Arthur Hayes' latest article: Trump's "colonization" of Venezuela, how will Bitcoin prices move?

1h ago

Is the Bitcoin surge a "phantom"? Spot trading volume drops to a 2-year low, liquidity faces a cold snap

3h ago

Trending Topics

View More6.45K Popularity

10.4K Popularity

27.32K Popularity

11.96K Popularity

150.26K Popularity

Pin

MICA Daily|BTC struggles to advance, pulls back to 92,000; tonight's ADP Non-Farm Employment Change will influence market trends

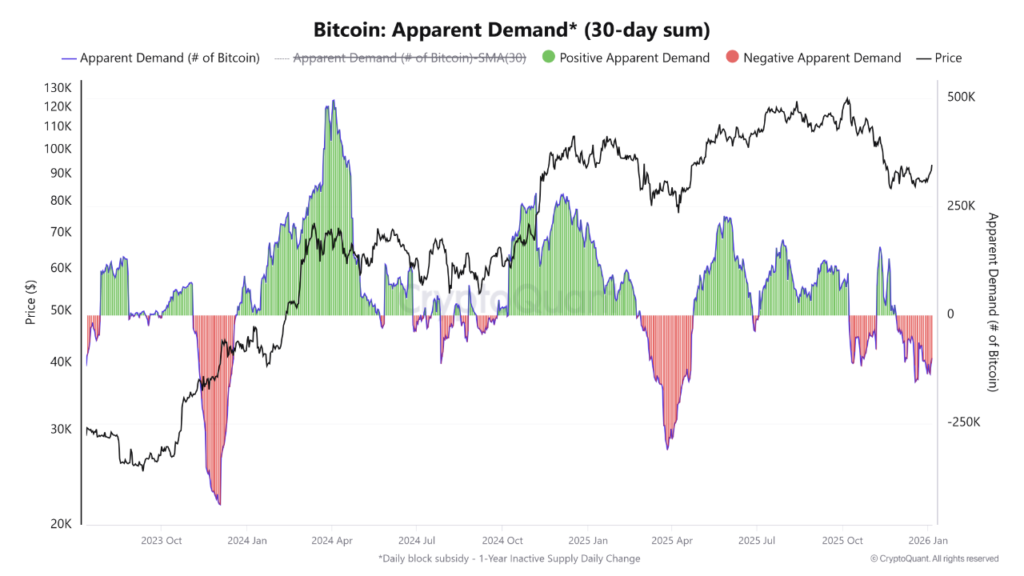

BTC broke above $94,000 the day before yesterday, but experienced a significant pullback yesterday. However, it was also mentioned yesterday that if BTC falls below $91,000 again, it will enter a bear market. Fortunately, the daily chart price is still holding at the $92,000 level. If there is a clear rebound in the next few days, there is a chance to follow the US stock market upward. To confirm a return to an upward trend, the price needs to effectively break through $97,000. Currently, the selling pressure at $94,000 is quite strong, so it is expected to be difficult to reach that level in the short term. Therefore, holding above $91,000 is more important now. Let’s also look at on-chain data. Even if the price returns above $92,000, the current on-chain demand still appears insufficient. A larger rebound is needed to support a breakthrough of $97,000. In a market with uncertain sentiment and low trading volume, on-chain activity has not shown obvious signs of improvement recently. However, as the holiday ends, many investors who had reduced trading are gradually returning, and this situation may change in a few days.

Let’s also look at on-chain data. Even if the price returns above $92,000, the current on-chain demand still appears insufficient. A larger rebound is needed to support a breakthrough of $97,000. In a market with uncertain sentiment and low trading volume, on-chain activity has not shown obvious signs of improvement recently. However, as the holiday ends, many investors who had reduced trading are gradually returning, and this situation may change in a few days.