# IranTradeSanctions

4.3K

Trump says the U.S. will impose a 25% tariff on countries trading with Iran. Do you think this will be enforced or political pressure remians? Could it escalate geopolitics and impact financial and crypto markets?

Discovery

#IranTradeSanctions

The "Domino Effect" in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about "what is being sold to Tehran," but rather "who is sitting at the table with Tehran."

1. Trump’s "25% Tariff": A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: "Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States."

The Impact: This move

The "Domino Effect" in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about "what is being sold to Tehran," but rather "who is sitting at the table with Tehran."

1. Trump’s "25% Tariff": A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: "Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States."

The Impact: This move

- Reward

- 48

- 62

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

#IranTradeSanctions

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

BTC0.18%

- Reward

- 10

- 18

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#IranTradeSanctions

💥 IranTradeSanctions U.S. Threatens 25% Tariffs on Iran Trading Partners: Macro Shockwaves, Geopolitical Escalation, and Crypto Implications

The announcement that the United States may impose a 25% tariff on countries trading with Iran is far from a standard trade headline. This is a potential structural shock to global trade, geopolitics, and financial markets, one that requires serious attention from traders, allocators, and crypto participants alike. Even if full enforcement is uncertain, the market’s perception of risk alone can create volatility across equities, comm

💥 IranTradeSanctions U.S. Threatens 25% Tariffs on Iran Trading Partners: Macro Shockwaves, Geopolitical Escalation, and Crypto Implications

The announcement that the United States may impose a 25% tariff on countries trading with Iran is far from a standard trade headline. This is a potential structural shock to global trade, geopolitics, and financial markets, one that requires serious attention from traders, allocators, and crypto participants alike. Even if full enforcement is uncertain, the market’s perception of risk alone can create volatility across equities, comm

- Reward

- 7

- 8

- Repost

- Share

CryptoChampion :

:

Buy To Earn 💎View More

#IranTradeSanctions

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

- Reward

- 7

- 6

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#IranTradeSanctions In 2025–2026, trade sanctions on Iran have once again become a central focus of international politics and global markets, driven by long‑standing tensions between Tehran and the United States, European powers, and the United Nations. Sanctions are economic and financial penalties designed to pressure Iran over its nuclear program, human rights issues, and regional behavior. In recent weeks, these sanctions have taken on new dimensions with unexpected tariff threats from the United States and renewed global enforcement mechanisms that are reshaping Iran’s economic landscape

- Reward

- 5

- 15

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

Global Alert: Iran Trade Sanctions Update 🌐⚖️

The international community is tightening trade restrictions on Iran, impacting multiple sectors from energy to tech. VIP traders and global investors need to stay informed to navigate risks and opportunities.

🔹 Key Details:

1️⃣ New Sanctions Scope:

Targeting energy exports, petrochemicals, and banking transactions

Stricter oversight on financial institutions facilitating Iran trade

2️⃣ Affected Markets:

Crude oil and gas trading

Key metals and commodities linked to Iran

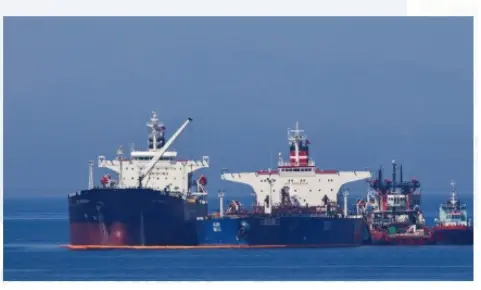

International shipping and logistics involving Iran

3️⃣ Investor/VIP Implica

The international community is tightening trade restrictions on Iran, impacting multiple sectors from energy to tech. VIP traders and global investors need to stay informed to navigate risks and opportunities.

🔹 Key Details:

1️⃣ New Sanctions Scope:

Targeting energy exports, petrochemicals, and banking transactions

Stricter oversight on financial institutions facilitating Iran trade

2️⃣ Affected Markets:

Crude oil and gas trading

Key metals and commodities linked to Iran

International shipping and logistics involving Iran

3️⃣ Investor/VIP Implica

- Reward

- 6

- 9

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#IranTradeSanctions In 2025–2026, trade sanctions on Iran have once again become a central focus of international politics and global markets, driven by long‑standing tensions between Tehran and the United States, European powers, and the United Nations. Sanctions are economic and financial penalties designed to pressure Iran over its nuclear program, human rights issues, and regional behavior. In recent weeks, these sanctions have taken on new dimensions with unexpected tariff threats from the United States and renewed global enforcement mechanisms that are reshaping Iran’s economic landscape

- Reward

- 5

- 6

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

Recent developments regarding trade sanctions on Iran have significant implications for global markets, commodities, and geopolitical stability. Investors and traders are closely monitoring these shifts to assess their potential impact on energy markets, currency flows, and regional trade.

1. Overview of the Sanctions

The sanctions target specific sectors of Iran’s economy, including energy exports, banking, and international trade channels.

These measures are aimed at pressuring compliance with international regulations while influencing regional economic dynamics.

2. Mar

Recent developments regarding trade sanctions on Iran have significant implications for global markets, commodities, and geopolitical stability. Investors and traders are closely monitoring these shifts to assess their potential impact on energy markets, currency flows, and regional trade.

1. Overview of the Sanctions

The sanctions target specific sectors of Iran’s economy, including energy exports, banking, and international trade channels.

These measures are aimed at pressuring compliance with international regulations while influencing regional economic dynamics.

2. Mar

- Reward

- 9

- 10

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

Global Alert: Iran Trade Sanctions Update 🌐⚖️

The international community is tightening trade restrictions on Iran, impacting multiple sectors from energy to tech. VIP traders and global investors need to stay informed to navigate risks and opportunities.

🔹 Key Details:

1️⃣ New Sanctions Scope:

Targeting energy exports, petrochemicals, and banking transactions

Stricter oversight on financial institutions facilitating Iran trade

2️⃣ Affected Markets:

Crude oil and gas trading

Key metals and commodities linked to Iran

International shipping and logistics involving Iran

3️⃣ Investor/VIP Implica

The international community is tightening trade restrictions on Iran, impacting multiple sectors from energy to tech. VIP traders and global investors need to stay informed to navigate risks and opportunities.

🔹 Key Details:

1️⃣ New Sanctions Scope:

Targeting energy exports, petrochemicals, and banking transactions

Stricter oversight on financial institutions facilitating Iran trade

2️⃣ Affected Markets:

Crude oil and gas trading

Key metals and commodities linked to Iran

International shipping and logistics involving Iran

3️⃣ Investor/VIP Implica

- Reward

- 1

- Comment

- Repost

- Share

#IranTradeSanctions

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

BTC0.18%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

27.28K Popularity

10.59K Popularity

6.86K Popularity

2.44K Popularity

4.21K Popularity

4.87K Popularity

4.3K Popularity

72.04K Popularity

33.38K Popularity

18.34K Popularity

4K Popularity

73.56K Popularity

207.88K Popularity

19.36K Popularity

177.73K Popularity

News

View MoreETH Breaks Through 2950 USDT

8 m

Trump's second son: The USD1 scale has surpassed PayPal's stablecoin PYUSD

14 m

Silver Reaches Historic $100 All-Time High

14 m

Analysis: Trump's renewed attack on the Federal Reserve prompted the market to seek safe-haven assets, pushing silver prices above $100 per ounce.

24 m

In the past 24 hours, the total contract liquidation across the entire network reached $151 million, with both longs and shorts being liquidated.

25 m

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateStrike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889