# MyWeekendTradingPlan

40.29K

Pin

Gate广场_Official

Gate Plaza | 1/31–2/1 Weekend Exclusive Benefits Topic: #MyWeekendTradingPlan

🎁 Post with the topic, 100 lucky posters * each receive $50 position experience voucher weekend benefits

In a volatile market, some choose short-term trading, some wait patiently, and others plan ahead for next week's opportunities. This weekend, will you choose to attack or defend?

👉 Do you expect a rebound or continued decline in the weekend market?

👉 Which tokens are you currently watching or trading?

👉 Are there any industry news or sudden events worth noting this weekend?

Post and share your trading ideas

View Original🎁 Post with the topic, 100 lucky posters * each receive $50 position experience voucher weekend benefits

In a volatile market, some choose short-term trading, some wait patiently, and others plan ahead for next week's opportunities. This weekend, will you choose to attack or defend?

👉 Do you expect a rebound or continued decline in the weekend market?

👉 Which tokens are you currently watching or trading?

👉 Are there any industry news or sudden events worth noting this weekend?

Post and share your trading ideas

- Reward

- 20

- 21

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

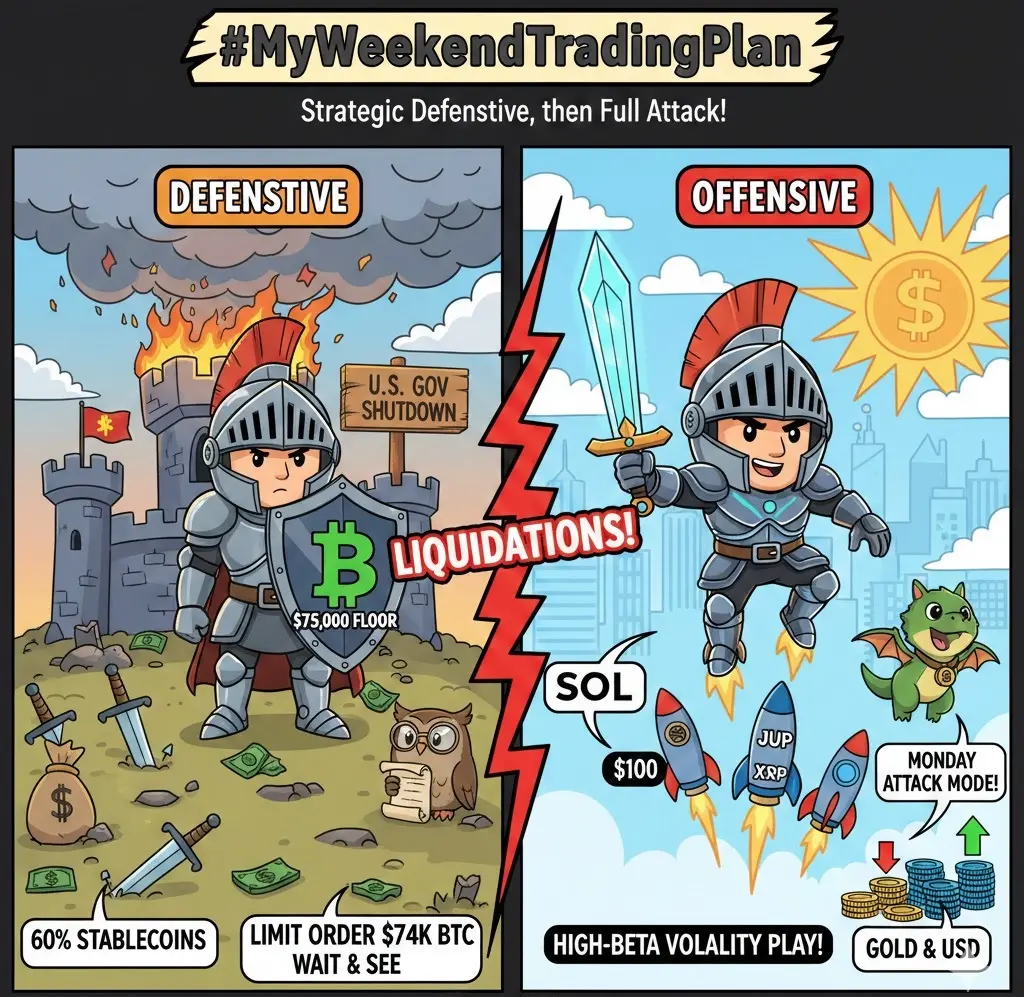

#MyWeekendTradingPlan Futures Market Outlook — Defense First, Then Precision Attack

The crypto futures market is entering the weekend under extreme stress, and the environment clearly favors caution over aggression. Bitcoin’s sharp move from the $80,000 region down into the $75,000–$77,000 range triggered more than $2.5 billion in long liquidations, flushing out excessive leverage in a very short time. This type of event typically resets the market, but it does not automatically signal an immediate reversal. Right now, sentiment is fragile, liquidity is thin, and emotions are high — all classi

The crypto futures market is entering the weekend under extreme stress, and the environment clearly favors caution over aggression. Bitcoin’s sharp move from the $80,000 region down into the $75,000–$77,000 range triggered more than $2.5 billion in long liquidations, flushing out excessive leverage in a very short time. This type of event typically resets the market, but it does not automatically signal an immediate reversal. Right now, sentiment is fragile, liquidity is thin, and emotions are high — all classi

- Reward

- 2

- 3

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#MyWeekendTradingPlan Futures Market Outlook — Defense First, Then Precision Attack

The crypto futures market is heading into the weekend under extreme stress, and the current environment clearly favors caution over aggression. Bitcoin’s sharp drop from the $80,000 region into the $75,000–$77,000 zone triggered more than $2.5 billion in long liquidations, rapidly flushing excessive leverage from the system. While such events often reset market structure, they do not automatically confirm a trend reversal. Sentiment remains fragile, liquidity is thin, and emotions are elevated — classic conditi

The crypto futures market is heading into the weekend under extreme stress, and the current environment clearly favors caution over aggression. Bitcoin’s sharp drop from the $80,000 region into the $75,000–$77,000 zone triggered more than $2.5 billion in long liquidations, rapidly flushing excessive leverage from the system. While such events often reset market structure, they do not automatically confirm a trend reversal. Sentiment remains fragile, liquidity is thin, and emotions are elevated — classic conditi

- Reward

- 2

- 3

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

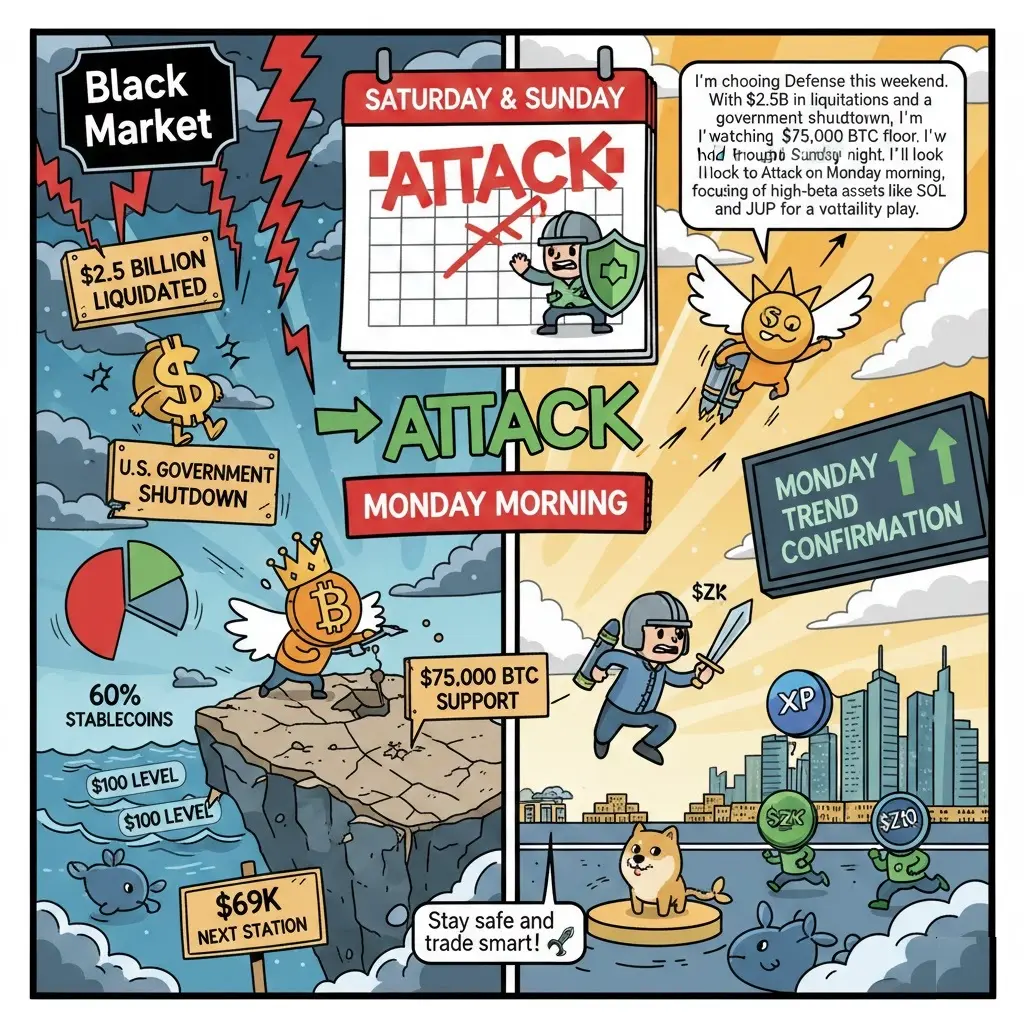

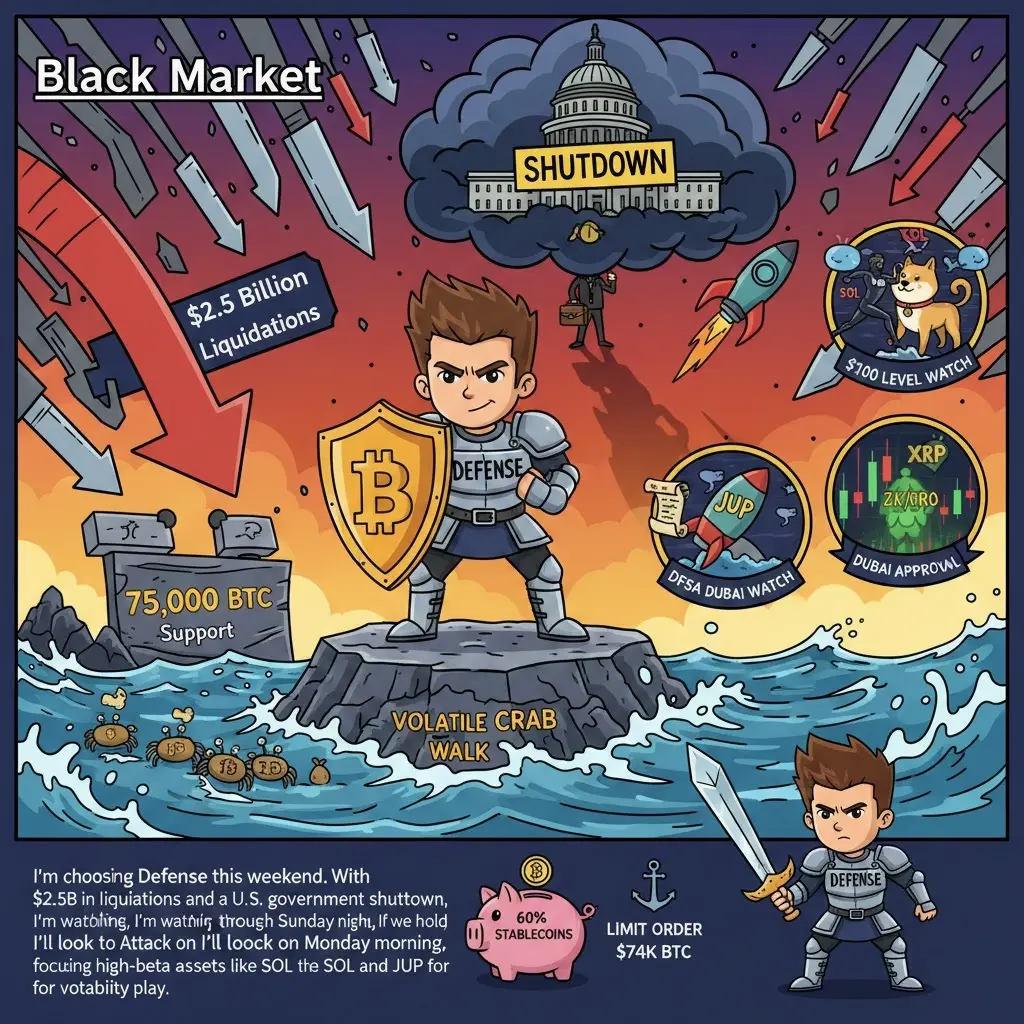

#MyWeekendTradingPlan

Market Sentiment: Offensive or Defensive?

The market is currently in a high-risk "Black Market" scenario. Bitcoin recently experienced a sharp drop from around $80,000 to the $75,000-$77,000 level, resulting in over $2.5 billion in liquidations.

My View: Strategic Defensive. While "dip buyers" are expecting a rebound, macroeconomic pressure stemming from the partial US government shutdown and shifts in Fed dynamics suggests catching the falling knife could be risky. Adopting a defensive stance – seeing a stable base at $75,000 – is the path to follow before going "offens

Market Sentiment: Offensive or Defensive?

The market is currently in a high-risk "Black Market" scenario. Bitcoin recently experienced a sharp drop from around $80,000 to the $75,000-$77,000 level, resulting in over $2.5 billion in liquidations.

My View: Strategic Defensive. While "dip buyers" are expecting a rebound, macroeconomic pressure stemming from the partial US government shutdown and shifts in Fed dynamics suggests catching the falling knife could be risky. Adopting a defensive stance – seeing a stable base at $75,000 – is the path to follow before going "offens

- Reward

- 3

- 2

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#MyWeekendTradingPlan #MyWeekendTradingPlan

Most weekend trading plans are trash. Why? Because they’re built on hope, not structure. Liquidity dries up, volume thins, and amateurs confuse “quiet” with “safe.” If your weekend plan doesn’t start with risk control, you’re not trading — you’re donating.

Here’s how I’m approaching this weekend, step by step.

First, context matters more than entries. Weekend price action is not about trend continuation; it’s about range manipulation. Big players rarely initiate fresh positions — they probe liquidity, hunt stops, and reset positioning for Monday. If

Most weekend trading plans are trash. Why? Because they’re built on hope, not structure. Liquidity dries up, volume thins, and amateurs confuse “quiet” with “safe.” If your weekend plan doesn’t start with risk control, you’re not trading — you’re donating.

Here’s how I’m approaching this weekend, step by step.

First, context matters more than entries. Weekend price action is not about trend continuation; it’s about range manipulation. Big players rarely initiate fresh positions — they probe liquidity, hunt stops, and reset positioning for Monday. If

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊🚨 HYPE/USDT Shows Warning Signs Despite Small Gain!

📊 Key Data:

· Current Price: 30.28 USDT 📈 (+0.80%)

· High Volatility: 24h Range 28.48 – 32.57

· 24h Turnover: 88.59M USDT

⚠️ Technical Alert:

· MACD still negative (-0.258) despite price rise

· Price near upper Bollinger Band (32.46 resistance)

· Volume trend weakening (MA5 < MA10)

🎯 Critical Levels:

· Strong Resistance: 32.46 USDT

· Immediate Support: 28.24 USDT

· Key Support: 27.90 (SAR indicator)

$HYPE

💡 Trader Insight:

Minor bounce may be technical correction, not a bullish reversal—watch MACD for confirmation.

#HYPE #MyWeekendTra

📊 Key Data:

· Current Price: 30.28 USDT 📈 (+0.80%)

· High Volatility: 24h Range 28.48 – 32.57

· 24h Turnover: 88.59M USDT

⚠️ Technical Alert:

· MACD still negative (-0.258) despite price rise

· Price near upper Bollinger Band (32.46 resistance)

· Volume trend weakening (MA5 < MA10)

🎯 Critical Levels:

· Strong Resistance: 32.46 USDT

· Immediate Support: 28.24 USDT

· Key Support: 27.90 (SAR indicator)

$HYPE

💡 Trader Insight:

Minor bounce may be technical correction, not a bullish reversal—watch MACD for confirmation.

#HYPE #MyWeekendTra

HYPE-1,5%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin (BTC) Technical Analysis: Fibonacci Supports, Channel Compression, and Breakout Scenarios

Bitcoin is currently trading around a critical Fibonacci-derived support zone, where price behavior is likely to define the next medium-term trend. The market is showing signs of compression within a descending and narrowing channel, increasing the probability of a directional breakout in the near term.

Key Fibonacci Support: 75,672 USD

According to Fibonacci retracement levels, 75,672 USD has been identified as a major support area.

This level was tested yesterday, confirming its technical releva

Bitcoin is currently trading around a critical Fibonacci-derived support zone, where price behavior is likely to define the next medium-term trend. The market is showing signs of compression within a descending and narrowing channel, increasing the probability of a directional breakout in the near term.

Key Fibonacci Support: 75,672 USD

According to Fibonacci retracement levels, 75,672 USD has been identified as a major support area.

This level was tested yesterday, confirming its technical releva

BTC-2,22%

- Reward

- 17

- 16

- Repost

- Share

not_queen :

:

2026 GOGOGO 👊View More

$ETH has hit the final target and is forming a potential double bottom on the 4H.

Now we wait for the daily candle close above support for confirmation.

Bullish divergence printing on the Oscillator.

If confirmation comes, we may get a solid long opportunity from here

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback

Now we wait for the daily candle close above support for confirmation.

Bullish divergence printing on the Oscillator.

If confirmation comes, we may get a solid long opportunity from here

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback

ETH-7,02%

- Reward

- 2

- 3

- Repost

- Share

GateUser-6857559e :

:

thanks for the useful information 😊View More

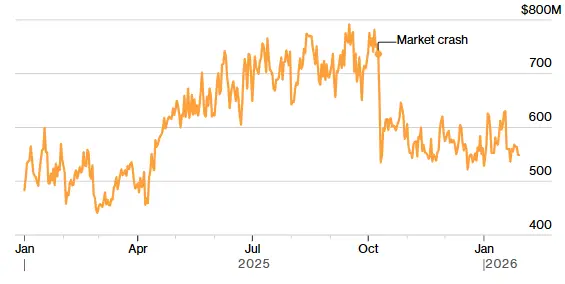

⚠️ BITCOIN LIQUIDITY IS DRYING UP

Bitcoin’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak.

Last time this happened was after the FTX collapse.

Thin order books mean small flows can now move price fast.

$BTC #MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta

Bitcoin’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak.

Last time this happened was after the FTX collapse.

Thin order books mean small flows can now move price fast.

$BTC #MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta

BTC-2,22%

- Reward

- like

- Comment

- Repost

- Share

#MyWeekendTradingPlan

#MyWeekendTradingPlan | Real & Deep Market Analysis

🧠 Weekend Market Psychology

Weekend markets operate without institutional dominance. Banks, funds, and major trading desks are largely inactive, leaving price action driven mostly by retail flow and low-volume participants.

As a result, price behavior becomes:

More emotional than logical

Highly sensitive to small orders

Prone to manipulation and false signals

This is why many weekend moves fail or reverse once institutional liquidity returns on Monday.

📉 Liquidity Reality & Market Structure

Weekends mean thin order bo

#MyWeekendTradingPlan | Real & Deep Market Analysis

🧠 Weekend Market Psychology

Weekend markets operate without institutional dominance. Banks, funds, and major trading desks are largely inactive, leaving price action driven mostly by retail flow and low-volume participants.

As a result, price behavior becomes:

More emotional than logical

Highly sensitive to small orders

Prone to manipulation and false signals

This is why many weekend moves fail or reverse once institutional liquidity returns on Monday.

📉 Liquidity Reality & Market Structure

Weekends mean thin order bo

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

40.29K Popularity

73K Popularity

371.21K Popularity

51.08K Popularity

69.44K Popularity

23.3K Popularity

27.92K Popularity

22.48K Popularity

94.34K Popularity

40.71K Popularity

35.57K Popularity

29.23K Popularity

19.3K Popularity

25.51K Popularity

216.97K Popularity

News

View MoreGold, silver, oil, and stocks all declined on Monday, as market sentiment shifted to caution

16 m

In the past hour, the entire network has been liquidated by $114 million, with ETH liquidations reaching $43.28 million.

18 m

"Maqi" has closed all long positions, and the on-chain contract account now holds only $1,278.

23 m

ETH Breaks Through 2300 USDT

24 m

BTC breaks through 77,000 USDT

27 m

Pin