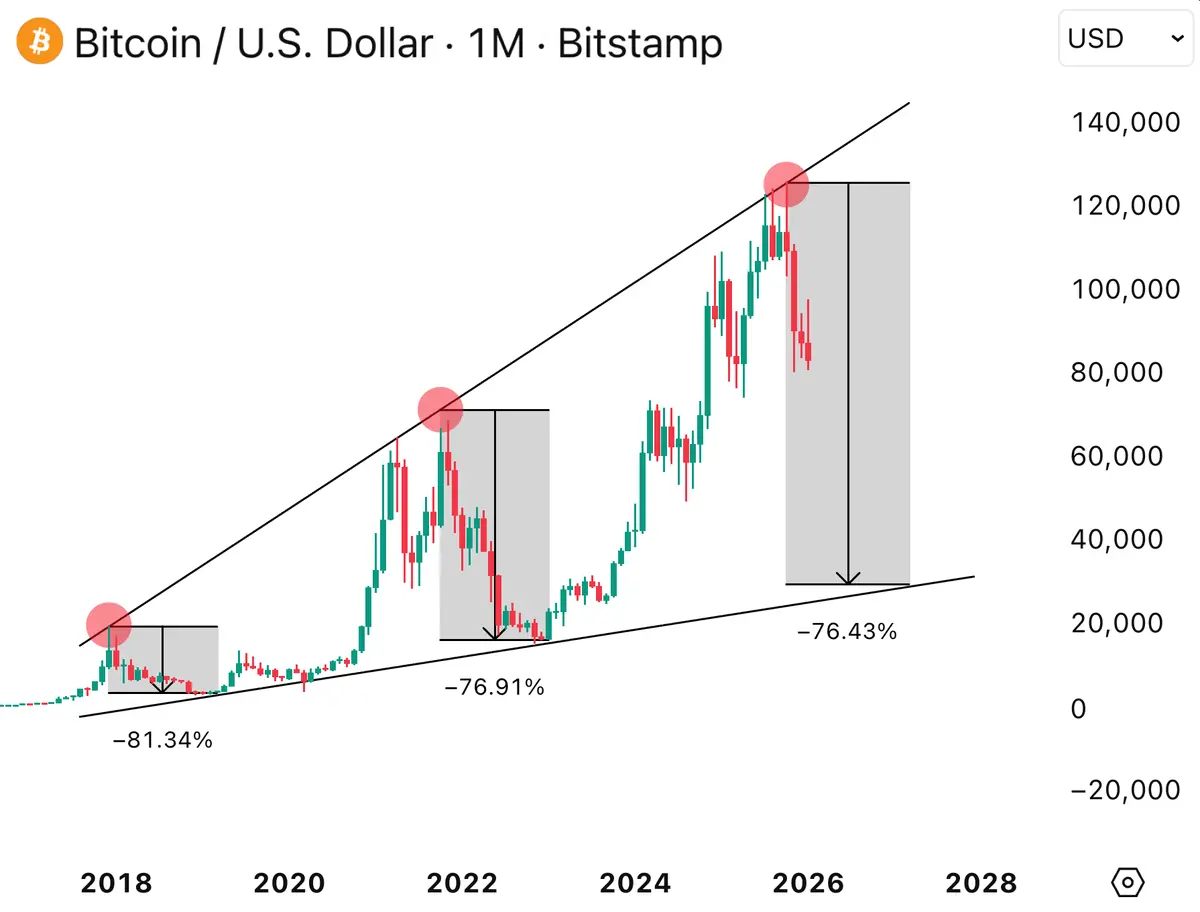

The four cycles of a bear market and the stage we are currently in.

Most bear markets: the early to mid-stage is characterized by “gradual decline + repeated torment,” and the later stage often involves “emotion-driven accelerated decline (panic waterfall),”

but not in a straight line, rather “rapid sell-off → technical rebound → further decline.”

There are also rare cases where the decline continues silently until no one is talking, but that is the extreme liquidity exhaustion stage.

🧠 Bear markets are usually divided into 4 stages

① Early Bear: Trend Breakdown Stage

Features: High levels weaken, each dip attracts “bottom-fishing funds.”

Market psychology: “This is just a correction.”

Trend: Decline is slow, but the structure has already deteriorated.

② Mid Bear: Classic Gradual Decline Stage (the most torturous)

Features: Sideways + slow downward movement, each rebound weaker than the last.

Market psychology: “No rise, no fall, nothing interesting.”

Trend: Time for space (testing patience).

📌 The vast majority of people get stuck here, not due to liquidation, but because their confidence is exhausted.

③ Late Bear: Emotional Collapse Stage (accelerated decline)

Suddenly appears: consecutive long bearish candles, volume surges downward, concentrated liquidations.

News alignment: intense negative news, “industry is doomed.”

Market psychology: “I don’t want it anymore, just sell.”

📉 This phase is often the fastest, harshest, and shortest decline.

📌 Technically: breaking below all key supports, cleansing the last batch of stubborn longs, leverage wiped out in one go. This is the “acceleration phase” of the bear market.

④ End of Bear: Liquidity Exhaustion + Sideways at Low Levels

Features: extremely low trading volume, almost no discussion.

Market psychology: “Anyway, I’m done playing.”

Trend: Long period of sideways consolidation, quietly building a bottom.

Remember what I said? The bottom is not formed in a day; the true bottom often appears when no one is paying attention.

🔄 Is it possible to have a continuous decline without acceleration?

Possible, but under very strict conditions:

No leverage

No systemic defaults

Market participants are extremely cooled down

Crypto markets rarely meet these three conditions because: high leverage, concentrated liquidity, and extreme emotions are typical features of this market.

So the conclusion is: the most “accelerated decline” in cryptocurrency bear markets tends to occur in the mid to late stages, not during the early to mid-stage of slow decline.

❓ How to identify the accelerated phase in the late stage of a bear market

⚠️ Signal to watch:

Daily candles with continuous high volume and long bearish candles

Mainstream coins break below key monthly/weekly levels

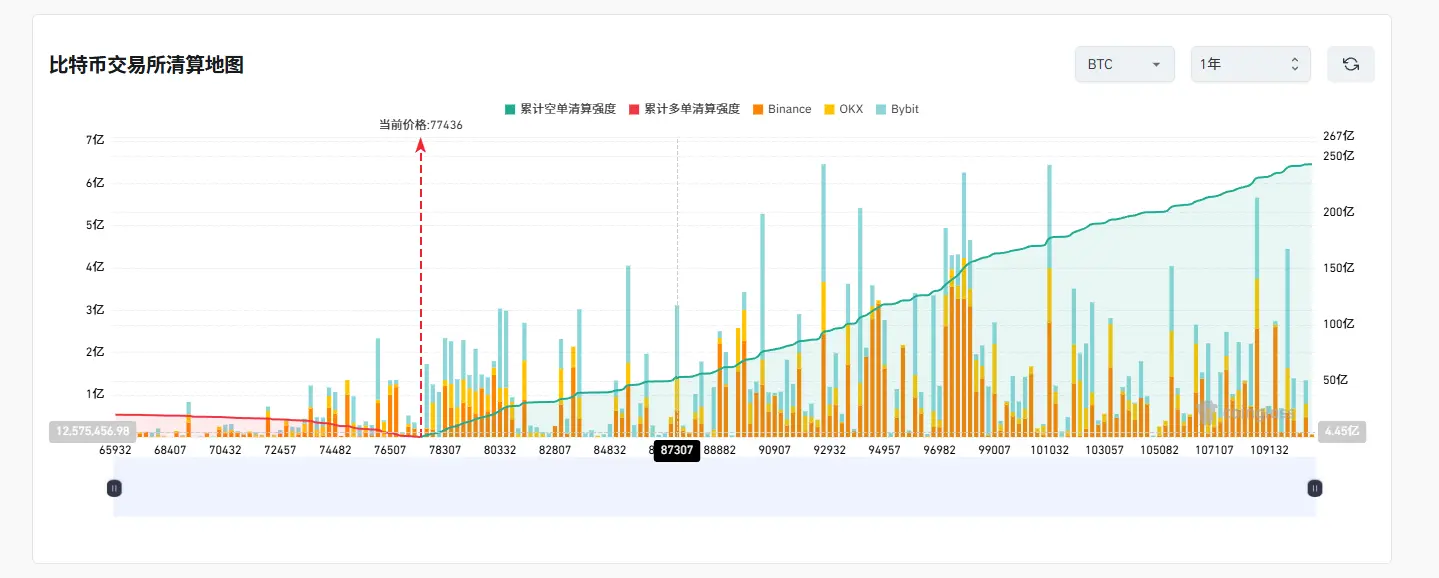

Liquidation amounts suddenly surge, everyone begins to doubt the market and themselves, “Is it going to zero?”

❓ When is the bottom formed

⚠️ Continuous shrinking volume, each decline with no volume, news ignored, no one arguing.

Long-term sideways oscillation, no further breakdown, fake breakdowns and fake breakouts increase.

This is the time to bottom fish; the bottom needs to be slowly formed, the cycle will not be short, and participants will have enough time.

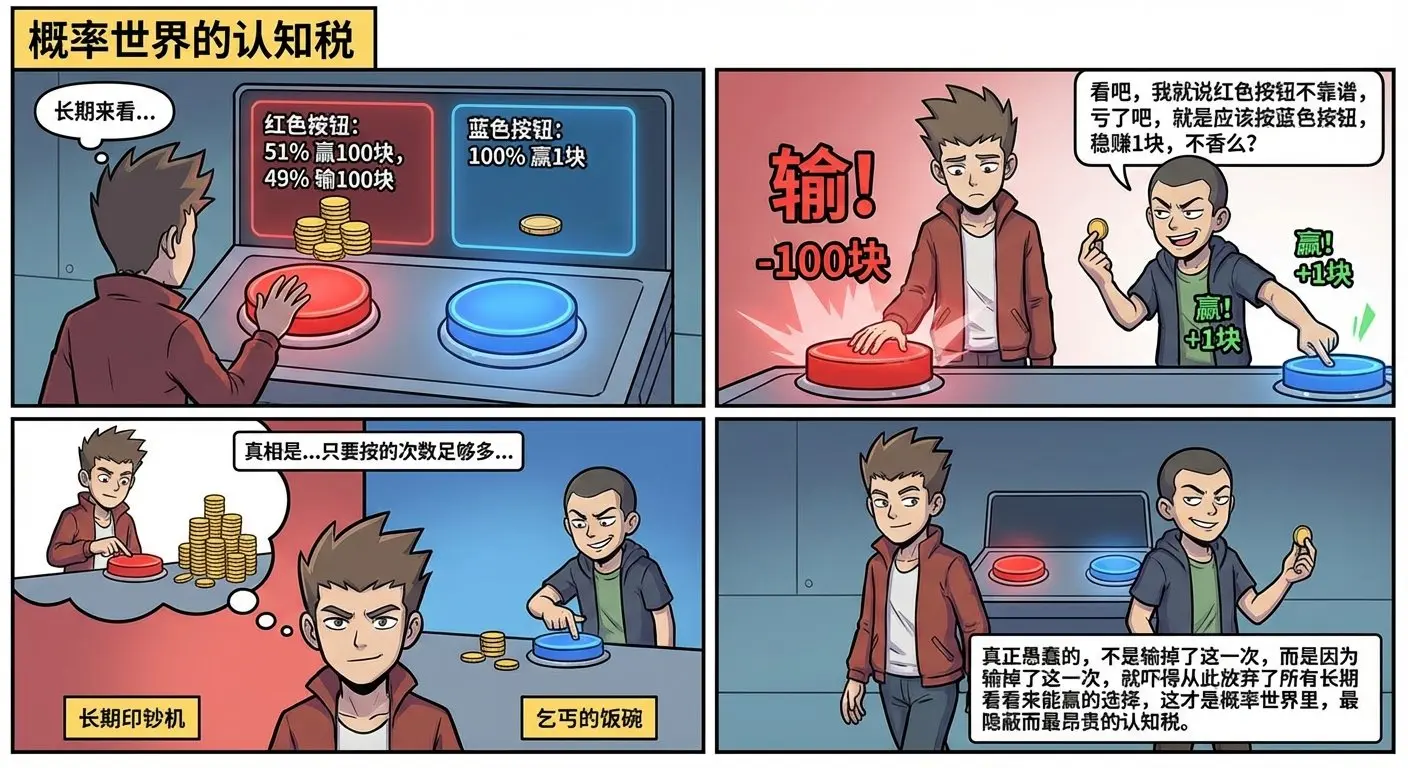

Gradual decline tests patience, accelerated decline tests faith, the true bottom usually appears after the “last acceleration.”

💡 Currently, we are still in the mid-stage of the bear market. Take it slow, no rush~

Most bear markets: the early to mid-stage is characterized by “gradual decline + repeated torment,” and the later stage often involves “emotion-driven accelerated decline (panic waterfall),”

but not in a straight line, rather “rapid sell-off → technical rebound → further decline.”

There are also rare cases where the decline continues silently until no one is talking, but that is the extreme liquidity exhaustion stage.

🧠 Bear markets are usually divided into 4 stages

① Early Bear: Trend Breakdown Stage

Features: High levels weaken, each dip attracts “bottom-fishing funds.”

Market psychology: “This is just a correction.”

Trend: Decline is slow, but the structure has already deteriorated.

② Mid Bear: Classic Gradual Decline Stage (the most torturous)

Features: Sideways + slow downward movement, each rebound weaker than the last.

Market psychology: “No rise, no fall, nothing interesting.”

Trend: Time for space (testing patience).

📌 The vast majority of people get stuck here, not due to liquidation, but because their confidence is exhausted.

③ Late Bear: Emotional Collapse Stage (accelerated decline)

Suddenly appears: consecutive long bearish candles, volume surges downward, concentrated liquidations.

News alignment: intense negative news, “industry is doomed.”

Market psychology: “I don’t want it anymore, just sell.”

📉 This phase is often the fastest, harshest, and shortest decline.

📌 Technically: breaking below all key supports, cleansing the last batch of stubborn longs, leverage wiped out in one go. This is the “acceleration phase” of the bear market.

④ End of Bear: Liquidity Exhaustion + Sideways at Low Levels

Features: extremely low trading volume, almost no discussion.

Market psychology: “Anyway, I’m done playing.”

Trend: Long period of sideways consolidation, quietly building a bottom.

Remember what I said? The bottom is not formed in a day; the true bottom often appears when no one is paying attention.

🔄 Is it possible to have a continuous decline without acceleration?

Possible, but under very strict conditions:

No leverage

No systemic defaults

Market participants are extremely cooled down

Crypto markets rarely meet these three conditions because: high leverage, concentrated liquidity, and extreme emotions are typical features of this market.

So the conclusion is: the most “accelerated decline” in cryptocurrency bear markets tends to occur in the mid to late stages, not during the early to mid-stage of slow decline.

❓ How to identify the accelerated phase in the late stage of a bear market

⚠️ Signal to watch:

Daily candles with continuous high volume and long bearish candles

Mainstream coins break below key monthly/weekly levels

Liquidation amounts suddenly surge, everyone begins to doubt the market and themselves, “Is it going to zero?”

❓ When is the bottom formed

⚠️ Continuous shrinking volume, each decline with no volume, news ignored, no one arguing.

Long-term sideways oscillation, no further breakdown, fake breakdowns and fake breakouts increase.

This is the time to bottom fish; the bottom needs to be slowly formed, the cycle will not be short, and participants will have enough time.

Gradual decline tests patience, accelerated decline tests faith, the true bottom usually appears after the “last acceleration.”

💡 Currently, we are still in the mid-stage of the bear market. Take it slow, no rush~