Post content & earn content mining yield

placeholder

ZhouXingxing'sDream

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRBAW9BBW

View Original

- Reward

- 2

- Comment

- Repost

- Share

DOGE Alarm Is Sounding: Is the Countdown for a Rally Starting?

Exciting developments in Dogecoin are coming one after another.

So, can this momentum really push DOGE higher?

Elon Musk Factor Returns to DOGE

According to social data platform LunarCrush, mentions of Dogecoin have increased by 33.19% in the past month compared to the previous month.

This significant rise indicates that interest in meme coins is strongly returning.

According to LunarCrush reports, discussions are centered around three main topics:

Technical analysis of DOGE, Elon Musk’s influence on the token, and DOGE’s deeper in

Exciting developments in Dogecoin are coming one after another.

So, can this momentum really push DOGE higher?

Elon Musk Factor Returns to DOGE

According to social data platform LunarCrush, mentions of Dogecoin have increased by 33.19% in the past month compared to the previous month.

This significant rise indicates that interest in meme coins is strongly returning.

According to LunarCrush reports, discussions are centered around three main topics:

Technical analysis of DOGE, Elon Musk’s influence on the token, and DOGE’s deeper in

DOGE-0,16%

- Reward

- 2

- 1

- Repost

- Share

BananaBallaBigOrange :

:

Elon Musk is waiting for you on the MoonCXU

宸光序

Created By@GateUser-3c8482cc

Subscription Progress

0.00%

MC:

$0

More Tokens

🔹 Institutional Move: Harvard University Q4 Reveals Bitcoin Reduction, Ethereum Increase, and Notable Losses

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

【$SOL Signal】Pullback to Long! 1H RSI Bottom Divergence + 4H Key Support, Clear Signs of Main Force Protecting the Market

$SOL The 1H timeframe is oscillating around a critical support zone (83.0-83.5). RSI( on the 1H chart has dropped to 38.5, showing early signs of bottom divergence, indicating selling exhaustion. Although the 4H chart is below the EMA50, the price has retested the recent support zone's lower boundary, and open interest (OI) remains stable, with no signs of panic selling. Coupled with negative funding rates, there is potential for a short squeeze rebound. Currently, the orde

View Original$SOL The 1H timeframe is oscillating around a critical support zone (83.0-83.5). RSI( on the 1H chart has dropped to 38.5, showing early signs of bottom divergence, indicating selling exhaustion. Although the 4H chart is below the EMA50, the price has retested the recent support zone's lower boundary, and open interest (OI) remains stable, with no signs of panic selling. Coupled with negative funding rates, there is potential for a short squeeze rebound. Currently, the orde

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

$RAY /USDT ANALYSIS

RAY is holding the descending channel support and showing early strength. The 50MA is the key barrier right below the upper trendline.

Clear breakout above both levels could trigger aggressive upside momentum. Rejection there keeps the structure intact and consolidation in play.$RAY

#GateSpringFestivalHorseRacingEvent #HongKongPlansNewVAGuidelines

RAY is holding the descending channel support and showing early strength. The 50MA is the key barrier right below the upper trendline.

Clear breakout above both levels could trigger aggressive upside momentum. Rejection there keeps the structure intact and consolidation in play.$RAY

#GateSpringFestivalHorseRacingEvent #HongKongPlansNewVAGuidelines

RAY8,69%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- 4

- Repost

- Share

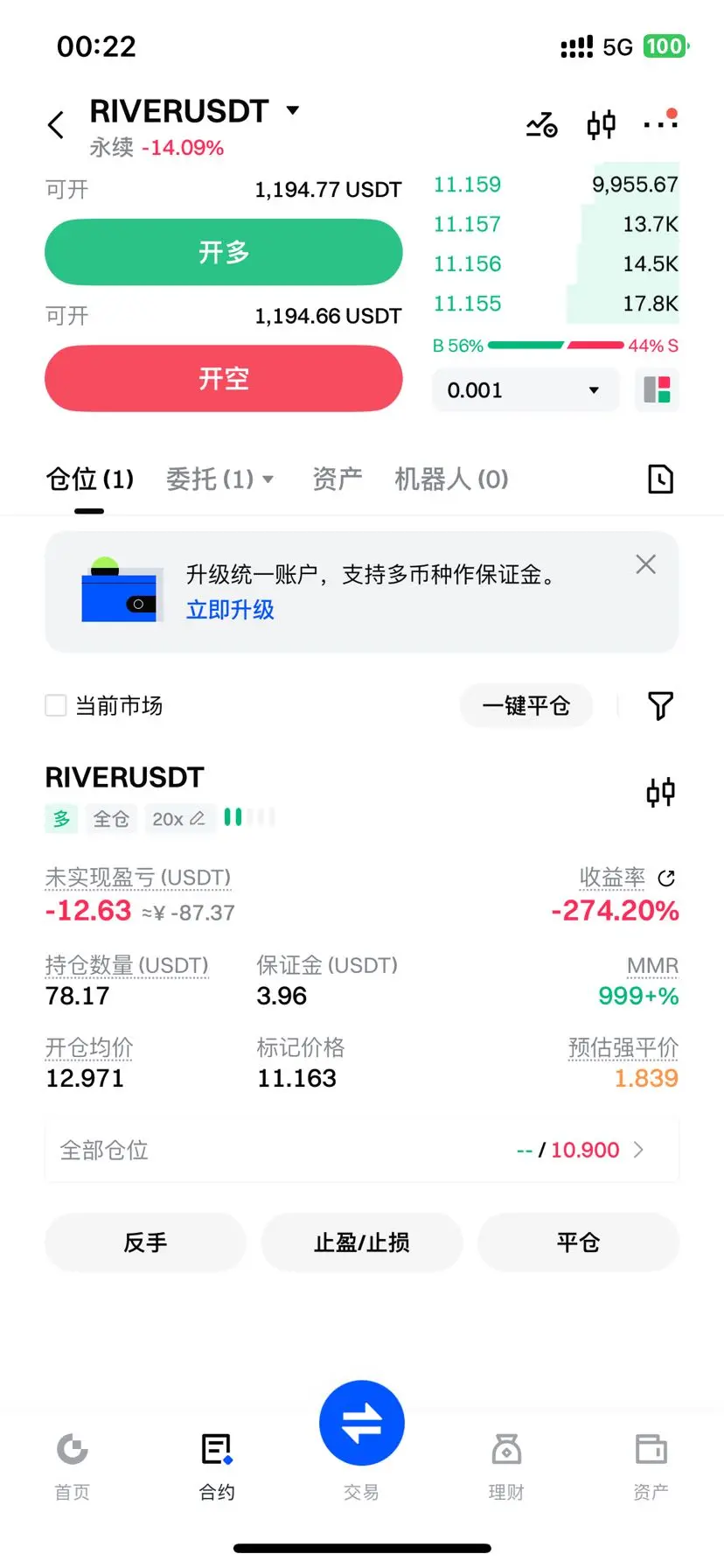

GateUser-84958c48 :

:

Close your position quickly; once you close it, it will soar.View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVEWV1AJUQ

View Original

- Reward

- 2

- Comment

- Repost

- Share

Bling Snacks

blingblingsnacks

Created By@PiHomework

Listing Progress

0.00%

MC:

$0.1

More Tokens

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJEA1TCUG

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AgJCA18

View Original

- Reward

- 2

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQDEBFFAAQ

View Original

- Reward

- 2

- Comment

- Repost

- Share

Crypto market remains range bound. with total market cap rebounding 0.2 in the past 24 hours

- Reward

- like

- Comment

- Repost

- Share

Start the Year of the Horse with a win! Gate Plaza's $50,000 Red Envelope Rain is waiting for you to post and smash https://www.gate.com/campaigns/4044?ref=UldFUFgK&ref_type=132

View Original

- Reward

- 2

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVURUQWNCQ

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More180.79K Popularity

37.68K Popularity

35.23K Popularity

77.78K Popularity

16.34K Popularity

Hot Gate Fun

View More- MC:$2.48KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

- MC:$2.48KHolders:10.00%

News

View MoreTesla stock price drops to a more than one-week low, down 3%

4 m

Bal: The neutral interest rate level has slightly increased but has not changed dramatically

5 m

Bahr: The expected impact of tariffs on inflation is projected to diminish by the end of the year

27 m

Baal: Evidence must show that commodity price inflation continues to decline before interest rate cuts.

27 m

Bahr: The persistent inflation rate above 2% poses significant risks

29 m

Pin