@gcsbtc @RallyOnChain is flooding the screen

View OriginalQuanZhilongHK

No content yet

QuanZhilongHK

The ApeCoin ecosystem is entering a brand new phase. The latest update from @apecoin shows significant progress on the ApeChain L3 testnet, with on-chain interaction costs dropping notably, providing more flexibility for NFT game and metaverse development.

As a member of the BAYC community, I have completed APE staking and continue to participate in building the Otherside ecosystem. The low-cost, high-performance on-chain environment will further enhance user engagement and asset utilization efficiency.

Feel free to share your staking strategies and practical experiences within the ApeChain ec

As a member of the BAYC community, I have completed APE staking and continue to participate in building the Otherside ecosystem. The low-cost, high-performance on-chain environment will further enhance user engagement and asset utilization efficiency.

Feel free to share your staking strategies and practical experiences within the ApeChain ec

APE0.85%

- Reward

- like

- Comment

- Repost

- Share

The accelerated development of quantum computing is reshaping the landscape of cryptographic security, with the traditional public blockchain cryptosystems facing the potential threat of "Store-Now-Decrypt-Later." Against this backdrop, Quranium has proposed an on-chain infrastructure roadmap centered on quantum security.

Quranium adopts the SLH-DSA signature scheme based on SHA-256 hashing, combined with a Proof-of-Stake (PoS) consensus mechanism, aiming to provide full-stack encryption guarantees for the quantum era. Its goal is not only to withstand the decryption capabilities of future qua

View OriginalQuranium adopts the SLH-DSA signature scheme based on SHA-256 hashing, combined with a Proof-of-Stake (PoS) consensus mechanism, aiming to provide full-stack encryption guarantees for the quantum era. Its goal is not only to withstand the decryption capabilities of future qua

- Reward

- 2

- 2

- Repost

- Share

XPapaDonsX :

:

HODL Tight 💪View More

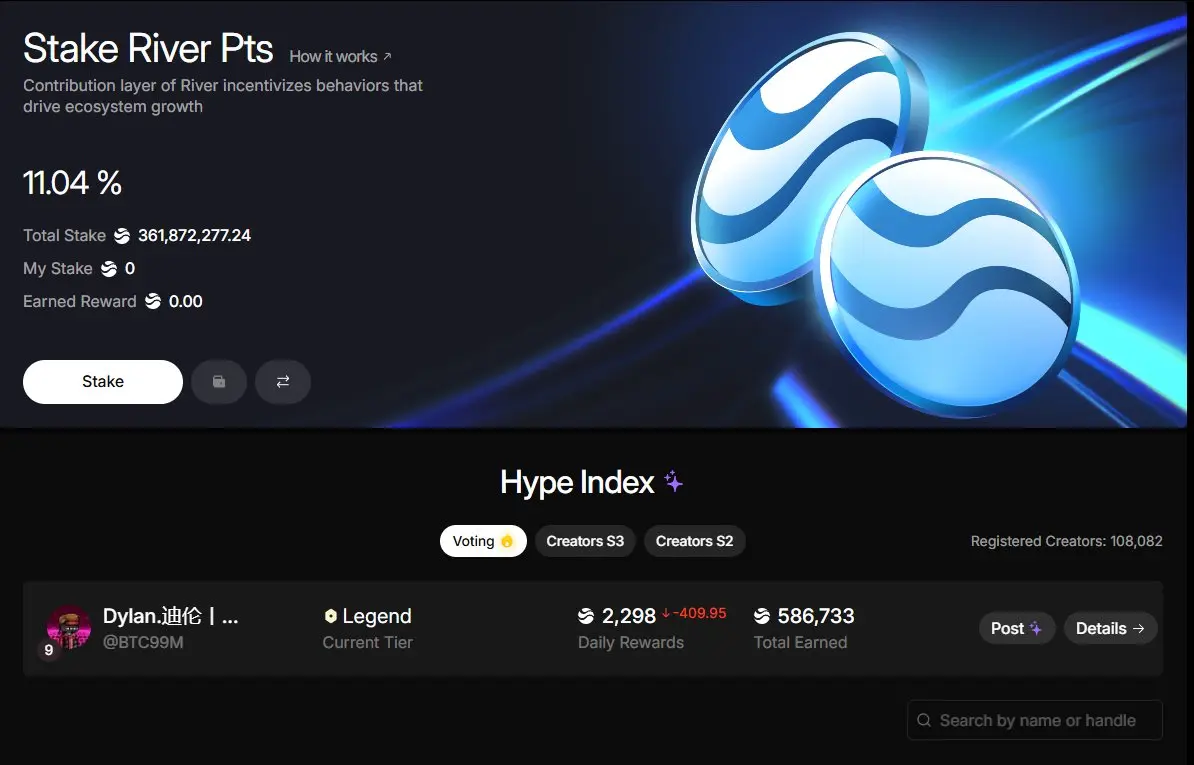

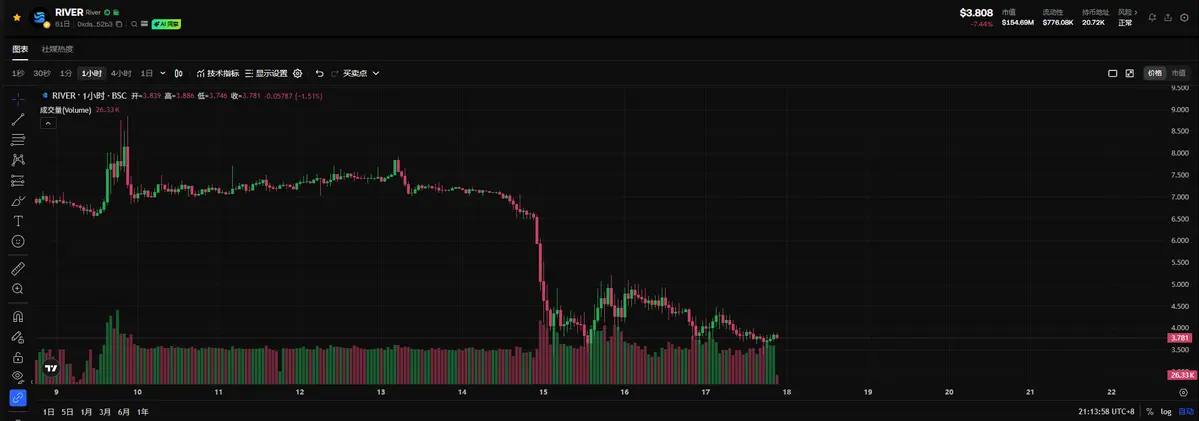

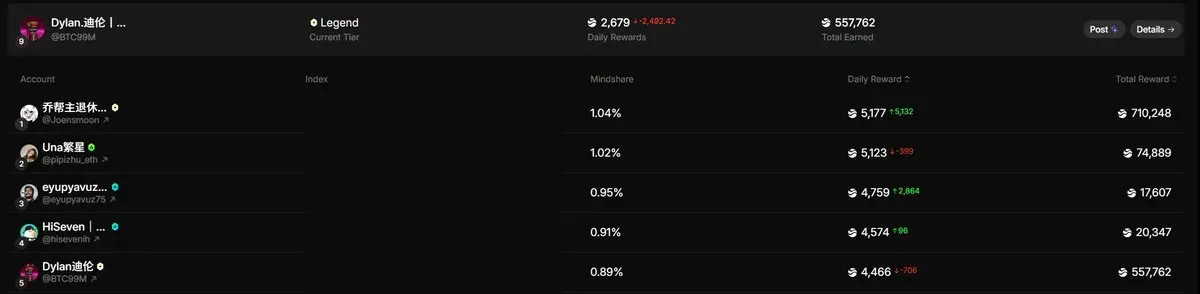

Recently, I’ve noticed that while @RiverdotInc and @River4FUN have maintained a steady pace of updates, this hasn’t stopped me from sharing why River continues to lead in the DeFi space.

1. Stable Asset System

The core of satUSD+ lies in cross-chain asset abstraction and automatic yield compounding. Users can earn stable returns across multiple chains without relying on bridges or extra steps. This frictionless experience makes it a truly low-risk stable asset.

2. S3 Incentive Mechanism

Voting for the current S3 season is in full swing, where points equal governance power. Each 1 Pts equals 1

1. Stable Asset System

The core of satUSD+ lies in cross-chain asset abstraction and automatic yield compounding. Users can earn stable returns across multiple chains without relying on bridges or extra steps. This frictionless experience makes it a truly low-risk stable asset.

2. S3 Incentive Mechanism

Voting for the current S3 season is in full swing, where points equal governance power. Each 1 Pts equals 1

View Original

- Reward

- like

- Comment

- Repost

- Share

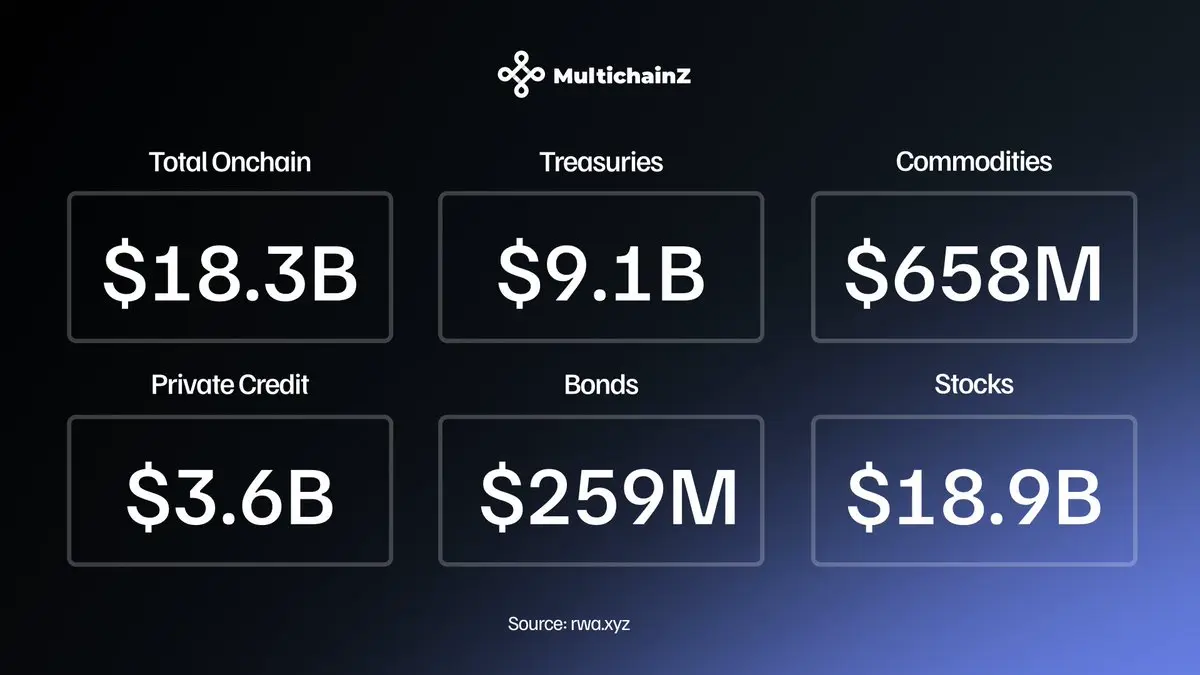

Just saw the in-depth conversation between Brian Armstrong and Larry, which once again confirms a trend: asset tokenization is becoming the next stage of global financial infrastructure.

@MultichainZ_’s perspective is very clear: Everything, on-chain.

When real-world assets can be borrowed and settled across networks and ecosystems on-chain, funding costs will be offset by returns, and liquidity friction will be eliminated. The boundaries between traditional finance and decentralized finance are rapidly blurring, and the definition of capital efficiency will be completely rewritten.

Who is alr

View Original@MultichainZ_’s perspective is very clear: Everything, on-chain.

When real-world assets can be borrowed and settled across networks and ecosystems on-chain, funding costs will be offset by returns, and liquidity friction will be eliminated. The boundaries between traditional finance and decentralized finance are rapidly blurring, and the definition of capital efficiency will be completely rewritten.

Who is alr

- Reward

- like

- Comment

- Repost

- Share

Just conducted an in-depth study of @MultichainZ_'s Omnichain Credit protocol, and it’s clear that this system is reshaping the fundamental paradigm of RWA lending.

This protocol uses yield-bearing real-world assets (RWAs) as collateral, allowing borrowing costs to be offset and structurally improving capital efficiency. At the same time, relying on its omnichain interoperability framework, it enables frictionless capital flows across multiple chains—no need for traditional bridging steps or additional trust assumptions.

In this model, the robust yield structures of traditional finance natural

View OriginalThis protocol uses yield-bearing real-world assets (RWAs) as collateral, allowing borrowing costs to be offset and structurally improving capital efficiency. At the same time, relying on its omnichain interoperability framework, it enables frictionless capital flows across multiple chains—no need for traditional bridging steps or additional trust assumptions.

In this model, the robust yield structures of traditional finance natural

- Reward

- like

- Comment

- Repost

- Share

Stay Untamed! The wildest party in Abu Dhabi this year is here

Organizer: @bcgame

Abu Dhabi in December is absolutely on fire: Bitcoin MENA, Solana Breakpoint, Global Blockchain Show...

And now, another massive party: Stay Untamed Party🔥

👉 Friends who want to attend can apply for tickets here:

🎧 The lineup is insane

DubVision, Mari Ferrari: Top 100 DJs

Esports (s1mple & electronic): Legendary CS duo

T10 Deccan Gladiators: Cricket star team

Top Web3 figures, KOLs, and creators all present

🎁 Lucky draws all night

iPhone 17 Pro, Labubu, $BC merchandise, and mysterious grand pri

Organizer: @bcgame

Abu Dhabi in December is absolutely on fire: Bitcoin MENA, Solana Breakpoint, Global Blockchain Show...

And now, another massive party: Stay Untamed Party🔥

👉 Friends who want to attend can apply for tickets here:

🎧 The lineup is insane

DubVision, Mari Ferrari: Top 100 DJs

Esports (s1mple & electronic): Legendary CS duo

T10 Deccan Gladiators: Cricket star team

Top Web3 figures, KOLs, and creators all present

🎁 Lucky draws all night

iPhone 17 Pro, Labubu, $BC merchandise, and mysterious grand pri

BC4.39%

- Reward

- like

- Comment

- Repost

- Share

🚀 I just studied the Omnichain Credit Protocol of @MultichainZ_, and I must say it is rewriting the underlying paradigm of RWA lending.

Core Mechanism Highlights:

1️⃣ Yield-bearing Collateral

Using sustainable income-generating assets like government bonds, money market funds, and stETH as collateral directly, the borrowing costs are offset, creating a *net positive yield credit position*. This is nearly impossible to achieve in traditional DeFi models.

2️⃣ Native Omnichain Liquidity Layer

No need for wrapped assets, no need for cross-chain bridges, and credit limits can be called in real-tim

Core Mechanism Highlights:

1️⃣ Yield-bearing Collateral

Using sustainable income-generating assets like government bonds, money market funds, and stETH as collateral directly, the borrowing costs are offset, creating a *net positive yield credit position*. This is nearly impossible to achieve in traditional DeFi models.

2️⃣ Native Omnichain Liquidity Layer

No need for wrapped assets, no need for cross-chain bridges, and credit limits can be called in real-tim

STETH0.42%

- Reward

- like

- Comment

- Repost

- Share

🧵 1/5 | The core bottleneck of DeFi: fragmented cross-chain liquidity play people for suckers

In the past few years, the biggest inefficiency in DeFi has come from Liquidity fragmentation—assets generate yields on one chain but cannot seamlessly enter the credit system on another chain. The result is:

Low capital utilization rate

Cross-chain opportunities are hard to capture.

The borrowing cost is not systematic.

The emergence of @MultichainZ_ is rewriting the rules.

As an omnichain credit protocol, it transforms yield-bearing RWAs/LSTs that were originally "trapped on-chain" into truly sched

In the past few years, the biggest inefficiency in DeFi has come from Liquidity fragmentation—assets generate yields on one chain but cannot seamlessly enter the credit system on another chain. The result is:

Low capital utilization rate

Cross-chain opportunities are hard to capture.

The borrowing cost is not systematic.

The emergence of @MultichainZ_ is rewriting the rules.

As an omnichain credit protocol, it transforms yield-bearing RWAs/LSTs that were originally "trapped on-chain" into truly sched

ETH0.44%

- Reward

- like

- Comment

- Repost

- Share

🌊River's ecological sustainability is steadily expanding, while the market's fluctuations instead highlight the value of allocation.

During my observation over this period: $RIVER is consolidating in a horizontal trend, and the Pts mechanism continues to iterate, truly allowing "those who contribute to earn more". This direction is correct.

Recently, I整理了一下我的一些长期滚雪球心得,给认真深耕 River 的朋友参考👇

1️⃣ Content Contribution: Altruism > Emotional Output

The daily output is not about "shouting orders and flattery", but about breaking down knowledge, explaining mechanisms, and providing a lower-dim

During my observation over this period: $RIVER is consolidating in a horizontal trend, and the Pts mechanism continues to iterate, truly allowing "those who contribute to earn more". This direction is correct.

Recently, I整理了一下我的一些长期滚雪球心得,给认真深耕 River 的朋友参考👇

1️⃣ Content Contribution: Altruism > Emotional Output

The daily output is not about "shouting orders and flattery", but about breaking down knowledge, explaining mechanisms, and providing a lower-dim

PTS-3.45%

- Reward

- like

- Comment

- Repost

- Share

It's really not easy to get Siri to full power.

It's super convenient to directly wake up and call GPT now ☺️

View OriginalIt's super convenient to directly wake up and call GPT now ☺️

- Reward

- like

- Comment

- Repost

- Share

🌀River Today's Key: Double AMA + 2.2 Simulation First Exposure, Pause is not a Crisis, it's a "Deep Breath"!

Countermeasure 2.2 Display: High density period rate reduction, low pressure period rebound, cumulative fluctuation pressed to 20–30%, ecology more "earthquake-resistant".

satUSD TVL 485 million, Vault APR 42%, Chain Abstraction begins multi-chain "internal digestion".

Tonight at 20:00 Chinese AMA, tomorrow Korean and English AMA - explaining the reasons for the suspension, compensation mechanism, and roadmap clearly.

110,000 Yapper is also bouncing back: after slimming down on

Countermeasure 2.2 Display: High density period rate reduction, low pressure period rebound, cumulative fluctuation pressed to 20–30%, ecology more "earthquake-resistant".

satUSD TVL 485 million, Vault APR 42%, Chain Abstraction begins multi-chain "internal digestion".

Tonight at 20:00 Chinese AMA, tomorrow Korean and English AMA - explaining the reasons for the suspension, compensation mechanism, and roadmap clearly.

110,000 Yapper is also bouncing back: after slimming down on

View Original

- Reward

- like

- Comment

- Repost

- Share

Today (11/16), continue to observe the ecological dynamics of @RiverdotInc and @River4FUN. As BTC falls below 99K and DeFi TVL shrinks across the board, $RIVER has also been dragged down to around 4.2 dollars (24h -5%), and River Pts has weakened to 0.0029, with market buying pressure clearly thinning.

This is not a single-point event, but a "chain reaction" of systemic pressure + misinterpretation of mechanisms.

1. Why the fall? - Dual pressure from market panic + misreading of mechanisms

The observations from the community (such as @2moonrocket) are very accurate:

DeFi TVL shrinks again by

View OriginalThis is not a single-point event, but a "chain reaction" of systemic pressure + misinterpretation of mechanisms.

1. Why the fall? - Dual pressure from market panic + misreading of mechanisms

The observations from the community (such as @2moonrocket) are very accurate:

DeFi TVL shrinks again by

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share