prices continued to soar. Gold prices briefly surpassed $4,990, hitting a new all-time high, up over 8% this week. Silver and platinum reached historic highs, with we

- Reward

- like

- Comment

- Repost

- Share

PwC Report Indicates Institutional Embrace of Crypto is Irreversible - - #cryptocurrency #bitcoin #altcoins

BTC0,02%

- Reward

- like

- Comment

- Repost

- Share

#现实世界资产RWA代币化 Seeing the 17 trend predictions from a16z, I have to be honest — RWA tokenization excites me but also makes me cautious.

What excites me is that this truly represents a shift in direction. Moving from purely transaction-driven to infrastructure-driven indicates that the market is finally becoming more rational. Stablecoins are becoming the key for fiat on/off ramps, which means on-chain assets now have a real value anchor, no longer just castles in the air.

But there are more reasons to be wary. I've been in this space for many years and have seen too many "innovative concepts"

View OriginalWhat excites me is that this truly represents a shift in direction. Moving from purely transaction-driven to infrastructure-driven indicates that the market is finally becoming more rational. Stablecoins are becoming the key for fiat on/off ramps, which means on-chain assets now have a real value anchor, no longer just castles in the air.

But there are more reasons to be wary. I've been in this space for many years and have seen too many "innovative concepts"

- Reward

- 3

- 3

- Repost

- Share

MamaWang :

:

Tokenized gold, silver, stocks, and real estate will become trends.View More

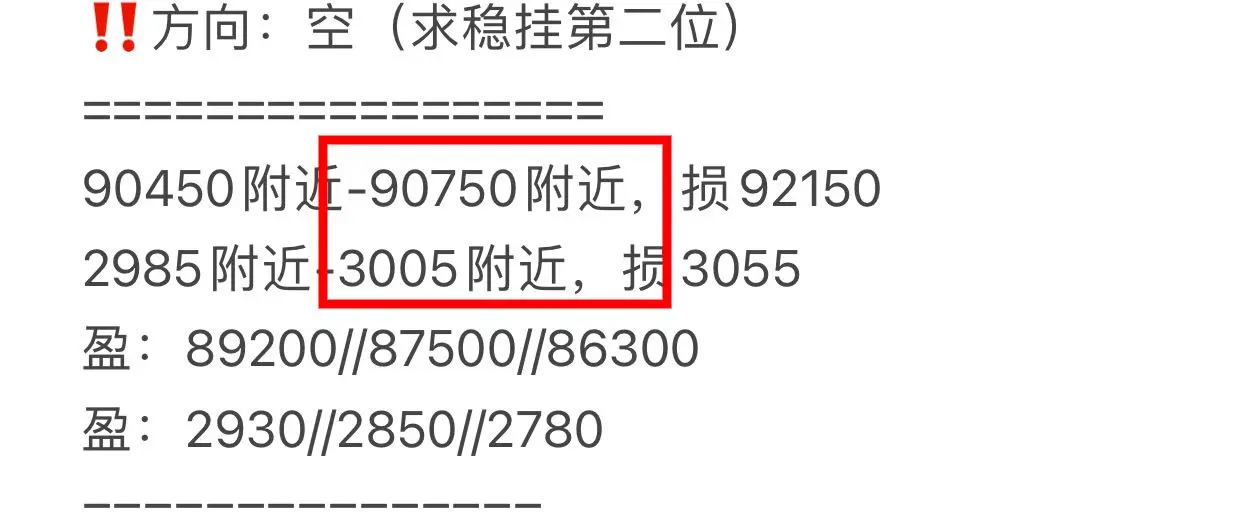

‼️Second order⬇️

‼️Direction: Long

Around 88,850 - 88,550, loss at 87,150

Around 2,915 - 2,895, loss at 2,845

Profit: 89,800 // 91,500 // 93,500

Profit: 2,965 // 3,015 // 3,085

#特朗普取消对欧关税威胁

View Original‼️Direction: Long

Around 88,850 - 88,550, loss at 87,150

Around 2,915 - 2,895, loss at 2,845

Profit: 89,800 // 91,500 // 93,500

Profit: 2,965 // 3,015 // 3,085

#特朗普取消对欧关税威胁

- Reward

- 1

- Comment

- Repost

- Share

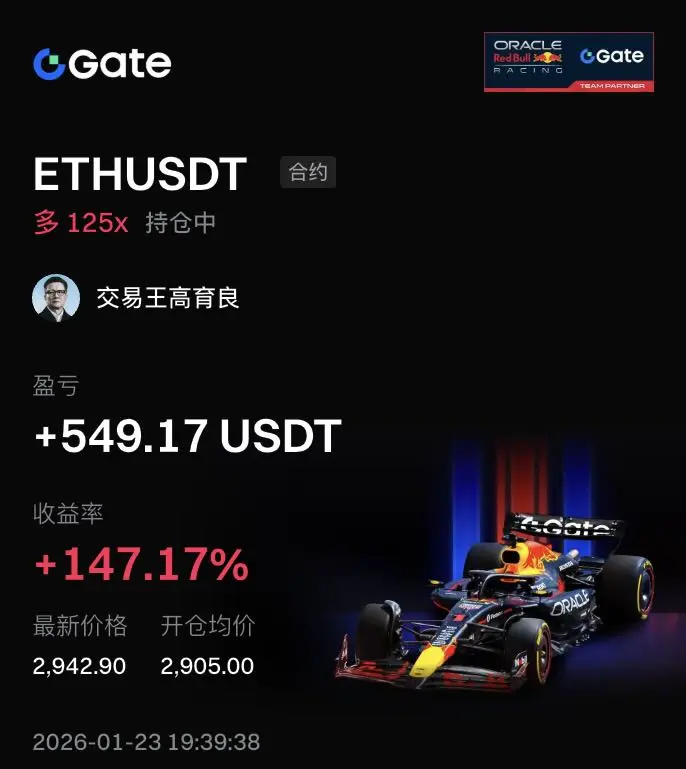

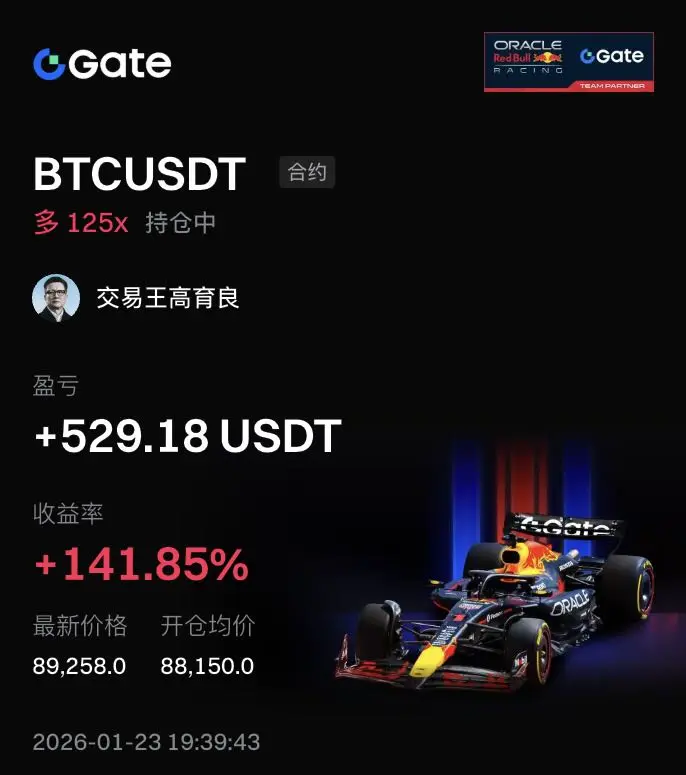

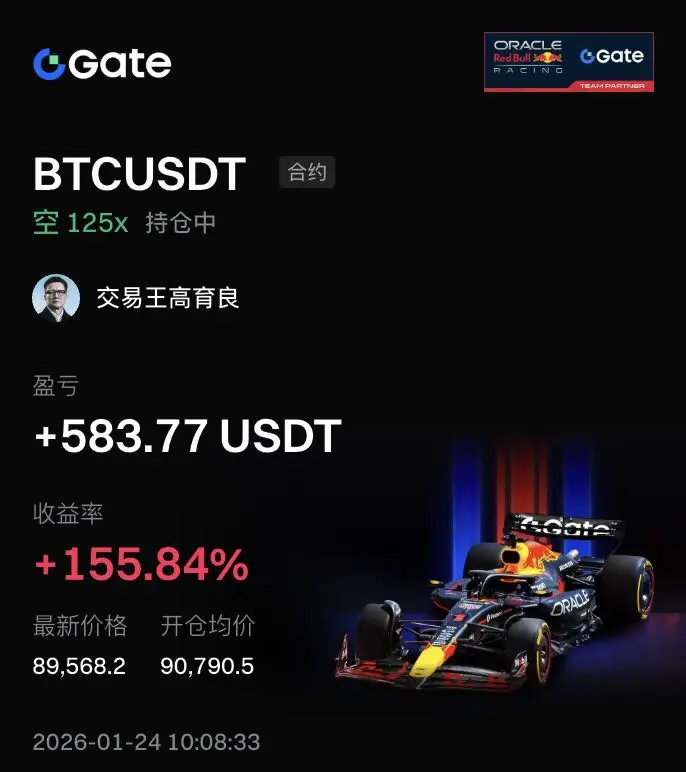

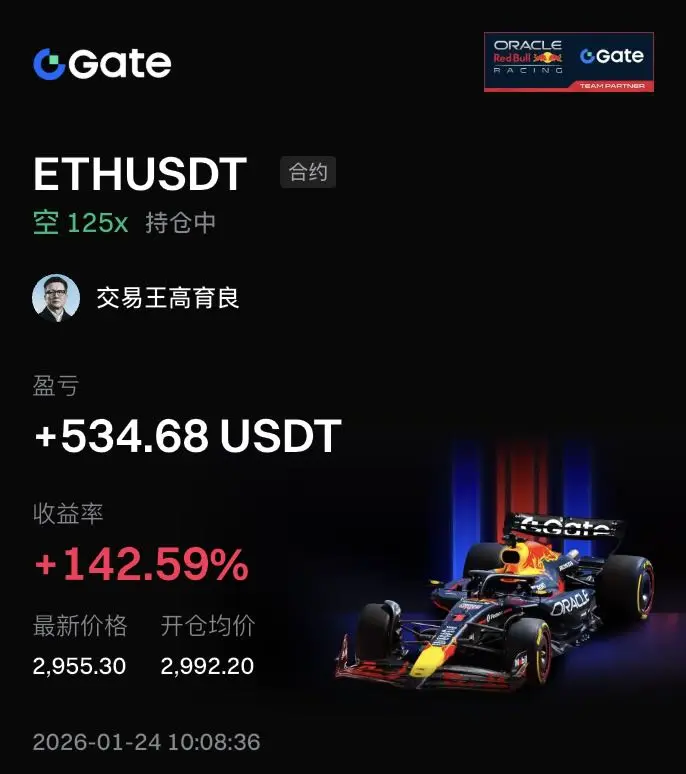

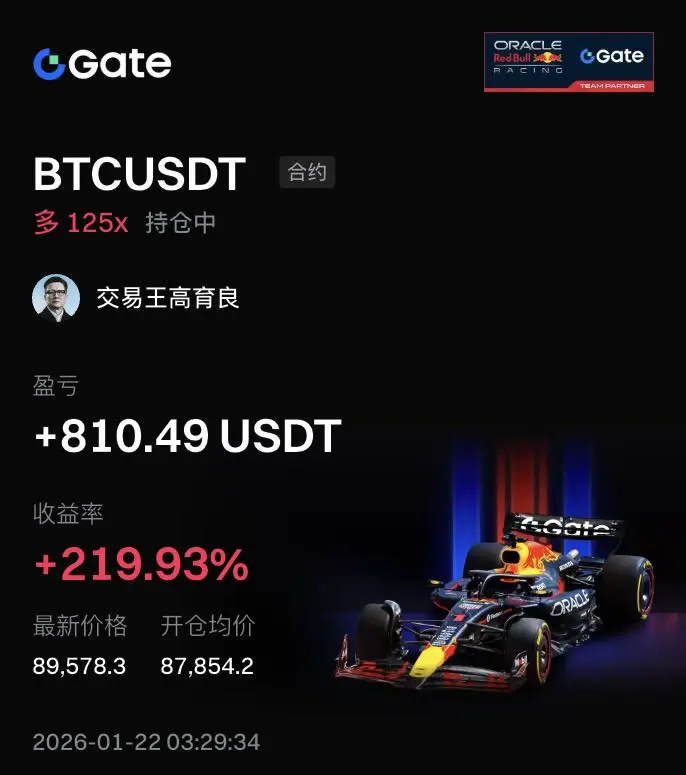

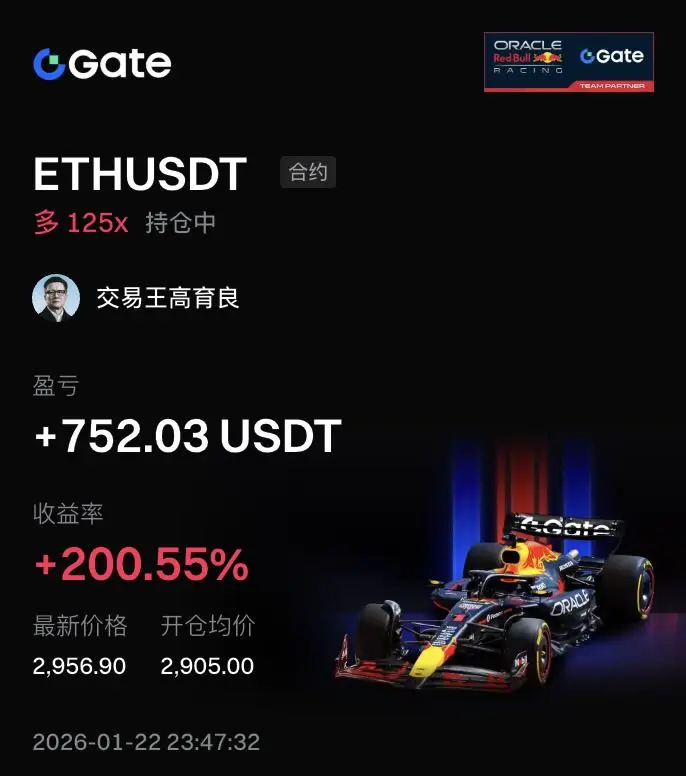

Weekend Review: Total profit this week exceeds 1500%! Total return nearly 5000 USDT!

Real-time performance shock release

ETH Long Positions Explosive Growth

· Average opening price: 2,895.10

· Current price: 3,029.30

· Return rate: +506.34%

· Profit amount: 1,791.57 USDT

· Status: Strong trend, continue holding

BTC Long Positions Steady Uptrend

· Average opening price: 87,854.2

· Current price: 90,084.4

· Return rate: +282.91%

· Profit amount: 1,048.41 USDT

· Status: Breakthrough key resistance, target towards 92,000

Total profit of dual currencies: 2,839.98 USDT | Overall return rate: 394.6%

View OriginalReal-time performance shock release

ETH Long Positions Explosive Growth

· Average opening price: 2,895.10

· Current price: 3,029.30

· Return rate: +506.34%

· Profit amount: 1,791.57 USDT

· Status: Strong trend, continue holding

BTC Long Positions Steady Uptrend

· Average opening price: 87,854.2

· Current price: 90,084.4

· Return rate: +282.91%

· Profit amount: 1,048.41 USDT

· Status: Breakthrough key resistance, target towards 92,000

Total profit of dual currencies: 2,839.98 USDT | Overall return rate: 394.6%

- Reward

- like

- 1

- Repost

- Share

StopTeasingMeAlready,Okay? :

:

Hmm.#GoldandSilverHitNewHighs Strategic Takeaways

Whale Activity: While retail sentiment is currently shaky, on-chain data shows whales are allocating more margin to long bets, signaling conviction that this is a "shake-out" before the next leg up.

Institutional Floor: Spot ETF inflows have stabilized rather than reversed, suggesting that the "quiet accumulation" you noted is indeed the primary driver for long-term support.

The "Leverage Flush": With over $850 million in long liquidations hitting the market recently, the system is much "lighter" and ready for a more sustainable move.

The Verdict:

Whale Activity: While retail sentiment is currently shaky, on-chain data shows whales are allocating more margin to long bets, signaling conviction that this is a "shake-out" before the next leg up.

Institutional Floor: Spot ETF inflows have stabilized rather than reversed, suggesting that the "quiet accumulation" you noted is indeed the primary driver for long-term support.

The "Leverage Flush": With over $850 million in long liquidations hitting the market recently, the system is much "lighter" and ready for a more sustainable move.

The Verdict:

- Reward

- 3

- 5

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$36.17K

Create My Token

#CryptoMarketWatch ENSO EXPLOSION IMMINENT $1

Entry: 1.184 🟩

Target 1: 1.286 🎯

Stop Loss: 0.654 🛑

This is NOT a drill. $ENSO is PUMPING. 80% gains in 24 hours are just the warm-up. The chart is screaming BUY. Forget retracements, we’re chasing the next ATH. Major resistance is broken. Volume is insane. This is your chance to catch a rocket. Don't get left behind. The market is moving NOW.

Not financial advice.

Entry: 1.184 🟩

Target 1: 1.286 🎯

Stop Loss: 0.654 🛑

This is NOT a drill. $ENSO is PUMPING. 80% gains in 24 hours are just the warm-up. The chart is screaming BUY. Forget retracements, we’re chasing the next ATH. Major resistance is broken. Volume is insane. This is your chance to catch a rocket. Don't get left behind. The market is moving NOW.

Not financial advice.

ENSO36,69%

- Reward

- like

- Comment

- Repost

- Share

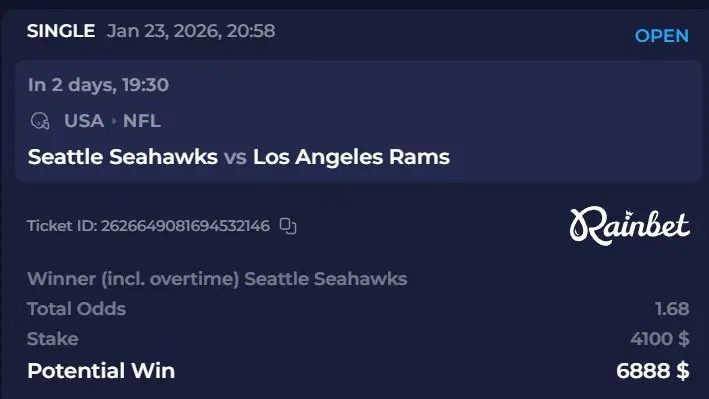

Seahawks to win it all imo

- Reward

- like

- Comment

- Repost

- Share

#现实世界资产RWA代币化 Seeing the 17 trend predictions from a16z, I have to be honest — RWA tokenization excites me but also makes me cautious.

What excites me is that this truly represents a shift in direction. Moving from purely transaction-driven to infrastructure-driven indicates that the market is finally becoming more rational. Stablecoins are becoming the key for fiat on/off ramps, which means on-chain assets now have a real value anchor, no longer just castles in the air.

But there are more reasons to be wary. I've been in this space for many years and have seen too many "innovative concepts"

View OriginalWhat excites me is that this truly represents a shift in direction. Moving from purely transaction-driven to infrastructure-driven indicates that the market is finally becoming more rational. Stablecoins are becoming the key for fiat on/off ramps, which means on-chain assets now have a real value anchor, no longer just castles in the air.

But there are more reasons to be wary. I've been in this space for many years and have seen too many "innovative concepts"

- Reward

- 3

- 3

- Repost

- Share

MamaWang :

:

Tokenized gold, silver, stocks, and real estate will become trends.View More

What\'s stopping you from getting rich this year?

- Reward

- like

- Comment

- Repost

- Share

📊 Today's Market Key Developments

· Latest Price: According to this morning's news, Ethereum has broken through and surpassed $3000. However, recent analysis shows that the price faces resistance when attempting to break above this level again.

· Key Resistance Level: $3000-$3050 is the current core resistance zone. Multiple attempts to break through have failed, indicating strong selling pressure in this area.

· Key Support Level: The primary support is in the $2900-$2920 range. If broken, the next significant support is at $2850-$2880.

· Market Sentiment Signals: The funding rates in the de

· Latest Price: According to this morning's news, Ethereum has broken through and surpassed $3000. However, recent analysis shows that the price faces resistance when attempting to break above this level again.

· Key Resistance Level: $3000-$3050 is the current core resistance zone. Multiple attempts to break through have failed, indicating strong selling pressure in this area.

· Key Support Level: The primary support is in the $2900-$2920 range. If broken, the next significant support is at $2850-$2880.

· Market Sentiment Signals: The funding rates in the de

ETH-0,44%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More38.26K Popularity

21.87K Popularity

15.84K Popularity

4K Popularity

11.73K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.47KHolders:20.04%

- MC:$0.1Holders:10.00%

- MC:$3.42KHolders:10.00%

- MC:$3.66KHolders:21.07%

News

View MoreThe Ethereum Foundation has assembled a quantum team to shift research into engineering practice.

15 m

Rainbow will launch the CCA auction on Uniswap on February 2nd.

20 m

Paradex caused liquidation due to database maintenance errors, refunding $650,000 to 200 users

56 m

Yesterday, the US spot Ethereum ETF experienced a net outflow of $41.7 million, marking the fourth consecutive day of net outflows.

1 h

Ethereum spot ETF saw a net outflow of $41,735,800 yesterday, continuing a 4-day net outflow.

1 h

Pin