#CryptoSurvivalGuide

#CryptoSurvivalGuide

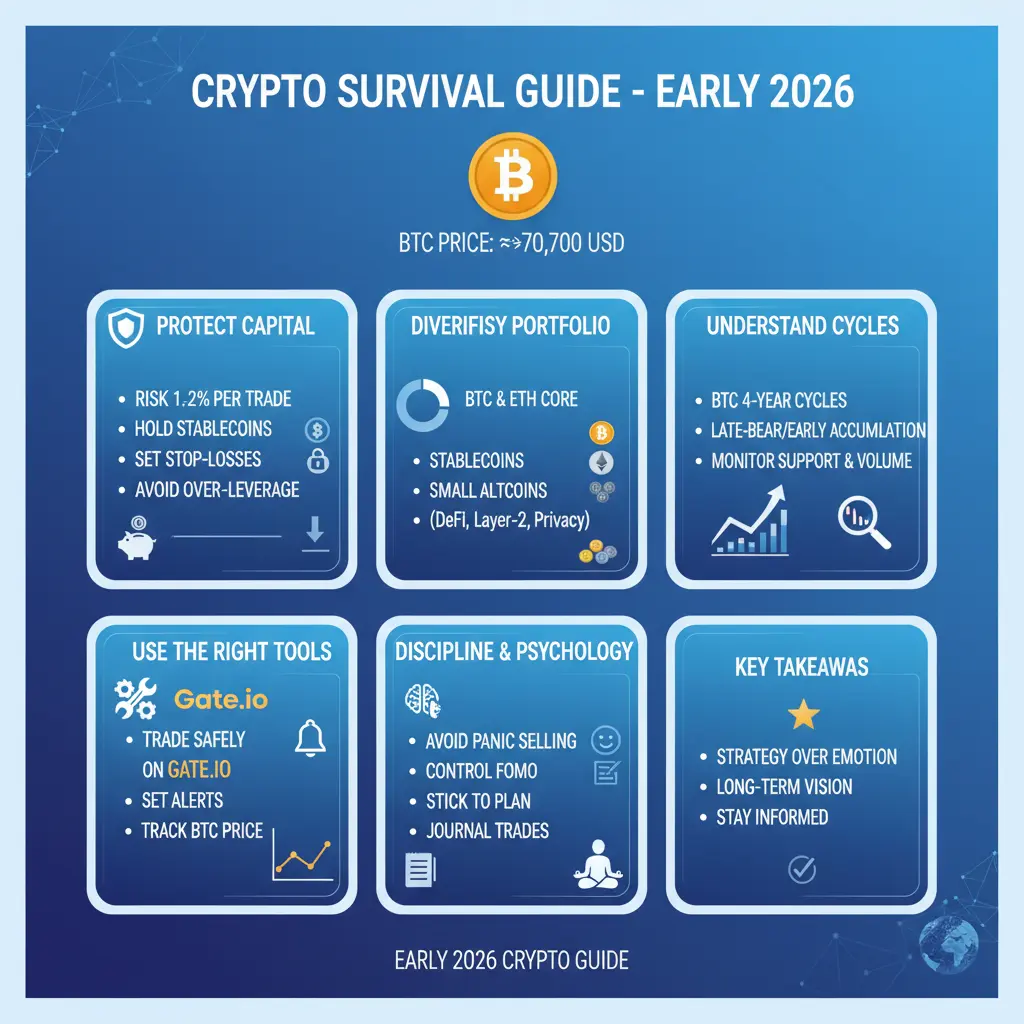

Building a Financial Fortress: Deepening Risk Control

Severe market fluctuations (volatility) represent chaos for the unprepared investor, yet for the disciplined one, they are merely a "data set." In the tense atmosphere of February 2026, it is vital to activate these three core mechanisms to protect your portfolio:

1. Asymmetric Risk and Loss Management

A common mistake made by market analysts is focusing solely on profit targets. Professionals, however, prioritize calculating the "risk/reward ratio."

The Psychology of Stop-Loss: When determining your stop-loss levels, do not pick a spot based on where you think "the price won't drop below." Instead, pick the point where your "thesis becomes invalid."

Liquidity Traps: Levels just below critical thresholds like $58,500 are often "liquidity hunt" zones where major players (whales) clear out the positions of retail investors. Therefore, you should place your stop-loss slightly below these technical supports, leaving a "safety gap" for the volatility to breathe.

2. Capital Efficiency and "Ammo" Management

The 30-40% cash (stablecoin) balance mentioned is not just a defensive strategy; it is your most powerful offensive weapon.

Opportunity Cost: If you are "all-in" with your entire capital, you become a mere spectator when the market hits a true bottom. A cash position allows you to accumulate "game-changing" assets at a discount once the market stabilizes.

Liquidation of Leveraged Positions: In periods of rising bond yields, funding costs increase, and the market often throws sudden "wicks" to flush out high-leverage positions. In this environment, even 2x-3x leverage can be classified as "high risk." Staying in the spot market whenever possible is the ultimate form of risk control.

3. Macroeconomic Filtering

A "hawkish" Fed stance implies that the total money supply (M2) in the system is either shrinking or becoming more expensive.

The Bond and Dollar Effect: When U.S. 10-year Treasury yields rise, investors flee risky assets (cryptocurrencies) in favor of guaranteed returns. This creates a "gravitational pull" effect on Bitcoin.

Strategic Patience: Risk control sometimes means doing absolutely nothing. Waiting on the sidelines until the market determines a clear direction—such as a high-volume break above the $61,200 resistance—is a far more profitable action than leaving your capital at the mercy of market whims.

Remember: Being "right" in the market provides an ego boost, but "managing risk" builds wealth. To recover a 10% loss today, you need a gain of over 11%; however, if your loss reaches 50%, you need a 100% gain just to break even. Mathematics is always on the side of the risk-averse.

#BTC

#CryptoSurvivalGuide

Building a Financial Fortress: Deepening Risk Control

Severe market fluctuations (volatility) represent chaos for the unprepared investor, yet for the disciplined one, they are merely a "data set." In the tense atmosphere of February 2026, it is vital to activate these three core mechanisms to protect your portfolio:

1. Asymmetric Risk and Loss Management

A common mistake made by market analysts is focusing solely on profit targets. Professionals, however, prioritize calculating the "risk/reward ratio."

The Psychology of Stop-Loss: When determining your stop-loss levels, do not pick a spot based on where you think "the price won't drop below." Instead, pick the point where your "thesis becomes invalid."

Liquidity Traps: Levels just below critical thresholds like $58,500 are often "liquidity hunt" zones where major players (whales) clear out the positions of retail investors. Therefore, you should place your stop-loss slightly below these technical supports, leaving a "safety gap" for the volatility to breathe.

2. Capital Efficiency and "Ammo" Management

The 30-40% cash (stablecoin) balance mentioned is not just a defensive strategy; it is your most powerful offensive weapon.

Opportunity Cost: If you are "all-in" with your entire capital, you become a mere spectator when the market hits a true bottom. A cash position allows you to accumulate "game-changing" assets at a discount once the market stabilizes.

Liquidation of Leveraged Positions: In periods of rising bond yields, funding costs increase, and the market often throws sudden "wicks" to flush out high-leverage positions. In this environment, even 2x-3x leverage can be classified as "high risk." Staying in the spot market whenever possible is the ultimate form of risk control.

3. Macroeconomic Filtering

A "hawkish" Fed stance implies that the total money supply (M2) in the system is either shrinking or becoming more expensive.

The Bond and Dollar Effect: When U.S. 10-year Treasury yields rise, investors flee risky assets (cryptocurrencies) in favor of guaranteed returns. This creates a "gravitational pull" effect on Bitcoin.

Strategic Patience: Risk control sometimes means doing absolutely nothing. Waiting on the sidelines until the market determines a clear direction—such as a high-volume break above the $61,200 resistance—is a far more profitable action than leaving your capital at the mercy of market whims.

Remember: Being "right" in the market provides an ego boost, but "managing risk" builds wealth. To recover a 10% loss today, you need a gain of over 11%; however, if your loss reaches 50%, you need a 100% gain just to break even. Mathematics is always on the side of the risk-averse.

#BTC