# BitcoinFallsBehindGold

23.36K

Bitcoin’s gold ratio is down about 55% from its peak and has fallen below the 200-week MA. Is this a good dip-buying opportunity? Share your latest Bitcoin strategy.

Discovery

#比特币相对黄金进入深度弱势

Why Is "Digital Gold" Falling Behind? The Return of Traditional Trust

For years, the narrative suggested that Bitcoin would eventually dethrone gold. However, January 2026 data paints a completely different picture. While spot gold has shattered the $5,200 per ounce barrier, Bitcoin has lost momentum, remaining stuck in the $86,000 - $89,000 range.

1. The Demand for Pure Safe-Haven Assets

Markets are currently seeking "protection" over "growth." Risks of a U.S. government shutdown, diplomatic crises surrounding Greenland, and new tariff threats have driven investors back to the

Why Is "Digital Gold" Falling Behind? The Return of Traditional Trust

For years, the narrative suggested that Bitcoin would eventually dethrone gold. However, January 2026 data paints a completely different picture. While spot gold has shattered the $5,200 per ounce barrier, Bitcoin has lost momentum, remaining stuck in the $86,000 - $89,000 range.

1. The Demand for Pure Safe-Haven Assets

Markets are currently seeking "protection" over "growth." Risks of a U.S. government shutdown, diplomatic crises surrounding Greenland, and new tariff threats have driven investors back to the

BTC2,03%

- Reward

- 8

- 20

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

BTC2,03%

- Reward

- 16

- 112

- Repost

- Share

GateUser-72338806 :

:

Happy New Year! 🤑View More

#比特币相对黄金进入深度弱势

🌈🚀Why Is "Digital Gold" Falling Behind? The Return of Traditional Trust

For years, the narrative suggested that Bitcoin would eventually dethrone gold. However, January 2026 data paints a completely different picture. While spot gold has shattered the $5,200 per ounce barrier, Bitcoin has lost momentum, remaining stuck in the $86,000 - $89,000 range.

1. The Demand for Pure Safe-Haven Assets

Markets are currently seeking "protection" over "growth." Risks of a U.S. government shutdown, diplomatic crises surrounding Greenland, and new tariff threats have driven investors back to

🌈🚀Why Is "Digital Gold" Falling Behind? The Return of Traditional Trust

For years, the narrative suggested that Bitcoin would eventually dethrone gold. However, January 2026 data paints a completely different picture. While spot gold has shattered the $5,200 per ounce barrier, Bitcoin has lost momentum, remaining stuck in the $86,000 - $89,000 range.

1. The Demand for Pure Safe-Haven Assets

Markets are currently seeking "protection" over "growth." Risks of a U.S. government shutdown, diplomatic crises surrounding Greenland, and new tariff threats have driven investors back to

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

#BitcoinFallsBehindGold

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

As of 27 January 2026, financial markets are witnessing a notable shift in relative asset performance as Bitcoin falls behind gold, signaling a period of deep weakness for the leading cryptocurrency when compared to traditional safe-haven assets. While Bitcoin has long been promoted as “digital gold,” recent price action suggests that investors are reassessing that narrative amid rising global uncertainty. Gold’s steady climb contrasts sharply with Bitcoin’s struggle to maintain momentum, highlighting a divergence in investor b

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

As of 27 January 2026, financial markets are witnessing a notable shift in relative asset performance as Bitcoin falls behind gold, signaling a period of deep weakness for the leading cryptocurrency when compared to traditional safe-haven assets. While Bitcoin has long been promoted as “digital gold,” recent price action suggests that investors are reassessing that narrative amid rising global uncertainty. Gold’s steady climb contrasts sharply with Bitcoin’s struggle to maintain momentum, highlighting a divergence in investor b

BTC2,03%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

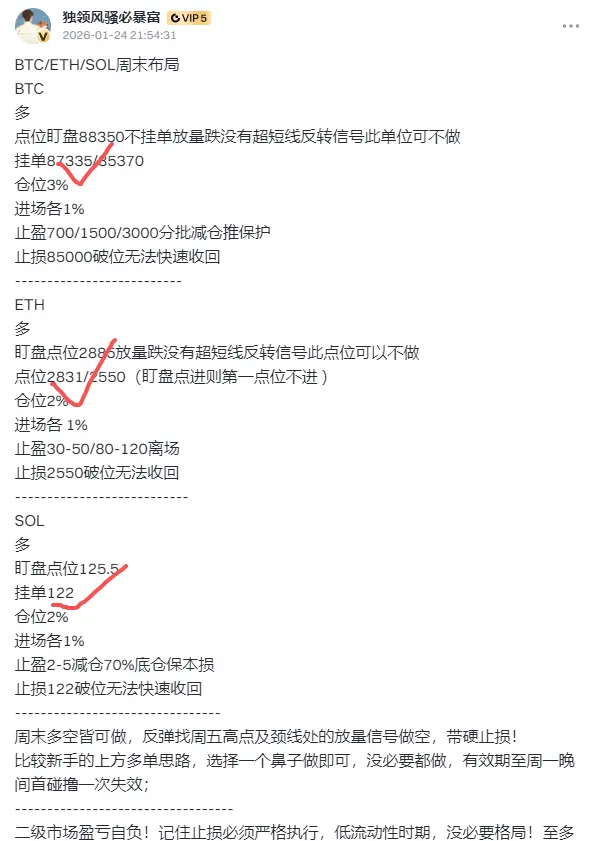

🔥 Effectiveness Over Noise. Survival Over Flexing.

Whether the market is “stable” or not is irrelevant.

What matters is effectiveness.

Don’t just talk about how 骚哥 helped you cut losses on a few trades —

look at how many times he helped you survive extreme market conditions.

That’s the real edge.

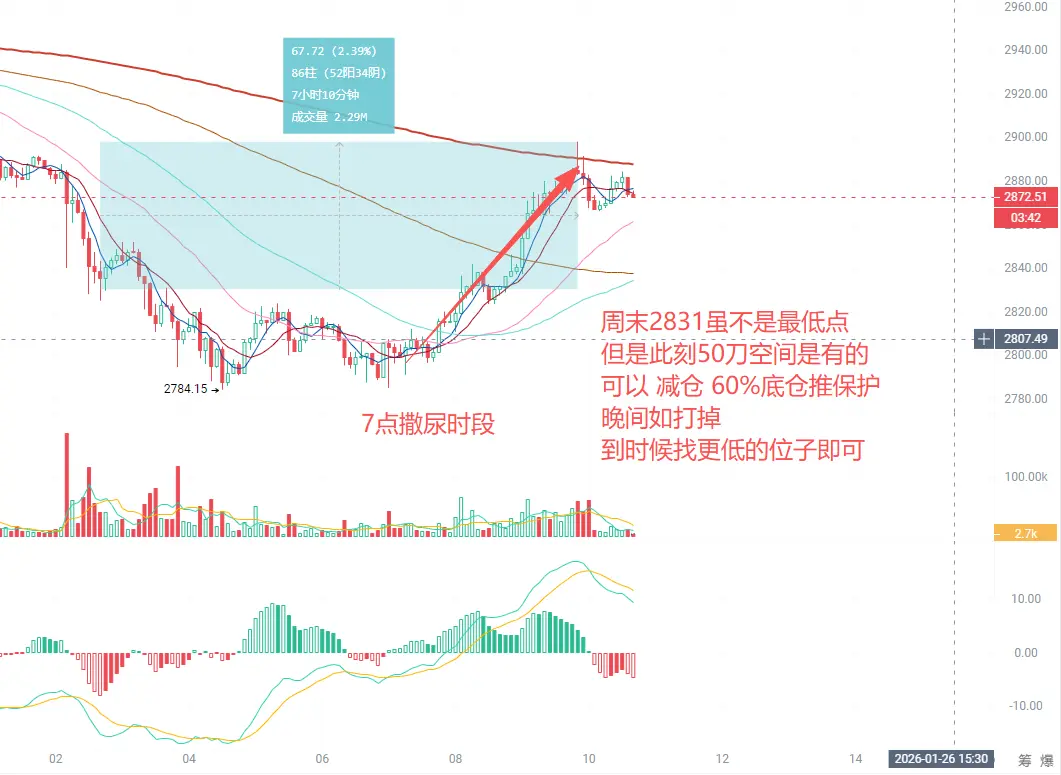

🧠 Missed the Weekend Low? So What.

Yes, you might’ve missed the perfect long entry over the weekend.

But markets don’t move once — they give multiple chances.

Buying on Monday after confirmation is not a mistake.

It’s discipline.

📌 Clear Strategy This Cycle • Bitcoin (BTC): Capital preservation com

Whether the market is “stable” or not is irrelevant.

What matters is effectiveness.

Don’t just talk about how 骚哥 helped you cut losses on a few trades —

look at how many times he helped you survive extreme market conditions.

That’s the real edge.

🧠 Missed the Weekend Low? So What.

Yes, you might’ve missed the perfect long entry over the weekend.

But markets don’t move once — they give multiple chances.

Buying on Monday after confirmation is not a mistake.

It’s discipline.

📌 Clear Strategy This Cycle • Bitcoin (BTC): Capital preservation com

- Reward

- 1

- Comment

- Repost

- Share

#比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear message: the hierarchy of safe-haven assets is shifting, and traditional defenses are reclaiming their historical role. Recent price action across multiple asset classes confirms a growing divergence between Bitcoin and Gold, signaling a decisive change in investor behavior. As uncertainty deepens across geopolitical, monetary, and economic fronts, capital is flowing not toward speculative innovation, but toward stability and preservation.

Gold’s ascent is not accidental. It reflects a deliberate reallocation by institut

Global financial markets are quietly delivering a clear message: the hierarchy of safe-haven assets is shifting, and traditional defenses are reclaiming their historical role. Recent price action across multiple asset classes confirms a growing divergence between Bitcoin and Gold, signaling a decisive change in investor behavior. As uncertainty deepens across geopolitical, monetary, and economic fronts, capital is flowing not toward speculative innovation, but toward stability and preservation.

Gold’s ascent is not accidental. It reflects a deliberate reallocation by institut

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

$BTC

Rejected hard from range high and now breaking the range low.

Lower highs → momentum is rolling over.

This looks like distribution, not a healthy pullback.

If price fails to reclaim the range, downside continuation is the base case.

Risk stays to the downside until structure flips.

#BTC #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats #GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

Rejected hard from range high and now breaking the range low.

Lower highs → momentum is rolling over.

This looks like distribution, not a healthy pullback.

If price fails to reclaim the range, downside continuation is the base case.

Risk stays to the downside until structure flips.

#BTC #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats #GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

$RVN looks like it’s carving out a classic falling wedge on the macro chart a structure that usually signals exhaustion on the downside.

Weekly price action suggests the bottom may already be in. Momentum is quietly shifting, and if this setup plays out, a solid reversal could be next.

I’m eyeing a potential 50%–100% upside from these levels. Definitely one to keep on your radar. 👀📈

#GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

Weekly price action suggests the bottom may already be in. Momentum is quietly shifting, and if this setup plays out, a solid reversal could be next.

I’m eyeing a potential 50%–100% upside from these levels. Definitely one to keep on your radar. 👀📈

#GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

RVN0,22%

- Reward

- like

- Comment

- Repost

- Share

#BitcoinRelativeToGoldDeepWeakness

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

BTC2,03%

- Reward

- 32

- 29

- Repost

- Share

Crazyasianrich :

:

Happy New Year! 🤑View More

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty. Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge against inflation, and an alternative to traditional f

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

11.68K Popularity

73.94K Popularity

29.4K Popularity

10.24K Popularity

10.37K Popularity

9.42K Popularity

8.33K Popularity

8.11K Popularity

74.31K Popularity

21.44K Popularity

82.33K Popularity

23.36K Popularity

50.15K Popularity

43.92K Popularity

197.27K Popularity

News

View MoreTRM Labs: Illegal cryptocurrency trading volume reached $158 billion last year, mainly driven by the Russian Ruble stablecoin A7A5.

7 m

U.S. stocks open higher, Dow Jones up 0.13%, Nasdaq up 0.6%

9 m

Strive: Currently holds 13,131.82 Bitcoins, making it the tenth-largest Bitcoin holder globally.

12 m

Barclays: Euro becomes the main "anti-dollar" trading target, as the dollar approaches a four-year low

27 m

USDC Treasury在以太坊销毁9515万枚USDC

32 m

Pin