DannyMarque

No content yet

DannyMarque

I don’t think you guys understand how bullish it is from a technical perspective to see this type of mid-day reversal in high beta names

$VIX gave back all its momentum

$IWM now green

Bitcoin, miners $CLSK, HPC/AI names like $IREN $NUAI $HIVE $APLD $CIFR all with V-shaped comebacks

Should be a great start to the year

$VIX gave back all its momentum

$IWM now green

Bitcoin, miners $CLSK, HPC/AI names like $IREN $NUAI $HIVE $APLD $CIFR all with V-shaped comebacks

Should be a great start to the year

- Reward

- like

- Comment

- Repost

- Share

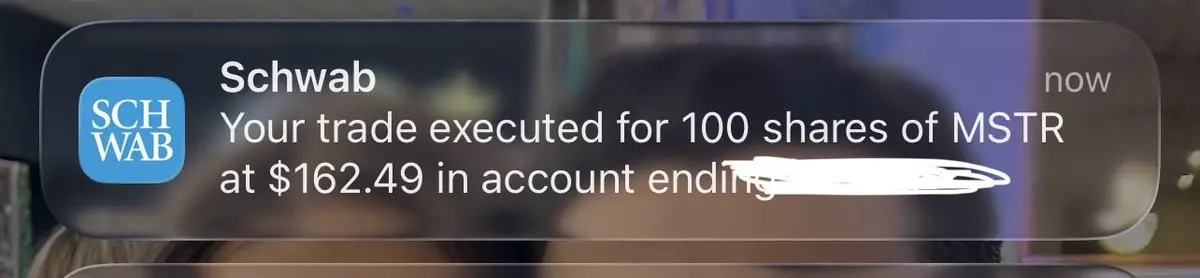

Started a new position of 100 shares in the worlds largest digital credit company

Last time I bought shares of Strategy $MSTR in this size was in 2023

Last time I bought shares of Strategy $MSTR in this size was in 2023

- Reward

- like

- Comment

- Repost

- Share

Since when are higher lows bearish?

Asking for a friend

Asking for a friend

- Reward

- like

- Comment

- Repost

- Share

I want to thank all the geopolitical analysts and economists on X who have become experts on the matters of Greenland and tariffs overnight and currently attribute the volatility in Bitcoin to these very matters

Your alpha will always be appreciated 🙏

Your alpha will always be appreciated 🙏

BTC-3.93%

- Reward

- like

- Comment

- Repost

- Share

Gold and Silver have been on an absolute tear over the last year

$GLD +72%

$SLV +208%

Together, these 2 assets represent ~$37T in economic value. If capital is willing to reprice physical commodities at 70-200% in a year what do you think that says about the trust in fiat systems?

Inert assets expensive to store, slow to move, difficult to verify constrained by a variety of physical and jurisdictional limitations....and yet they managed to absorb trillions in capital under current global monetary conditions

Gold and Silver are giving us a glimpse of how large the repricing will be once the ma

$GLD +72%

$SLV +208%

Together, these 2 assets represent ~$37T in economic value. If capital is willing to reprice physical commodities at 70-200% in a year what do you think that says about the trust in fiat systems?

Inert assets expensive to store, slow to move, difficult to verify constrained by a variety of physical and jurisdictional limitations....and yet they managed to absorb trillions in capital under current global monetary conditions

Gold and Silver are giving us a glimpse of how large the repricing will be once the ma

BTC-3.93%

- Reward

- 1

- Comment

- Repost

- Share

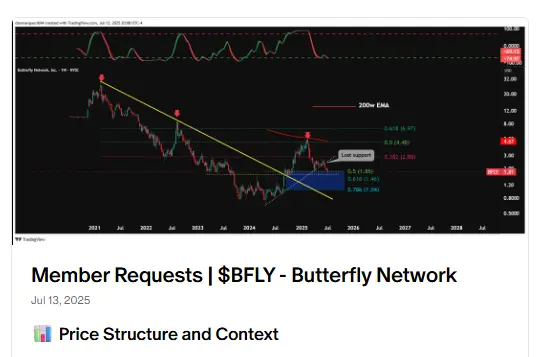

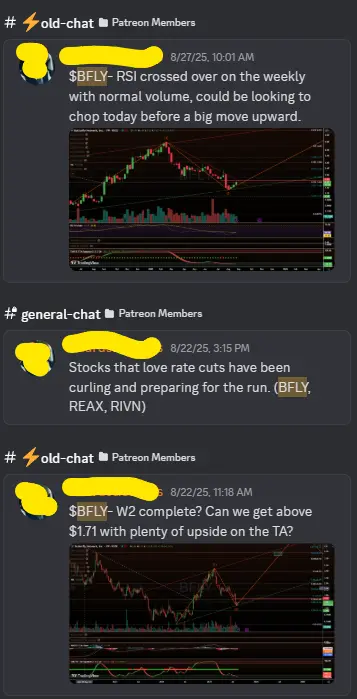

Butterfly Network $BFLY with a quiet 2-3.5x since the summer all while Bitcoin / crypto didn't do anything

One of the only ppl to find this gem I think

One of the only ppl to find this gem I think

BTC-3.93%

- Reward

- like

- Comment

- Repost

- Share

$GRRR Gorilla Tech

Very high risk small cap currently $280M but showing signs that its at the end of this falling wedge. Could be early stages of a pretty large reversal

$110M cash

$16m debt

Very high risk small cap currently $280M but showing signs that its at the end of this falling wedge. Could be early stages of a pretty large reversal

$110M cash

$16m debt

- Reward

- 1

- 5

- Repost

- Share

GateUser-4bcb5245 :

:

Buy to earn 💎View More

I don't want to bust anyone's Gold $GLD bubble, BUT, the last ~50 years of history suggests that being bullish at a monthly RSI > 80 and buying at these levels almost always guarantees you're buying the top

Buying here typically seen an average pullback of -38%

Buying here typically seen an average pullback of -38%

- Reward

- like

- Comment

- Repost

- Share

After much thought and consultation with my financial advisors at Goldman Stanley I just sold all my Bitcoin and bought Gold and Silver instead

I rather have hard assets that I can physically touch and store in a bank vault that I trust

I rather have hard assets that I can physically touch and store in a bank vault that I trust

BTC-3.93%

- Reward

- like

- Comment

- Repost

- Share

$OKLO is one of the nuclear plays to continue keeping an eye on. Its been on my radar for the last 2 years. Personally I own $SMR but the reality is that small, modular next-gen nuclear power plants are the future

Also, few technical charts are this clean

Also, few technical charts are this clean

- Reward

- like

- Comment

- Repost

- Share

$NIO - Nio

Nothing about the fundamentals makes me like the company. It still loses money and the chinese EV market is seeing intense levels of new entrants. However, the chart does look better than fundamentals.

Personally, I don't invest in Chinese equities but it had a very explosive move in the summer blowing through and above the ichimoku cloud.

Now, it's come back to reality. Still in the cloud holding support and trying to find a bottom on declining volume (signs of exhaustion)

Wouldn't be surprised to see the following path unfold

Nothing about the fundamentals makes me like the company. It still loses money and the chinese EV market is seeing intense levels of new entrants. However, the chart does look better than fundamentals.

Personally, I don't invest in Chinese equities but it had a very explosive move in the summer blowing through and above the ichimoku cloud.

Now, it's come back to reality. Still in the cloud holding support and trying to find a bottom on declining volume (signs of exhaustion)

Wouldn't be surprised to see the following path unfold

- Reward

- like

- Comment

- Repost

- Share

The key win here for $MSTR and Bitcoin DATs isn't that exclusions didn’t happen it’s that the conversation is now happening at the right institutional level.

For me, the more interesting development is why MSCI landed where it did. In its own words, MSCI acknowledged that "distinguishing between investment companies and operating companies that hold digital assets as part of their core operations requires further research and consultation with market participants"

That sentence matters far more than anything else as it confirms something many of us already know which is that Bitcoin-native bus

For me, the more interesting development is why MSCI landed where it did. In its own words, MSCI acknowledged that "distinguishing between investment companies and operating companies that hold digital assets as part of their core operations requires further research and consultation with market participants"

That sentence matters far more than anything else as it confirms something many of us already know which is that Bitcoin-native bus

BTC-3.93%

- Reward

- like

- Comment

- Repost

- Share

$CLSK Cleanspark

For those that care about open gaps getting filled...

For those that care about open gaps getting filled...

- Reward

- like

- Comment

- Repost

- Share

I expect a meaningful move lower in the US 10-yr, and the chart is increasingly consistent with this view. If correct, it has broad implications for

- US equities

- Cost of capital

- Housing affordability (lower mortgage rates)

- Duration sensitive assets (growth stocks)

Yes, we have a triangle pattern and yes, there are higher lows. But, triangles are not directionally deterministic. How they're formed and how price behaves inside the triangle is much more important.

What makes this pattern bearish is you have:

1. Overlapping price action for ~3 years which is early distribution type of beha

- US equities

- Cost of capital

- Housing affordability (lower mortgage rates)

- Duration sensitive assets (growth stocks)

Yes, we have a triangle pattern and yes, there are higher lows. But, triangles are not directionally deterministic. How they're formed and how price behaves inside the triangle is much more important.

What makes this pattern bearish is you have:

1. Overlapping price action for ~3 years which is early distribution type of beha

- Reward

- like

- Comment

- Repost

- Share

Don't see much talk about $HIMS anymore after a -50% pullback since October. Alot of good things beginning to unfold on the chart that make it hard to ignore such as:

- Finding support at the 1.136 fib + 100w EMA

- Selling on declining volume = exhaustion

- TMO and DSS Bresser reset and at bottom of band

- Price at the bottom of 3+ yr ascending channel. The last 4 instances $HIMS reacted to the bottom of this channel saw an avg reaction of +132%

There's an interesting setup here

@Freedom_By_40 @Fibonacci_TA @cantonmeow @matthughes13 @MarketMaestro1

- Finding support at the 1.136 fib + 100w EMA

- Selling on declining volume = exhaustion

- TMO and DSS Bresser reset and at bottom of band

- Price at the bottom of 3+ yr ascending channel. The last 4 instances $HIMS reacted to the bottom of this channel saw an avg reaction of +132%

There's an interesting setup here

@Freedom_By_40 @Fibonacci_TA @cantonmeow @matthughes13 @MarketMaestro1

- Reward

- like

- Comment

- Repost

- Share

$SLNH Soluna Holdings

Getting better at technical analysis is more than just pattern recognition, its learning to anticipate and understand emerging structures happening within the charts

In this example, we have a clear falling wedge and,

- A gap fill

- Bullish divergence (lower low on price + higher low on Williams %R)

- A dragonfly doji (aka bullish reversal candle) printed at the bottom of the lower trendline of the triangle on last day of the year which has now resulted in 2 strong green back to back days on positive volume

To confirm the breakout, 2 trendlines need to be broken

1. The

Getting better at technical analysis is more than just pattern recognition, its learning to anticipate and understand emerging structures happening within the charts

In this example, we have a clear falling wedge and,

- A gap fill

- Bullish divergence (lower low on price + higher low on Williams %R)

- A dragonfly doji (aka bullish reversal candle) printed at the bottom of the lower trendline of the triangle on last day of the year which has now resulted in 2 strong green back to back days on positive volume

To confirm the breakout, 2 trendlines need to be broken

1. The

- Reward

- like

- Comment

- Repost

- Share

$SOUN - SoundHound AI

Sometimes the technical analysis on a chart is this clean

- Found support at high timeframe demand

- Ended last week with a dragonfly doji on the 100w EMA

- Held the trendline support going back to April 2024

- Weekly TMO reset at lower band, pending flip

- DSS Bressert bottoming, pending flip

A +40-50% move can unfold here over coming months as long as all the above continue to hold true

Sometimes the technical analysis on a chart is this clean

- Found support at high timeframe demand

- Ended last week with a dragonfly doji on the 100w EMA

- Held the trendline support going back to April 2024

- Weekly TMO reset at lower band, pending flip

- DSS Bressert bottoming, pending flip

A +40-50% move can unfold here over coming months as long as all the above continue to hold true

- Reward

- like

- Comment

- Repost

- Share

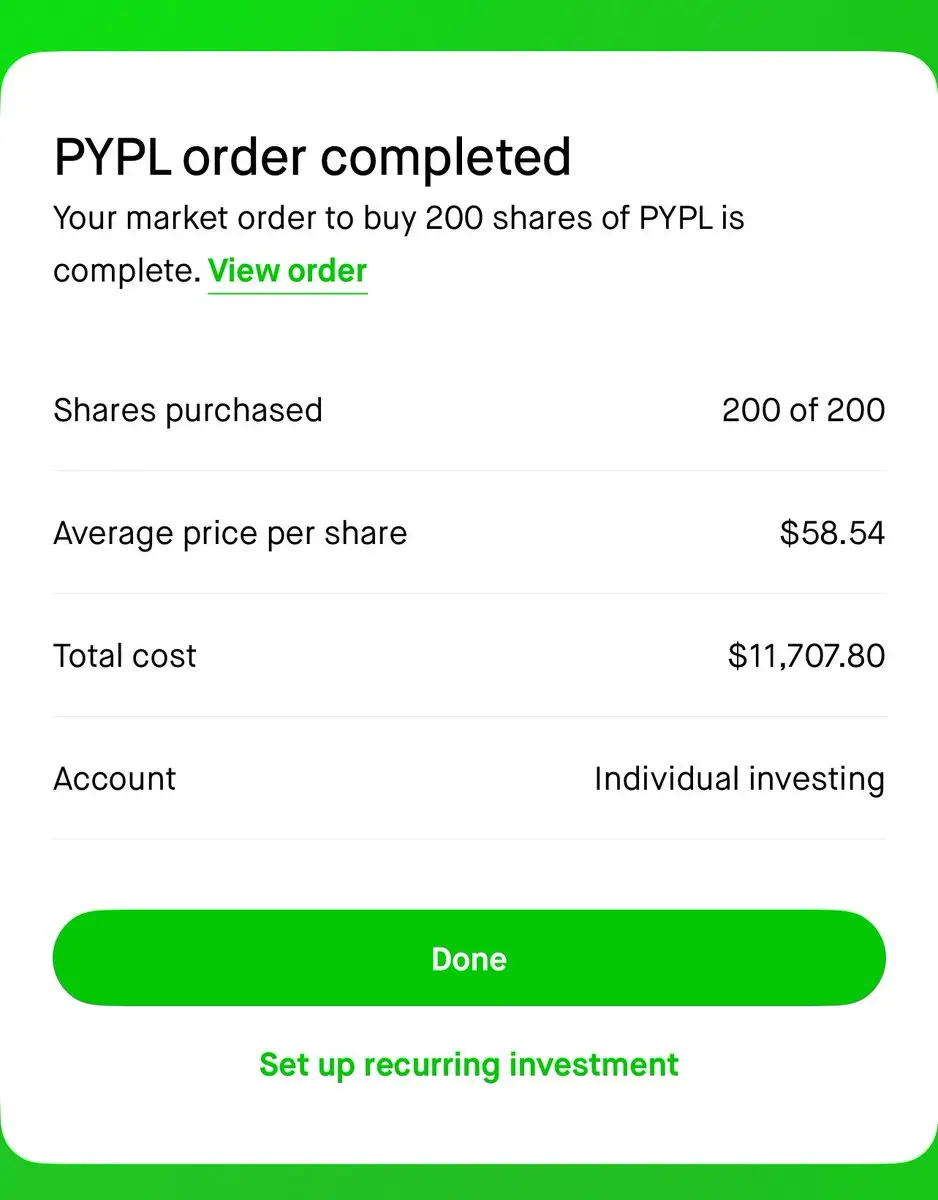

I understand the overall market perception around PayPal $PYPL. It’s a laggard, no one cares about it.

But it’s laughable to see market pricing them like a dying business at 11.9x P/E and

Yes they’re still a turnaround story, yes there’s alot of competition in payments but - Venmo + PayPal are top finance apps

- they continue to do aggressive share buybacks

- lowest valuation since IPO

- strong FCF

- one of a few fintechs w/genuine partnership with OpenAI

- PYUSD stablecoin is one of the fastest growing tokenized assets in the $1B+ supply category

Think about it this way. We know stocks don’

But it’s laughable to see market pricing them like a dying business at 11.9x P/E and

Yes they’re still a turnaround story, yes there’s alot of competition in payments but - Venmo + PayPal are top finance apps

- they continue to do aggressive share buybacks

- lowest valuation since IPO

- strong FCF

- one of a few fintechs w/genuine partnership with OpenAI

- PYUSD stablecoin is one of the fastest growing tokenized assets in the $1B+ supply category

Think about it this way. We know stocks don’

PYUSD0.07%

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More10.45K Popularity

36.35K Popularity

51.88K Popularity

13.52K Popularity

9.82K Popularity

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889