# CPIDataIncoming

84.99K

The U.S. September CPI and employment data will be released this Friday — a key signal that could shape the Fed’s next rate-cut moves. How do you think this will affect the crypto market?

S_A_N

Today, the crypto market is showing a quiet but hopeful mood. Bitcoin is trading around $113,000, while Ethereum sits near $4,070, both making small but steady gains. Most other cryptocurrencies are following this gentle upward trend, giving traders a bit of relief after recent ups and downs. There’s still some nervous energy in the air, especially with renewed talk about Binance and global regulations, but for now, the market feels balanced - calm, steady, and waiting to see what happens next.

#CPIDataIncoming

#QuantumComputingStocksSurge

#GateFunMemeFrenzy

#CPIDataIncoming

$GT

$BTC

#CPIDataIncoming

#QuantumComputingStocksSurge

#GateFunMemeFrenzy

#CPIDataIncoming

$GT

$BTC

- Reward

- like

- Comment

- Repost

- Share

#CPIDataIncoming

The financial world is once again holding its breath as the next U.S. Consumer Price Index (CPI) data release approaches a report that could send ripples across global markets and decide the near-term direction of both crypto and equities. CPI, which measures inflation across the economy, has become one of the most powerful indicators shaping central bank decisions, investor sentiment, and risk appetite. For months, traders have been balancing on a razor’s edge between optimism for rate cuts and fear of sticky inflation. Now, as the latest data looms, everyone from Wall Stre

The financial world is once again holding its breath as the next U.S. Consumer Price Index (CPI) data release approaches a report that could send ripples across global markets and decide the near-term direction of both crypto and equities. CPI, which measures inflation across the economy, has become one of the most powerful indicators shaping central bank decisions, investor sentiment, and risk appetite. For months, traders have been balancing on a razor’s edge between optimism for rate cuts and fear of sticky inflation. Now, as the latest data looms, everyone from Wall Stre

- Reward

- 4

- 6

- Repost

- Share

BabaJi :

:

Buy To Earn 💎View More

#CPIDataIncoming

Inflation data incoming—markets are holding their breath!”

Global markets are closely watching today’s release of the U.S. Consumer Price Index (CPI). This data is one of the most influential economic indicators, impacting not only traditional financial markets but also the cryptocurrency space directly.

🔸 What Is CPI?

CPI measures the average change in prices of goods and services purchased by consumers in a country.

In short, it’s known as the pulse of inflation.

Central banks—especially the U S Federal Reserve (FED)—base their interest rate decisions largely on this d

Inflation data incoming—markets are holding their breath!”

Global markets are closely watching today’s release of the U.S. Consumer Price Index (CPI). This data is one of the most influential economic indicators, impacting not only traditional financial markets but also the cryptocurrency space directly.

🔸 What Is CPI?

CPI measures the average change in prices of goods and services purchased by consumers in a country.

In short, it’s known as the pulse of inflation.

Central banks—especially the U S Federal Reserve (FED)—base their interest rate decisions largely on this d

- Reward

- 30

- 20

- Repost

- Share

YamahaBlue :

:

HODL Tight 💪View More

XRP (XRP/USDT) Technical Outlook – Bulls Eye Channel Breakout Attempt

XRP is trading near $2.62, showing strong recovery momentum after rebounding from the 0.236 Fib retracement ($2.32) and lower trendline support of a descending channel.

The price has climbed above the 20 EMA ($2.54) and is now testing resistance around the 0.382 Fib ($2.57–$2.62) zone. A successful breakout and daily close above this region could open the door toward the next resistance levels at $2.78 (0.5 Fib) and $2.99 (0.618 Fib).

The EMA cluster (20/50/100/200) is tightening, hinting at a potential momentum shift if bul

XRP is trading near $2.62, showing strong recovery momentum after rebounding from the 0.236 Fib retracement ($2.32) and lower trendline support of a descending channel.

The price has climbed above the 20 EMA ($2.54) and is now testing resistance around the 0.382 Fib ($2.57–$2.62) zone. A successful breakout and daily close above this region could open the door toward the next resistance levels at $2.78 (0.5 Fib) and $2.99 (0.618 Fib).

The EMA cluster (20/50/100/200) is tightening, hinting at a potential momentum shift if bul

XRP-0,06%

- Reward

- 14

- 27

- Repost

- Share

Sumon123 :

:

HODL Tight 💪View More

#CPIDataIncoming

#CPIDataIncoming 💥

The Consumer Price Index (CPI) has a direct and powerful impact on the crypto market’s behavior — especially on major assets like Bitcoin (BTC) and Ethereum (ETH). CPI reflects inflation levels, and when the data release is approaching, traders across the crypto space become extremely alert.

When we say “CPI Data Incoming,” it means the inflation report is about to be released soon, and the market is preparing for strong reactions. This moment can bring high volatility, quick price swings, and even sudden market sentiment shifts.

If CPI numbers come out hi

#CPIDataIncoming 💥

The Consumer Price Index (CPI) has a direct and powerful impact on the crypto market’s behavior — especially on major assets like Bitcoin (BTC) and Ethereum (ETH). CPI reflects inflation levels, and when the data release is approaching, traders across the crypto space become extremely alert.

When we say “CPI Data Incoming,” it means the inflation report is about to be released soon, and the market is preparing for strong reactions. This moment can bring high volatility, quick price swings, and even sudden market sentiment shifts.

If CPI numbers come out hi

- Reward

- 20

- 8

- Repost

- Share

BabaJi :

:

bull runView More

🔥 U.S. CPI & Jobs Data This Friday A Decisive Moment for the Crypto Market

This Friday’s release of the U.S. September CPI (Consumer Price Index) and Employment Report will be one of the most closely watched macro events of the month. These two indicators will heavily influence how the Federal Reserve adjusts monetary policy — and, in turn, how the crypto market reacts in the coming weeks.

I’m posting this because macro data is one of the strongest drivers of crypto price action, yet it’s often overlooked by new investors. Understanding how inflation, interest rates, and employment interact c

This Friday’s release of the U.S. September CPI (Consumer Price Index) and Employment Report will be one of the most closely watched macro events of the month. These two indicators will heavily influence how the Federal Reserve adjusts monetary policy — and, in turn, how the crypto market reacts in the coming weeks.

I’m posting this because macro data is one of the strongest drivers of crypto price action, yet it’s often overlooked by new investors. Understanding how inflation, interest rates, and employment interact c

- Reward

- 5

- 11

- Repost

- Share

Gold is crashing & fell below $4000

On the other hand, $BTC showed upward momentum today.

What do you think, Rotation of money from gold to BTC has started ?

Yes 👍 No 👎

#ETHOn-ChainActivityRises #ERC-8004IgnitesMachineEconomy #BitcoinMarketAnalysis #CPIDataIncoming #GateQuantFundNewUserExclusiveComing

On the other hand, $BTC showed upward momentum today.

What do you think, Rotation of money from gold to BTC has started ?

Yes 👍 No 👎

#ETHOn-ChainActivityRises #ERC-8004IgnitesMachineEconomy #BitcoinMarketAnalysis #CPIDataIncoming #GateQuantFundNewUserExclusiveComing

BTC-1,27%

- Reward

- 3

- 12

- Repost

- Share

#CPIDataIncoming

U.S. September CPI & Employment Data – The Next Big Catalyst for the Crypto Market

This Friday, the United States will release its September CPI (Consumer Price Index) and employment data, two of the most critical economic indicators that could shape the Federal Reserve’s next move on interest rates. These reports are not just important for traditional markets; they could also send strong ripples through the entire crypto market as investors react to inflation trends and monetary policy expectations.

Why This Data Matters

The CPI measures inflation, showing how quickly prices

U.S. September CPI & Employment Data – The Next Big Catalyst for the Crypto Market

This Friday, the United States will release its September CPI (Consumer Price Index) and employment data, two of the most critical economic indicators that could shape the Federal Reserve’s next move on interest rates. These reports are not just important for traditional markets; they could also send strong ripples through the entire crypto market as investors react to inflation trends and monetary policy expectations.

Why This Data Matters

The CPI measures inflation, showing how quickly prices

- Reward

- 5

- 4

- Repost

- Share

BabaJi :

:

1000x Vibes 🤑View More

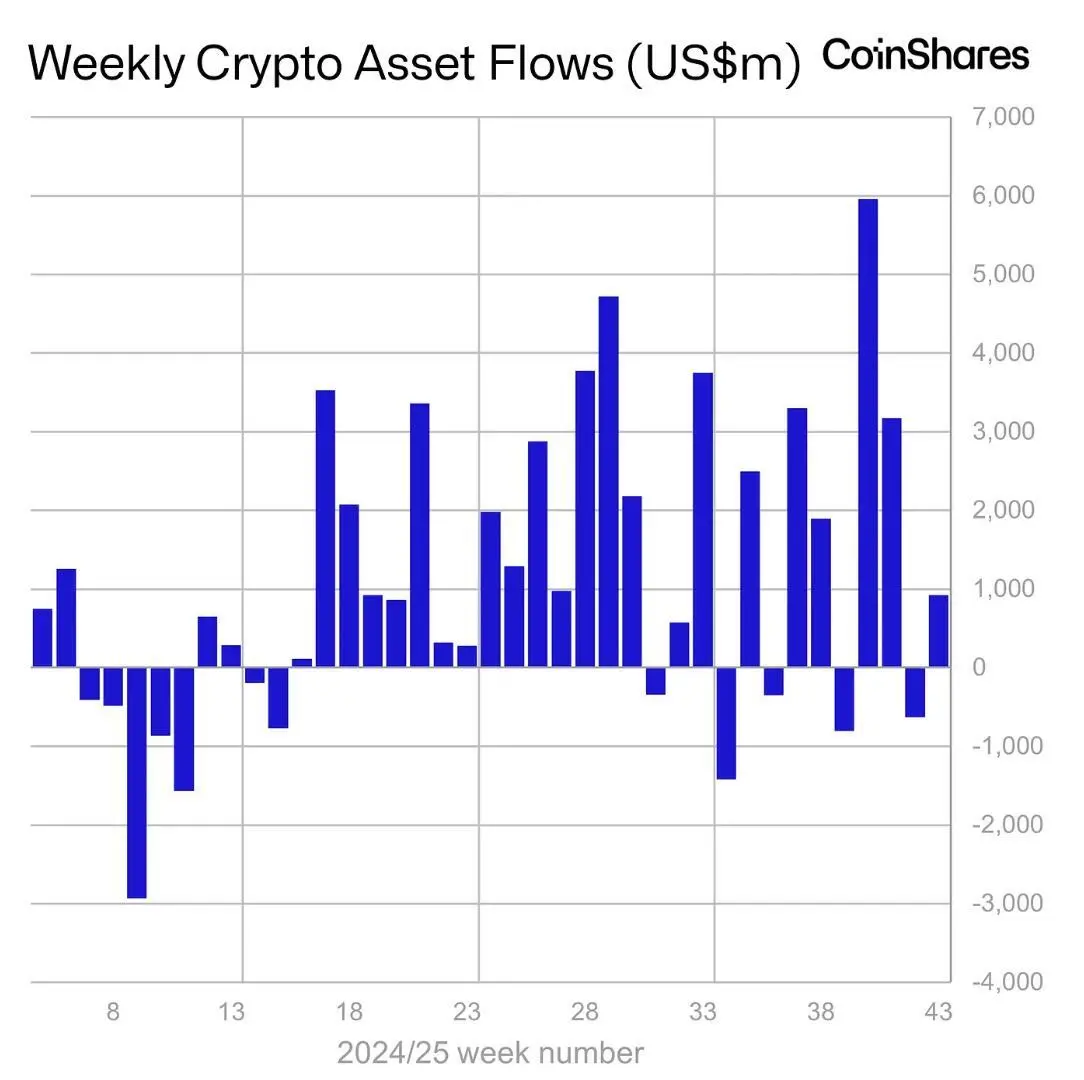

Digital asset funds logged $921M inflows last week as lower-than-expected US CPI boosted investor confidence, per CoinShares.

#CPIDataIncoming

#BitcoinMarketAnalysis

#CPIDataIncoming

#BitcoinMarketAnalysis

- Reward

- like

- Comment

- Repost

- Share

I don't know why I'm always watching these tokens $COAI , $AIA , $KGEN but most importantly I'm always watching the mother of all $BTC to be on a Safer side but we're around resistance level if breakout is successful we'll definitely surge else we'll bleed 🩸

#CPIDataIncoming #AreYouBullishOrBearishToday? #btc #trade

#CPIDataIncoming #AreYouBullishOrBearishToday? #btc #trade

- Reward

- 2

- 1

- Repost

- Share

Rilwan_cryptocycle001 :

:

DYOR 🤓Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

193.3K Popularity

50.47K Popularity

20.38K Popularity

8.39K Popularity

3.83K Popularity

5.62K Popularity

6.92K Popularity

1.16K Popularity

15.81K Popularity

7.33K Popularity

4.57K Popularity

4.05K Popularity

19.7K Popularity

19.13K Popularity

38.16K Popularity

News

View MoreAsian stock markets are expected to rise again, following the rebound of U.S. tech stocks

41 m

ETHZilla Launches Aircraft Engine Cash Flow RWA Token

49 m

The Federal Reserve plans to launch a "simplified main account" within the year, but the overall regulatory framework for cryptocurrencies remains unclear.

49 m

Google's parent company Alphabet's bond subscription demand exceeds $100 billion

51 m

Trump pushes for a ban on investor single-family home purchases, faces resistance from Congress Republicans

52 m

Pin