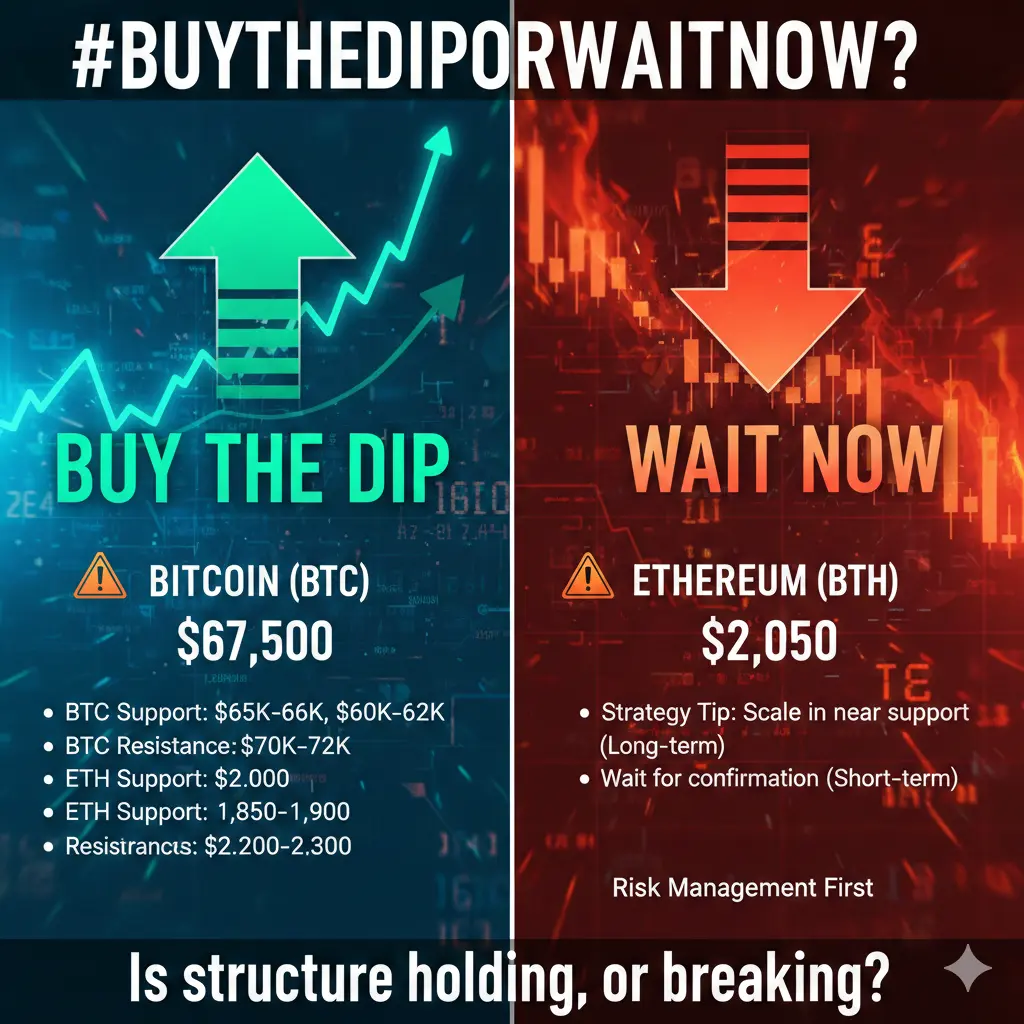

#BuyTheDipOrWaitNow? Markets are sitting at decision zones, and structure matters more than emotion right now.

Currently:

• Bitcoin trading around $67,000 – $68,000

• Ethereum trading near $2,000 – $2,100

These are not random numbers — they’re compression zones where momentum either rebuilds or breaks.

📊 Key Levels to Watch

🟠 Bitcoin (BTC)

Strong Support: $65,000 – $66,000

Major Support: $60,000 – $62,000

Resistance: $70,000 – $72,000

If BTC continues to defend the $65K area with rising spot volume and decreasing sell pressure, this zone may act as a higher-low structure within a broader uptrend.

However, a confirmed breakdown below $60K would likely shift sentiment from “healthy pullback” to “trend correction,” potentially opening liquidity pockets lower.

Key signal to watch:

• Are buyers stepping in aggressively on dips?

• Or are bounces getting weaker each time?

🔵 Ethereum (ETH)

Psychological Support: $2,000

Stronger Support: $1,850 – $1,900

Resistance: $2,200 – $2,300

ETH holding $2,000 keeps the structure neutral-to-bullish.

A strong reclaim and sustained hold above $2,200 could trigger momentum traders to re-enter.

But if $1,900 fails with heavy volume, that may increase short-term downside pressure toward deeper support.

Watch for:

• RSI divergence

• Volume spikes on rebounds

• Higher low formations on lower timeframes

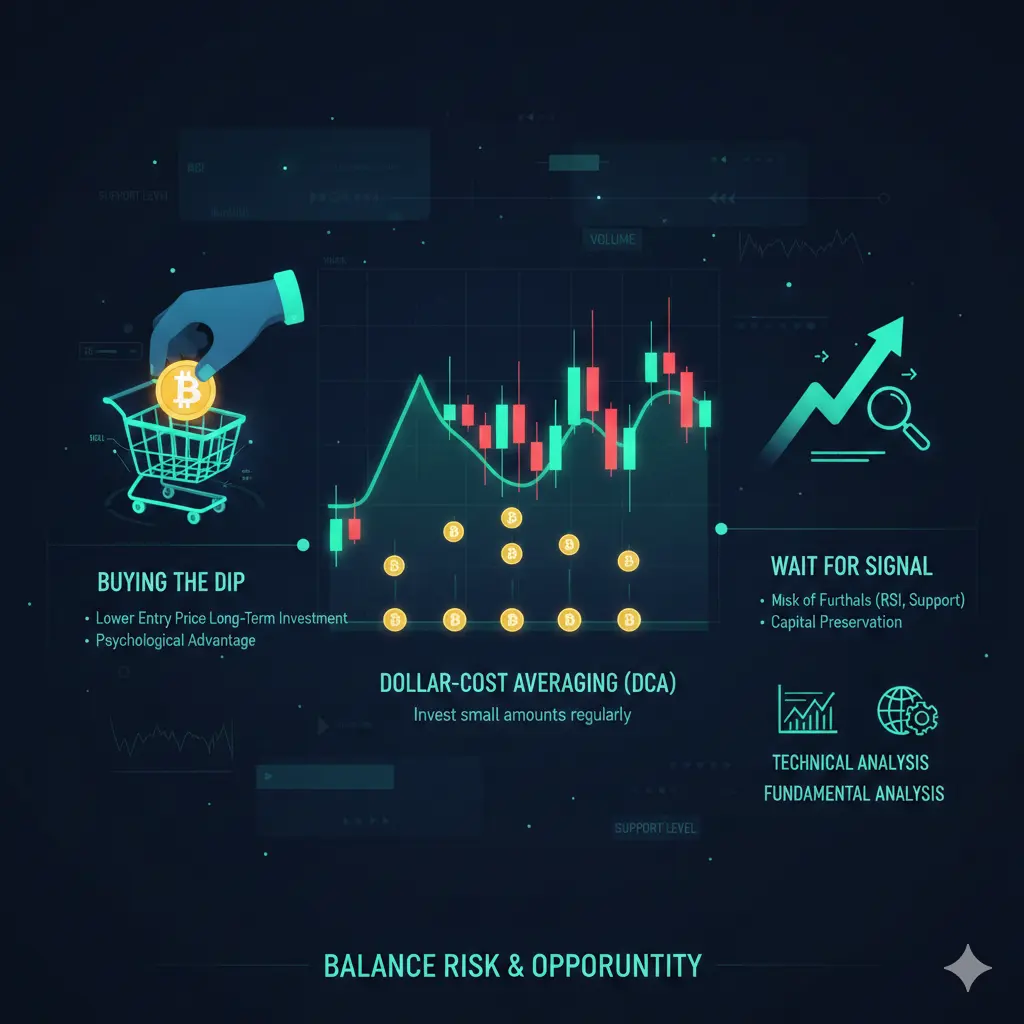

💡 Strategy Perspective

For long-term investors:

Scaling into support zones (instead of one full entry) reduces timing stress. Structured accumulation works better than emotional entries.

For short-term traders:

Wait for confirmation — such as trendline breaks, bullish engulfing candles, or volume-backed reversals. Don’t anticipate the move; react to it.

Golden rule:

Never go all-in at one level. Capital preservation > perfect entry.

🧠 Bigger Question

This isn’t just “buy or wait?”

It’s:

Is market structure holding — or breaking?

If support levels continue to produce higher lows, dips may represent opportunity.

If structure weakens and key zones fail, patience becomes the stronger position.

In volatile markets, discipline beats prediction every time. 🚀

Currently:

• Bitcoin trading around $67,000 – $68,000

• Ethereum trading near $2,000 – $2,100

These are not random numbers — they’re compression zones where momentum either rebuilds or breaks.

📊 Key Levels to Watch

🟠 Bitcoin (BTC)

Strong Support: $65,000 – $66,000

Major Support: $60,000 – $62,000

Resistance: $70,000 – $72,000

If BTC continues to defend the $65K area with rising spot volume and decreasing sell pressure, this zone may act as a higher-low structure within a broader uptrend.

However, a confirmed breakdown below $60K would likely shift sentiment from “healthy pullback” to “trend correction,” potentially opening liquidity pockets lower.

Key signal to watch:

• Are buyers stepping in aggressively on dips?

• Or are bounces getting weaker each time?

🔵 Ethereum (ETH)

Psychological Support: $2,000

Stronger Support: $1,850 – $1,900

Resistance: $2,200 – $2,300

ETH holding $2,000 keeps the structure neutral-to-bullish.

A strong reclaim and sustained hold above $2,200 could trigger momentum traders to re-enter.

But if $1,900 fails with heavy volume, that may increase short-term downside pressure toward deeper support.

Watch for:

• RSI divergence

• Volume spikes on rebounds

• Higher low formations on lower timeframes

💡 Strategy Perspective

For long-term investors:

Scaling into support zones (instead of one full entry) reduces timing stress. Structured accumulation works better than emotional entries.

For short-term traders:

Wait for confirmation — such as trendline breaks, bullish engulfing candles, or volume-backed reversals. Don’t anticipate the move; react to it.

Golden rule:

Never go all-in at one level. Capital preservation > perfect entry.

🧠 Bigger Question

This isn’t just “buy or wait?”

It’s:

Is market structure holding — or breaking?

If support levels continue to produce higher lows, dips may represent opportunity.

If structure weakens and key zones fail, patience becomes the stronger position.

In volatile markets, discipline beats prediction every time. 🚀