# NonfarmPayrollsComing

271.25K

The first U.S. nonfarm payroll report of 2026 is out tonight, with 60K jobs expected. It could shape Fed rate-cut expectations and short-term BTC moves, as BTC consolidates near $90.5K. Will this data decide BTC’s next direction?

CryptoSeth

おはようございます、ファミリー ☘️

非農業部門雇用者数と失業率の4時間後の発表はボラティリティを高めるでしょう。失業率は4.4%から4.5%に上昇すると予想されています。

原文表示非農業部門雇用者数と失業率の4時間後の発表はボラティリティを高めるでしょう。失業率は4.4%から4.5%に上昇すると予想されています。

- 報酬

- いいね

- コメント

- リポスト

- 共有

#NonfarmPayrollsComing #NonfarmPayrollsComing

#NonfarmPayrollsComing #NonfarmPayrollsComing

非農業部門雇用者数(NFP)レポートは、米国の重要な経済指標であり、農業労働者や政府職員などを除く雇用者数の増減を示します。このレポートは、米ドル、金利予想、世界の金融市場に大きな影響を与えます。

NFPの重要性:

堅調な雇用成長は堅実な経済を示し、米ドルを強化し、金利が変わらないか上昇する可能性があります。このシナリオは、暗号通貨、株式、金などのリスク資産に圧力をかけることがあります。逆に、雇用成長が鈍化すると、経済活動の減速を示し、ドルが弱まり、金利引き下げの期待が高まり、暗号通貨や株式、金に支援材料となることがあります。

暗号通貨への影響:

暗号通貨の価格は、NFPデータによりドルや金利予想の変動を通じて反応します。堅調なNFP結果は、一般的にドル高と高利回りを意味し、BTCや他の暗号通貨に圧力をかけることがあります。逆に、弱い結果はドルの弱体化と低利回りを示し、これらのデジタル資産に支援をもたらすことがあります。

NFP発表時の市場動向:

NFPの発表は、市場のボラティリティを高め、数秒以内に急激な価格変動が起こることがあります。流動性が低下し、スプレッドが拡大しやすく、ストップロス注文が簡

#NonfarmPayrollsComing #NonfarmPayrollsComing

非農業部門雇用者数(NFP)レポートは、米国の重要な経済指標であり、農業労働者や政府職員などを除く雇用者数の増減を示します。このレポートは、米ドル、金利予想、世界の金融市場に大きな影響を与えます。

NFPの重要性:

堅調な雇用成長は堅実な経済を示し、米ドルを強化し、金利が変わらないか上昇する可能性があります。このシナリオは、暗号通貨、株式、金などのリスク資産に圧力をかけることがあります。逆に、雇用成長が鈍化すると、経済活動の減速を示し、ドルが弱まり、金利引き下げの期待が高まり、暗号通貨や株式、金に支援材料となることがあります。

暗号通貨への影響:

暗号通貨の価格は、NFPデータによりドルや金利予想の変動を通じて反応します。堅調なNFP結果は、一般的にドル高と高利回りを意味し、BTCや他の暗号通貨に圧力をかけることがあります。逆に、弱い結果はドルの弱体化と低利回りを示し、これらのデジタル資産に支援をもたらすことがあります。

NFP発表時の市場動向:

NFPの発表は、市場のボラティリティを高め、数秒以内に急激な価格変動が起こることがあります。流動性が低下し、スプレッドが拡大しやすく、ストップロス注文が簡

BTC-1.92%

- 報酬

- 3

- 3

- リポスト

- 共有

Discovery :

:

注意深く見守る 🔍️もっと見る

#NonfarmPayrollsComing #NonfarmPayrollsComing

#NonfarmPayrollsComing #NonfarmPayrollsComing

非農雇用者数(NFP)レポートは、米国の重要な経済指標であり、農業労働者や政府職員などのセクターを除いた雇用者数の増減を詳細に示しています。このレポートは、米ドル、金利予想、世界の金融市場に大きな影響を与えます。

NFPの重要性:

堅調な雇用成長は堅実な経済を示し、米ドルを強化し、金利が変わらないか上昇する可能性が高まります。このシナリオは、暗号通貨、株式、金などのリスク資産に圧力をかけることがあります。逆に、雇用成長が弱い場合は経済活動の鈍化を示し、通常はドルが弱まり、金利引き下げの期待が高まり、暗号通貨や株式、金に支援をもたらすことがあります。

暗号通貨への影響:

暗号通貨の価格は、NFPデータによりドルや金利予想の変動を通じて反応します。堅調なNFP結果は一般的にドルの強化と高い利回りを意味し、BTCや他の暗号通貨に圧力をかける可能性があります。逆に、結果が弱い場合はドルの弱化と低い利回りを示し、これらのデジタル資産を支援します。

NFP発表時の市場の動き:

NFPの発表は、市場のボラティリティを高め、数秒以内に急激な価格変動が起こることがあります。流動性が低下し、スプレッドが拡大しやすく、ス

#NonfarmPayrollsComing #NonfarmPayrollsComing

非農雇用者数(NFP)レポートは、米国の重要な経済指標であり、農業労働者や政府職員などのセクターを除いた雇用者数の増減を詳細に示しています。このレポートは、米ドル、金利予想、世界の金融市場に大きな影響を与えます。

NFPの重要性:

堅調な雇用成長は堅実な経済を示し、米ドルを強化し、金利が変わらないか上昇する可能性が高まります。このシナリオは、暗号通貨、株式、金などのリスク資産に圧力をかけることがあります。逆に、雇用成長が弱い場合は経済活動の鈍化を示し、通常はドルが弱まり、金利引き下げの期待が高まり、暗号通貨や株式、金に支援をもたらすことがあります。

暗号通貨への影響:

暗号通貨の価格は、NFPデータによりドルや金利予想の変動を通じて反応します。堅調なNFP結果は一般的にドルの強化と高い利回りを意味し、BTCや他の暗号通貨に圧力をかける可能性があります。逆に、結果が弱い場合はドルの弱化と低い利回りを示し、これらのデジタル資産を支援します。

NFP発表時の市場の動き:

NFPの発表は、市場のボラティリティを高め、数秒以内に急激な価格変動が起こることがあります。流動性が低下し、スプレッドが拡大しやすく、ス

BTC-1.92%

- 報酬

- いいね

- コメント

- リポスト

- 共有

#NonfarmPayrollsComing 非農就業者数 (NFP)レポートは、米国で最も注目される経済指標の一つです。農業従事者、政府関係者、その他一部のセクターを除く雇用者数の増減を測定します。NFPデータは、米ドル、金利予想、そして暗号通貨を含む世界の市場に大きな影響を与えます。

なぜNFPが重要なのか

堅調な雇用成長は健全な経済を示します。これにより、通常はドルが強化され、金利上昇の期待が高まります。そのような環境では、暗号通貨、株式、金などのリスク資産が圧力を受ける可能性があります。逆に、予想よりも弱い雇用成長は経済の減速を示し、ドルを弱め、利下げの期待を高め、暗号通貨やその他のリスク資産を支援します。

NFPが暗号通貨に与える影響

暗号市場はドルの強さと金利予想を通じて間接的に反応します:

強いNFP:ドルが強化 → 利回り上昇 → BTCやアルトコインに圧力

弱いNFP:ドルが弱まる → 利回り低下 → BTCやアルトコインに潜在的な上昇余地

リリース時に期待できること

NFPの発表はしばしば高いボラティリティを引き起こします。価格は数秒以内に大きく振れることがあります。流動性が低下し、スプレッドが拡大し、ストップロスが発動されるリスクもあります。

NFP周辺の取引戦略

レポート直前に新規取引を開始しないこと。

すでに利益が出ている場合は、一部利益確定を検討。

リリ

なぜNFPが重要なのか

堅調な雇用成長は健全な経済を示します。これにより、通常はドルが強化され、金利上昇の期待が高まります。そのような環境では、暗号通貨、株式、金などのリスク資産が圧力を受ける可能性があります。逆に、予想よりも弱い雇用成長は経済の減速を示し、ドルを弱め、利下げの期待を高め、暗号通貨やその他のリスク資産を支援します。

NFPが暗号通貨に与える影響

暗号市場はドルの強さと金利予想を通じて間接的に反応します:

強いNFP:ドルが強化 → 利回り上昇 → BTCやアルトコインに圧力

弱いNFP:ドルが弱まる → 利回り低下 → BTCやアルトコインに潜在的な上昇余地

リリース時に期待できること

NFPの発表はしばしば高いボラティリティを引き起こします。価格は数秒以内に大きく振れることがあります。流動性が低下し、スプレッドが拡大し、ストップロスが発動されるリスクもあります。

NFP周辺の取引戦略

レポート直前に新規取引を開始しないこと。

すでに利益が出ている場合は、一部利益確定を検討。

リリ

BTC-1.92%

- 報酬

- 9

- 6

- リポスト

- 共有

StylishKuri :

:

2026年ゴゴゴ 👊もっと見る

#NonfarmPayrollsComing #Crypto2026Vision 🌐💹

意図的な市場の時代におけるレジリエンスのエンジニアリング

2026年の暗号市場はもはや反射的な投機や hype追いかけの遊び場ではない。速度やスペクタクルは過去のものだ。今重要なのは構造、洞察、そして耐久性である。市場はシステムを理解すること—反応することではなく—を報いる。

1️⃣ 感情的反射よりも分析的確信

• 投機的衝動—レバレッジ回転、誤ったストーリー—は体系的にフィルタリングされている。

• 成功は価値の動きの理由を理解している者に味方する、ただいつ動くかだけではない。

• 忍耐、調査、意図的なポジショニングが新たなアルファだ。

2️⃣ グローバルマクロの流れの中の暗号

• 資産は次のように反応する:

• 流動性サイクル

• 金利動向

• 主権債務の拡大

• クロスアセットの回転

• ボラティリティは文脈に依存し、混沌ではない。暗号はもはや孤立した実験ではなく、グローバル資本の反応性コンポーネントとなっている。

3️⃣ 機関投資家の参加:静かだが強力

• 機関はもはや hypeを追いかけていない—彼らは:

• 戦略的に配分

• エクスポージャーを構築

• リスクを調整

• 結果:より深い流動性、長期的な視野、予測可能な市場反応。

4️⃣ プロトコル層の効

原文表示意図的な市場の時代におけるレジリエンスのエンジニアリング

2026年の暗号市場はもはや反射的な投機や hype追いかけの遊び場ではない。速度やスペクタクルは過去のものだ。今重要なのは構造、洞察、そして耐久性である。市場はシステムを理解すること—反応することではなく—を報いる。

1️⃣ 感情的反射よりも分析的確信

• 投機的衝動—レバレッジ回転、誤ったストーリー—は体系的にフィルタリングされている。

• 成功は価値の動きの理由を理解している者に味方する、ただいつ動くかだけではない。

• 忍耐、調査、意図的なポジショニングが新たなアルファだ。

2️⃣ グローバルマクロの流れの中の暗号

• 資産は次のように反応する:

• 流動性サイクル

• 金利動向

• 主権債務の拡大

• クロスアセットの回転

• ボラティリティは文脈に依存し、混沌ではない。暗号はもはや孤立した実験ではなく、グローバル資本の反応性コンポーネントとなっている。

3️⃣ 機関投資家の参加:静かだが強力

• 機関はもはや hypeを追いかけていない—彼らは:

• 戦略的に配分

• エクスポージャーを構築

• リスクを調整

• 結果:より深い流動性、長期的な視野、予測可能な市場反応。

4️⃣ プロトコル層の効

- 報酬

- 8

- コメント

- リポスト

- 共有

#非农就业数据 | 非農雇用者数 (NFP) 市場への影響

今日の米国非農業部門雇用者数のデータは、市場のボラティリティにとって重要な要因です。NFPは金利、USDの強さ、全体的なリスクセンチメントの期待に直接影響を与えるため、暗号通貨トレーダーにとって非常に重要です。

予想よりも強いNFP:

労働市場の強さを示す → 金利期待の高まり → 暗号通貨などリスク資産への圧力。

予想よりも弱いNFP:

利下げ期待の高まり → USDの軟化 → ビットコイン、イーサリアム、アルトコインのポジティブな勢い。

リリース前は、市場はしばしば警戒感を持ち、取引量が減少します。データ発表後は、特にBTC、ETH、主要通貨ペアで急激な動きが見られることが一般的です。

トレーダーは重要なサポートとレジスタンスレベルを注視し、過剰なレバレッジを避け、高ボラティリティ期間中はリスク管理を慎重に行うべきです。

マクロデータが市場のトーンを決定します — 忍耐と規律が最も重要です。

原文表示今日の米国非農業部門雇用者数のデータは、市場のボラティリティにとって重要な要因です。NFPは金利、USDの強さ、全体的なリスクセンチメントの期待に直接影響を与えるため、暗号通貨トレーダーにとって非常に重要です。

予想よりも強いNFP:

労働市場の強さを示す → 金利期待の高まり → 暗号通貨などリスク資産への圧力。

予想よりも弱いNFP:

利下げ期待の高まり → USDの軟化 → ビットコイン、イーサリアム、アルトコインのポジティブな勢い。

リリース前は、市場はしばしば警戒感を持ち、取引量が減少します。データ発表後は、特にBTC、ETH、主要通貨ペアで急激な動きが見られることが一般的です。

トレーダーは重要なサポートとレジスタンスレベルを注視し、過剰なレバレッジを避け、高ボラティリティ期間中はリスク管理を慎重に行うべきです。

マクロデータが市場のトーンを決定します — 忍耐と規律が最も重要です。

- 報酬

- 9

- 8

- リポスト

- 共有

EagleEye :

:

明けましておめでとうございます! 🤑もっと見る

🔥非農就業者数発表:何を期待し、市場にどのような影響を与える可能性があるか 🔥

今夜は、投資家やトレーダーにとって重要な瞬間です。2026年最初の米国非農業部門雇用者数レポートの発表が予定されています。新たに60,000件の雇用が創出されると予想されており、このレポートは単なる月次の雇用状況の更新以上の意味を持ちます。これは、連邦準備制度の政策決定や短期的な市場センチメントに影響を与える重要な指標です。今夜発表される雇用データは、Fedの利下げ期待を形成する可能性が高く、それがビットコインを含むさまざまな資産に深い影響を与える可能性があります。現在、ビットコインは約90,500ドル付近で落ち着いており、慎重な期待感を反映しています。投資家やトレーダーは、このデータを注視し、経済の強さを測り、ビットコインの次の動きを予測しようとしています。このレポートはビットコインを上昇させる明確な指標を提供するのか、それとも調整を引き起こすのか?今後数時間は、市場の方向性を決定づける重要な時間となるでしょう。

このデータが暗号通貨と市場にとって重要な理由

非農業部門雇用者数レポートは、米国労働市場の健康状態を示す重要な経済指標です。これは、経済の強さや弱さの先行シグナルとなります。雇用状況が良好であれば、利上げの継続や維持の根拠となり得ますが、数字が弱い場合は利下げ期待を高めることになりま

今夜は、投資家やトレーダーにとって重要な瞬間です。2026年最初の米国非農業部門雇用者数レポートの発表が予定されています。新たに60,000件の雇用が創出されると予想されており、このレポートは単なる月次の雇用状況の更新以上の意味を持ちます。これは、連邦準備制度の政策決定や短期的な市場センチメントに影響を与える重要な指標です。今夜発表される雇用データは、Fedの利下げ期待を形成する可能性が高く、それがビットコインを含むさまざまな資産に深い影響を与える可能性があります。現在、ビットコインは約90,500ドル付近で落ち着いており、慎重な期待感を反映しています。投資家やトレーダーは、このデータを注視し、経済の強さを測り、ビットコインの次の動きを予測しようとしています。このレポートはビットコインを上昇させる明確な指標を提供するのか、それとも調整を引き起こすのか?今後数時間は、市場の方向性を決定づける重要な時間となるでしょう。

このデータが暗号通貨と市場にとって重要な理由

非農業部門雇用者数レポートは、米国労働市場の健康状態を示す重要な経済指標です。これは、経済の強さや弱さの先行シグナルとなります。雇用状況が良好であれば、利上げの継続や維持の根拠となり得ますが、数字が弱い場合は利下げ期待を高めることになりま

BTC-1.92%

- 報酬

- 8

- 6

- リポスト

- 共有

SoominStar :

:

2026年ゴゴゴ 👊もっと見る

#NonfarmPayrollsComing 非農就業者数 (NFP)レポートは、米国で最も注目される経済指標の一つです。農業従事者、政府関係者、その他一部のセクターを除く雇用者数の増減を測定します。NFPデータは、米ドル、金利予想、そして暗号通貨を含む世界の市場に大きな影響を与えます。

なぜNFPが重要なのか

堅調な雇用成長は健全な経済を示します。これにより、通常はドルが強化され、金利上昇の期待が高まります。そのような環境では、暗号通貨、株式、金などのリスク資産が圧力を受ける可能性があります。逆に、予想よりも弱い雇用成長は経済の減速を示し、ドルを弱め、利下げの期待を高め、暗号通貨やその他のリスク資産を支援します。

NFPが暗号通貨に与える影響

暗号市場はドルの強さと金利予想を通じて間接的に反応します:

強いNFP:ドルが強化 → 利回り上昇 → BTCやアルトコインに圧力

弱いNFP:ドルが弱まる → 利回り低下 → BTCやアルトコインに潜在的な上昇余地

リリース時に期待できること

NFPの発表はしばしば高いボラティリティを引き起こします。価格は数秒以内に大きく振れることがあります。流動性が低下し、スプレッドが拡大し、ストップロスが発動されるリスクもあります。

NFP周辺の取引戦略

レポート直前に新規取引を開始しないこと。

すでに利益が出ている場合は、一部利益確定を検討。

リリ

なぜNFPが重要なのか

堅調な雇用成長は健全な経済を示します。これにより、通常はドルが強化され、金利上昇の期待が高まります。そのような環境では、暗号通貨、株式、金などのリスク資産が圧力を受ける可能性があります。逆に、予想よりも弱い雇用成長は経済の減速を示し、ドルを弱め、利下げの期待を高め、暗号通貨やその他のリスク資産を支援します。

NFPが暗号通貨に与える影響

暗号市場はドルの強さと金利予想を通じて間接的に反応します:

強いNFP:ドルが強化 → 利回り上昇 → BTCやアルトコインに圧力

弱いNFP:ドルが弱まる → 利回り低下 → BTCやアルトコインに潜在的な上昇余地

リリース時に期待できること

NFPの発表はしばしば高いボラティリティを引き起こします。価格は数秒以内に大きく振れることがあります。流動性が低下し、スプレッドが拡大し、ストップロスが発動されるリスクもあります。

NFP周辺の取引戦略

レポート直前に新規取引を開始しないこと。

すでに利益が出ている場合は、一部利益確定を検討。

リリ

BTC-1.92%

- 報酬

- 1

- 2

- リポスト

- 共有

Discovery :

:

2026年ゴゴゴ 👊もっと見る

#NonfarmPayrollsComing

米国非農業部門雇用者数(NFP)報告は、世界の市場で最も影響力のある経済指標の一つです。2026年1月のNFPが近づくにつれ、その重要性は雇用数を超えて広がっています。2025年12月の報告では、米国経済は約50,000の雇用を創出し、予想を下回り、採用活動の鈍化を示しました。同時に、失業率はわずかに改善し4.4%となり、賃金の伸びは前年比3.8%で安定を保ちました。この採用の鈍化と堅調な賃金の組み合わせは、労働市場の健全性を微妙に映し出し、すべての資産クラスの投資家の注目を集めています。

米国労働市場の健全性 現在のデータが示すもの

最新の数字は、米国の労働市場が緩やかに調整されつつも依然として堅調であることを示しています。雇用の伸びは予想より遅いものの、失業率のわずかな低下は基礎的な安定性を示しています。このパターンは、より広範な経済の不確実性の中で慎重な採用を反映しており、労働市場が冷え込んでいる一方で崩壊していないことを強調しています。市場参加者はこれらの動向を詳細に分析し、より広い経済の勢いを評価しています。

市場の感応度 株式、暗号資産、外国為替の反応

NFPデータは歴史的に株式、暗号資産、外国為替市場で激しい動きを引き起こします。予想を下回る報告は、金融緩和策の緩和への憶測を高め、リスクオン資産を支援する可能性があります

原文表示米国非農業部門雇用者数(NFP)報告は、世界の市場で最も影響力のある経済指標の一つです。2026年1月のNFPが近づくにつれ、その重要性は雇用数を超えて広がっています。2025年12月の報告では、米国経済は約50,000の雇用を創出し、予想を下回り、採用活動の鈍化を示しました。同時に、失業率はわずかに改善し4.4%となり、賃金の伸びは前年比3.8%で安定を保ちました。この採用の鈍化と堅調な賃金の組み合わせは、労働市場の健全性を微妙に映し出し、すべての資産クラスの投資家の注目を集めています。

米国労働市場の健全性 現在のデータが示すもの

最新の数字は、米国の労働市場が緩やかに調整されつつも依然として堅調であることを示しています。雇用の伸びは予想より遅いものの、失業率のわずかな低下は基礎的な安定性を示しています。このパターンは、より広範な経済の不確実性の中で慎重な採用を反映しており、労働市場が冷え込んでいる一方で崩壊していないことを強調しています。市場参加者はこれらの動向を詳細に分析し、より広い経済の勢いを評価しています。

市場の感応度 株式、暗号資産、外国為替の反応

NFPデータは歴史的に株式、暗号資産、外国為替市場で激しい動きを引き起こします。予想を下回る報告は、金融緩和策の緩和への憶測を高め、リスクオン資産を支援する可能性があります

- 報酬

- 16

- 17

- リポスト

- 共有

EagleEye :

:

投資 To Earn 💎もっと見る

#NonfarmPayrollsComing

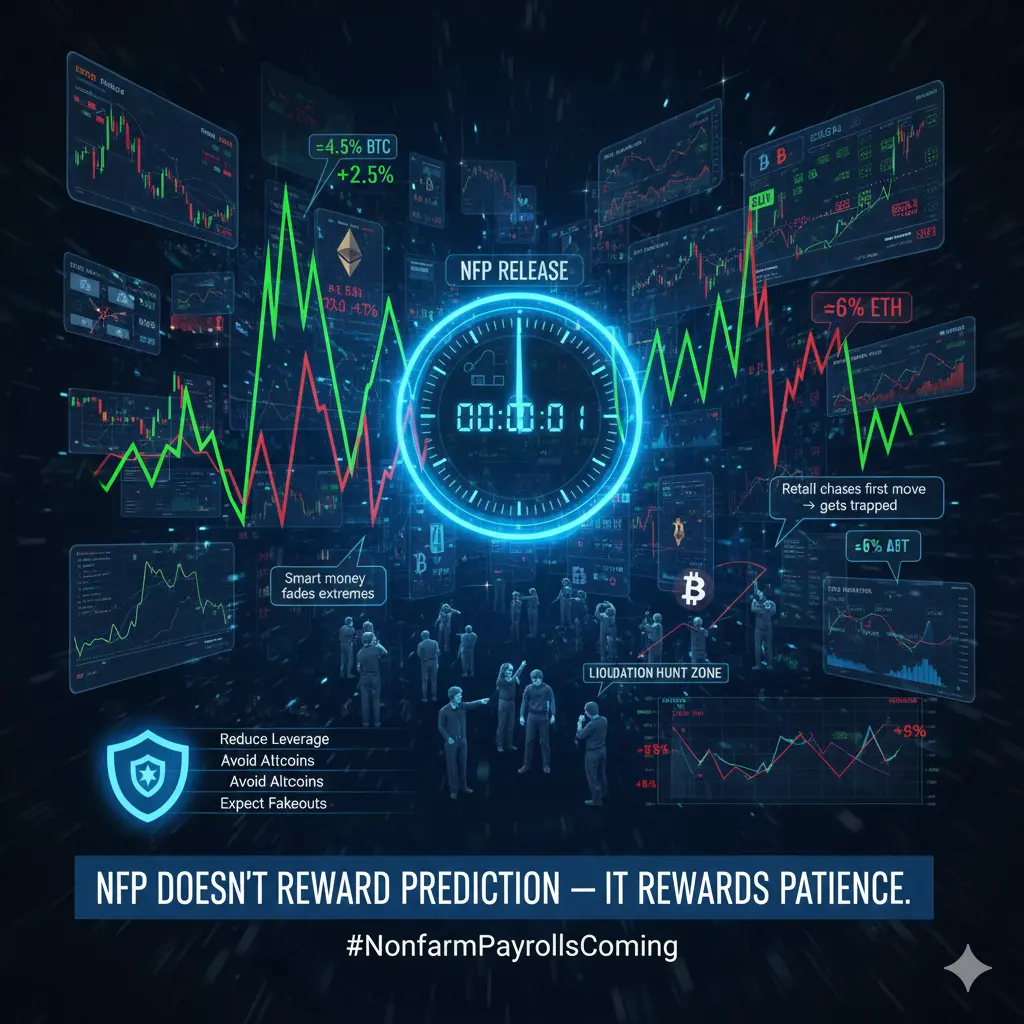

非農雇用者数(NFP)が近づくにつれ、暗号市場は最も敏感なマクロフェーズの一つに入ります。これは単なるニュースイベントではなく、ビットコイン、アルトコイン、ステーブルコインの流動性を数分で動かすことができるボラティリティの乗数です。

NFPは、金利、ドルの強さ、リスク志向に関する期待を定義し、それが直接暗号の価格動向を形成します。

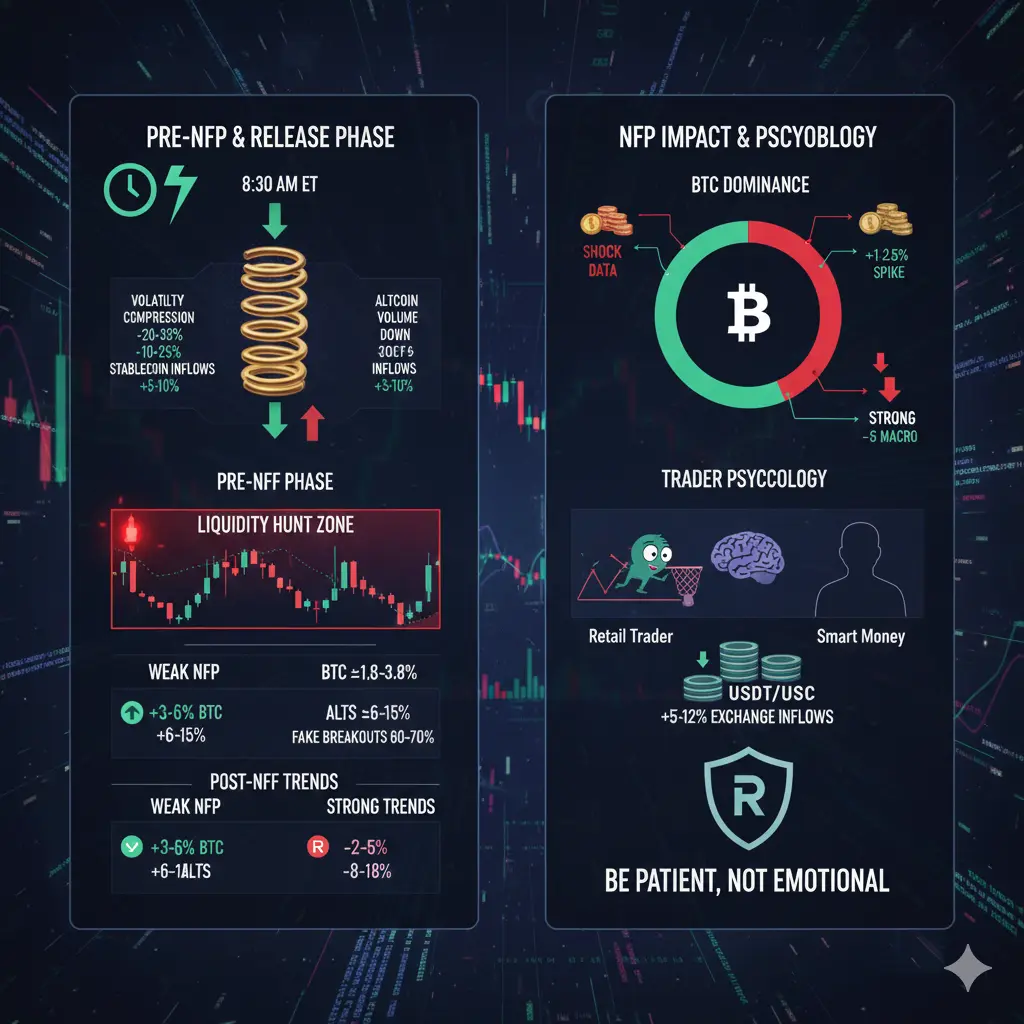

⏳ NFP前段階:ポジショニングと圧縮

通常、NFPの24〜72時間前に、市場は明確なパターンを示します:

BTCのボラティリティが約20〜35%圧縮

先物の未決済建玉が5〜12%減少

資金調達率が平坦化またはニュートラルに

アルトコインの取引量が10〜25%減少

トレーダーは資本の5〜10%をステーブルコインに移動

この段階は、リリース前に価格エネルギーが蓄積されるコイル状のスプリング効果を生み出します。

⚡ NFPリリース:最初の5〜15分 (流動性ハントゾーン)

リリース時点:

ビットコイン (BTC)

即時動き:±1.8%〜±3.8%

ウィックの延長:最大±4.5%

フェイクブレイクの確率:高 (60–70%)

イーサリアム (ETH)

反応の大きさ:±2.5%〜±6%

しばしばBTCを超え、その後リトレース

高ベータアルトコイン

突然の振れ幅:±6%〜±15%

清算主導の動きが支配的

このフェーズ

原文表示非農雇用者数(NFP)が近づくにつれ、暗号市場は最も敏感なマクロフェーズの一つに入ります。これは単なるニュースイベントではなく、ビットコイン、アルトコイン、ステーブルコインの流動性を数分で動かすことができるボラティリティの乗数です。

NFPは、金利、ドルの強さ、リスク志向に関する期待を定義し、それが直接暗号の価格動向を形成します。

⏳ NFP前段階:ポジショニングと圧縮

通常、NFPの24〜72時間前に、市場は明確なパターンを示します:

BTCのボラティリティが約20〜35%圧縮

先物の未決済建玉が5〜12%減少

資金調達率が平坦化またはニュートラルに

アルトコインの取引量が10〜25%減少

トレーダーは資本の5〜10%をステーブルコインに移動

この段階は、リリース前に価格エネルギーが蓄積されるコイル状のスプリング効果を生み出します。

⚡ NFPリリース:最初の5〜15分 (流動性ハントゾーン)

リリース時点:

ビットコイン (BTC)

即時動き:±1.8%〜±3.8%

ウィックの延長:最大±4.5%

フェイクブレイクの確率:高 (60–70%)

イーサリアム (ETH)

反応の大きさ:±2.5%〜±6%

しばしばBTCを超え、その後リトレース

高ベータアルトコイン

突然の振れ幅:±6%〜±15%

清算主導の動きが支配的

このフェーズ

- 報酬

- 30

- 19

- リポスト

- 共有

Vortex_King :

:

2026年ゴゴゴ 👊もっと見る

もっと詳しく

成長中のコミュニティに、40M人のユーザーと一緒に参加しましょう

⚡️ 暗号通貨ブームのディスカッションに、40M人のユーザーと一緒に参加しましょう

💬 お気に入りの人気クリエイターと交流しよう

👍 あなたの興味を見つけよう

人気の話題

355.62K 人気度

19.22K 人気度

58.86K 人気度

13.16K 人気度

461.18K 人気度

2.83K 人気度

2.42K 人気度

1.15K 人気度

804 人気度

80.02K 人気度

41.78K 人気度

96.82K 人気度

14.18K 人気度

66.68K 人気度

1.51K 人気度

ニュース

もっと見るピン