# MacroMarkets

3.79K

MissCrypto

#BitcoinFallsBehindGold | Digital Gold vs Real Safe Haven

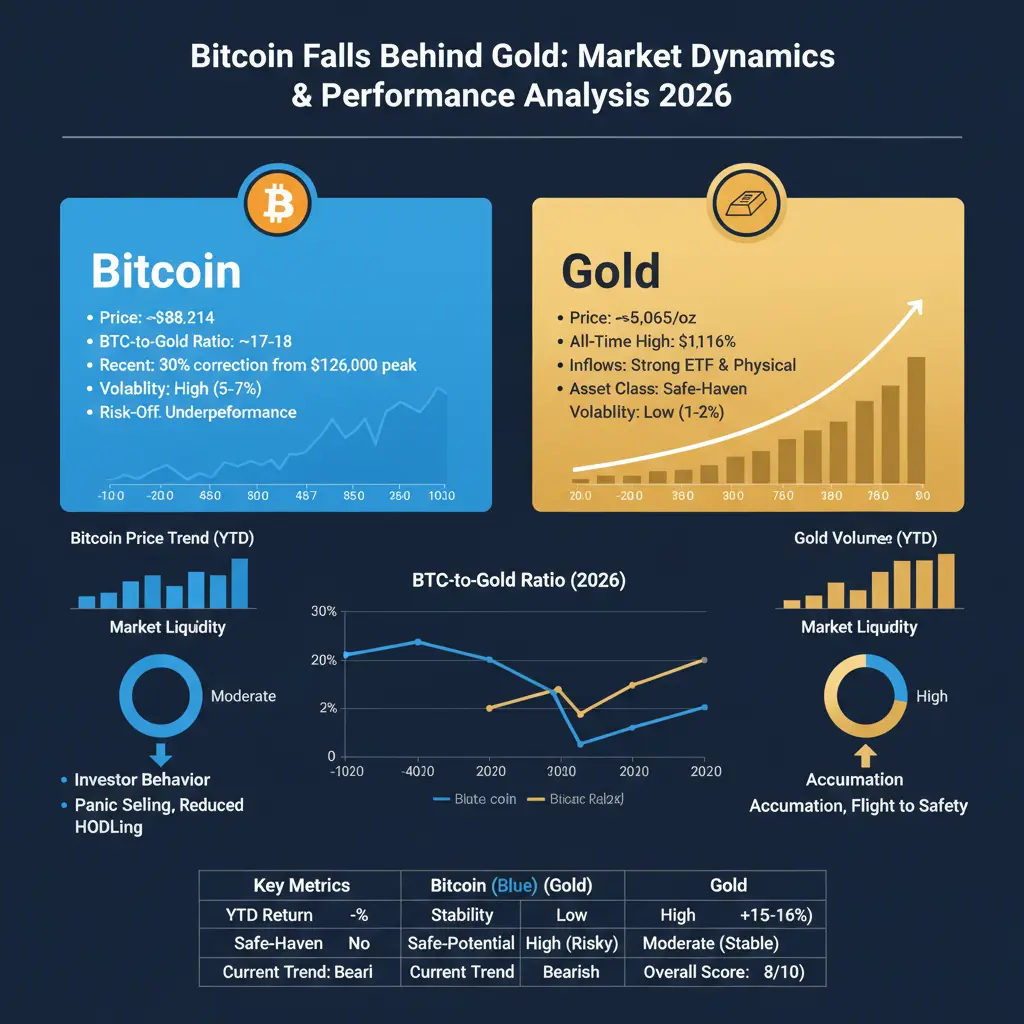

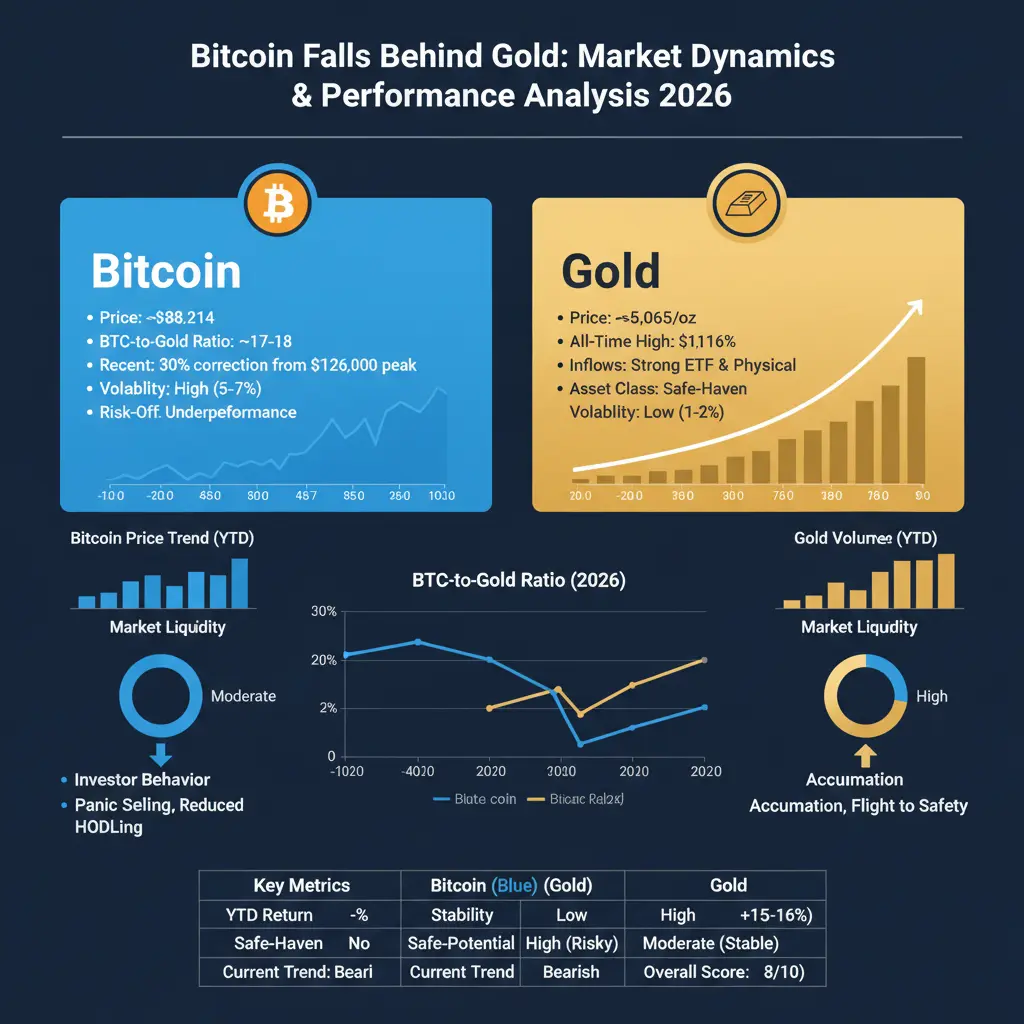

As 2026 unfolds, Bitcoin’s long-standing narrative as “digital gold” is facing its toughest stress test yet.

While gold continues its historic rally—breaking above $5,100 per ounce and attracting massive institutional and central-bank inflows—Bitcoin has significantly underperformed during recent risk-off phases. This divergence highlights a deeper shift in liquidity, investor psychology, and macroeconomic positioning.

Bitcoin: Volatility Meets Caution

BTC trades near $88,200, down ~30% from its 2025 peak of $126,000

High volatility per

As 2026 unfolds, Bitcoin’s long-standing narrative as “digital gold” is facing its toughest stress test yet.

While gold continues its historic rally—breaking above $5,100 per ounce and attracting massive institutional and central-bank inflows—Bitcoin has significantly underperformed during recent risk-off phases. This divergence highlights a deeper shift in liquidity, investor psychology, and macroeconomic positioning.

Bitcoin: Volatility Meets Caution

BTC trades near $88,200, down ~30% from its 2025 peak of $126,000

High volatility per

BTC-0.06%

- Reward

- 6

- 12

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold | Digital Gold vs Real Safe Haven (2026 Update)

As 2026 unfolds, Bitcoin’s long-standing narrative as “digital gold” is facing one of its most serious reality checks.

While gold continues a historic rally—pushing beyond $5,100 per ounce with strong central-bank and institutional inflows, Bitcoin has struggled to perform during recent risk-off phases. This growing divergence reflects a deeper shift in liquidity preference, investor psychology, and macro positioning.

📉 Bitcoin: Volatility Meets Caution

BTC trades near $88,200, roughly 30% below its 2025 peak ($126,000)

H

As 2026 unfolds, Bitcoin’s long-standing narrative as “digital gold” is facing one of its most serious reality checks.

While gold continues a historic rally—pushing beyond $5,100 per ounce with strong central-bank and institutional inflows, Bitcoin has struggled to perform during recent risk-off phases. This growing divergence reflects a deeper shift in liquidity preference, investor psychology, and macro positioning.

📉 Bitcoin: Volatility Meets Caution

BTC trades near $88,200, roughly 30% below its 2025 peak ($126,000)

H

BTC-0.06%

- Reward

- 8

- 13

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

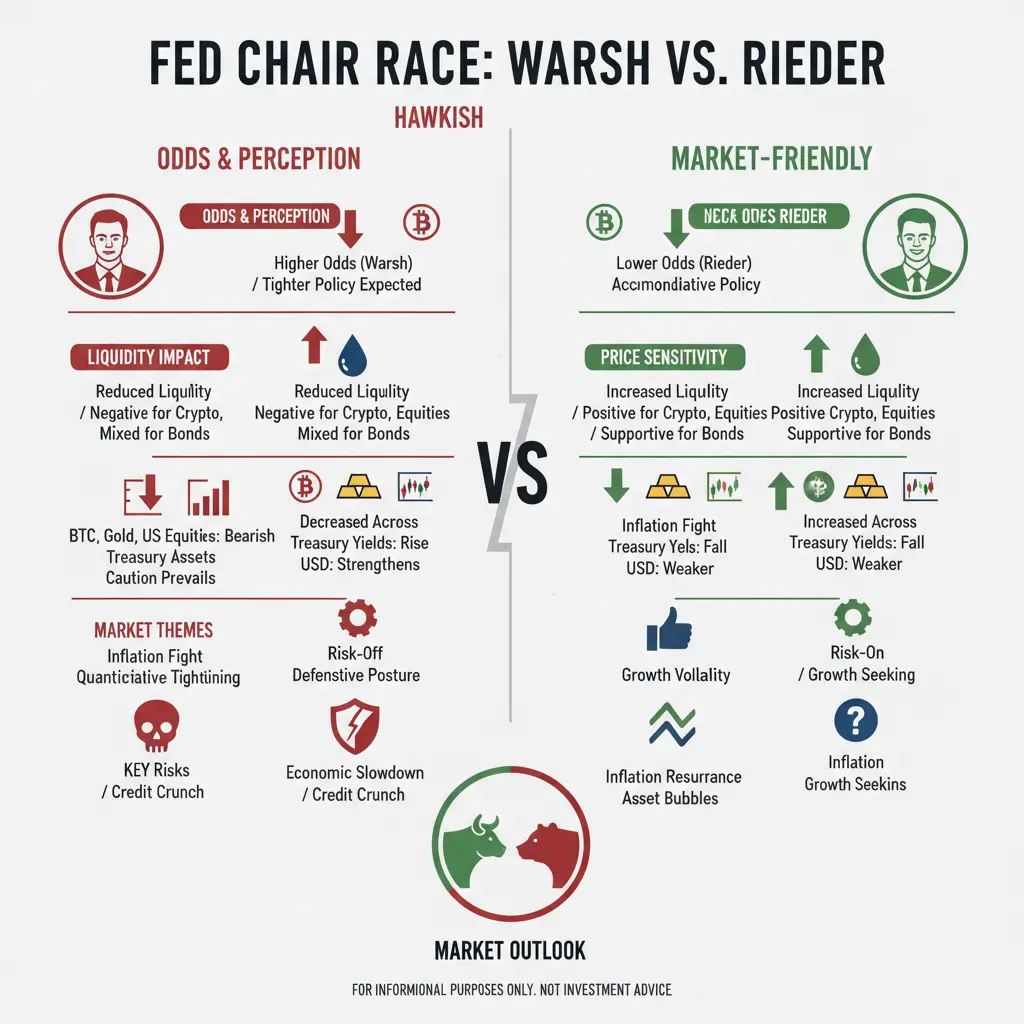

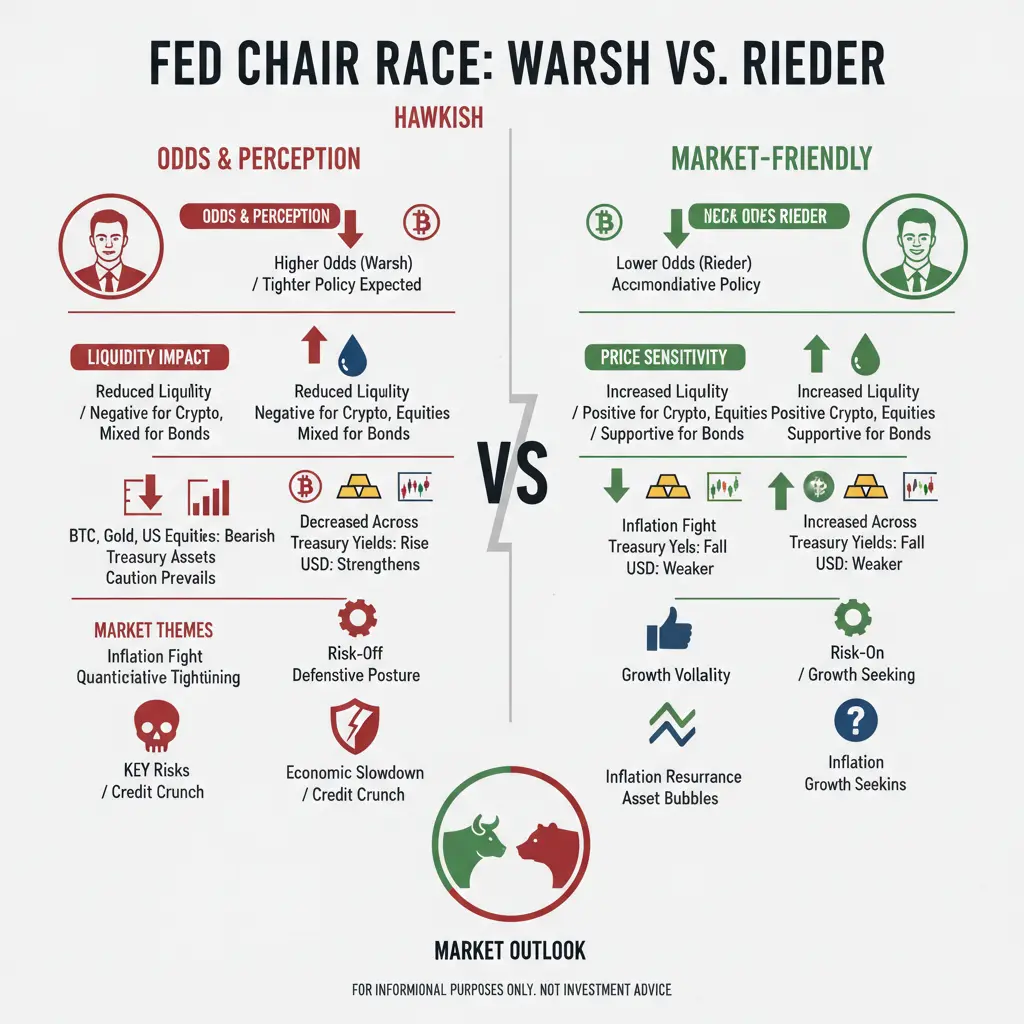

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 14

- 22

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#IranTradeSanctions Global markets are reacting to renewed geopolitical pressure after former U.S. President Donald Trump announced a 25% tariff on countries trading with Iran. While headlines highlight uncertainty, experienced investors know that volatility often creates opportunity — if approached strategically.

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

- Reward

- 2

- 2

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#NextFedChairPredictions

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

Who’s the Favorite for Fed Chair — And How Will It Impact Markets?

The race to replace Jerome Powell as Chair of the Federal Reserve has become one of the most influential macro events in global finance. President Trump has narrowed his shortlist, with Kevin Warsh and Rick Rieder emerging as clear frontrunners. Trump has hinted he could announce his decision as soon as next week, with Powell’s term ending in May.

This decision is not only political — it will directly impact liquidity, interest rates, market volatility, capital flow, and asset prices across crypto, equi

- Reward

- 7

- 3

- Repost

- Share

Selmus :

:

BTC ETH BTC ETH BTC ETHView More

#IranTradeSanctions Global markets are reacting to renewed geopolitical pressure after former U.S. President Donald Trump announced a 25% tariff on countries trading with Iran. While headlines highlight uncertainty, experienced investors know that volatility often creates opportunity — if approached strategically.

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

- Reward

- 1

- 6

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#GoldPrintsNewATH Gold Enters a New Price Discovery Phase

Gold has officially surpassed its previous all-time highs and moved into a fresh price discovery cycle, with spot prices trading near $4,506 per ounce. This breakout represents one of the strongest structural rallies in modern gold market history and reflects deeper shifts in global capital allocation.

Key Drivers Behind Gold’s Historic Move

1. Monetary Policy Outlook

Market expectations for U.S. Federal Reserve rate cuts in 2026 have strengthened gold’s appeal. Lower interest rates reduce the opportunity cost of holding non-yielding as

Gold has officially surpassed its previous all-time highs and moved into a fresh price discovery cycle, with spot prices trading near $4,506 per ounce. This breakout represents one of the strongest structural rallies in modern gold market history and reflects deeper shifts in global capital allocation.

Key Drivers Behind Gold’s Historic Move

1. Monetary Policy Outlook

Market expectations for U.S. Federal Reserve rate cuts in 2026 have strengthened gold’s appeal. Lower interest rates reduce the opportunity cost of holding non-yielding as

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

Merry Christmas ⛄Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

40.53K Popularity

3.93K Popularity

3.3K Popularity

1.57K Popularity

1.58K Popularity

1.37K Popularity

1.43K Popularity

1.69K Popularity

68.33K Popularity

110.66K Popularity

77.59K Popularity

19.39K Popularity

44.04K Popularity

36.9K Popularity

192.73K Popularity

News

View MoreThe US Bitcoin strategic reserve idea heats up, Adam Back reiterates BTC could surge to $1 million

3 m

ERC-20 stablecoin market cap loses $7 billion in a week. Is Bitcoin capital quietly withdrawing?

4 m

Vitalik Buterin unveils the blockchain layer extension model: How does Ethereum use computation and data to break through performance bottlenecks?

6 m

The number of ETH waiting in line to join the Ethereum PoS network has surpassed 3,330,000, reaching a new all-time high.

6 m

Data: 1.5 million PENDLE transferred from an anonymous address, worth approximately $2.82 million

8 m

Pin

📊 2 Altcoins to Watch In The Final Week Of January 2026

The crypto market took a turn for the worse in the last few days and while the macro financial conditions are showing signs of improvement. Nevertheless, altcoins are leaning more on the external network developments to turn for the better.

🔸 Hedera ($HBAR )

HBAR trades near $0.1058 at the time of writing, extending a downtrend that began more than three months ago. Persistent bearish market conditions have slowed Hedera’s growth. Price action remains under pressure, reflecting cautious sentiment as investors assess whether the prolongeGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889