# HasTheMarketDipped?

171.98K

The market is volatile. Do you think the market has dipped? Should we continue to wait for a better trend or buy the dip? Share your views.

dragon_fly2

🎉 Congratulations to Our Outstanding Contributors! 🎉

We’re thrilled to announce the winners of the Plaza Recommended Topic Posting Activity!

Your insights, creativity, and passion continue to light up the community. 👏

🏆 Prize Winners:

1️⃣ #加密行情预测 (Crypto Market Prediction)

LittleQueen, Mr. LV, K-Line Prince, Cryptoself, Crypto Rhino Brother Community

2️⃣ #非农数据超预期 (NFP Data Above Expectations)

HighAmbition💐🎉, MakingMoneyEatMeat, KatyPaty, Luna_Star, Ryakpanda

3️⃣ #市场触底了吗? (Has the Market Bottomed?)

repanzal, Cryptochampion, Spicy Hand Toning Coins, Eagle Eye, yusfirah

4️⃣ #加密市场反弹 (Crypto

We’re thrilled to announce the winners of the Plaza Recommended Topic Posting Activity!

Your insights, creativity, and passion continue to light up the community. 👏

🏆 Prize Winners:

1️⃣ #加密行情预测 (Crypto Market Prediction)

LittleQueen, Mr. LV, K-Line Prince, Cryptoself, Crypto Rhino Brother Community

2️⃣ #非农数据超预期 (NFP Data Above Expectations)

HighAmbition💐🎉, MakingMoneyEatMeat, KatyPaty, Luna_Star, Ryakpanda

3️⃣ #市场触底了吗? (Has the Market Bottomed?)

repanzal, Cryptochampion, Spicy Hand Toning Coins, Eagle Eye, yusfirah

4️⃣ #加密市场反弹 (Crypto

- Reward

- 6

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

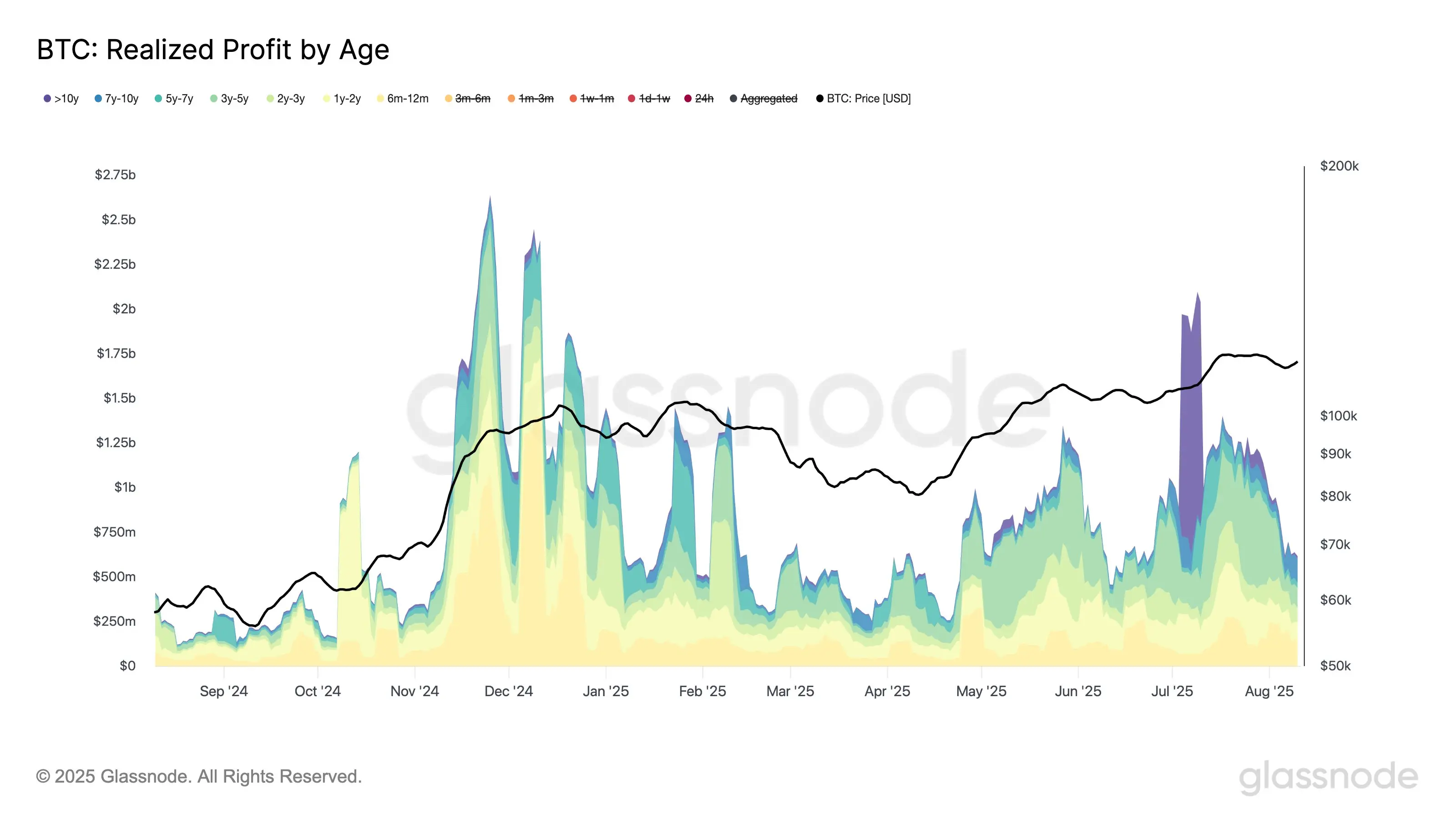

#HasTheMarketDipped? Has the Market Truly Dipped? Crypto Market Outlook — Early 2026 and Beyond

As the crypto market transitions from late-2025 into early 2026, price action continues to reflect structural consolidation rather than distribution. Bitcoin remains resilient above prior cycle breakout zones, fluctuating near the high-$80,000s to low-$90,000s range, while Ethereum holds firmly just under the $3,000 psychological level. Volatility has compressed further, suggesting that the market is absorbing supply rather than signaling exhaustion. Historically, extended low-volatility phases at e

As the crypto market transitions from late-2025 into early 2026, price action continues to reflect structural consolidation rather than distribution. Bitcoin remains resilient above prior cycle breakout zones, fluctuating near the high-$80,000s to low-$90,000s range, while Ethereum holds firmly just under the $3,000 psychological level. Volatility has compressed further, suggesting that the market is absorbing supply rather than signaling exhaustion. Historically, extended low-volatility phases at e

- Reward

- 9

- 1

- Repost

- Share

Crypto_Buzz_with_Alex :

:

⚡ “Energy here is contagious, loving the crypto charisma!”#HasTheMarketDipped? Crypto Market Update — December 26, 2025 & 2026 Outlook

As December 2025 comes to a close, the crypto market is showing signs of consolidation rather than a sharp decline. Bitcoin (BTC) is trading near $89,000, holding a range-bound structure with reduced volatility and lighter year-end volumes. Similarly, Ethereum (ETH) is hovering around $2,900, reflecting steady support and ongoing anticipation for network upgrades and institutional adoption. Market activity is subdued, which is typical at year-end, with traders focusing on positioning and profit-taking rather than pani

As December 2025 comes to a close, the crypto market is showing signs of consolidation rather than a sharp decline. Bitcoin (BTC) is trading near $89,000, holding a range-bound structure with reduced volatility and lighter year-end volumes. Similarly, Ethereum (ETH) is hovering around $2,900, reflecting steady support and ongoing anticipation for network upgrades and institutional adoption. Market activity is subdued, which is typical at year-end, with traders focusing on positioning and profit-taking rather than pani

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

Thank you for the information and sharing.#HasTheMarketDipped? The Bank of Japan’s “Historic Rate Hike” Becomes the Market’s Sole Driver

The Bank of Japan (BOJ) concluded its monetary policy meeting on December 18–19, 2025, announcing a 25-basis-point increase to 0.75%, the highest level since 1995. This decision marks a significant shift away from decades of ultra-loose monetary policy. Strong wage growth and rising business confidence, particularly among large manufacturers reaching a four-year high, provided further justification for normalization. This move is not just a domestic event but has immediate implications for global cap

The Bank of Japan (BOJ) concluded its monetary policy meeting on December 18–19, 2025, announcing a 25-basis-point increase to 0.75%, the highest level since 1995. This decision marks a significant shift away from decades of ultra-loose monetary policy. Strong wage growth and rising business confidence, particularly among large manufacturers reaching a four-year high, provided further justification for normalization. This move is not just a domestic event but has immediate implications for global cap

BTC-1,14%

- Reward

- 12

- 3

- Repost

- Share

Ryakpanda :

:

Christmas rush! 🚀View More

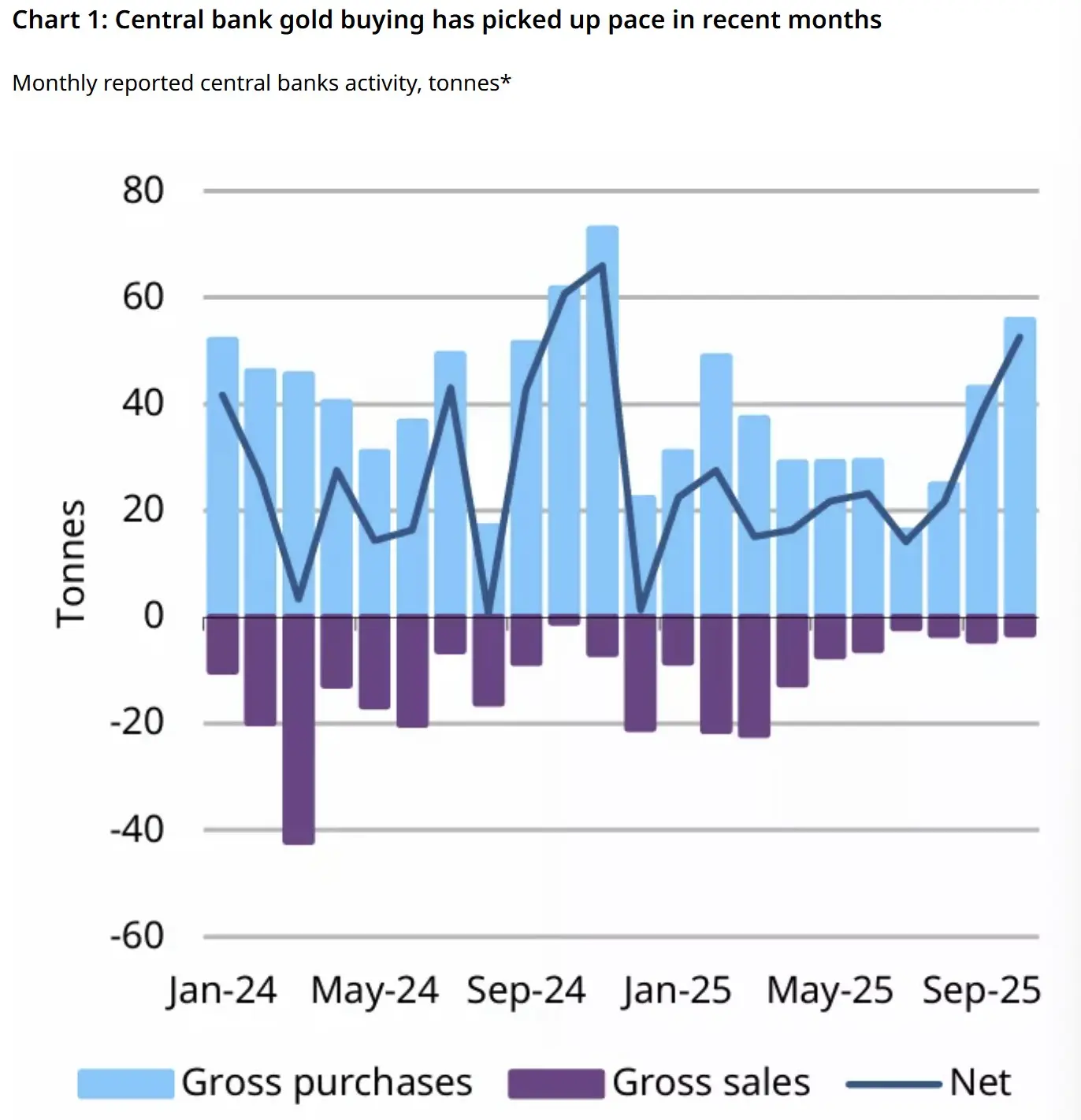

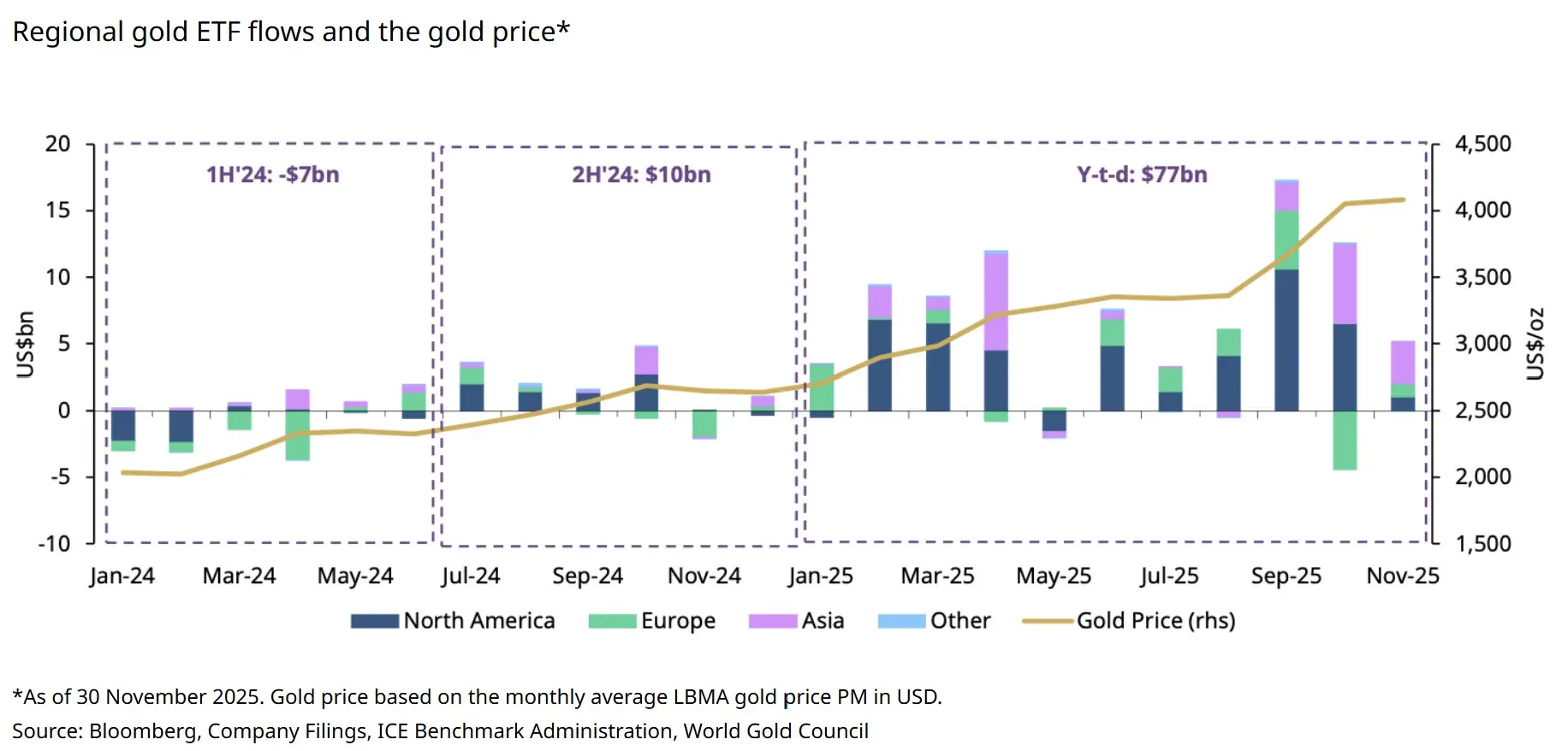

The Bitcoin-to-gold ratio fell 50% in 2025: Here’s why

The Bitcoin-to-gold ratio, which highlights the ounces of gold required to purchase one BTC, has retraced to 20 ounces per BTC, down roughly 50% from around 40 ounces in December 2024. Rather than a collapse in Bitcoin ( $BTC ) demand, this sharp shift reflected the unique macroeconomic regime of 2025, where gold’s asset performance dominated that of the crypto asset.

Why gold ( $XAUT ) dominated the store-of-value bid in 2025

Gold led the global store-of-value bid in 2025, delivering a year-to-date (YTD) gain of 63% and breaking above $4,

The Bitcoin-to-gold ratio, which highlights the ounces of gold required to purchase one BTC, has retraced to 20 ounces per BTC, down roughly 50% from around 40 ounces in December 2024. Rather than a collapse in Bitcoin ( $BTC ) demand, this sharp shift reflected the unique macroeconomic regime of 2025, where gold’s asset performance dominated that of the crypto asset.

Why gold ( $XAUT ) dominated the store-of-value bid in 2025

Gold led the global store-of-value bid in 2025, delivering a year-to-date (YTD) gain of 63% and breaking above $4,

- Reward

- 6

- 3

- Repost

- Share

Vortex_King :

:

Bull Run 🐂View More

The Long Night Will End: Why Now Is a Critical Period to Layout Altcoins for 2026

Most altcoins are nearing the end of their decline, so now is the time to watch the market with a "ready to buy" mindset, rather than waiting for a rebound to short.

The darkest moments in the market are often the times when clear-headed thinking is most needed.

When market confidence is low, we should pay more attention to the signals from data and structural changes. Based on multiple analyses, a consensus is forming: the current altcoin market has entered the tail end of its decline, and the macro and regulato

Most altcoins are nearing the end of their decline, so now is the time to watch the market with a "ready to buy" mindset, rather than waiting for a rebound to short.

The darkest moments in the market are often the times when clear-headed thinking is most needed.

When market confidence is low, we should pay more attention to the signals from data and structural changes. Based on multiple analyses, a consensus is forming: the current altcoin market has entered the tail end of its decline, and the macro and regulato

- Reward

- 7

- 5

- Repost

- Share

FuckTheMudHorse :

:

Wow, it's still okay.View More

#HasTheMarketDipped? I think this week we are gonna pump really hard and break $94k

Or else we are gonna dump really hard and break below $85k.

Massive expiry on 26th December so be prepared for some insane volatility.

Or else we are gonna dump really hard and break below $85k.

Massive expiry on 26th December so be prepared for some insane volatility.

- Reward

- like

- Comment

- Repost

- Share

#HasTheMarketDipped? The Bank of Japan’s “Historic Rate Hike” Becomes the Market’s Key Driver

The global financial landscape is at a critical juncture as the Bank of Japan (BOJ) raised its benchmark interest rate by 25 basis points to 0.75%, the highest level since 1995. This decision, unanimously approved by the BOJ Policy Board, reflects a significant shift from decades of ultra-loose monetary policy. It follows strong wage growth and rising business confidence in Japan, signaling that inflation and economic momentum support a move toward policy normalization.

The rate hike has immediate imp

The global financial landscape is at a critical juncture as the Bank of Japan (BOJ) raised its benchmark interest rate by 25 basis points to 0.75%, the highest level since 1995. This decision, unanimously approved by the BOJ Policy Board, reflects a significant shift from decades of ultra-loose monetary policy. It follows strong wage growth and rising business confidence in Japan, signaling that inflation and economic momentum support a move toward policy normalization.

The rate hike has immediate imp

BTC-1,14%

- Reward

- 5

- 1

- Repost

- Share

StylishKuri :

:

HODL Tight 💪Asia Morning Briefing: Hyperliquid Enters the Solana-Style Valuation Debate as Markets Stay Cautious

Asia wakes up to a market narrative that feels familiar, but sharper this time. A new valuation debate is forming around Hyperliquid, and it closely resembles the way Solana began to be viewed in its last major cycle. The shift is subtle but important. Instead of being treated as just another DeFi protocol riding speculative flows, Hyperliquid is increasingly framed as financial infrastructure with operating leverage, cash flow dynamics, and long-term economic gravity.

At the center of this dis

Asia wakes up to a market narrative that feels familiar, but sharper this time. A new valuation debate is forming around Hyperliquid, and it closely resembles the way Solana began to be viewed in its last major cycle. The shift is subtle but important. Instead of being treated as just another DeFi protocol riding speculative flows, Hyperliquid is increasingly framed as financial infrastructure with operating leverage, cash flow dynamics, and long-term economic gravity.

At the center of this dis

BTC-1,14%

- Reward

- 7

- 3

- Repost

- Share

Mahamtrader :

:

HODL Tight 💪View More

#HasTheMarketDipped?

Many people in crypto are asking one simple question: Has the market dipped, or is this just a short pause? Market dips are very common and happen in every financial market. Prices do not move in one straight line. Sometimes the market goes up, sometimes it moves sideways, and sometimes it goes down to take a break. In crypto, these dips feel stronger because prices move faster and emotions play a bigger role.

A dip does not always mean the market is over. Often, it happens because of fear, news, profit booking, or macro events like economic data and interest rate expecta

Many people in crypto are asking one simple question: Has the market dipped, or is this just a short pause? Market dips are very common and happen in every financial market. Prices do not move in one straight line. Sometimes the market goes up, sometimes it moves sideways, and sometimes it goes down to take a break. In crypto, these dips feel stronger because prices move faster and emotions play a bigger role.

A dip does not always mean the market is over. Often, it happens because of fear, news, profit booking, or macro events like economic data and interest rate expecta

BTC-1,14%

- Reward

- 21

- 16

- Repost

- Share

FoxFox :

:

when altcoins have bull ?? 🤔🤔🤔🤔View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

845.66K Popularity

308.55K Popularity

152.72K Popularity

406.98K Popularity

38.56K Popularity

186.32K Popularity

240.95K Popularity

194.82K Popularity

271.81K Popularity

96.56K Popularity

6.07M Popularity

56.42K Popularity

5.37M Popularity

397.23K Popularity

59.83K Popularity

News

View More1inch Network upgrades its platform, reducing the median execution time for Swap transactions to 14 seconds

3 m

Circle CEXed $1 Billion USDC on Solana in Past 10 Hours

5 m

Crypto Fear Index drops to 10, market "Extreme Fear" has lasted nearly a month

12 m

Data: If BTC drops below $64,869, the total long liquidation strength on mainstream CEXs will reach $1.604 billion.

14 m

Solomon: The market needs a few weeks to digest the Iran situation, and risk assets require higher premiums

27 m

Pin