#ADPJobsMissEstimates

Weak Jobs Data Shifts the Macro Narrative

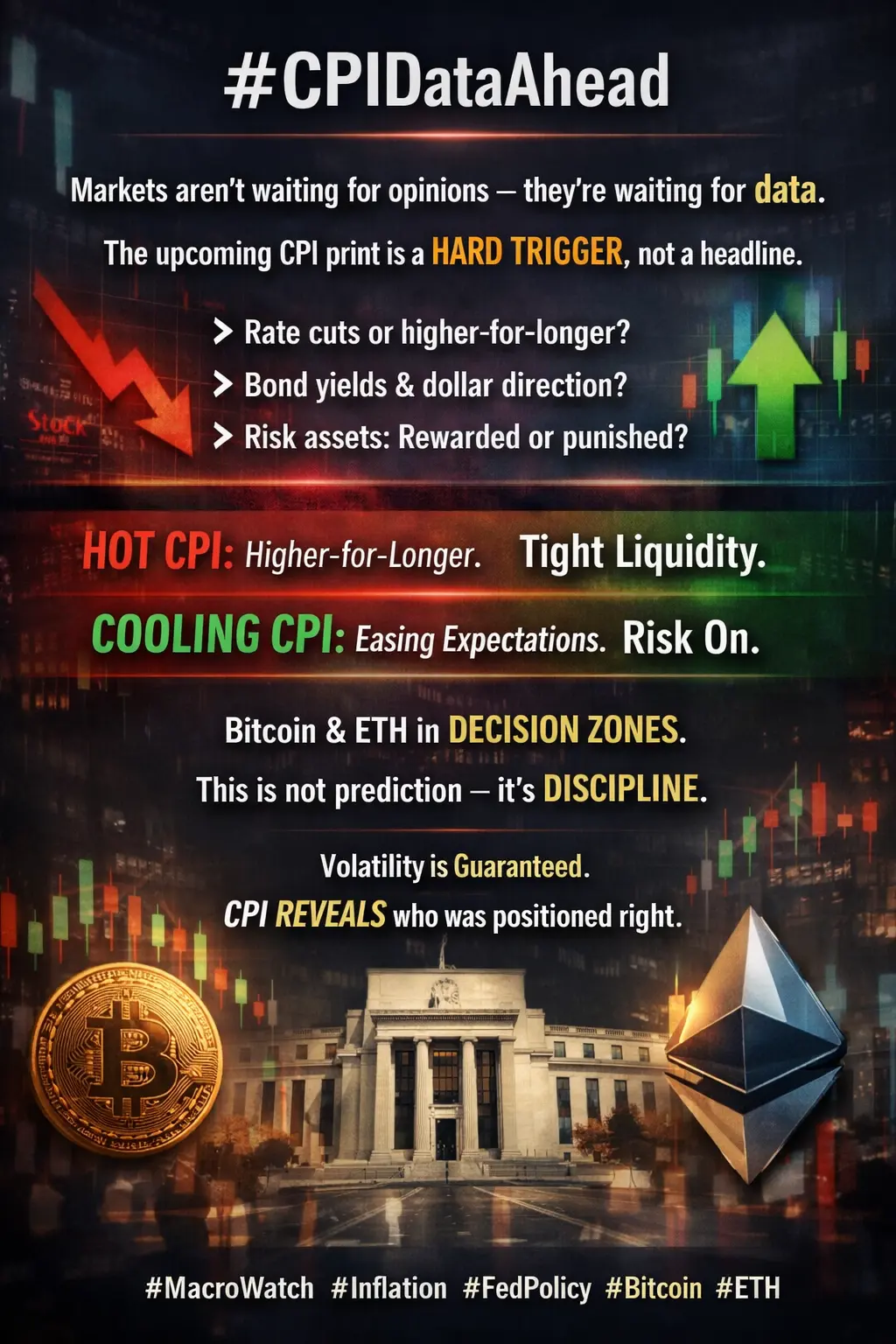

The latest ADP employment report missed expectations and signals that private sector hiring is slowing faster than markets anticipated. This matters because labor data directly feeds into inflation outlook and central bank policy expectations. A softer job market reduces wage pressure and increases the chances of a more cautious monetary stance in the months ahead.

From Dragon Fly Official’s view, this jobs miss is an early sign that macro momentum may be cooling. If confirmed by upcoming official payroll data, it could support a shift toward easier financial conditions — a backdrop that historically benefits liquidity-sensitive assets like equities and crypto.

Market reaction is already reflecting this tension. Bond yields tend to soften on weaker labor prints, while risk assets react to changing rate expectations. However, one report alone doesn’t confirm a trend. Divergence between ADP and official government data is common, so traders should focus on confirmation rather than headlines.

From Dragon Fly Official’s perspective, the strategic focus now is monitoring whether follow-up data supports a broader slowdown narrative. If macro conditions continue to soften and rate expectations ease, risk assets may attempt a recovery phase. Until then, volatility is likely to remain elevated.

🎯 Possible trading signal: If upcoming macro data confirms cooling labor and falling yields, it may favor cautious bullish positioning in major crypto assets — but only after technical confirmation and strong support holds.

⚠ Risk warning: Market conditions remain highly volatile and macro data can quickly reverse sentiment. Any trade should use strict risk management, proper position sizing, and clear stop levels. Never trade based on a single data release.

What’s your outlook — early sign of easing or temporary noise?

Weak Jobs Data Shifts the Macro Narrative

The latest ADP employment report missed expectations and signals that private sector hiring is slowing faster than markets anticipated. This matters because labor data directly feeds into inflation outlook and central bank policy expectations. A softer job market reduces wage pressure and increases the chances of a more cautious monetary stance in the months ahead.

From Dragon Fly Official’s view, this jobs miss is an early sign that macro momentum may be cooling. If confirmed by upcoming official payroll data, it could support a shift toward easier financial conditions — a backdrop that historically benefits liquidity-sensitive assets like equities and crypto.

Market reaction is already reflecting this tension. Bond yields tend to soften on weaker labor prints, while risk assets react to changing rate expectations. However, one report alone doesn’t confirm a trend. Divergence between ADP and official government data is common, so traders should focus on confirmation rather than headlines.

From Dragon Fly Official’s perspective, the strategic focus now is monitoring whether follow-up data supports a broader slowdown narrative. If macro conditions continue to soften and rate expectations ease, risk assets may attempt a recovery phase. Until then, volatility is likely to remain elevated.

🎯 Possible trading signal: If upcoming macro data confirms cooling labor and falling yields, it may favor cautious bullish positioning in major crypto assets — but only after technical confirmation and strong support holds.

⚠ Risk warning: Market conditions remain highly volatile and macro data can quickly reverse sentiment. Any trade should use strict risk management, proper position sizing, and clear stop levels. Never trade based on a single data release.

What’s your outlook — early sign of easing or temporary noise?