Post content & earn content mining yield

placeholder

After the 1011 major liquidation, the Bitcoin bull market will restart.

Author: Coinbase Institutional Research

Key Points

1. Despite ongoing panic sentiment across the entire crypto market, we believe that the liquidation events in October are more likely to be a prelude to medium- to long-term strength rather than a sign of weakness, creating a good start for a Q4 rally.

2. However, a full market stabilization may take several months, with a mid-term trend likely showing gradual warming rather than soaring to new all-time highs.

3. Over the past 30 days, the flow of "smart money" in the crypto space has concentrated around the EVM tech stack, while moving away from Solana and BSC.

Summary

After the massive liquidation event on October 10th, we believe the crypto market has reached a short-term bottom, with current market positioning significantly improved. The market appears to be resetting rather than crashing. We think this round of selling has brought market leverage levels back to a healthier structural state, which could support medium- to short-term trends.

Key Points

1. Despite ongoing panic sentiment across the entire crypto market, we believe that the liquidation events in October are more likely to be a prelude to medium- to long-term strength rather than a sign of weakness, creating a good start for a Q4 rally.

2. However, a full market stabilization may take several months, with a mid-term trend likely showing gradual warming rather than soaring to new all-time highs.

3. Over the past 30 days, the flow of "smart money" in the crypto space has concentrated around the EVM tech stack, while moving away from Solana and BSC.

Summary

After the massive liquidation event on October 10th, we believe the crypto market has reached a short-term bottom, with current market positioning significantly improved. The market appears to be resetting rather than crashing. We think this round of selling has brought market leverage levels back to a healthier structural state, which could support medium- to short-term trends.

- Reward

- like

- Comment

- Repost

- Share

⚡ $SOL 𝗘𝘆𝗲𝘀 $𝟭𝟵𝟬 – 𝗜𝘀 𝘁𝗵𝗲 𝗥𝗮𝗹𝗹𝘆 𝗔𝗯𝗼𝘂𝘁 𝘁𝗼 𝗕𝗲𝗴𝗶𝗻 ❓ $SOL 𝗨𝗣𝗗𝗔𝗧𝗘 👇

#sol has been consolidating for quite some time and is now attempting to recover from its recent dip.

Currently, the price is showing signs of strength and is trying to pull back toward the previous resistance zone around $185–$190.

However, SOL is at a critical level. If it can hold above $150, there’s a strong chance it could surge back toward $180–$190. On the flip side, failing to hold this zone could see a drop toward $130–$125, though that scenario seems less likely.

Based on my personal

#sol has been consolidating for quite some time and is now attempting to recover from its recent dip.

Currently, the price is showing signs of strength and is trying to pull back toward the previous resistance zone around $185–$190.

However, SOL is at a critical level. If it can hold above $150, there’s a strong chance it could surge back toward $180–$190. On the flip side, failing to hold this zone could see a drop toward $130–$125, though that scenario seems less likely.

Based on my personal

SOL-0.62%

- Reward

- 2

- Comment

- Repost

- Share

$IP

$IP is trading around 3.729, gaining over 2% after bouncing from its 24h low of 3.623. The coin earlier tested resistance near 4.041 before a healthy correction, and now buyers seem to be stepping back in. The short-term structure looks stable, showing potential for another upward move if momentum continues to build.

Entry Point (EP)

3.70 – 3.75 range is ideal for entry while price stabilizes above the support level.

Target Points (TP)

TP1: 3.88

TP2: 4.02

TP3: 4.15

Stop Loss (SL)

3.60 – just below the recent low to keep downside limited.

Reasons for Trade

• IP bounced strongly from the

$IP is trading around 3.729, gaining over 2% after bouncing from its 24h low of 3.623. The coin earlier tested resistance near 4.041 before a healthy correction, and now buyers seem to be stepping back in. The short-term structure looks stable, showing potential for another upward move if momentum continues to build.

Entry Point (EP)

3.70 – 3.75 range is ideal for entry while price stabilizes above the support level.

Target Points (TP)

TP1: 3.88

TP2: 4.02

TP3: 4.15

Stop Loss (SL)

3.60 – just below the recent low to keep downside limited.

Reasons for Trade

• IP bounced strongly from the

IP3.48%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin has 3 CME gaps below current price - 103.8K, 96.8K, and 91.5K. Which one gets filled determines if we rally or crash. TTP reveals why taking ONLY the 104.8K gap keeps bull hopes alive, but touching the lower ones means game over for short-term bulls.

#Bitcoin #CMEGap #BTC #TradingStrategy #CryptoAnalysis

#Bitcoin #CMEGap #BTC #TradingStrategy #CryptoAnalysis

BTC-1.04%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Whales Have Cashed Out Billions Since $100K, Says CryptoQuant CEO Ki Young Ju

Bitcoin whale investors have been selling off since BTC reached $100,000, leading to a recent price drop to $103,400. Despite some institutional buying, analysts warn of potential dominance by sellers if this influx wanes, though current levels may present a buying opportunity.

BTC-1.04%

- Reward

- like

- Comment

- Repost

- Share

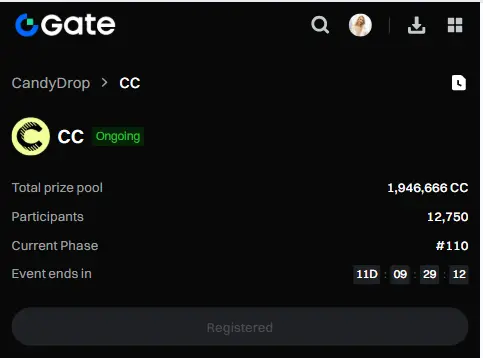

🚀 Cloud Coin ($CC ): Making the Cloud Less Centralized

Traditional cloud solutions keep data and control in one place. Cloud Coin flips that model: a blockchain-powered node network spreads out storage and computing capacity, offering consumers real data ownership, clear operations, and better privacy. By using surplus capacity among nodes, this architecture also makes things more resilient and can lower expenses.

What stands out:

🔒 Data sovereignty: users have control over keys and access.

⚡ Performance that can grow—distributed nodes cut down on single-point bottlenecks.

🔁 Tr

Traditional cloud solutions keep data and control in one place. Cloud Coin flips that model: a blockchain-powered node network spreads out storage and computing capacity, offering consumers real data ownership, clear operations, and better privacy. By using surplus capacity among nodes, this architecture also makes things more resilient and can lower expenses.

What stands out:

🔒 Data sovereignty: users have control over keys and access.

⚡ Performance that can grow—distributed nodes cut down on single-point bottlenecks.

🔁 Tr

CC14.48%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Countdown to the US Dollar Credit Crisis: A $30 trillion bomb is about to explode, can Bitcoin take over as "digital gold"?

US President Trump suddenly threw out a warning about a "$30 trillion tariff refund crisis," triggering severe shocks in global markets. This astronomical figure, equivalent to 10% of the US annual GDP, not only exposes the structural cracks in the dollar credit system but also foreshadows an unprecedented wave of asset reallocation that is brewing. This article analyzes the vulnerability of dollar hegemony, the technological attributes of the crypto market, and historica

View OriginalUS President Trump suddenly threw out a warning about a "$30 trillion tariff refund crisis," triggering severe shocks in global markets. This astronomical figure, equivalent to 10% of the US annual GDP, not only exposes the structural cracks in the dollar credit system but also foreshadows an unprecedented wave of asset reallocation that is brewing. This article analyzes the vulnerability of dollar hegemony, the technological attributes of the crypto market, and historica

- Reward

- like

- Comment

- Repost

- Share

$ETH – After breaking below the Weekly Bull Market Support Band, the price has tapped into the support range aligning with the golden pocket between the 0.5 and 0.618 Fibonacci POIs, the same zone where it previously bottomed, as I highlighted in earlier PAT Updates.

I believe that as long as the price holds above the 0.5 Fibonacci POI, the odds of a reversal to the upside remain high. If it fails to do so, I expect more consolidation, which would signal short-term weakness.

As the price approaches the prior high-timeframe support range, marked in green, also aligning with the Weekly Bull Mark

I believe that as long as the price holds above the 0.5 Fibonacci POI, the odds of a reversal to the upside remain high. If it fails to do so, I expect more consolidation, which would signal short-term weakness.

As the price approaches the prior high-timeframe support range, marked in green, also aligning with the Weekly Bull Mark

ETH-0.07%

- Reward

- like

- Comment

- Repost

- Share

$XRP /USDT – Bulls Breakout Signal

$XRP just fired a clean breakout above the $2.40 zone and pushed toward $2.47 with strong buying pressure. Momentum is picking up, and buyers are stepping in on every dip. As long as price holds above $2.38–$2.40, the upside remains in play.

Entry Zone:

$2.42 – $2.46

(Current price: ~$2.46)

Key Support Levels:

• $2.40 (Primary support to hold)

• $2.35 (Secondary support if market pulls back deeper)

Immediate Resistance:

• $2.50

• $2.56

Trade Setup:

Look for a stable pullback into the entry zone. If price holds above $2.40 after retest, continuation toward nex

$XRP just fired a clean breakout above the $2.40 zone and pushed toward $2.47 with strong buying pressure. Momentum is picking up, and buyers are stepping in on every dip. As long as price holds above $2.38–$2.40, the upside remains in play.

Entry Zone:

$2.42 – $2.46

(Current price: ~$2.46)

Key Support Levels:

• $2.40 (Primary support to hold)

• $2.35 (Secondary support if market pulls back deeper)

Immediate Resistance:

• $2.50

• $2.56

Trade Setup:

Look for a stable pullback into the entry zone. If price holds above $2.40 after retest, continuation toward nex

XRP0.12%

- Reward

- 1

- Comment

- Repost

- Share

Having been in the crypto world for these years, I finally see through one thing🌪️:

Most people lose money, not to the market, but to their own "unstoppable hands"🖐️.

The market is fine, the position is also fine, the problem lies in —

When you make a profit, you always want to hold on a little longer, but when you incur a loss, you refuse to admit defeat and stubbornly wait for a miracle💔.

I used to be that "emotional player", with my account repeatedly going to zero, until one day, I set "five self-destructive military rules" for myself ⚔️:

🔹 Never go ALL-IN —— No matter how certain you

View OriginalMost people lose money, not to the market, but to their own "unstoppable hands"🖐️.

The market is fine, the position is also fine, the problem lies in —

When you make a profit, you always want to hold on a little longer, but when you incur a loss, you refuse to admit defeat and stubbornly wait for a miracle💔.

I used to be that "emotional player", with my account repeatedly going to zero, until one day, I set "five self-destructive military rules" for myself ⚔️:

🔹 Never go ALL-IN —— No matter how certain you

- Reward

- 1

- Comment

- Repost

- Share

The US Senate has reached an agreement to end the government shutdown. Notably, the government shutdown is a major recent cause of liquidity issues. This development marks a turning point and is a positive variable for the markets. As a result, cryptocurrencies and European and US stock index futures surged collectively in early trading. Bitcoin temporarily broke above $106,000, and Ethereum briefly surpassed $3,600. European STOXX 50 index futures rose by 1.3%, and DAX futures increased by 1.3%. The Asia-Pacific markets opened sharply higher, with the Korean stock index rising over 2%, the Ja

View Original

- Reward

- like

- Comment

- Repost

- Share

Unveiling the Trillion-Dollar Feast of Stablecoins: Who Is Profiting?

[Plain Language Overview] Stablecoins like USDT and USDC are the "bloodstream" of the crypto ecosystem. They offer no interest to holders but generate huge profits for issuers: Circle's revenue in 2024 is 1.7 billion USD, and Tether's profit is 13 billion USD!

Where does the money come from? Float funds leverage Federal Reserve rate hikes, combining bond interest and transaction fees. Circle outsources compliance to BlackRock, while Tether takes aggressive bets on Bitcoin and gold. Profit sharing: Circle gives half to Coinba

[Plain Language Overview] Stablecoins like USDT and USDC are the "bloodstream" of the crypto ecosystem. They offer no interest to holders but generate huge profits for issuers: Circle's revenue in 2024 is 1.7 billion USD, and Tether's profit is 13 billion USD!

Where does the money come from? Float funds leverage Federal Reserve rate hikes, combining bond interest and transaction fees. Circle outsources compliance to BlackRock, while Tether takes aggressive bets on Bitcoin and gold. Profit sharing: Circle gives half to Coinba

BTC-1.04%

- Reward

- like

- Comment

- Repost

- Share

Ledger eyes IPO as crypto hacks fuel demand for hardware wallets

Crypto hardware wallet manufacturer Ledger is the latest to vie for a spot on the public markets as demand for its secure storage solution has surged over recent months due to the growing wave of hacks and scams.

During an interview with the Financial Times, Ledger CEO Pascal Gauthier said the

During an interview with the Financial Times, Ledger CEO Pascal Gauthier said the

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40 million users in our growing community

⚡️ Join 40 million users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

27.74K Popularity

102.08K Popularity

28.46K Popularity

24.93K Popularity

11.49K Popularity

- Hot Gate FunView More

- MC:$4.01KHolders:10.00%

- MC:$4.1KHolders:20.14%

- MC:$4.07KHolders:20.04%

- MC:$3.99KHolders:10.00%

- MC:$4KHolders:10.00%

- Pin

- 🚀 Gate Square “Gate Fun Token Challenge” is Live!

Create tokens, engage, and earn — including trading fee rebates, graduation bonuses, and a $1,000 prize pool!

Join Now 👉 https://www.gate.com/campaigns/3145

💡 How to Participate:

1️⃣ Create Tokens: One-click token launch in [Square - Post]. Promote, grow your community, and earn rewards.

2️⃣ Engage: Post, like, comment, and share in token community to earn!

📦 Rewards Overview:

Creator Graduation Bonus: 50 GT

Trading Fee Rebate: The more trades, the more you earn

Token Creator Pool: Up to $50 USDT per user + $5 USDT for the first 50 launche - 💥 Gate Square Event: #PostToWinTRUST 💥

Post original content on Gate Square related to TRUST or the CandyDrop campaign for a chance to share 13,333 TRUST in rewards!

📅 Event Period: Nov 6, 2025 – Nov 16, 2025, 16:00 (UTC)

📌 Related Campaign:

CandyDrop 👉 https://www.gate.com/announcements/article/47990

📌 How to Participate:

1️⃣ Post original content related to TRUST or the CandyDrop event.

2️⃣ Content must be at least 80 words.

3️⃣ Add the hashtag #PostToWinTRUST

4️⃣ Include a screenshot showing your CandyDrop participation.

🏆 Rewards (Total: 13,333 TRUST)

🥇 1st Prize (1 winner): 3,833